Commodity insight 05.06.12(Gold,Pepper)

- 1. Commodity Insight 05th June, 2012 Turnover of 04.06.12 Commodity Rate Rate Up / Down 05.06.12 04.06.12 Exchange Turnover (Cr.) Gold 1618.25 $ 1617.90 $ 0.35 $ MCX 56409 Silver 28.26 $ 28.23 $ 0.03 $ NCDEX 5354 Crude 83.93 $ 84.25 $ - 0.32 $ USDINR 55.92 55.70 0.22 Gold Fundamentally, Gold rallied 4% last week on unexpectedly weak U.S. jobs data could signal a return to the safe haven status that has eluded bullion for the past seven to eight months. Friday move was the biggest daily percentage gain for gold in more than three years. The European leaders gathering last week could not bring any respite, as neither progress was made over debt crisis nor any commitment was made to prevent Greece from quitting the European bloc after the comments made by the Greece Prime Minister that risk of Greece leaving EURO is real. Although EU ministers showed their support wanting Greece to stay in the bloc, even then they are unwilling to compromise on austerity measures to give boost to the growth. Gold imports in India are likely to dip by about 50 per cent in May to 50-60 tonnes as weakening rupee and higher duties has led to steep rise in price of the precious metal, an industry body said on recently. India had imported 102 tonnes of gold in the same period last year. Technically, Gold has given an downside move of $250 in past three months, prices have also broken major support of $1640 in COMEX and also trading below 200 DMA. As the prices have broken major support so there can be some more sell off till $1570 in short term. Well on the other side, MCX Gold has major support at 28300 or 27800 levels. But the overall scenario looks bullish, so anytime in such correction Gold is good buy for the target of 30500 and 31000 levels. In long term Gold prices are expected to touch levels of $2000 in COMEX, any small correction till $1570 or $1550 should be a good buy opportunity for the targets of $1790 and if the prices are able to break and give close above $1790 than Gold prices can touch levels of $2000 in next five to six months. In MCX once if prices are able to break 30500 levels on closing basis than levels of 32000 & 33000 are easily achievable in next six months. Pepper Fundamentally, On the back of supply shortage and high demand from the domestic market, India's pepper has advanced more than 14 percent in last two weeks, while other spices has dropped on lower demand. Even though the higher arrivals from Brazil and Vietnam in the global market has damped the demand for Indian variety, thin supplies in the domestic market amid strong demand has kept the pepper positive for the week period. Depreciating rupee against the US dollar has also supported the Indian variety in the global market despite higher arrivals from Vietnam and Brazil, which is offered at much lower price than India. Global Pepper production in 2012 is expected to increase 7.2% to 3.20 lakh tonnes as compared to 2.98 lakh tonnes in 2011 with sharp rise of 24% in Indonesian pepper output and in Vietnam by 10%. Pepper output in Vietnam is estimated to be 1.35 lakh tonne as compared to 1.10 lakh tonne estimated early in the beginning of year (2012). • Equities • Commodities • Wealth • Mutual Funds • Insurance 1

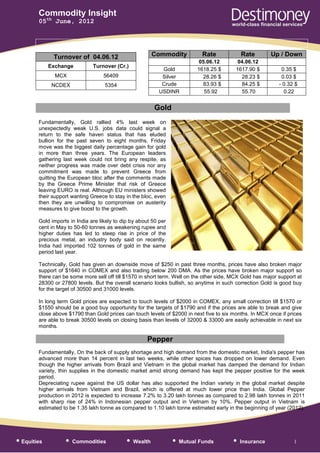

- 2. Commodity Insight 05th June, 2012 Technically, Pepper prices have given good upside move of approx 15000 Rs. i.e.from 28800 to 43400 in last one month. Pepper is overbought at present levels, so anytime there can be sharp correction which can take prices till 36000 or 34000 rs in next one month. Overall, it seems that pepper will move in a range of 34000 on lower side and 44000 rs on higher side. If pepper manages to break the level of 33000 on downside then the levels of 28000 are easily achievable. In long term, We maintain our bearish view in pepper till the time prices does not break levels of 44500 on higher side. So rise in prices till 39000 or 40000 Rs. should be used as selling opportunity for the target of 34000 Rs in next one month. Gold Chart GOLD CONTINUOUS 100 TROY OZ [COMEX] (1,626.80, 1,629.70, 1,610.00, 1,613.90, -8.19995) 1950 1900 1850 1800 1750 1700 1650 1600 1550 1500 1450 1400 Relative Strength Index (54.2588) 80 70 60 50 40 30 Volume (0) 1.0 0.5 0.0 -0.5 -1.0 13 20 27 5 11 18 25 1 8 15 22 29 6 12 19 26 3 10 17 24 31 7 14 21 28 5 12 19 27 3 9 17 23 30 6 13 21 27 5 12 19 26 2 9 16 23 30 7 14 21 29 4 11 18 July August September October November December 2012 February March April May June • Equities • Commodities • Wealth • Mutual Funds • Insurance 2

- 3. Commodity Insight 05th June, 2012 Daily Trading Range Gold today’s trading levels are 29850 - 30200 Intraday Support @ 29850 - 29950 and Resistance @ 30150 - 30200 Intraday Trend Up, Buy on dips…. Gold Buy @ 29950 SL 29850 TGT 30150…. Open Calls Type Stop Closing Date of Commodity Initiated Price Target Comments Loss Price Call Spread Calls Date Type Commodity Initiated Stop Target Comments of Call Price Loss Spread Spread Report by: - Sumeet Bagadia (Head - Commodities & Currencies Research) sumeet.bagadia@destimoney.com Kunal Kame (Research Associate) kunal.kame@destimoney.com Siddhesh Ghare (Research Associate) siddhesh.ghare@destimoney.com • Equities • Commodities • Wealth • Mutual Funds • Insurance 3

- 4. Commodity Insight 05th June, 2012 For private circulation only Website: www.destimoney.com Disclaimer In the preparation of the material contained in this document, Destimoney* has used information that is publicly available, as also data developed in-house. Some of the material used in the document may have been obtained from members/persons other than Destimoney and which may have been made available to Destimoney. Information gathered & material used in this document is believed to be from reliable sources. Destimoney has not independently verified all the information and opinions given in this material. Accordingly, no representation or warranty, express or implied, is made as to the accuracy, authenticity, completeness or fairness of the information and opinions contained in this material. For data reference to any third party in this material no such party will assume any liability for the same. Destimoney does not in any way through this material solicit or offer for purchase or sale of any financial services, commodities, products dealt in this material. Destimoney and any of its officers, directors, personnel and employees, shall not be liable for any loss or damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. The recipient alone shall be fully responsible, and/or liable for any decision taken on the basis of this material. All recipients of this material before dealing and/or transacting in any of the products advised, opined or referred to in this material shall make their own investigation, seek appropriate professional advice and make their own independent decision. This information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Destimoney or its affiliates to any registration requirement within such jurisdiction or country. This information does not constitute an offer to sell or a solicitation of an offer to buy any financial products to any person in any jurisdiction where it is unlawful to make such an offer or solicitation. No part of this material may be duplicated in whole or in part in any form and / or redistributed without the prior written consent of Destimoney. This material is strictly confidential to the recipient and should not be reproduced or disseminated to anyone else. Names such as Teji Mandi, Maal Lav, Maal Le or similar others for market calls and products are merely names coined internally and are not universally defined, and shall not be construed to be indicative of past or potential performance. Recipients of research reports shall always independently verify reliability and suitability of the reports and opinions before investing. *"Destimoney" means any company using the name “Destimoney” as part of its name. • Equities • Commodities • Wealth • Mutual Funds • Insurance 4