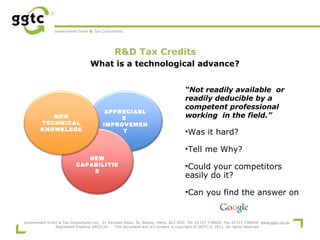

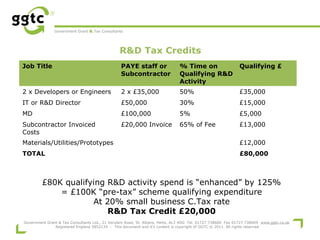

The document outlines the R&D tax relief scheme in the UK, highlighting that £1.2bn was returned to companies in 2012-2013, with many SMEs unaware of their eligibility. It describes qualifying activities for claiming tax credits and emphasizes that even loss-making businesses can benefit. The paper stresses the importance of accurately assessing qualifying R&D activities, which are complex in nature and require expertise beyond standard financial assessment.