632020 Sources, Rules, and Creation of an Innovation Guide S.docx

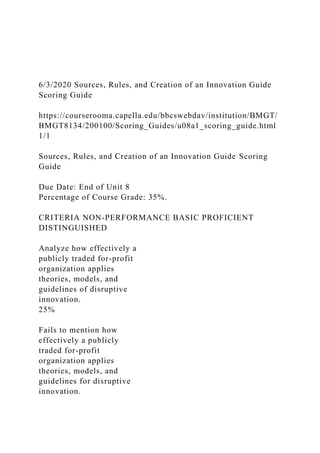

- 1. 6/3/2020 Sources, Rules, and Creation of an Innovation Guide Scoring Guide https://courserooma.capella.edu/bbcswebdav/institution/BMGT/ BMGT8134/200100/Scoring_Guides/u08a1_scoring_guide.html 1/1 Sources, Rules, and Creation of an Innovation Guide Scoring Guide Due Date: End of Unit 8 Percentage of Course Grade: 35%. CRITERIA NON-PERFORMANCE BASIC PROFICIENT DISTINGUISHED Analyze how effectively a publicly traded for-profit organization applies theories, models, and guidelines of disruptive innovation. 25% Fails to mention how effectively a publicly traded for-profit organization applies theories, models, and guidelines for disruptive innovation.

- 2. Outlines how effectively a publicly traded for-profit organization applies theories, models, and guidelines for disruptive innovation. Analyzes how effectively a publicly traded for-profit organization applies theories, models, and guidelines for disruptive innovation. Analyzes how effectively a publicly traded for-profit organization applies theories, models, and guidelines for disruptive innovation. Synthesizes the application for gaps in an exceptionally accurate and impressive manner. Develop approaches for leading strategic foresight and suggest alternative models of disruptive and value innovation for a publicly traded for-profit organization. 25% Fails to list approaches for leading strategic foresight and suggesting alternative models of disruptive and value innovation for a publicly

- 3. traded for-profit organization. Outlines approaches for leading strategic foresight and suggests alternative models of disruptive and value innovation for a publicly traded for-profit organization. Develops approaches for leading strategic foresight and suggests alternative models of disruptive and value innovation for a publicly traded for-profit organization. Develops approaches for leading strategic foresight and suggests alternative models of disruptive and value innovation for a publicly traded for-profit organization. Recommendations are supported with substantial literature and superiority in critical thinking skills is evident. Create an innovation “cookbook” with best practice guidelines. 25% Fails to create an innovation “cookbook” with best practice guidelines.

- 4. Makes a limited attempt at creating an innovation “cookbook” with limited practice guidelines and limited or no supporting theories. Creates an innovation “cookbook” with best practice guidelines. Creates a robust innovation “cookbook” with exceptional clarity of best practice guidelines. Presents and carefully integrates supporting theories and highlighting similarities and differences. Communicate in a manner expected of doctoral-level composition, including full APA compliance and demonstration of critical thinking skills. 25% Fails to communicate in a manner expected of doctoral-level composition, including full APA compliance and demonstration of critical thinking skills. Communicates at a basic level in a manner

- 5. expected of doctoral-level composition and includes partial APA compliance and demonstration of critical thinking skills. Communicates in a manner expected of doctoral-level composition including full APA compliance and demonstration of critical thinking skills. Communicates in a manner expected of doctoral-level composition including full APA compliance and demonstration of critical thinking skills. Communication is exceptionally polished and impressive at a superior level. The 5 Myths of Innovation W I N T E R 2 0 1 1 V O L . 5 2 N O . 2 R E P R I N T N U M B E R 5 2 2 1 0 By Julian Birkinshaw, Cyril Bouquet and J.-L. Barsoux Please note that gray areas reflect artwork that has been intentionally removed. The substantive content of the ar- ticle appears as originally published.

- 6. Myth # 2: Build It and They Will Come … The U.K.-based soc- cer club Ebbsfleet United was bought and run in 2007 by a Web community of 30,000. But by 2010 its paying membership had dwindled to just 800. SLOANREVIEW.MIT.EDU WINTER 2011 MIT SLOAN MANAGEMENT REVIEW 43 I N N O VA T I O N HISTORICALLY, MOST MANAGERS equated innovation primarily with the development of new products and new technologies. But increasingly, innovation is seen as applying to the devel- opment of new service offerings, business models, pricing plans and routes to market, as well as new management practices. There is now a greater recognition that novel ideas can transform any part of the value chain — and that products and services represent just the tip of the innovation iceberg.1 This shift of focus has implications for who “owns” innovation. It used to be the preserve of a

- 7. select band of employees — be they designers, engineers or scientists — whose responsibility it was to generate and pursue new ideas, often in a separate location. But increasingly, innovation has come to be seen as the responsibility of the entire organization. For many large companies, in fact, the new imperative is to view innovation as an “all the time, everywhere” capability that harnesses the skills and imagination of employees at all levels.2 Making innovation everyone’s job is intuitively appealing but very hard to achieve. Many compa- nies have put in place suggestions, schemes, ideation programs, venturing units and online forums. (See “A Glossary of Established Drivers of Innovation,” p. 45.) However, the success rate of such ap- The 5 Myths of Innovation Nowadays, goes the theory, innovation is supposed to be done constantly, by everyone in the company, improving everything the company is about — and new Web-based tools are here to help it happen. Is the theory right? Or do the experiences of companies reveal something different? BY JULIAN BIRKINSHAW, CYRIL BOUQUET AND J.-L. BARSOUX THE LEADING QUESTION

- 8. What conven- tional wisdom about innova- tion no longer applies? FINDINGS Online forums are not a panacea for innovation. Innovation shouldn’t always be “open.” Internal and external experts should be used for very differ- ent problems. Innovation must be bottom-up and top-down — in an approach that’s balanced. www.sloanreview.mit.edu 44 MIT SLOAN MANAGEMENT REVIEW WINTER 2011 SLOANREVIEW.MIT.EDU I N N O VA T I O N proaches is mixed. Employees face capacity, time and motivation issues around their participation. There

- 9. is often a lack of follow-through in well-intentioned schemes. And there is typically some level of discon- nect between the priorities of those at the top and the efforts of those lower down in the organization. Moreover, Web-based tools for capturing and developing ideas have not yet delivered on their promise: A recent McKinsey survey revealed that the number of respondents who are satisfied over- all w ith the Web 2.0 tools (21%) is slig htly outweighed by the number who voice clear dissat- isfaction (22%).3 To understand these challenges, and to identify the innovation practices that work, we spent three years studying the process of innovation in 13 global companies. (See “About the Research.”) All of these companies embarked on often-lengthy journeys aimed at making themselves more consis- tently and sustainably innovative. All sought to

- 10. engage their employees in the process, and all made use of online tools to facilitate and improve the quality and quantity of ideas. Our research allowed us to confirm many of the standard arguments for how to encourage innovation in large organiza- tions, but we also uncovered some surprising findings. (See “Questions That Work — and Don’t — in Online Innovation Forums, ” p. 47 for a sum- mary.) In this article we focus on the key insights that emerged from our research, organized around five persistent “myths” that continue to haunt the innovation efforts of many companies. Myth # 1. The Eureka Moment For many people, it is still the sudden flash of insight — think Archimedes in his bath or Newton below the apple tree — that defines the process of innova- tion. According to this view, companies need to hire a bunch of insightful and contrarian thinkers, and provide them with a fertile environment, and lots of

- 11. time and space, to come up with bright ideas. Alas, the truth is far more prosaic. It is often said that innovation is 5% inspiration and 95% perspi- ration, and our research bears this out. If you think of innovation as a chain of linked activities — from generating new ideas through to commercializing them successfully — it is the latter stages of the pro- cess where ideas are being worked up and developed in detail that are the most time consuming.4 More- over, it is also the latter stages where problems occur. We recently conducted a survey in 123 companies, asking managers to evaluate how effective they were at each stage in the innovation value chain. On aver- age, they indicated that they were relatively good at generating new ideas (either from inside or outside the boundaries of the company), but their perfor- mance dropped for every successive stage of the chain. (See “Which Parts of the Innovation Value

- 12. Chain Are Companies Good At?” p. 48) We are not suggesting that generating ideas is unimportant. But that is not where most companies struggle. Most companies are sufficiently good at generating ideas; the “bottleneck” in the innovation process actually occurs a lot further down the pipeline. The eureka myth helps explains why so many companies are drawn to big brainstorming events, with names such as ideation workshops and inno- vation jams.5 In the course of our research we saw many different types of brainstorming events, and indeed we helped several of the sample companies to put them on. Such events are always valuable: They help to focus the efforts of a large number of people, they generate excitement and interest and they generate some useful ideas. But even with all these benefits, it’s not clear that ideation workshops are the right way to build com-

- 13. panywide innovation capability. As an analogy, think of the role that big musical festivals like Live Aid play in the alleviation of poverty. These big events are terrific for raising awareness and money on a one-time basis, but the process of poverty al- leviation takes years of hard effort on the part of aid organizations, and the outcomes are achieved long after the memory of the big event has faded. The involvement of the general public in aid work usu- ally ends with the check we write to Live Aid; but for the aid organization receiving the money, that is where the real work starts. Our research showed that most companies fail to think through the consequences of putting on ide- ation workshops. The first problem is that they underestimate the amount of work that is needed after the workshop is completed. IBM’s 2006 online Inno- vation Jam, described in more detail below, required a

- 14. team of 60 researchers to sort through the 30,000 posts received over a 72-hour period. UBS Investment ABOUT THE RESEARCH Our research was con- ducted over a three-year period in cooperation with a group of leading compa- nies. The participants came from various sectors: con- sumer products (Mars, Sara Lee, Best Buy, Whirl- pool), pharmaceuticals (Roche Diagnostics, GSK), broadcasting (BBC), energy (BP), information and com- munication technology (BT, IBM), business information (ThomsonReuters) — as well as two banks that were at the center of the recent financial crisis (UBS and RBS). We could have excluded them from the study, but they faced dis- tinctive challenges that significantly enriched the study. We interviewed a total of 54 people, some of them several times, in these companies, and we wrote up detailed case studies about six of the

- 15. companies (Mars, Roche, GSK, IBM, BT and UBS). Apart from tracking and reporting on their innova- tion efforts, some of the participant companies also came together for a roundtable conference at London Business School in December 2008. This provided a fascinating window on the challenges of implementing an inno- vation strategy in large organizations, and it al- lowed us to test out some of our provisional ideas. www.sloanreview.mit.edu WINTER 2011 MIT SLOAN MANAGEMENT REVIEW 45SLOANREVIEW.MIT.EDU Bank’s Idea Exchange, while conducted on a smaller scale, also involved a great deal of post-event work. As one UBS manager observed: “Preliminary sorting, then scoring and giving feedback on such a large number of ideas took a huge amount of time and ef- fort by category owners and subject matter experts.

- 16. The ideas coming through were good, but if we are to do it again we need a repeatable, dashboard-style re- porting system for quantifying results and keeping the momentum going.” The second, and more insidious, problem with ideation workshops is that they can actually be dis- empowering if the organization lacks the capacity to act on the ideas generated. We heard quite a few grumbles during the research from individuals who had put forward their bright ideas through a work- shop or online forum, but received no response — not even an acknowledgment. If the “funnel” is con- stricted further down, at the point where ideas get assessed and developed, stuffing new ideas at the top is simply going to exacerbate the problem. So what should you do? First, be very clear what problem you are trying to solve, and put on an ide- ation workshop only if you believe that it is a lack of

- 17. ideas that is holding you back. Second, if you believe that an ideation workshop is the right approach, be prepared to invest a lot of time and effort into the follow-up work. It is sobering to note that successful innovation programs typically take many years to bear fruit: Procter & Gamble’s Connect + Develop initiative was piloted and developed over a 10-year period, while Royal Dutch Shell’s Gamechanger ini- tiative took more than five years to yield benefits. Alas, many companies lack the continuity in leadership needed to make this type of long-term commitment. Takeaway: Most innovation efforts fail not because of a lack of bright ideas, but because of a lack of careful and thoughtful follow-up. Smart companies know where the weakest links in their entire inno- vation value chain are, and they invest time in correcting those weaknesses rather than further re- inforcing their strengths.

- 18. Myth # 2. Build It and They Will Come The emergence of second-generation Internet technologies (“Web 2.0”) has had a dramatic im- pact on how we share, aggregate and interpret information. The proliferation and growth of on- line communities such as Facebook and LinkedIn seduce us into assuming that these new means of social interaction will also transform the way we get things done at work. But for every online community that succeeds, many others fail. Some make a good start but then enthusiasm wanes. For example, MyFootballClub is a U.K.-based website whose 30,000 members bought a soccer club, Ebbsfleet United, in 2007. However, by 2010 its paying membership had dwindled to just 800 people, leading to severe financial difficulties for Ebbsfleet United. Other online community ini- tiatives fail to live up to their founders’ hopes. For

- 19. example, during the transition period before he came into office, President Obama endorsed the idea of an online “Citizen’s Briefing Book” for peo- ple to submit ideas to him. Some 44,000 proposals and 1.4 million votes were received, but as the Inter- national Herald Tribune reported, “the results were A GLOSSARY OF ESTABLISHED DRIVERS OF INNOVATION There is a growing body of work on the leading-edge practices in innovation management. Consultants and scholars concur on a number of proven condi- tions that contribute to sustained innovation.i These include: Shared understanding: Sustained innovation is a collective endeavor built on a shared sense of what the company is becoming — and what it is not becom- ing. It is also about creating a culture to support innovation — for example, by destigmatizing failure and celebrating successes. Alignment: Besides promoting values that support innovation, organizations also have to address structural impediments (such as silos) and realign contra- dictory systems and processes. As the group head of innovation in one company told us, “We needed to create an environment where it

- 20. was ‘safe to experiment’; where it was possible to ‘pilot’ and ‘test’ ideas before they were subjected to our stringent performance metrics.” Tools: Employees need the training, concepts and techniques to innovate. In the memorable words of a decision support manager at 3M, “It doesn’t work to urge people to think outside the box without giving them the tools to climb out.”ii Diversity: Innovation requires a degree of friction. Bringing in outsiders — new hires, experts, suppliers or customers — and mixing people across business units, functions and geographies helps spark new ideas. Interaction: Organizations need to establish forums, platforms and events to help employees build networks and to provide opportunities for exchange and serendipity to happen. Slack: Employees need some access to slack resources, not least in terms of timeout from their regular activities to experiment and develop new ideas. This also requires focus — both personal and organizational — on eliminating non- value-adding activities. www.sloanreview.mit.edu 46 MIT SLOAN MANAGEMENT REVIEW WINTER 2011

- 21. SLOANREVIEW.MIT.EDU I N N O VA T I O N quietly published, but they were embarrassing.”6 The most popular ideas — in the middle of an eco- nomic meltdown — included legalizing marijuana and online poker, and revoking the Church of Sci- entology’s tax-exempt status. How does this affect the process of innovation? Unsurprisingly, all the companies we studied had figured out that the tools of Web 2.0 could poten- tially be very valuable in helping large numbers of people get involved in an innovation process. Most had built some sort of online forum in which em- ployees could post their ideas, comment and build on the ideas of others and evaluate proposals. For example, IBM used space on its corporate Intranet to launch a 72-hour Innovation Jam in 2006, the purpose being to get IBM employees, clients and

- 22. partners involved in an online debate about new business opportunities. The Innovation Jam at- tracted 57,000 visitors and 30,000 posts. A rather different example is Royal Bank of Scotland’s devel- opment of a virtual innovation center in Second Life, which allowed the bank to prototype potential new banking environments and get direct and rapid feedback from employees around the world. In these and other cases, the implicit logic was: Build it, and they will come. Both IBM and RBS had considerable success in attracting interest, but the overall story was much more mixed. Some on- line for ums really helped to galvanize their company’s innovation efforts. Others ended up underused and unloved. What are the biggest problems with developing online innovation forums? The first is that the forum doesn’t take off. It’s usually quite straight-

- 23. forward to get people to check out a new site once or twice, but they need a reason to keep coming back. As MyFootballClub found, the risk is that the novelty of an innovation forum will wear out pretty quickly and participation will dwindle. A manager at Roche Diagnostics observed: “Our hope that our internal technology-oriented people would gravi- tate to using this type of tool was completely unfounded. We really had to push people (via an electronic marketing campaign) to involve them in suggesting solutions to the six problems we identi- fied.” Equally, managers at Mars and UBS found their innovation efforts stalling after promising starts. One said: “We probably underestimated the communications needed. We were good up-front, but learned that continuous communications is vital. We had to counter some skepticism, to create the belief that something would happen.”

- 24. The second risk is that, like Obama’s Citizen’s Briefing Book, the ideas that get posted are off- topic, half-baked or irrelevant. All the managers we spoke to acknowledged that they had to work hard to “separate the wheat from the chaff.” Many of the ideas put forward were parochial or ill-informed, and few people took the trouble to build on the ideas of others. The notion that the good ideas would be picked up by others and rise to the top rarely worked out. So what should you do to avoid these problems? The most important point is to understand the types of interaction that occur in online forums, so that you use them in the right way. If you are looking for creative, never-heard-before ideas, and if you want people to take responsibility for building on one an- other’s ideas, then a face-to-face workshop is your best bet. But if you are looking for a specific answer

- 25. to a question, or if you want to generate a wide vari- ety of views about some existing ideas, then an online forum can be highly efficient. (See “Questions That Work — and Don’t — in Online Innovation Fo- rums” for examples.) Takeaway: Online forums are not a panacea for dis- tributed innovation. Online forums are good for capturing and filtering large numbers of existing ideas; in-person forums are good for generating and building on new ideas. Smart companies are selec- tive in their use of online forums for innovation. Myth # 3. Open Innovation Is the Future Any discussion of innovation in large companies sooner or later turns to the issue of “open” innova- tion — the idea that companies should look for ways of tapping into and harnessing the ideas that lie beyond their formal boundaries. Many compa- nies are now embracing open innovation in its

- 26. many guises. For example, the Danish toymaker LEGO has been leveraging customer ideas as a source of innovation for years, and some new products are even labeled “created by LEGO fans.”7 And one of P&G’s first experiments with online www.sloanreview.mit.edu SLOANREVIEW.MIT.EDU WINTER 2011 MIT SLOAN MANAGEMENT REVIEW 47 advertising invited people to make spoof movies of P&G’s “Talking Stain” TV ad and post them on YouTube — resulting in over 200 submissions, some of which proved good enough to air on TV.8 Our research confirmed that most large com- panies believe a more open approach to innovation is necessary, but it also underlined that there is no free lunch on offer. The benefits of open innova- tion, in terms of providing a company with access to a vastly greater pool of ideas, are obvious. But

- 27. the costs are also considerable, including practical challenges in resolving intellectual property own- ership issues, lack of trust on both sides of the fence and the operational costs involved in building an open innovation capability. Open innovation is not the future, but it is certainly part of the future, and the smart approach is to use the tools of open innovation selectively. Roche Diagnostics was a company that got a lot of value out of open innovation. In 2009 it put in place an experimental initiative to overcome spe- cific technological problems that were preventing certain R&D programs from moving forward. The company identified six technology challenges that needed solving, and it opened the challenges up to the internal R&D community and to the external technology community through Innocentive and UTEK (now Innovaro), two well-known technol-

- 28. ogy marketplaces. The manager in charge of the initiative described the outcome thus: Internally, the number of responses to these six challenges was very low. But one very thoughtful response to one of the challenges was brilliant, and paid for the entire experiment. Externally, we used Innocentive and UTEK, and both had a far higher response rate than our internal exper- iment — more than 10 times the volume of responses, in fact. We offered a $1,500 reward, so this could have been an influencing factor. We received one novel solution, which really made the entire experiment worthwhile, but more than that was our very positive experience of in- volving external collaborators. Roche’s experience was the closest thing we saw to a proper experiment that compared the merits of tap- ping into internal and external communities — and

- 29. it really highlighted the value of tapping into the ex- ternal group. But note that the potential respondents were being asked a very narrow, technology-specific question. Clearly, the external community would have been far less useful for tackling company-spe- cific or situation-specific problems. What are the downsides or limitations of open innovation? One set of concerns relates to how you handle intellectual property issues. At the time of writing, Roche Diagnostics was still working through the details of the licensing agreement with the person who solved its technological problem, and the transaction and licensing costs were far from trivial. A related issue is that without the strong IP protection that a market-maker like In- nocentive provides, external parties are careful with what they will share. IBM discovered this in its In- novation Jam. As one manager recalled, “This Jam

- 30. was established as an open forum, so anyone can take these ideas and use them. So we felt we were taking a few risks doing this, and perhaps it meant that our clients were quieter in the discussions than QUESTIONS THAT WORK — AND DON’T — IN ONLINE INNOVATION FORUMS WHAT WORKS ■ Option-based questions where you want to know the distribution of current views, for example: • Which of the following sources of information do you use most frequently in the workplace? (print media, digital media, experts, colleagues) • How would you rate our speed of customer responsiveness on a one-10 scale? ■ Narrow, often technical, questions for which there is one (or more) factually correct answer, for example: • Can anyone tell me what to do when I am faced with this error code? Syntax Loop unspecified Ref 56663. WHAT DOESN’T ■ Questions that ask for a big conceptual leap forward without providing any

- 31. raw material for people to latch onto, for example: • We are looking for radical new approaches to customer service in our retail bank — any ideas? Advice: Provide some unusual stimuli to encourage people to think differently, for example: How could we make the retail bank more like your favorite restaurant? ■ Questions that ask people to build one another’s ideas in a constructive manner, for example: • Let’s start a discussion thread about new approaches to working more closely with our customers. Advice: Use a mix of online and in-person brainstorming sessions; or actively manage the thread to create some coherence. www.sloanreview.mit.edu 48 MIT SLOAN MANAGEMENT REVIEW WINTER 2011 SLOANREVIEW.MIT.EDU I N N O VA T I O N we would have liked. But it was important to make this open in every sense of the word.” A second set of concerns was around how the

- 32. companies we studied actually used the insights provided by external sources. One European tele- com company had a “scouting” unit in Silicon Valley to keep an eye on exciting new startups and emerging technologies, but the scouting team dis- covered that the only technologies the folks back in Europe were interested in were those that would help them accelerate their current development road map. The really radical ideas, the ones that the scouting unit was putatively looking for, were sim- ply too dissonant for the European development teams to get their heads around. A final concern is simply the time it takes to do open innovation properly. Companies such as Procter & Gamble, Intel and LEGO have put an enormous amount of investment into building their own external networks, and they are begin- ning to see a return, but you shouldn’t underestimate

- 33. the time and effort involved. Takeaway: External innovation forums have access to a broad range of expertise that makes them effec- tive for solving narrow technological problems; internal innovation forums have less breadth but more understanding of context. Smart companies use their external and internal experts for very dif- ferent types of problems. Myth # 4. Pay Is Paramount A dominant concern when organizations set out to grow their innovation capabilities is how to structure rewards for ideas. A common refrain is that innovation involves discretionary effort on top of existing respon- sibilities, so we have to offer incentives so people to put in that extra effort. The example of the venture capital industry was mentioned as a setting in which people coming up with ideas, and those backing them, all have the opportunity to become rich.

- 34. But both academic theory and our discussions with chief innovation officers indicate that this is a red herring. Let’s briefly look at the theory. People are moti- vated by many factors, but extrinsic rewards such as money are usually secondary, hygiene-type factors. The more powerful motivators are typically “social” factors, such as the recognition and status that is conferred on those who do well, and “personal” fac- tors, such as the intrinsic pleasure that some work affords. More specifically, there is evidence from psychology research that individuals view the offer of reward for an enjoyable task as an attempt to control their behavior, which hence undermines their intrinsic task interest and creative perfor- mance.9 Parallel research in behavioral economics suggests that intrinsic motivation is especially likely to suffer when the incentives are large.10

- 35. All of which suggests that you don’t need mone- t a r y re w a rd s f o r i n n ov a t i o n . In n ov a t i o n i s intrinsically enjoyable, and it’s easy to recognize and confer status on those who put their discre- tionary effort into it. Our research interviews provided plentiful evidence that this is the case. Take the experience of UBS. With considerable upheaval at senior levels of the bank, the innovation movement was very much a grassroots effort — built around “UBS Idea Exchange,” an online tool. The executive in charge of that effort commented: “We found that employees having an opportunity to put forward their ideas brought huge personal rewards. We learned very clearly (through our ex- periments) that financial rewards would not have made any difference. People reported that recogni- tion of their ideas was a reward in itself. They wanted to be engaged and to participate. We there-

- 36. fore involved people in presenting their ideas to senior management.” WHICH PARTS OF THE INNOVATION VALUE CHAIN ARE COMPANIES GOOD AT? Originating ideas usually isn’t the hardest part of innovating. Most companies are sufficiently good at generating ideas, the “bottleneck” in the innovation pro- cess actually occurs a lot further down the pipeline. 1 Generating ideas inside Generating ideas outside Cross-pollinating ideas inside Selecting promising ideas Developing ideas into products/services Diffusing proven ideas across the company 2 3 How good is your company at the following activities, on a scale of one to five? How good is your company at the

- 37. following activities, on a scale of one to five? www.sloanreview.mit.edu SLOANREVIEW.MIT.EDU WINTER 2011 MIT SLOAN MANAGEMENT REVIEW 49 The sentiment was echoed by the head of inno- vation at Mars Central Europe: “We try to recognize people rather than offer material rewards. We hold a corporate event, biannually, called Make The Dif- ference, where ideas and success stor ies are celebrated. The Central Europe team is very proud of the fact that we won more awards at this event last year than any other … F A L L 2 0 1 6 I S S U E Clayton M. Christensen Thomas Bartman Derek van Bever The Hard Truth About Business

- 38. Model Innovation Many attempts at business model innovation fail. To change that, executives need to understand how business models develop through predictable stages over time — and then apply that understanding to key decisions about new business models. Vol. 58, No. 1 Reprint #58123 http://mitsmr.com/2cBmhTk http://mitsmr.com/2cBmhTk The Hard Truth About Business Model Innovation E S S A Y : B U S I N E S S M O D E L S PLEASE NOTE THAT GRAY AREAS REFLECT ARTWORK THAT HAS BEEN INTENTIONALLY REMOVED. THE SUBSTANTIVE CONTENT OF THE ARTICLE APPEARS AS ORIGINALLY PUBLISHED. THE LEADING QUESTION How can executives improve their odds of success at business model innovation? FINDINGS �Understand that,

- 39. over time, business models become more resistant to change. �Analyze how consis- tent a proposed business model innovation is with the priorities of the existing business. SURVEYING THE LANDSCAPE of recent attempts at business model innovation, one could be forgiven for be- lieving that success is essentially random. For example, conventional wisdom would suggest that Google Inc., with its Midas touch for innovation, might be more likely to succeed in its business model innovation efforts than a traditional, older, industrial company like the automaker Daimler AG. But that’s not always the case. Google+, which Google launched in 2011, has failed to gain traction as a social net- work, while at this writing Daimler is building a promising new venture, car2go, which has become one of the world’s leading car-sharing businesses. Are those surprising out- comes simply anomalies, or could they have been predicted?

- 40. To our eyes, the landscape of failed attempts at business model innovation is crowded — and becoming more so — as management teams at established companies mount both of- fensive and defensive initiatives involving new business models. A venture capitalist who advises large financial ser- vices companies on strategy shared his observation about the anxiety his investors feel about the changes underway in their industry: “They look at the fintech [financial technology] startups and see their business models being unbundled and attacked at every point in the value chain.” And financial services companies are not alone. A PwC survey published in 2015 revealed that 54% of CEOs worldwide were concerned about new competitors entering their market, and an equal percentage said they had either begun to compete in FALL 2016 MIT SLOAN MANAGEMENT REVIEW 31 Many attempts at business model innovation fail. To change that, executives need to understand how business models develop through predictable stages over time — and then apply that understanding to key decisions about new business models.

- 41. BY CLAYTON M. CHRISTENSEN, THOMAS BARTMAN, AND DEREK VAN BEVER 32 MIT SLOAN MANAGEMENT REVIEW FALL 2016 SLOANREVIEW.MIT.EDU E S S A Y : B U S I N E S S M O D E L S nontraditional markets themselves or considered doing so.1 For its part, the Boston Consulting Group reports that in a 2014 survey of 1,500 senior execu- tives, 94% stated that their companies had attempted some degree of business model innovation.2 We’ve decided to wade in at this juncture because business model innovation is too important to be left to random chance and guesswork. Executed correctly, it has the ability to make companies resilient in the face of change and to create growth unbounded by the lim- its of existing businesses. Further, we have seen businesses overcome other management problems that resulted in high failure rates. For example, if you

- 42. bought a car in the United States in the 1970s, there was a very real possibility that you would get a “lemon.” Some cars were inexplicably afflicted by problem after problem, to the point that it was accepted that such lemons were a natural consequence of inherent ran- domness in manufacturing. But management expert W. Edwards Deming demonstrated that manufactur- ing doesn’t have to be random, and, having incorporated his insights in the 1980s, the major auto- motive companies have made lemons a memory of a bygone era. To our eyes, there are currently a lot of lem- ons being produced by the business model innovation process — but it doesn’t have to be that way. In our experience, when the business world en- counters an intractable management problem, it’s a sign that business executives and scholars are get- ting something wrong — that there isn’t yet a satisfactory theory for what’s causing the problem,

- 43. and under what circumstances it can be overcome. This is what has resulted in so much wasted time and effort in attempts at corporate renewal. And this confusion has spawned a welter of well-mean- ing but ultimately misguided advice, ranging from prescriptions to innovate only close to the core business to assertions about the type of leader who is able to pull off business model transformations, or the capabilities a business requires to achieve successful business model innovation. The hard truth about business model innova- tion is that it is not the attributes of the innovator that principally drive success or failure, but rather the nature of the innovation being attempted. Busi- ness models develop through predictable stages over time — and executives need to understand the priorities associated with each business model stage. Business leaders then need to evaluate

- 44. whether or not a business model innovation they are considering is consistent with the current pri- orities of their existing business model. This analysis matters greatly, as it drives a whole host of decisions about where the new initiative should be housed, how its performance should be measured, and how the resources and processes at work in the company will either support it or extinguish it. This truth has revealed itself to us gradually over time, but our thinking has crystallized over the past two years in an intensive study effort we have led at the Harvard Business School. As part of that research effort, we have analyzed 26 cases of both successful and failed business model innovation; in addition, we have selected a set of nine industry-leading com- panies whose senior leaders are currently struggling with the issue of conceiving and sustaining success in business model innovation. (See “About the Re-

- 45. search.”) We have profiled these nine companies’ efforts extensively, documented their successes and failures, and convened their executives on campus periodically to enable them to share insights and frustrations with each other. Stepping back, we’ve made a number of observations that we hope will prove generally helpful, and we also have a sense of the work that remains to be done. There are a number of lessons that managers can learn from past successes and failures, but all depend on understanding the rules that govern business model formation and development — how new models are created and how they evolve across time, the kinds of changes that are possible to those mod- els at various stages of development, and what that means for organizational renewal and growth. The Business Model’s Journey The confusion surrounding business model innova- tion begins, appropriately enough, with confusion

- 46. about the term “business model.” In our course at the Harvard Business School, we teach students to use a four-box business model framework that we developed with colleagues from the consulting firm Innosight LLC. This framework consists of the value proposition for customers (which we will refer to as the “job to be done”); the organization’s resources, such as people, cash, and technology; the processes3 that it uses to convert inputs to finished products or ABOUT THE RESEARCH This article assembles knowledge that the primary author has developed over the course of two decades studying what causes good businesses to fail, comple- mented by a two-year intensive research project to uncover where current man- agers and leadership teams stumble in executing busi- ness model innovation. Over the course of the past two years of in-depth study, we evaluated 26 business

- 47. model innovations in the his- torical record that had run a course from idea to develop- ment to success, or failure. The study identified 10 fail- ures and 16 successes and coded each across 20 di- mensions to identify patterns associated with success and failure. To further develop our understanding of the causal- ity behind the relationships we observed, we also as- sembled a cohort of nine market-leading companies from industries as diverse as information technology, con- sumer products, travel and leisure, fashion, publishing, and financial services. Each of these companies is at- tempting to execute some degree of business model innovation. We observed these companies as they undertook their business model innovation efforts and conducted interviews with more than 60 C-level execu- tives across the nine companies. In addition to our interviews, we convened two working sessions at Harvard Business School

- 48. that brought executives from each company to- gether to discuss the challenges, opportunities, and realities of business model innovation from the perspective of the manager. SLOANREVIEW.MIT.EDU FALL 2016 MIT SLOAN MANAGEMENT REVIEW 33 services; and the profit formula that dictates the mar- gins, asset velocity, and scale required to achieve an attractive return.4 (See “The Elements of a Business Model.”) Collectively, the organization’s resources and processes define its capabilities — how it does things — while its customer value proposition and profit formula characterize its priorities — what it does, and why. 5 This way of viewing business models is useful for two reasons. First, it supplies a common language and framework to understand the capabilities of a business. Second, it highlights the interdependencies

- 49. among elements and illuminates what a business is incapable of doing. Interdependencies describe the integration required between individual elements of the business model — each component of the model must be congruent with the others. They explain why, for example, Rolls-Royce Motor Cars Ltd. is unable to sell cheap bespoke cars and why Wal-Mart Stores Inc. is unable to combine low prices with fancy stores. Understanding the interdependencies in a business model is important because those interdependencies grow and harden across time, creating another funda- mental truth that is critical for leaders to understand: Business models by their very nature are designed not to change, and they become less flexible and more resistant to change as they develop over time. Leaders of the world’s best businesses should take special note, be- cause the better your business model performs at its assigned task, the more interdependent and less capa-

- 50. ble of change it likely is. The strengthening of these interdependencies is not an intentional act by manag- ers; rather, it comes from the emergence of processes that arise as the natural, collective response to recur- rent activities. The longer a business unit exists, the more often it will confront similar problems and the more ingrained its approaches to solving those prob- lems will become. We often refer to these ingrained approaches as a business’s “culture.”6 In fact, this pattern is so consistent and important that we’ve begun to think of the development of a business model across time as resembling a journey whose progress and route are predictable — although the time that it takes a business model to follow this journey will differ by industry and circumstance. (See “The Three Stages of a Business Model’s Jour- ney,” p. 34.) As the diagram depicts, a business model, which in an established company is typically

- 51. embodied in a business unit,7 travels a one-way jour- ney, beginning with the creation of the new business unit and its business model, then shifting to sustain- ing and growing the business unit, and ultimately moving to wringing efficiency from it. Each stage of the journey supports a specific type of innovation, builds a particular set of interdependencies into the model, and is responsive to a particular set of perfor- mance metrics. This is the arc of the journey of virtually every business model — if it is lucky and successful enough to travel the entire length of the route. Unsuccessful business units will falter before concluding the journey and be absorbed or shut- tered. Now, let’s explore each of the three stages and how the business model evolves through them. 1. Creation Peter Drucker once said that the pur- pose of a business is to create a customer.8 That goal characterizes the first stage of the journey,

- 52. when the business searches for a meaningful value proposition, which it can design initial product and service offerings to fulfill. This is the stage THE ELEMENTS OF A BUSINESS MODEL A business model is made up of four elements: (1) a value proposition for customers; (2) resources, such as people, money, and technology; (3) the processes that the organiza- tion uses to convert inputs to finished products or services; and (4) the profit formula that dictates the margins, asset velocity, and scale required to achieve an attractive return. Interdependencies, represented here by bidirectional arrows, describe the integration required between individual elements of the business model. They require that every component of the model be congruent with every other component. A product that helps customers to more effectively, conveniently, and affordably do a job they've been trying to do Assets and fixed cost structure, and the margins and velocity required to cover them People, technology, products, facilities, equipment, brands, and

- 53. cash that are required to deliver this value proposition to the targeted customers Ways of working together to address recurrent tasks in a consistent way: training, development, manufacturing, budgeting, planning, etc. Value proposition Profit formula Resources Priorities Capabilities Processes 34 MIT SLOAN MANAGEMENT REVIEW FALL 2016 SLOANREVIEW.MIT.EDU E S S A Y : B U S I N E S S M O D E L S at which a relatively small band of resources (a founding team armed with an idea, some funding

- 54. and ambition, and sometimes a technology) is en- tirely focused on developing a compelling value proposition — fulfilling a significant unmet need, or “job.”9 It’s useful to think of the members of the founding team as completely immersed in this search. The information swirling around them at this point in the journey — the information they pay the most attention to — consists of insights they are able to glean into the unfulfilled jobs of prospective customers. We emphasize the primacy of the job at this point of the journey because it is very difficult for a business to remain focused on a customer’s job as the operation scales. Understanding the progress a customer is trying to make — and providing the experiences in purchase and use that will fulfill that job perfectly — requires patient, bottom-up in- quiry. The language that is characteristic of this

- 55. stage is the language of questions, not of answers. The link between value proposition and resources is already forming, but the rest of the model is still unformed: The new organization has yet to face the types of recurrent tasks that create processes, and its profit formula is nascent and exploratory. This gives the business an incredible flexibility that will disappear as it evolves along the journey and its language shifts from questions to answers. 2. Sustaining Innovation Business units lucky and skilled enough to discover an unfulfilled job and develop a product or service that addresses it enter the sustaining innovation phase of the busi- ness model journey. At this stage, customer demand reaches the point where the greatest challenge the business faces is no longer determining whether the product fulfills a job, but rather scaling operations to meet growing demand. Whereas in the creation

- 56. phase the business unit created customers, in the sustaining innovation phase it is building these customers into a reliable, loyal base and building the organization into a well-oiled machine that delivers the product or service flawlessly and re- peatedly. The innovations characteristic of this phase of the business model journey are what we call sustaining innovations — in other words, bet- ter products that can be sold for higher prices to the current target market. A curious change sets in at this stage of the jour- ney, however: As the business unit racks up sales, the voice of the customer gets louder, drowning out to some extent the voice of the job. Why does this hap- pen? It’s not that managers intend to lose touch with the job, but while the voice of the job is faint and re- quires interrogation to hear, the voice of the customer is transmitted into the business with each

- 57. sale and gets louder with every additional transac- tion. The voice of the job emerges only in one-to-one, in-depth conversations that reveal the job’s context in a customer’s life, but listening to the voice of the customer allows the business to scale its understand- ing. Customers can be surveyed and polled to learn their preferences, and those preferences are then channeled into efforts to improve existing products. The business unit is now no longer in the busi- ness of identifying new unmet needs but rather in the business of building processes — locking down the current model. The data that surrounds manag- ers is now about revenues, products, customers, and competition. While in the creation phase, the found- ing team had to dig to discover data, data now floods THE THREE STAGES OF A BUSINESS MODEL’S JOURNEY A business model, which in an established company is typically embodied in a busi- ness unit, travels a journey that begins with the creation of the new business unit and its business model, and then shifts to sustaining and growing the

- 58. business unit — and still later to wringing efficiency from it. Each stage of the journey is conducive to a specific type of innovation, builds a particular set of interdependencies into the model, and is responsive to a particular set of performance metrics. Green bidirectional arrows represent interdependencies between aspects of the business model that are well- established at that stage; business model elements in bold represent areas of focus during that stage of business model evolution. Business model elements and interde- pendencies shown in beige are still somewhat flexible at that point in the journey. • Market-creating innovations • Metrics about job to be done • Data about context of the job • Flexible business model • Language of questions about the job and context • Sustaining innovations • Income statement metrics • Data about customers • Processes emerge • Language of statements about products, customers, competitors, and markets • Efficiency innovations • Balance sheet, ratio metrics • Data about costs, efficiency

- 59. • Rigid business model to facilitate modularity • Language of statements about cost and efficiency Creation Sustaining Innovation Efficiency Market forms and business begins to grow Processes form in response to recurrent tasks Performance oversupply may creep in Modular structure forms Investors demand return of capital

- 60. Value proposition Resources Processes Profit formula Value proposition Resources Processes Profit formula Value proposition Resources Processes Profit formula SLOANREVIEW.MIT.EDU FALL 2016 MIT SLOAN MANAGEMENT REVIEW 35 the business’s offices, with more arriving with each new transaction. Data begs to be analyzed — it is the way the game is scored — so the influx of data pre- cipitates the adoption of metrics to evaluate the

- 61. business’s performance and direct future activity to improving the metrics. The performance metrics in this phase focus on the income statement, leading managers to direct investments toward growing the top line and maximizing the bottom line. 3. Efficiency At some point, however, these invest- ments in product performance no longer generate adequate additional profitability. At this point, the business unit begins to prioritize the activities of effi- ciency innovation, which reduce cost by eliminating labor or by redesigning products to eliminate com- ponents or replace them with cheaper alternatives. (There is, however, always some amount of both types of innovation — sustaining and efficiency — occurring at any point of a business’s evolution.) Broadly, the activities of efficiency innovation in- clude outsourcing, adding financial leverage, optimizing processes, and consolidating industries to

- 62. gain economies of scale. While many factors can cause businesses to transition into the efficiency in- novation phase of their evolution, one we have often observed is the result of performance “overshoot,” in which the business delivers more performance than the market can utilize and consumers become unwilling to pay for additional performance im- provement or to upgrade to improved versions. Managers should not bemoan the shift to efficiency innovation. It needs to happen; over time, business units must become more efficient to remain com- petitive, and the shift to efficiency innovations as the predominant form of innovation activity is a natural outcome of that process. To managers, the efficiency innovation phase marks the point where the voice of the shareholders drowns out the voice of the customer. Gleaning new understanding of that initial job to be done is now

- 63. the long-lost ambition of a bygone era, and manag- ers become inundated with data about costs and efficiency. The business unit frequently achieves efficiency by shifting to a modular structure, stan- dardizing the interdependencies between each of the components of its business model so that they may be outsourced to third parties. In hardening these interdependencies, the business unit reaps the efficiency rewards of modularization but leaves flex- ibility behind, firmly cementing the structure of its business model in place. Deviations from the exist- ing structure undermine the modularity of the components and reduce efficiency, so when evaluat- ing such changes, the business will often choose to forsake them in pursuit of greater efficiency. Now, when the business unit generates increasing amounts of free cash flow from its efficiency innova- tions, it is likely to sideline the capital, to diversify

- 64. the company, or to invest it in industry consolidation. This is one of the major drivers of merger and ac- quisition (M&A) activity. Whereas the sustaining innovation phase was exciting to managers, customers, and shareholders, the efficiency innovation phase re- duces degrees of managerial freedom. Efficiency innovations lure managers with their promises of low risk, high returns, and quick paybacks from cost reduc- tion, but the end result is often a race to the bottom that sees the business’s ability to serve the job and customers atrophy as it improves its service to shareholders. The natural evolution of business units occurs all around us. Consider the case of The Boeing Co. and its wildly successful 737 business unit. The 737 busi- ness was announced in 1965 and launched its first version, the 737-100, in 1967, with Lufthansa as its first customer. With orders from several additional major airlines, the new business unit demonstrated

- 65. that its medium-haul plane fulfilled an important job to be done. Before even delivering the first -100, Boeing began improving the 737 and launched a Managers should not bemoan the shift to efficiency innovation. It needs to happen; over time, business units must become more efficient to remain competitive. 36 MIT SLOAN MANAGEMENT REVIEW FALL 2016 SLOANREVIEW.MIT.EDU E S S A Y : B U S I N E S S M O D E L S stretched version, the -200, with a longer fuselage to meet demands from airlines requiring greater seating capacity. Boeing entered the sustaining innovation phase and continued to improve its product by devel- oping several generations of new 737s, stretching the fuselage like an accordion while nearly doubling the plane’s range and more than doubling its revenue per available seat mile. The business continued to im- prove how it served customers with the Next Generation series in the 1990s, which offered even

- 66. bigger aircraft and better avionics systems. Facing increased competition and demands for improved financial performance, the 737 business shifted its focus to efficiency innovation in the early 2000s. To free resources and liberate capital, Boeing began to outsource aspects of 737 production. Most notably, Boeing sold a facility in Wichita, Kansas, that manufactured the main fuselage platform for the 737 to the Toronto-based investment company Onex Corp. in 2005. Outsourcing subsystem production allowed the business to improve its capital efficiency and deliver improved returns on capital.10 Given that road map, what is the hope for com- panies that seek to develop new business models or to create new businesses? Thus far in this article we’ve explored the journey that business units take over time. And while we’re not sure that a business unit can break off from this race, we know that its

- 67. parent companies can — by developing new busi- nesses. Although the processes of an individual business unit’s business model propel it along this journey, the opportunity exists to develop a process of business creation at the corporate level. But doing so successfully requires paying careful attention to the implications of the business model road map. Implications For Business Model Innovation It’s worth internalizing the road map view of busi- ness model evolution because it helps explain why most attempts to alter the course of existing business units fail. Unaware of the interdependen- cies and rigidities that constrain business units to pursuing their existing journey, managers attempt to compel existing business units to pursue new priorities or attempt to create a new business inside an existing unit. Using the road map as a guiding principle allows leaders to correctly categorize the

- 68. innovation opportunities that appear before them in terms of their fit with their existing business model’s priorities. Several recommendations for managers emerge from this insight. Determine how consistent the opportunity is with the priorities of the existing business model. The only types of innovation you can perform nat- urally within an existing business model are those that build on and improve the existing model and accelerate its progress along the journey — in other words, those innovations that are consistent with its current priorities — by sharpening its focus on fulfilling the existing job or improving its financial performance. Therefore, a crucial question for leaders to ask when evaluating an innovation op- portunity is: To what degree does it align with the existing priorities of the business model? Many failed business model innovations involve

- 69. the pursuit of opportunities that appear to be con- sistent with a unit’s current business model but that in fact are likely to be rejected by the existing busi- ness or its customers. (See “Evaluating the Fit Between an Opportunity and an Existing Busi- ness.”) To determine how consistent an opportunity is with the priorities of the existing business model, leaders should ask: Is the new job to be done for the customer similar to the existing job? (The greater the similarity, the more appropriate it is for the ex- isting business to pursue the opportunity.) How does pursuit of the opportunity affect the existing profit formula? Are the margins better, transaction sizes larger, and addressable markets bigger? If so, it is likely to fit well with the existing profit formula. If not, managers should tread with caution in The only types of innovation you can perform naturally within an existing business model are those that build on and improve the existing model and accelerate its progress.

- 70. SLOANREVIEW.MIT.EDU FALL 2016 MIT SLOAN MANAGEMENT REVIEW 37 asking an existing business to take it on … Business: Think different; Schumpeter Anonymous . The Economist ; London Vol. 400, Iss. 8745, (Aug 6, 2011): 60. ProQuest document link ABSTRACT Innovation is today's equivalent of the Holy Grail. Rich-world governments see it as a way of staving off stagnation. Poor governments see it as a way of speeding up growth. And businesspeople everywhere see it as the key to survival. Which makes Clay Christensen the closest thing we have to Sir Galahad. Fourteen years ago Mr Christensen, a knight of the Harvard Business School, revolutionised the study of the subject with The Innovator's Dilemma, a book that popularised the term disruptive

- 71. innovation. This month he publishes a new study, The Innovator's DNA, co-written with Jeff Dyer and Hal Gregersen, which tries to take us inside the minds of successful innovators. Mr Christensen and his colleagues list five habits of mind that characterise disruptive innovators: associating, questioning, observing, networking and experimenting. FULL TEXT Economist.com/blogs/schumpeter Clay Christensen lays down some rules for innovators. But can innovation be learned? INNOVATION is today's equivalent of the Holy Grail. Rich- world governments see it as a way of staving off stagnation. Poor governments see it as a way of speeding up growth. And businesspeople everywhere see it as the key to survival. Which makes Clay Christensen the closest thing we have to Sir Galahad. Fourteen years ago Mr Christensen, a knight of the Harvard Business School, revolutionised the study of the subject with "The Innovator's Dilemma", a

- 72. book that popularised the term "disruptive innovation". This month he publishes a new study, "The Innovator's DNA", co-written with Jeff Dyer and Hal Gregersen, which tries to take us inside the minds of successful innovators. How do they go about their business? How do they differ from regular suits? And what can companies learn from their mental habits? Mr Christensen and his colleagues list five habits of mind that characterise disruptive innovators: associating, questioning, observing, networking and experimenting. Innovators excel at connecting seemingly unconnected things. Marc Benioff got the idea for Salesforce.com by looking at enterprise software through the prism of online businesses such as Amazon and eBay. Why were software companies flogging cumbersome products in the form of CD-ROMs rather than as flexible services over the internet? Salesforce.com is now worth $19 billion. These creative associations often come from broadening your experience. Mr Benioff had his lucrative epiphany while on sabbatical--swimming with dolphins, he says. Joe Morton, co-founder of XANGO, got the idea for a new health drink when he tasted mangosteen fruit in Malaysia. Mr Christensen and co reckon that businesspeople are

- 73. 35% more likely to sprout a new idea if they have lived in a foreign country (a rather precise statistic). But this is not a recipe for just hanging loose: IDEO, an innovation consultancy, argues that the best innovators are "T- shaped"--they need to have depth in one area as well as breadth in lots. http://library.capella.edu/login?qurl=https%3A%2F%2Fsearch.p roquest.com%2Fdocview%2F881484308%3Faccountid%3D2796 5 http://library.capella.edu/login?qurl=https%3A%2F%2Fsearch.p roquest.com%2Fdocview%2F881484308%3Faccountid%3D2796 5 Innovators are constantly asking why things aren't done differently. William Hunter, the founder of Angiotech Pharmaceuticals, asked doctors why they didn't cover the stents they use in heart operations with drugs to reduce the amount of scar tissue (which accounts for 20% of rejections). David Neeleman, the founder of JetBlue and Azul, wondered why people treated airline tickets like cash, freaking out when they lose them, whereas customers could instead be given an electronic code? This taste for questions is linked to a talent for observation. Corey Wride came up with the idea for Movie Mouth, a company that uses popular films to teach foreign languages,

- 74. when he was working in Brazil. He noticed that the best English speakers had picked it up from film stars, not school teachers. But people without a flair for languages find the "Brad Pitt" method tricky--actors speak too fast. So Mr Wride invented a computer program that allows users to slow films down, hear explanations of various idioms and even speak the actors' lines for them. For all their reputation as misfits, innovators tend to be great networkers. But they hang around gabfests to pick up ideas, not to win contracts. Michael Lazaridis, the founder of Research in Motion, says he had the idea for the BlackBerry at a trade show, when someone told him how Coca- Cola machines used wireless technology to signal that they needed refilling. Kent Bowen has turned CPS Technologies into one of the world's fizziest ceramics companies by encouraging his employees to network with scientists who are confronted with similar problems in different fields: for example, the company eliminated troublesome ice crystals by talking to experts on freezing sperm (really). Innovators are also inveterate experimenters, who fiddle with both their products and their business models. Jeff Bezos, the founder of Amazon, now sells e-readers and rents out

- 75. computer power and data storage (by one estimate a quarter of small and medium-sized companies in Silicon Valley use the company's cloud). These experiments are frequently serendipitous. IKEA never planned to base its business on self-assembly. But then a marketing manager discovered that the best way to get some furniture back into a lorry, after a photo-shoot, was to take its legs off, and a new business model was born. Listen to mommy Messrs Christensen, Dyer and Gregersen argue that companies that have the highest "innovation premiums" (calculated by looking at the proportion of their market value that cannot be accounted for by their current products) display the same five habits of mind as individual innovators. They work hard to recruit creative people. (Mr Bezos asks job applicants to tell him about something they have invented.) They work equally hard at stimulating observation and questioning. Keyence Corporation, a Japanese maker of automation devices for factories, requires its salespeople to spend hours watching its customers' production lines. Procter &Gamble and Google have found that job swaps provoke useful questions: the Googlers were stunned that P&G did not invite

- 76. "mommy bloggers"--women who write popular blogs on child- rearing--to attend its press conferences. For all their insistence that innovation can be learned, Mr Christensen and co produce a lot of evidence that the disruptive sort requires genius. Nearly all the world's most innovative companies are run by megaminds who set themselves hubristic goals such as "putting a ding in the universe" (Steve Jobs). During Mr Jobs's first tenure at Apple, the company's innovation premium was 37%. In 1985- 98, when Mr Jobs was elsewhere, the premium fell to minus 30%. Now that Mr Jobs is back, the premium has risen to 52%. The innovator's DNA is rare, alas. And unlike Mr Jobs's products, it is impossible to clone. DETAILS Subject: International; Nonfiction; Innovations; Management science; Books LINKS Linking Service Classification: 9175: Western Europe; 2600: Management

- 77. science/operations research; 5400: Research &development Publication title: The Economist; London Volume: 400 Issue: 8745 Pages: 60 Publication year: 2011 Publication date: Aug 6, 2011 Section: Business Publisher: The Economist Intelligence Unit N.A., Incorporated Place of publication: London Country of publication: United Kingdom, London Publication subject: Business And Economics--Economic Systems And Theories, Economic History, Business And Economics--Economic Situation And Conditions ISSN: 00130613 CODEN: ECSTA3 Source type: Magazines Language of publication: English

- 78. Document type: Commentary ProQuest document ID: 881484308 Document URL: http://library.capella.edu/login?qurl=https%3A%2F%2Fsearch.p roquest.com%2Fdocv iew%2F881484308%3Faccountid%3D27965 Copyright: (Copyright 2011 The Economist Newspaper Ltd. All rights reserved.) Last updated: 2017-11-18 Database: ProQuest Central http://WV9LQ5LD3P.search.serialssolutions.com?ctx_ver=Z39. 88-2004&ctx_enc=info:ofi/enc:UTF- 8&rfr_id=info:sid/ProQ:abiglobal&rft_val_fmt=info:ofi/fmt:kev :mtx:journal&rft.genre=unknown&rft.jtitle=The%20Economist &rft.atitle=Business:%20Think%20different;%20Schumpeter&rf t.au=Anonymous&rft.aulast=Anonymous&rft.aufirst=&rft.date= 2011-08- 06&rft.volume=400&rft.issue=8745&rft.spage=60&rft.isbn=&rf t.btitle=&rft.title=The%20Economist&rft.issn=00130613&rft_id =info:doi/ Terms and Conditions Contact ProQuest https://search.proquest.com/info/termsAndConditions http://www.proquest.com/go/pqissupportcontactBusiness: Think

- 79. different; Schumpeter ARTWORK Josef Schulz, Form #1, 2001 C-print, 120 x 160 cm How P&G Tripled Its Innovation Success Rate Inside the company’s new-growth factory by Bruce Brown and Scott D. Anthony Spotlight 64 Harvard Business Review June 2011 SPOTLIGHT ON PRODUCT INNOVATION 1157 Jun11 Brown.indd 641157 Jun11 Brown.indd 64 4/27/11 4:39:24 PM4/27/11 4:39:24 PM Scott D. Anthony is the managing director of Innosight. Bruce Brown is the chief technology offi cer of Procter & Gamble. June 2011 Harvard Business Review 65 HBR.ORG

- 80. 1157 Jun11 Brown.indd 651157 Jun11 Brown.indd 65 4/27/11 4:39:33 PM4/27/11 4:39:33 PM BBACK IN 2000 the prospects for Procter & Gamble’s Tide, the biggest brand in the company’s fabric and household care division, seemed limited. The laundry detergent had been around for more than 50 years and still dominated its core markets, but it was no longer growing fast enough to support P&G’s needs. A decade later Tide’s revenues have nearly doubled, helping push annual division revenues from $12 billion to almost $24 billion. The brand is surging in emerging markets, and its iconic bull’s-eye logo is turning up on an array of new products and even new businesses, from instant clothes fresh- eners to neighborhood dry cleaners. This isn’t accidental. It’s the result of a strategic eff ort by P&G over the past decade to systematize in-novation and growth. To understand P&G’s strategy, we need to go back more than a century to the sources of its inspiration— Thomas Edison and Henry Ford. In the 1870s Edison created the world’s fi rst industrial research lab, Menlo Park, which gave rise to the technologies behind the modern electric-power and motion-picture indus- tries. Under his inspired direction, the lab churned out ideas; Edison himself ultimately held more than 1,000 patents. Edison of course understood the im- portance of mass production, but it was his friend Henry Ford who, decades later, perfected it. In 1910 the Ford Motor Company shifted the production of its famous Model T from the Piquette Avenue Plant, in Detroit, to its new Highland Park complex nearby. Although the assembly line wasn’t a novel concept, Highland Park showed what it was capable of: In four

- 81. years Ford slashed the time required to build a car from more than 12 hours to just 93 minutes. How could P&G marry the creativity of Edison’s lab with the speed and reliability of Ford’s factory? The answer its leaders devised, a “new-growth fac- tory,” is still ramping up. But already it has helped the company strengthen both its core businesses and its ability to capture innovative new-growth opportunities. P&G’s eff orts to systematize the serendipity that so often sparks new-business creation carry impor- tant lessons for leaders faced with shrinking product life cycles and increasing global competition. Laying the Foundation Innovation has long been the backbone of P&G’s growth. As chairman, president, and CEO Bob Mc- Donald notes, “We know from our history that while promotions may win quarters, innovation wins decades.” The company spends nearly $2 billion annually on R&D—roughly 50% more than its clos- est competitor, and more than most other competi- tors combined. Each year it invests at least another $400 million in foundational consumer research to discover opportunities for innovation, conducting some 20,000 studies involving more than 5 million consumers in nearly 100 countries. Odds are that as you’re reading this, P&G researchers are in a store somewhere observing shoppers, or even in a con- sumer’s home. These investments are necessary but not suf- fi cient to achieve P&G’s innovation goals. “People will innovate for financial gain or for competitive

- 82. advantage, but this can be self-limiting,” McDonald says. “There needs to be an emotional component as well—a source of inspiration that motivates people.” At P&G that inspiration lies in a sense of purpose driven from the top down—the message that each innovation improves people’s lives. At the start of the 2000s only about 15% of P&G’s innovations were meeting revenue and profit tar- gets. So the company launched its now well-known Connect + Develop program to bring in outside innovations and built a robust stage-gate process to help manage ideas from inception to launch. (For more on C+D, see Larry Huston and Nabil Sakkab, “Connect and Develop: Inside Procter & Gamble’s New Model for Innovation,” HBR March 2006.) These actions showed early signs of rais- ing innovation success rates, but it was clear that P&G needed more breakthrough innovations. And it had to come up with them as reliably as Ford’s factory had rolled out Model Ts. 66 Harvard Business Review June 2011 SPOTLIGHT ON PRODUCT INNOVATION 1157 Jun11 Brown.indd 661157 Jun11 Brown.indd 66 4/27/11 4:39:43 PM4/27/11 4:39:43 PM without a further boost to its organic growth capa- bilities, the company would still have trouble hitting its targets.

- 83. P&G’s leaders recognized that the kind of growth the company was after couldn’t come from simply doing more of the same. It needed to come up with more breakthrough innovations—ones that could create completely new markets. And it needed to do this as reliably as Henry Ford’s Highland Park factory had rolled out Model Ts. In 2004 Gil Cloyd, then the chief technology of- ficer, and A.G. Lafley, then the CEO, tasked two 30-year P&G veterans, John Leikhim and David Gou- lait, with designing a new-growth factory whose intellectual underpinnings would derive from the Harvard Business School professor Clayton Chris- tensen’s disruptive-innovation theory. The basic concept of disruption—driving growth through new off erings that are simpler, more convenient, easier to access, or more affordable—was hardly foreign to P&G. Many of the company’s powerhouse brands, including Tide, Crest, Pampers, and Swiff er, had fol- lowed disruptive paths. Leikhim and Goulait, with support from other managers, began by holding a two-day workshop for seven new-product-development teams, guided by facilitators from Innosight (a firm Christensen co- founded). The attendees explored how to shake up embedded ways of thinking that can inhibit disrup- tive approaches. They formulated creative ways to address critical commercial questions—for example, whether demand would be sufficient to warrant a new-product launch. Learning from the workshop helped spur the development of new products, such as the probiotic supplement Align, and also bolstered existing ones, such as Pampers.

- 84. In the years that followed, Leikhim and Goulait shored up the factory’s foundation, working with Cloyd and other P&G leaders to: Teach senior management and project team members the mind-sets and behaviors that foster disruptive growth. The training, which has changed over time, initially ranged from short modules on top- ics such as assessing the demand for an early-stage idea to multiday courses in entrepreneurial thinking. Form a group of new-growth-business guides to help teams working on disruptive proj- ects. These experts might, for instance, advise teams to remain small until their project’s key commercial questions, such as whether consumers would ha- bitually use the new product, have been answered. The guides include several entrepreneurs who have succeeded—and, even more important, failed—in starting businesses. Develop organizational structures to drive new growth. For example, in a handful of business units the company created small groups focused primarily on new-growth initiatives. The groups (which, like the training, have evolved signifi cantly) augmented an existing entity, FutureWorks, whose charter is to create new brands and business mod- els. Dedicated teams within the groups conducted market research, developed technology, created business plans, and tested assumptions for specifi c projects. Produce a process manual—a step-by-step guide to creating new-growth businesses. The manual includes overarching principles as well as

- 85. detailed procedures and templates to help teams describe opportunities, identify requirements for success, monitor progress, make go/no-go decisions, and more. Run demonstration projects to showcase the emerging factory’s work. One of these was a line of pocket-size products called Swash, which quickly refresh clothes: For example, someone who’s in a hurry can give a not-quite-clean shirt a spray rather than putting it through the wash. Idea in Brief Procter & Gamble is a famous innovator. Nonethe- less, in the early 2000s only 15% of its innovations were meeting their revenue and profi t targets. To address this, the company set about build- ing organizational structures to systematize innovation. The resulting new-growth factory includes large new- business creation groups, focused project teams, and entrepreneurial guides who help teams rapidly proto- type and test new products and business models in the market. The teams follow a step-by-step business development manual and use specialized project and

- 86. portfolio management tools. Innovation and strategy assessments, once sepa- rate, are now combined in revamped executive reviews. P&G’s experience sug- gests six lessons for leaders looking to build new-growth factories: Coordinate the factory with the company’s core businesses, be a vigilant portfolio manager, start small and grow carefully, create tools for gauging new businesses, make sure the right people are doing the right work, and nurture cross-pollination. About the Spotlight Artist Each month we illustrate our Spotlight package with a series of works from an ac- complished artist. We hope that the lively and cerebral creations of these photogra- phers, painters, and instal- lation artists will infuse our pages with additional energy and intelligence and amplify what are often complex and abstract concepts.