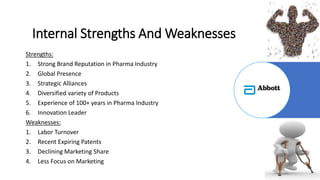

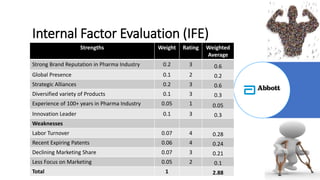

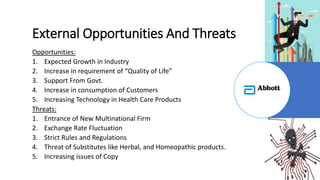

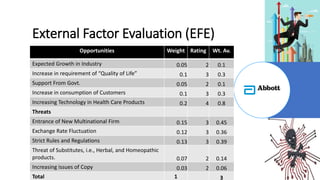

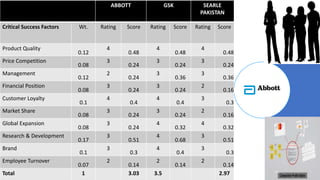

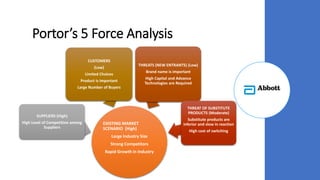

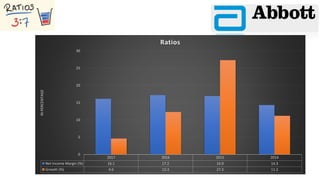

Abbott Laboratories (Pakistan) is a pharmaceutical company founded in 1888 that has been operating in Pakistan since 1948. It has over 1,500 employees and manufacturing facilities in Karachi. The company produces pharmaceuticals, nutritional products, diagnostics, and medical devices. Abbott's main competitors in Pakistan include GSK, Searle Pakistan, Sanofi Aventis, Ferozsons Labs, and Pfizer. An analysis of Abbott's strengths, weaknesses, opportunities, and threats was conducted, as well as financial analysis showing steady growth from 2012-2017. Recommendations included focusing on products with fewer side effects, reducing employee turnover, engaging with the government, and adopting new technologies.