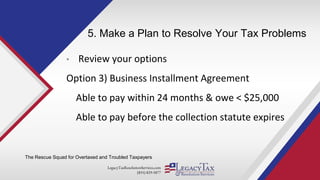

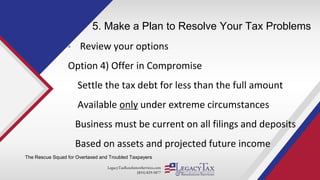

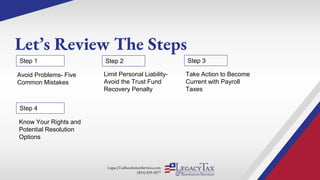

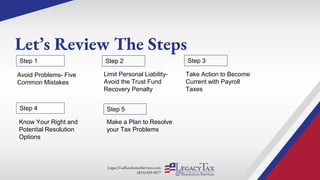

The document outlines a presentation aimed at helping business owners resolve payroll tax problems, detailing five essential steps to compliance and resolution. It highlights common payroll tax mistakes, such as late filing and incorrect worker classification, and emphasizes the importance of understanding one's rights and developing a proactive plan. Additionally, it promotes consulting with Legacy Tax Resolution Services to seek expert advice on managing tax issues.