Report

Share

Download to read offline

Recommended

On July 24, 2019, U.S. Citizenship and Immigration Services (USCIS) published a FINAL rule that will make significant changes to the EB-5 Immigrant Investor Program; the rule will go into effect on Nov. 21, 2019. This is noted to be the first significant revision to the program’s regulations since 1993. Some of these revisions include: NEW RULEMAKING BRINGS SIGNIFICANT CHANGES TO THE EB-5 INVESTOR VISA GREEN CAR...

NEW RULEMAKING BRINGS SIGNIFICANT CHANGES TO THE EB-5 INVESTOR VISA GREEN CAR...Nachman Phulwani Zimovcak (NPZ) Law Group, P.C.

Recommended

On July 24, 2019, U.S. Citizenship and Immigration Services (USCIS) published a FINAL rule that will make significant changes to the EB-5 Immigrant Investor Program; the rule will go into effect on Nov. 21, 2019. This is noted to be the first significant revision to the program’s regulations since 1993. Some of these revisions include: NEW RULEMAKING BRINGS SIGNIFICANT CHANGES TO THE EB-5 INVESTOR VISA GREEN CAR...

NEW RULEMAKING BRINGS SIGNIFICANT CHANGES TO THE EB-5 INVESTOR VISA GREEN CAR...Nachman Phulwani Zimovcak (NPZ) Law Group, P.C.

More Related Content

What's hot

What's hot (17)

Divorce tax planning before the divorce - Wayne Lippman

Divorce tax planning before the divorce - Wayne Lippman

Virginia Tech - New Employee Orientation - Faculty Retirement

Virginia Tech - New Employee Orientation - Faculty Retirement

15 06-18 Top 10 Tax Preparer And Other Tax Penalties - Not Going To Jail But ...

15 06-18 Top 10 Tax Preparer And Other Tax Penalties - Not Going To Jail But ...

2013 Tax Facts: General Information about Fairfax County Taxes

2013 Tax Facts: General Information about Fairfax County Taxes

Virginia Tech - New Employee Orientation - Voluntary Retirement Savings Plans

Virginia Tech - New Employee Orientation - Voluntary Retirement Savings Plans

Updated property tax information for texas taxpayers

Updated property tax information for texas taxpayers

Viewers also liked

Viewers also liked (20)

Indiana's CollegeChoice 529 Education Savings Plan Credit

Indiana's CollegeChoice 529 Education Savings Plan Credit

- S-3A - Agricultural Fertilizers, Pesticides, Machinery & Equip.

- S-3A - Agricultural Fertilizers, Pesticides, Machinery & Equip.

Estate Tax Form - Remittance Memo (Decedents dying on or after July 1, 1985)

Estate Tax Form - Remittance Memo (Decedents dying on or after July 1, 1985)

Similar to wv8379 state.wv.us/taxrev/forms

Similar to wv8379 state.wv.us/taxrev/forms (20)

ct2008 Connecticut Telefile Tax Return and Instructions -

ct2008 Connecticut Telefile Tax Return and Instructions -

Frequently Asked Questions - Massachusetts State Income Taxes

Frequently Asked Questions - Massachusetts State Income Taxes

BI-473 - Partnership/Limited Liability Company Schedule

BI-473 - Partnership/Limited Liability Company Schedule

More from taxman taxman

More from taxman taxman (20)

Recently uploaded

Saudi Arabia [ Abortion pills) Jeddah/riaydh/dammam/++918133066128☎️] cytotec tablets uses abortion pills 💊💊 How effective is the abortion pill? 💊💊 +918133066128) "Abortion pills in Jeddah" how to get cytotec tablets in Riyadh " Abortion pills in dammam*💊💊 The abortion pill is very effective. If you’re taking mifepristone and misoprostol, it depends on how far along the pregnancy is, and how many doses of medicine you take:💊💊 +918133066128) how to buy cytotec pills

At 8 weeks pregnant or less, it works about 94-98% of the time. +918133066128[ 💊💊💊 At 8-9 weeks pregnant, it works about 94-96% of the time. +918133066128) At 9-10 weeks pregnant, it works about 91-93% of the time. +918133066128)💊💊 If you take an extra dose of misoprostol, it works about 99% of the time. At 10-11 weeks pregnant, it works about 87% of the time. +918133066128) If you take an extra dose of misoprostol, it works about 98% of the time. In general, taking both mifepristone and+918133066128 misoprostol works a bit better than taking misoprostol only. +918133066128 Taking misoprostol alone works to end the+918133066128 pregnancy about 85-95% of the time — depending on how far along the+918133066128 pregnancy is and how you take the medicine. +918133066128 The abortion pill usually works, but if it doesn’t, you can take more medicine or have an in-clinic abortion. +918133066128 When can I take the abortion pill?+918133066128 In general, you can have a medication abortion up to 77 days (11 weeks)+918133066128 after the first day of your last period. If it’s been 78 days or more since the first day of your last+918133066128 period, you can have an in-clinic abortion to end your pregnancy.+918133066128

Why do people choose the abortion pill? Which kind of abortion you choose all depends on your personal+918133066128 preference and situation. With+918133066128 medication+918133066128 abortion, some people like that you don’t need to have a procedure in a doctor’s office. You can have your medication abortion on your own+918133066128 schedule, at home or in another comfortable place that you choose.+918133066128 You get to decide who you want to be with during your abortion, or you can go it alone. Because+918133066128 medication abortion is similar to a miscarriage, many people feel like it’s more “natural” and less invasive. And some+918133066128 people may not have an in-clinic abortion provider close by, so abortion pills are more available to+918133066128 them. +918133066128 Your doctor, nurse, or health center staff can help you decide which kind of abortion is best for you. +918133066128 More questions from patients: Saudi Arabia+918133066128 CYTOTEC Misoprostol Tablets. Misoprostol is a medication that can prevent stomach ulcers if you also take NSAID medications. It reduces the amount of acid in your stomach, which protects your stomach lining. The brand name of this medication is Cytotec®.+918133066128) Unwanted Kit Mifty kit IN Salmiya (+918133066128) Abortion pills IN Salmiyah Cytotec pills

Mifty kit IN Salmiya (+918133066128) Abortion pills IN Salmiyah Cytotec pillsAbortion pills in Kuwait Cytotec pills in Kuwait

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Recently uploaded (20)

Mifepristone Available in Muscat +918761049707^^ €€ Buy Abortion Pills in Oman

Mifepristone Available in Muscat +918761049707^^ €€ Buy Abortion Pills in Oman

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

The Abortion pills for sale in Qatar@Doha [+27737758557] []Deira Dubai Kuwait

Mifty kit IN Salmiya (+918133066128) Abortion pills IN Salmiyah Cytotec pills

Mifty kit IN Salmiya (+918133066128) Abortion pills IN Salmiyah Cytotec pills

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Getting Real with AI - Columbus DAW - May 2024 - Nick Woo from AlignAI

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

Al Mizhar Dubai Escorts +971561403006 Escorts Service In Al Mizhar

TVB_The Vietnam Believer Newsletter_May 6th, 2024_ENVol. 006.pdf

TVB_The Vietnam Believer Newsletter_May 6th, 2024_ENVol. 006.pdf

Buy Verified TransferWise Accounts From Seosmmearth

Buy Verified TransferWise Accounts From Seosmmearth

Pre Engineered Building Manufacturers Hyderabad.pptx

Pre Engineered Building Manufacturers Hyderabad.pptx

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

wv8379 state.wv.us/taxrev/forms

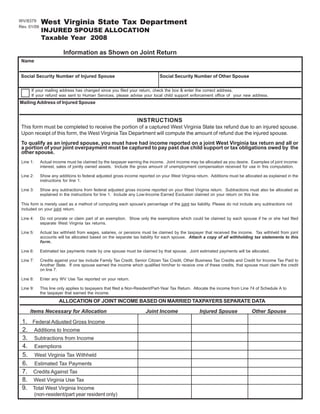

- 1. West Virginia State Tax Department WV/8379 Rev. 01/09 INJURED SPOUSE ALLOCATION Taxable Year 2008 Information as Shown on Joint Return Name Social Security Number of Injured Spouse Social Security Number of Other Spouse If your mailing address has changed since you filed your return, check the box & enter the correct address. If your refund was sent to Human Services, please advise your local child support enforcement office of your new address. Mailing Address of Injured Spouse INSTRUCTIONS This form must be completed to receive the portion of a captured West Virginia State tax refund due to an injured spouse. Upon receipt of this form, the West Virginia Tax Department will compute the amount of refund due the injured spouse. To qualify as an injured spouse, you must have had income reported on a joint West Virginia tax return and all or a portion of your joint overpayment must be captured to pay past due child support or tax obligations owed by the other spouse. Line 1: Actual income must be claimed by the taxpayer earning the income. Joint income may be allocated as you desire. Examples of joint income: interest, sales of jointly owned assets. Include the gross amount of unemployment compensation received for use in this computation. Line 2: Show any additions to federal adjusted gross income reported on your West Virginia return. Additions must be allocated as explained in the instructions for line 1. Line 3: Show any subtractions from federal adjusted gross income reported on your West Virginia return. Subtractions must also be allocated as explained in the instructions for line 1. Include any Low-Income Earned Exclusion claimed on your return on this line. This form is merely used as a method of computing each spouse’s percentage of the joint tax liability. Please do not include any subtractions not included on your joint return. Line 4: Do not prorate or claim part of an exemption. Show only the exemptions which could be claimed by each spouse if he or she had filed separate West Virginia tax returns. Line 5: Actual tax withheld from wages, salaries, or pensions must be claimed by the taxpayer that received the income. Tax withheld from joint accounts will be allocated based on the separate tax liability for each spouse. Attach a copy of all withholding tax statements to this form. Line 6: Estimated tax payments made by one spouse must be claimed by that spouse. Joint estimated payments will be allocated. Line 7: Credits against your tax include Family Tax Credit, Senior Citizen Tax Credit, Other Business Tax Credits and Credit for Income Tax Paid to Another State. If one spouse earned the income which qualified him/her to receive one of these credits, that spouse must claim the credit on line 7. Line 8: Enter any WV Use Tax reported on your return. Line 9: This line only applies to taxpayers that filed a Non-Resident/Part-Year Tax Return. Allocate the income from Line 74 of Schedule A to the taxpayer that earned the income. ALLOCATION OF JOINT INCOME BASED ON MARRIED TAXPAYERS SEPARATE DATA Items Necessary for Allocation Joint Income Injured Spouse Other Spouse 1. Federal Adjusted Gross Income 2. Additions to Income 3. Subtractions from Income 4. Exemptions 5. West Virginia Tax Withheld 6. Estimated Tax Payments 7. Credits Against Tax 8. West Virginia Use Tax 9. Total West Virginia Income (non-resident/part year resident only)