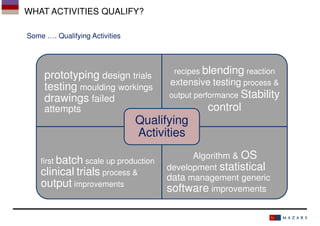

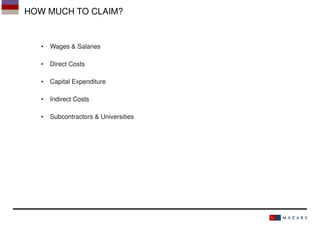

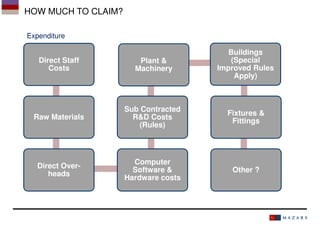

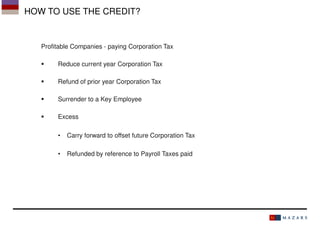

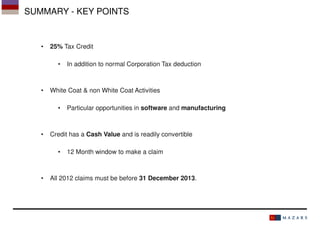

The document outlines the R&D Tax Credit in Ireland, detailing eligible activities, who can qualify, and how to claim the credit. It emphasizes that the credit provides a 25% refund on certain qualifying expenditures, encouraging innovation within both traditional and non-traditional R&D activities. Key dates for claims and potential refunds for loss-making companies are also discussed.