General circular 16_1_2012_xbrl

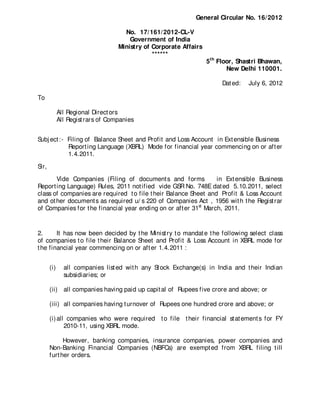

- 1. General Circular No. 16/ 2012 No. 17/ 161/ 2012-CL-V Government of India Ministry of Corporate Affairs ****** 5 th Floor, Shastri Bhawan, New Delhi 110001. Dat ed: July 6, 2012 To All Regional Direct ors All Regist rars of Companies Subj ect :- Filing of Balance Sheet and Profit and Loss Account in Ext ensible Business Report ing Language (XBRL) Mode for financial year commencing on or aft er 1.4.2011. Sir, Vide Companies (Filing of document s and forms in Ext ensible Business Report ing Language) Rules, 2011 not ified vide GSR No. 748E dat ed 5.10.2011, select class of companies are required t o file t heir Balance Sheet and Profit & Loss Account and ot her document s as required u/ s 220 of Companies Act , 1956 wit h t he Regist rar of Companies for t he financial year ending on or aft er 31st March, 2011. 2. It has now been decided by t he Minist ry t o mandat e t he following select class of companies t o file t heir Balance Sheet and Profit & Loss Account in XBRL mode for t he financial year commencing on or aft er 1.4.2011 : (i) all companies list ed wit h any St ock Exchange(s) in India and t heir Indian subsidiaries; or (ii) all companies having paid up capit al of Rupees five crore and above; or (iii) all companies having t urnover of Rupees one hundred crore and above; or (i) all companies who were required t o file t heir financial st at ement s for FY 2010-11, using XBRL mode. However, banking companies, insurance companies, power companies and Non-Banking Financial Companies (NBFCs) are exempt ed from XBRL filing t ill furt her orders.

- 2. -2- 3. The applicable t axonomy as per Schedule VI of t he Companies Act , 1956 has already been placed on t he Minist ry’ s websit e www.mca.gov.in . The Business Rules, validat ion t ools, et c. required for preparing t he financial st at ement s in XBRL format , as per t he revised Schedule-VI and Account ing St andards, are under preparat ion and would soon be made available by t he Minist ry. The act ual dat e for enabling XBRL filing will be int imat ed separat ely. 4. Additional Fee Exemption: All companies referred t o in Para-2 above, will be allowed t o file t heir financial st at ement s in XBRL mode wit hout any addit ional fee/ penalt y upt o 15h November, 2012 or wit hin 30 days from t he dat e of t heir AGM, whichever is lat er. 5. Training Requirement: St akeholders are advised t o visit t he Minist ry’ s websit e www.mca.gov.in/ XBRL/ index.ht ml regularly t o have t raining in XBRL on t axonomy relat ed issues. Yours fait hfully, (Sanj ay Shorey) Joint Direct or