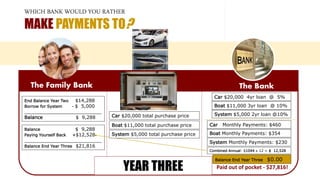

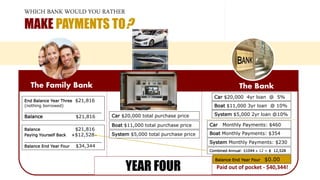

The document discusses the advantages of borrowing from "The Family Bank" versus a traditional bank. Borrowing from The Family Bank allows one to use their own savings as collateral for loans, pay the loan back to themselves with interest, and end up with more money than they started with after four years. Borrowing from a traditional bank requires paying thousands more in total interest, and having no savings or assets left after repaying the loans. The Family Bank offers benefits like no credit checks, no bank hours, keeping one's own money, and guaranteed returns with protection against loss, disability, or death.