The document discusses the potential of extended reality (XR) technologies like virtual, augmented and mixed realities for businesses. It summarizes the hype but ultimate failure of Google Glass, noting how this has made business leaders more cautious about new technologies. However, the document suggests that while XR technologies have yet to fulfill their promise due to limited applications and use cases, major adoption by businesses is expected in the coming years as the technologies mature and their real business benefits become clear.

![RACONTEUR.NET 03

/xr-business-2018

G

oogle Glass is going to

transform the world,

we were told five years

ago. The $1,500 (£1,160)

voice-activated, hands-free smart

spectacles would be as ubiquitous

and useful as smartphones.

Soon people realised that the real-

ity of Google Glass fell short of the

hype. In addition, it fulfilled no

use-case, was pricey, invaded pri-

vacy and was downright creepy. No

one batted an eyelid when Google

stopped selling the purportedly rev-

olutionary tech in 2015.

The bombastic entrance and

high-profile failure of Google Glass

is important, however, as it evolved

the concept of wearables and simul-

taneously elevated the barrier many

business leaders struggle to over-

come with new technologies.

Recent research shows that

C-suite executives are interested

in so-called extended reality (XR)

technologies, namely virtual, aug-

mented and mixed realities. Indeed,

analysts at Gartner predict that by

2019 some 20 per cent of large-enter-

prise businesses will have adopted

XR technologies.

Furthermore, managing director

of Accenture Technology, Maynard

Williams, reveals that according to

a 2018 study by his company: “Some

27 per cent of executives believe it is

very important for their organisa-

tions to be a pioneer in XR solutions.”

He says: “Making well-planned

forays into immersive experiences

now will help build the capabilities

needed to transform entire indus-

tries tomorrow.”

Business leaders can’t afford to

punt on potential, though; they seek

fully baked solutions that will make a

significant improvement today. Alas,

the Google Glass misstep is one of a

growing number of overhyped tech

products that have made corporate

decision-makers, among others, war-

ier about XR’s lofty promises, argues

Naji El-Arifi, head of innovation at

consultants Wunderman Commerce.

“Overall, the community is now

much more cautious of the tech-

nology due to Google Glass’s fail-

ures in approach. I feel most compa-

nies learnt from that and now take

things much more slowly,” says Mr

El-Arifi, while stressing the potency

of mature XR. “Understanding the

real and digital worlds, and bring-

ing them together seamlessly so they

can share the common reality, will be

the next big thing in B2B [business to

business] and B2C [business to con-

sumer]. It will also take the disrup-

tor crown away from mobile.”

Is the gulf between expectation

and reality widening, and is that

harming the long-term chance of

XR technologies triumphing?

Karl Maddix, co-founder and

chief executive of VR software

development company Masters of

Pie, believes there is often still too

much untruthful marketing in this

space. “It is easy to make people

excited with scenarios of XR rev-

olutionising our lives in the near

future, supported by captivating

mock-ups and videos of perfect vir-

tual environments, but this is often

lacking substance; all flash and no

Gordon,” he says.

“The hype they generate does help

when it comes to attracting inves-

tors and making potential end-users

excited enough to initiate a conver-

sation. But that conversation needs

to be grounded in reality, with peo-

ple who are on the front line and

are interested in building solutions,

and not just showing how visionary

they are.”

Jeremy Dalton, head of VR/AR

at PwC, contests that the ballyhoo

around XR is “partly the result of a

lack of understanding of the tech-

nology”. He continues: “Ultimately,

this stems from a minimal experi-

ence that is then used to build a view

on all areas of the technology, lead-

ing to many misconceptions about

the value of XR.

“It’s the kind of technology that

has to be tried before being under-

stood; in many cases we see, expec-

tations are exceeded as it’s diffi-

cult to describe in words what is

ultimately a very visual and immer-

sive experience.”

Richard Das, senior manager at

Deloitte Digital, agrees. “As the say-

ing goes, if you judge a fish by its

ability to climb a tree, you’ll be dis-

appointed,” he says. “Because we

bring many of our preconceptions

to the table of what tech is, it’s hard

to measure expectations of what it

could be.”

Dr Karen Correia da Silva, senior

social scientist at consumer behav-

iour specialists Canvas8, points

out that Google Glass is succeed-

ing in the B2B space. “An adapted

version is thriving in US facto-

ries,” she says. “At DHL, employ-

ees used Glass to streamline the

package-picking process, improv-

ing efficiency by 15 per cent. Google

tried jumping all the way to the cus-

tomer applications when the prod-

uct and tech perhaps weren’t quite

there. But when it shifted its focus

to a place that could get value out of

the technology as it was at the time,

it succeeded.”

The dearth of XR use-cases is

a worry, though it is expected to

improve before long. “Limited soft-

ware or applications will always

restrict demand, or kill the hype,

for a technically sound product,”

says Mark Bates, general man-

ager of Hire Intelligence, a B2B

rental organisation that has seen

a 394 per cent increase in XR

hardware inquires in the last

two years.

“The power and potential of XR is

strong, but the loop must be closed

between industry needs, hardware

capability and application devel-

opment. Once applications are rel-

evant, senior personnel in industry

will trial the tech and then word of

mouth about the quality of experi-

ence will drive greater adoption.”

For Rebecca Gregory-Clarke,

head of immersive technology at

Digital Catapult, it is clear that

business leaders have to look past

the hype and focus on matur-

ing XR. She concludes: “For those

looking to take full advantage of

immersive technology, it’s impor-

tant to get involved now to be

well positioned to take maximum

advantage once the technology has

fully evolved. We’re currently in

the ‘black-and-white TV’ era of XR,

a nascent version of a now-ubiqui-

tous technology.”

Grounding tech in

extended reality

XR FOR BUSINESS

@raconteur /raconteur.net @raconteur_london

The significant potential of reality technologies

should not be lost in past hype and disappointment

STEPHENARMSTRONG

Contributor to The Sunday

Times, Monocle, Wallpaper*

and GQ, he is also an

occasional broadcaster

on BBC Radio.

SOPHIE CHARARA

Associate editor at The

AmbientandWareable, she

is also a freelance writer

on technology and pop

culture, with bylines in

Stuff,WIREDand Forbes.

ANNA CODREA-RADO

Freelance culture and

technology journalist, her

work has been published in

The New York Times, The

Guardian and WIRED.

NICK EASEN

Award-winning freelance

journalist and broadcaster,

he produces for BBC

World News, and writeson

business,economics,science,

technologyandtravel.

OLIVER PICKUP

Award-winning

journalist, he specialises

in technology, business

and sport, and

contributes to a wide

range of publications.

EMMA

WOOLLACOTT

Specialist technology

writer, she covers legal and

regulatory issues, and has

contributed to Forbes and

the New Statesman.

Distributed in

OLIVER PICKUP

Distributed in association with

CONTRIBUTORS

TimothyFadek/CorbisviaGettyImages

DEVELOPMENT

Publishing manager

Frank Monaghan

Digital content executive

Fran Cassidy

Head of production

Justyna O'Connell

Design

Joanna Bird

Grant Chapman

Sara Gelfgren

Kellie Jerrard

Samuele Motta

Head of design

Tim Whitlock

Production editor

Benjamin Chiou

Managing editor

Peter Archer

Although this publication is funded through advertising and

sponsorship, all editorial is without bias and sponsored features

are clearly labelled. For an upcoming schedule, partnership

inquiries or feedback, please call +44 (0)20 3877 3800 or

email info@raconteur.net

Raconteur is a leading publisher of special-interest content and

research. Its publications and articles cover a wide range of topics,

including business, finance, sustainability, healthcare, lifestyle and

technology. Raconteur special reports are published exclusively in

The Times and The Sunday Times as well as online at raconteur.net

The information contained in this publication has been obtained

from sources the Proprietors believe to be correct. However,

no legal liability can be accepted for any errors. No part of this

publication may be reproduced without the prior consent of the

Publisher. © Raconteur Media

raconteur.net

The original model

of Google Glass

failed to live up

to the hype

Bringing immersive

technology to business

info@makereal.co.uk

+44 (0)845 0178 777

Why not arrange to meet and learn more?

For over a decade, Make Real has been working with the

enterprise sector to design, develop and deploy mission

critical business applications.

We don’t hype specific technologies, we evangelise

the real benefits.

We believe in using the right tools to meet business

challenges and add value, whether it’s augmented reality,

virtual reality, simulation or serious games.

Top concerns about XR startups

Concerns startups hear from potential investors

Slow adoption

71%

Lack of an

established market

for the technology

67%

Untested

technology

18%

Perkins Coie 2018](https://image.slidesharecdn.com/xr-for-business-2018-181206111126/85/XR-for-Business-2018-2-320.jpg)

![RACONTEUR.NET 03

/xr-business-2018

G

oogle Glass is going to

transform the world,

we were told five years

ago. The $1,500 (£1,160)

voice-activated, hands-free smart

spectacles would be as ubiquitous

and useful as smartphones.

Soon people realised that the real-

ity of Google Glass fell short of the

hype. In addition, it fulfilled no

use-case, was pricey, invaded pri-

vacy and was downright creepy. No

one batted an eyelid when Google

stopped selling the purportedly rev-

olutionary tech in 2015.

The bombastic entrance and

high-profile failure of Google Glass

is important, however, as it evolved

the concept of wearables and simul-

taneously elevated the barrier many

business leaders struggle to over-

come with new technologies.

Recent research shows that

C-suite executives are interested

in so-called extended reality (XR)

technologies, namely virtual, aug-

mented and mixed realities. Indeed,

analysts at Gartner predict that by

2019 some 20 per cent of large-enter-

prise businesses will have adopted

XR technologies.

Furthermore, managing director

of Accenture Technology, Maynard

Williams, reveals that according to

a 2018 study by his company: “Some

27 per cent of executives believe it is

very important for their organisa-

tions to be a pioneer in XR solutions.”

He says: “Making well-planned

forays into immersive experiences

now will help build the capabilities

needed to transform entire indus-

tries tomorrow.”

Business leaders can’t afford to

punt on potential, though; they seek

fully baked solutions that will make a

significant improvement today. Alas,

the Google Glass misstep is one of a

growing number of overhyped tech

products that have made corporate

decision-makers, among others, war-

ier about XR’s lofty promises, argues

Naji El-Arifi, head of innovation at

consultants Wunderman Commerce.

“Overall, the community is now

much more cautious of the tech-

nology due to Google Glass’s fail-

ures in approach. I feel most compa-

nies learnt from that and now take

things much more slowly,” says Mr

El-Arifi, while stressing the potency

of mature XR. “Understanding the

real and digital worlds, and bring-

ing them together seamlessly so they

can share the common reality, will be

the next big thing in B2B [business to

business] and B2C [business to con-

sumer]. It will also take the disrup-

tor crown away from mobile.”

Is the gulf between expectation

and reality widening, and is that

harming the long-term chance of

XR technologies triumphing?

Karl Maddix, co-founder and

chief executive of VR software

development company Masters of

Pie, believes there is often still too

much untruthful marketing in this

space. “It is easy to make people

excited with scenarios of XR rev-

olutionising our lives in the near

future, supported by captivating

mock-ups and videos of perfect vir-

tual environments, but this is often

lacking substance; all flash and no

Gordon,” he says.

“The hype they generate does help

when it comes to attracting inves-

tors and making potential end-users

excited enough to initiate a conver-

sation. But that conversation needs

to be grounded in reality, with peo-

ple who are on the front line and

are interested in building solutions,

and not just showing how visionary

they are.”

Jeremy Dalton, head of VR/AR

at PwC, contests that the ballyhoo

around XR is “partly the result of a

lack of understanding of the tech-

nology”. He continues: “Ultimately,

this stems from a minimal experi-

ence that is then used to build a view

on all areas of the technology, lead-

ing to many misconceptions about

the value of XR.

“It’s the kind of technology that

has to be tried before being under-

stood; in many cases we see, expec-

tations are exceeded as it’s diffi-

cult to describe in words what is

ultimately a very visual and immer-

sive experience.”

Richard Das, senior manager at

Deloitte Digital, agrees. “As the say-

ing goes, if you judge a fish by its

ability to climb a tree, you’ll be dis-

appointed,” he says. “Because we

bring many of our preconceptions

to the table of what tech is, it’s hard

to measure expectations of what it

could be.”

Dr Karen Correia da Silva, senior

social scientist at consumer behav-

iour specialists Canvas8, points

out that Google Glass is succeed-

ing in the B2B space. “An adapted

version is thriving in US facto-

ries,” she says. “At DHL, employ-

ees used Glass to streamline the

package-picking process, improv-

ing efficiency by 15 per cent. Google

tried jumping all the way to the cus-

tomer applications when the prod-

uct and tech perhaps weren’t quite

there. But when it shifted its focus

to a place that could get value out of

the technology as it was at the time,

it succeeded.”

The dearth of XR use-cases is

a worry, though it is expected to

improve before long. “Limited soft-

ware or applications will always

restrict demand, or kill the hype,

for a technically sound product,”

says Mark Bates, general man-

ager of Hire Intelligence, a B2B

rental organisation that has seen

a 394 per cent increase in XR

hardware inquires in the last

two years.

“The power and potential of XR is

strong, but the loop must be closed

between industry needs, hardware

capability and application devel-

opment. Once applications are rel-

evant, senior personnel in industry

will trial the tech and then word of

mouth about the quality of experi-

ence will drive greater adoption.”

For Rebecca Gregory-Clarke,

head of immersive technology at

Digital Catapult, it is clear that

business leaders have to look past

the hype and focus on matur-

ing XR. She concludes: “For those

looking to take full advantage of

immersive technology, it’s impor-

tant to get involved now to be

well positioned to take maximum

advantage once the technology has

fully evolved. We’re currently in

the ‘black-and-white TV’ era of XR,

a nascent version of a now-ubiqui-

tous technology.”

Grounding tech in

extended reality

XR FOR BUSINESS

@raconteur /raconteur.net @raconteur_london

The significant potential of reality technologies

should not be lost in past hype and disappointment

STEPHENARMSTRONG

Contributor to The Sunday

Times, Monocle, Wallpaper*

and GQ, he is also an

occasional broadcaster

on BBC Radio.

SOPHIE CHARARA

Associate editor at The

AmbientandWareable, she

is also a freelance writer

on technology and pop

culture, with bylines in

Stuff,WIREDand Forbes.

ANNA CODREA-RADO

Freelance culture and

technology journalist, her

work has been published in

The New York Times, The

Guardian and WIRED.

NICK EASEN

Award-winning freelance

journalist and broadcaster,

he produces for BBC

World News, and writeson

business,economics,science,

technologyandtravel.

OLIVER PICKUP

Award-winning

journalist, he specialises

in technology, business

and sport, and

contributes to a wide

range of publications.

EMMA

WOOLLACOTT

Specialist technology

writer, she covers legal and

regulatory issues, and has

contributed to Forbes and

the New Statesman.

Distributed in

OLIVER PICKUP

Distributed in association with

CONTRIBUTORS

TimothyFadek/CorbisviaGettyImages

DEVELOPMENT

Publishing manager

Frank Monaghan

Digital content executive

Fran Cassidy

Head of production

Justyna O'Connell

Design

Joanna Bird

Grant Chapman

Sara Gelfgren

Kellie Jerrard

Samuele Motta

Head of design

Tim Whitlock

Production editor

Benjamin Chiou

Managing editor

Peter Archer

Although this publication is funded through advertising and

sponsorship, all editorial is without bias and sponsored features

are clearly labelled. For an upcoming schedule, partnership

inquiries or feedback, please call +44 (0)20 3877 3800 or

email info@raconteur.net

Raconteur is a leading publisher of special-interest content and

research. Its publications and articles cover a wide range of topics,

including business, finance, sustainability, healthcare, lifestyle and

technology. Raconteur special reports are published exclusively in

The Times and The Sunday Times as well as online at raconteur.net

The information contained in this publication has been obtained

from sources the Proprietors believe to be correct. However,

no legal liability can be accepted for any errors. No part of this

publication may be reproduced without the prior consent of the

Publisher. © Raconteur Media

raconteur.net

The original model

of Google Glass

failed to live up

to the hype

Bringing immersive

technology to business

info@makereal.co.uk

+44 (0)845 0178 777

Why not arrange to meet and learn more?

For over a decade, Make Real has been working with the

enterprise sector to design, develop and deploy mission

critical business applications.

We don’t hype specific technologies, we evangelise

the real benefits.

We believe in using the right tools to meet business

challenges and add value, whether it’s augmented reality,

virtual reality, simulation or serious games.

Top concerns about XR startups

Concerns startups hear from potential investors

Slow adoption

71%

Lack of an

established market

for the technology

67%

Untested

technology

18%

Perkins Coie 2018](https://image.slidesharecdn.com/xr-for-business-2018-181206111126/85/XR-for-Business-2018-3-320.jpg)

![04 RACONTEUR.NET 05XR FOR BUSINESS

N

obody wants to sink money

in a gimmick and there’s

often a good case to be

made for hanging back a

little to watch how well a new tech-

nology works out for early adopters.

However, there comes a time when

an innovation has proved its worth

and it’s important to recognise

when that point has been reached.

Whether it’s Eastman Kodak’s fail-

ure to invest in digital photography

or Blockbuster dismissing the idea of

streaming video, corporate history

is littered with examples of organi-

sations that simply missed the boat.

It’s hardly surprising that many

organisations have taken a sceptical

view of XR (extended reality), seeing

it perhaps as a consumer technology

that has no real place in the commer-

cial world.

However, this could be a big mis-

take. With investment pouring into

the area from the likes of Microsoft,

ODG and Meta, analysts see it as a

booming technology that’s set for

far more widespread adoption.

“Virtual reality (VR) and aug-

mented reality (AR) technologies

are developing rapidly, with proof

of concepts and production deploy-

ments laying solid foundations for

widespread business adoption,” says

Mark Lillie, global chief information

officer programme leader at Deloitte.

“One of the most startling things

about the current landscape is

that there are two extremes when

it comes to understanding. We

either get a client approaching

us who knows exactly what they

want, the context that it’s going

to be used in and the potential

benefits to their organisation. Or

we get clients who really have no

idea what they want, they just

know they need to be looking at

immersive technology for their

future competitiveness.”

BIS Research predicts that the mar-

ket for AR will rise from $3.48 billion

in 2017 to a staggering $198.17 billion

by 2025, a compound annual growth

rate of 65.1 per cent. The technology

can, it says in a recent report, be seen

as just as ground-breaking as the

development of personal computers

back in 1981.

And in a survey earlier this year,

technology industry association

CompTIA found that three quar-

ters of companies were aware of VR,

with one in five already having a VR/

AR initiative underway; just under a

quarter are piloting the technology.

“Truthfully, we’re seeing less and

less resistance from C-suite exec-

utives and decision-makers when

it comes to VR, AR and MR [mixed

reality], certainly in comparison

to even just three years ago,” says

Shaun Allan, chief XR officer at digi-

tal consultancy hedgehog lab.

Return on investment

in reality technologies

can be protracted,

such are the lengthy

development times

Face up to reality before it’s too late

RoI

EMMA WOOLLACOTT

SerrahGalosonUnsplash

Many organisations fail to

understand the amount of

time and money required

The most common current use of

XR is in employee training, cited by

62 per cent in the CompTIA survey,

with half of early adopters using XR in

customer engagements. Other early

uses include virtual meetings (47

per cent), research and development

simulations (45 per cent) and on-the-

job information, delivering informa-

tion to an employee while they are

engaged with a task (43 per cent).

James Burrows, technical director

at Immersive Studios, says his com-

pany’s clients are happy using VR in

these niches because there’s already

a wealth of successful case studies

making the value proposition clear.

“That doesn’t mean we’re not see-

ing new, novel or unusual briefs, but

certainly we have started noticing

certain consistent trends in the what,

where and when of VR/AR,” he says.

“This means clients who fall out-

side those parameters tend to be

more cautious, for the simple rea-

son there isn’t the same body of

proven success.”

However, hanging back may mean

missing the boat, as XR is not a tech-

nology that can be implemented

overnight, and many organisations

failtounderstandtheamountoftime

and money required. Generating

content is comparable to producing a

video game; it’s time consuming and

requires highly skilled professionals.

“Clients have had a good ten years

of getting a handle on average budg-

ets for more traditional apps and web-

based projects, but suddenly those

assumptions go out of the window

when you add an AR or VR element

into the project,” says Mr Burrows.

“We’re only now getting to the

point where clients are starting to

understand the level of work which

goes into producing these sorts of

experiences and are planning these

sorts of amounts into their budgets.”

This high cost applies even in

the proof-of-concept (PoC) stage.

“Firms should work with the sup-

plier to scope the PoC so it fits their

budget and objective," says Jim

Tramontana, senior product man-

ager at Honeywell Process Solutions.

“Toooften,companiestrytovalidate

the technology by testing the entire

scope of the implementation. This

results in firms finding the PoC itself

too expensive and lengthy, meaning

results are difficult to validate.”

However, for those organisations

that are prepared to take the risk

and make the necessary investment,

the rewards can be significant.

According to a recent report from

the Capgemini Research Institute,

82 per cent of companies currently

implementing AR/VR say the bene-

fits are either meeting or exceeding

their expectations.

Indeed, efficiency improvements

mean that three quarters of compa-

nies with large-scale implementa-

tions say they’re seeing operational

benefits of more than 10 per cent.

Last year, for example, KFC intro-

duced a VR training simulation to

teach its “secret recipe” for prepar-

ing chicken. Using the simulation,

trainees were able to master the five

steps of making fried chicken in ten

minutes, compared with twenty five

minutes for conventional teaching.

Meanwhile, Boeing cut the time

engineers needed for wiring pro-

duction time by 25 per cent, after

replacing assembly manuals with

smartglasses displays.

“For businesses that are still ret-

icent about immersive technol-

ogy, we usually counter with the

same argument, no matter what the

industry. That is if they don’t start

looking at this now, they’re dead

in the water because one or more

of their competitors will be,” says

hedgehog lab’s Mr Allan.

“Simply put, if they don’t at least

dip their toe and have a go, they’re

going to be playing catch-up with

their competitors soon enough.”CompTIA 2017

Current state of XR adoption

XR initiative

already

underway

21%

Experimenting/

piloting with XR

23%

Planning to have XR

initiative in next year

18%

No current

plans/not sure

39%

Ways XR is used by early adopters

Employee

training

62%

Customer

engagement

50%

Virtual

meetings

47%

Simulation

in R&D

45%

On-the-job

information

43%

Commercial feature

S

ince Bryn Mooser co-founded

immersive media company

RYOT in 2012, the studio has

been pushing the boundaries

of what can be produced with VR and

AR. The idea of the company goes

back to the time he spent in Haiti’s

capital city Port-au-Prince, after the

devastating earthquake of 2010.

“I moved down to build a high

school and when I was there I met

my co-founder David Darg. We were

both film-makers who had an inter-

est in humanitarian work and we

started making films there,” explains

Mr Mooser.

It was very clear to him that the

global view of Haiti was cynical and

many people felt like there was noth-

ing they could do about global prob-

lems, but as technology advanced

and connected people around

the world through social media,

there was no longer any excuse to

do nothing.

“RYOT started as a news website

with a function where every story

had an action, so when you read

about something in the world, you

could actually do something about it,

whether it be to sign a petition, vol-

unteer or donate,” says Mr Mooser.

From creating the world’s first all-VR

film in a war zone with Welcome to

Aleppo to the first in natural disas-

ter VR with The Nepal Project, RYOT’s

work is now defining what is possible

in a fully VR world.

“My mission has always been how

do we use technology to try and

make the world a better place?

We began to experiment with new

technologies to tell stories and we

found our perfect medium with VR,”

explains Mr Mooser.

RYOT quickly made a name for

itself as the go-to VR firm for news

and documentaries, and developed

VR content for high-profile com-

panies, including The Associated

Press, HuffPost and The New York

Times. Today RYOT is focused

on building what the future of

content and media will look like in a

5G world.

“What will a movie or TV show look

like in 5G and how will you watch

content in the back of your driver-

less car when it’s enabled with 5G?

We believe 5G is ushering in the

fourth industrial revolution; it’s like

nothing that has come before and

it will create major disruptions in all

industries, from mobility to health to

technology,” says Mr Mooser.

Super-fast 5G internet will not only

offer mobile users more stable con-

nections and low latency, but this

game-changing innovation is set to

unlock exciting new types of expe-

riences. “We are focused on how

to help build and enable the prod-

ucts of the future, so the consumers

of tomorrow can’t live without 5G,”

says Mr Mooser.

Transitioning to a more AR-friendly

digital environment may not be the

leap many consumers expect it to

be. For example, although few users

will be fully aware of the underlying

AR technology, every time face fil-

ters are used in popular social media

apps, they will be becoming more

comfortable with AR applications.

Businesses are building new prod-

ucts and services that are going to

enable consumers and businesses

alike to do things they never dreamed

possible via 5G. “It’s not enough to

just have lower latency and better

download speeds. The 5G solutions

that leverage those benefits could

be amazing. But is that enough to get

somebody to switch phones? I don’t

know,” says Mr Mooser.

Ideas that were once based in sci-

ence fiction are on course to become

increasingly feasible thanks to the

power of 5G. Driverless cars will

be able to communicate with each

other driving down the road and the

near real-time rendering of items in

AR can be wholly achieved.

“We’re at the tipping point right

now and we’re looking at how to

bring forward-thinking companies

on to the bleeding edge of technol-

ogy, and use that technology to tell

stories in a new way and capture a

new audience,” says Mr Mooser.

If companies want to remain at the

top of their market, it’s no longer

possible for them to gloss over AR/

VR technologies and 5G-enabled

services, as the impact of these

solutions will mean every industry

is about to experience a dramatic

disruption. A fully 5G-enabled world

will fundamentally change the enter-

tainment experience for viewers, in

part thanks to the ability of advanced

computing in the cloud.

Mr Mooser believes leaders will

approach 5G in one of two ways.

“Either they’re going to take con-

trol of the tremendous opportunity

to lead into the future or get left

behind, which if you look at histori-

cal trends, is what happens to many,”

he says.

In an age of disruptive startups that

have the power to transform entire

industries through the use of new

technologies, it’s now up to busi-

nesses to make sure they are inno-

vating fast with the right partners.

Mr Mooser concludes: “From a

business perspective, there has

never been a more exciting time.”

For further information please visit

www.ryot.org

RYOT is focused on building

what the future of content

and media will look like in

a 5G world

Bryn Mooser

Founder, RYOT

5G coming of age

Virtual reality (VR) and augmented reality (AR) clearly have

the potential to change dramatically how we perceive the

world around us. But much more work has to be done

for these technologies to move from their current

limited phase to become a truly transformative power

and revolutionise how content is consumed](https://image.slidesharecdn.com/xr-for-business-2018-181206111126/85/XR-for-Business-2018-4-320.jpg)

![04 RACONTEUR.NET 05XR FOR BUSINESS

N

obody wants to sink money

in a gimmick and there’s

often a good case to be

made for hanging back a

little to watch how well a new tech-

nology works out for early adopters.

However, there comes a time when

an innovation has proved its worth

and it’s important to recognise

when that point has been reached.

Whether it’s Eastman Kodak’s fail-

ure to invest in digital photography

or Blockbuster dismissing the idea of

streaming video, corporate history

is littered with examples of organi-

sations that simply missed the boat.

It’s hardly surprising that many

organisations have taken a sceptical

view of XR (extended reality), seeing

it perhaps as a consumer technology

that has no real place in the commer-

cial world.

However, this could be a big mis-

take. With investment pouring into

the area from the likes of Microsoft,

ODG and Meta, analysts see it as a

booming technology that’s set for

far more widespread adoption.

“Virtual reality (VR) and aug-

mented reality (AR) technologies

are developing rapidly, with proof

of concepts and production deploy-

ments laying solid foundations for

widespread business adoption,” says

Mark Lillie, global chief information

officer programme leader at Deloitte.

“One of the most startling things

about the current landscape is

that there are two extremes when

it comes to understanding. We

either get a client approaching

us who knows exactly what they

want, the context that it’s going

to be used in and the potential

benefits to their organisation. Or

we get clients who really have no

idea what they want, they just

know they need to be looking at

immersive technology for their

future competitiveness.”

BIS Research predicts that the mar-

ket for AR will rise from $3.48 billion

in 2017 to a staggering $198.17 billion

by 2025, a compound annual growth

rate of 65.1 per cent. The technology

can, it says in a recent report, be seen

as just as ground-breaking as the

development of personal computers

back in 1981.

And in a survey earlier this year,

technology industry association

CompTIA found that three quar-

ters of companies were aware of VR,

with one in five already having a VR/

AR initiative underway; just under a

quarter are piloting the technology.

“Truthfully, we’re seeing less and

less resistance from C-suite exec-

utives and decision-makers when

it comes to VR, AR and MR [mixed

reality], certainly in comparison

to even just three years ago,” says

Shaun Allan, chief XR officer at digi-

tal consultancy hedgehog lab.

Return on investment

in reality technologies

can be protracted,

such are the lengthy

development times

Face up to reality before it’s too late

RoI

EMMA WOOLLACOTT

SerrahGalosonUnsplash

Many organisations fail to

understand the amount of

time and money required

The most common current use of

XR is in employee training, cited by

62 per cent in the CompTIA survey,

with half of early adopters using XR in

customer engagements. Other early

uses include virtual meetings (47

per cent), research and development

simulations (45 per cent) and on-the-

job information, delivering informa-

tion to an employee while they are

engaged with a task (43 per cent).

James Burrows, technical director

at Immersive Studios, says his com-

pany’s clients are happy using VR in

these niches because there’s already

a wealth of successful case studies

making the value proposition clear.

“That doesn’t mean we’re not see-

ing new, novel or unusual briefs, but

certainly we have started noticing

certain consistent trends in the what,

where and when of VR/AR,” he says.

“This means clients who fall out-

side those parameters tend to be

more cautious, for the simple rea-

son there isn’t the same body of

proven success.”

However, hanging back may mean

missing the boat, as XR is not a tech-

nology that can be implemented

overnight, and many organisations

failtounderstandtheamountoftime

and money required. Generating

content is comparable to producing a

video game; it’s time consuming and

requires highly skilled professionals.

“Clients have had a good ten years

of getting a handle on average budg-

ets for more traditional apps and web-

based projects, but suddenly those

assumptions go out of the window

when you add an AR or VR element

into the project,” says Mr Burrows.

“We’re only now getting to the

point where clients are starting to

understand the level of work which

goes into producing these sorts of

experiences and are planning these

sorts of amounts into their budgets.”

This high cost applies even in

the proof-of-concept (PoC) stage.

“Firms should work with the sup-

plier to scope the PoC so it fits their

budget and objective," says Jim

Tramontana, senior product man-

ager at Honeywell Process Solutions.

“Toooften,companiestrytovalidate

the technology by testing the entire

scope of the implementation. This

results in firms finding the PoC itself

too expensive and lengthy, meaning

results are difficult to validate.”

However, for those organisations

that are prepared to take the risk

and make the necessary investment,

the rewards can be significant.

According to a recent report from

the Capgemini Research Institute,

82 per cent of companies currently

implementing AR/VR say the bene-

fits are either meeting or exceeding

their expectations.

Indeed, efficiency improvements

mean that three quarters of compa-

nies with large-scale implementa-

tions say they’re seeing operational

benefits of more than 10 per cent.

Last year, for example, KFC intro-

duced a VR training simulation to

teach its “secret recipe” for prepar-

ing chicken. Using the simulation,

trainees were able to master the five

steps of making fried chicken in ten

minutes, compared with twenty five

minutes for conventional teaching.

Meanwhile, Boeing cut the time

engineers needed for wiring pro-

duction time by 25 per cent, after

replacing assembly manuals with

smartglasses displays.

“For businesses that are still ret-

icent about immersive technol-

ogy, we usually counter with the

same argument, no matter what the

industry. That is if they don’t start

looking at this now, they’re dead

in the water because one or more

of their competitors will be,” says

hedgehog lab’s Mr Allan.

“Simply put, if they don’t at least

dip their toe and have a go, they’re

going to be playing catch-up with

their competitors soon enough.”CompTIA 2017

Current state of XR adoption

XR initiative

already

underway

21%

Experimenting/

piloting with XR

23%

Planning to have XR

initiative in next year

18%

No current

plans/not sure

39%

Ways XR is used by early adopters

Employee

training

62%

Customer

engagement

50%

Virtual

meetings

47%

Simulation

in R&D

45%

On-the-job

information

43%

Commercial feature

S

ince Bryn Mooser co-founded

immersive media company

RYOT in 2012, the studio has

been pushing the boundaries

of what can be produced with VR and

AR. The idea of the company goes

back to the time he spent in Haiti’s

capital city Port-au-Prince, after the

devastating earthquake of 2010.

“I moved down to build a high

school and when I was there I met

my co-founder David Darg. We were

both film-makers who had an inter-

est in humanitarian work and we

started making films there,” explains

Mr Mooser.

It was very clear to him that the

global view of Haiti was cynical and

many people felt like there was noth-

ing they could do about global prob-

lems, but as technology advanced

and connected people around

the world through social media,

there was no longer any excuse to

do nothing.

“RYOT started as a news website

with a function where every story

had an action, so when you read

about something in the world, you

could actually do something about it,

whether it be to sign a petition, vol-

unteer or donate,” says Mr Mooser.

From creating the world’s first all-VR

film in a war zone with Welcome to

Aleppo to the first in natural disas-

ter VR with The Nepal Project, RYOT’s

work is now defining what is possible

in a fully VR world.

“My mission has always been how

do we use technology to try and

make the world a better place?

We began to experiment with new

technologies to tell stories and we

found our perfect medium with VR,”

explains Mr Mooser.

RYOT quickly made a name for

itself as the go-to VR firm for news

and documentaries, and developed

VR content for high-profile com-

panies, including The Associated

Press, HuffPost and The New York

Times. Today RYOT is focused

on building what the future of

content and media will look like in a

5G world.

“What will a movie or TV show look

like in 5G and how will you watch

content in the back of your driver-

less car when it’s enabled with 5G?

We believe 5G is ushering in the

fourth industrial revolution; it’s like

nothing that has come before and

it will create major disruptions in all

industries, from mobility to health to

technology,” says Mr Mooser.

Super-fast 5G internet will not only

offer mobile users more stable con-

nections and low latency, but this

game-changing innovation is set to

unlock exciting new types of expe-

riences. “We are focused on how

to help build and enable the prod-

ucts of the future, so the consumers

of tomorrow can’t live without 5G,”

says Mr Mooser.

Transitioning to a more AR-friendly

digital environment may not be the

leap many consumers expect it to

be. For example, although few users

will be fully aware of the underlying

AR technology, every time face fil-

ters are used in popular social media

apps, they will be becoming more

comfortable with AR applications.

Businesses are building new prod-

ucts and services that are going to

enable consumers and businesses

alike to do things they never dreamed

possible via 5G. “It’s not enough to

just have lower latency and better

download speeds. The 5G solutions

that leverage those benefits could

be amazing. But is that enough to get

somebody to switch phones? I don’t

know,” says Mr Mooser.

Ideas that were once based in sci-

ence fiction are on course to become

increasingly feasible thanks to the

power of 5G. Driverless cars will

be able to communicate with each

other driving down the road and the

near real-time rendering of items in

AR can be wholly achieved.

“We’re at the tipping point right

now and we’re looking at how to

bring forward-thinking companies

on to the bleeding edge of technol-

ogy, and use that technology to tell

stories in a new way and capture a

new audience,” says Mr Mooser.

If companies want to remain at the

top of their market, it’s no longer

possible for them to gloss over AR/

VR technologies and 5G-enabled

services, as the impact of these

solutions will mean every industry

is about to experience a dramatic

disruption. A fully 5G-enabled world

will fundamentally change the enter-

tainment experience for viewers, in

part thanks to the ability of advanced

computing in the cloud.

Mr Mooser believes leaders will

approach 5G in one of two ways.

“Either they’re going to take con-

trol of the tremendous opportunity

to lead into the future or get left

behind, which if you look at histori-

cal trends, is what happens to many,”

he says.

In an age of disruptive startups that

have the power to transform entire

industries through the use of new

technologies, it’s now up to busi-

nesses to make sure they are inno-

vating fast with the right partners.

Mr Mooser concludes: “From a

business perspective, there has

never been a more exciting time.”

For further information please visit

www.ryot.org

RYOT is focused on building

what the future of content

and media will look like in

a 5G world

Bryn Mooser

Founder, RYOT

5G coming of age

Virtual reality (VR) and augmented reality (AR) clearly have

the potential to change dramatically how we perceive the

world around us. But much more work has to be done

for these technologies to move from their current

limited phase to become a truly transformative power

and revolutionise how content is consumed](https://image.slidesharecdn.com/xr-for-business-2018-181206111126/85/XR-for-Business-2018-5-320.jpg)

![10 RACONTEUR.NET 11XR FOR BUSINESS

T

he ongoing trade spat

between Washington and

Beijing certainly makes

headline news, but behind

the ruffling of feathers over steel

pipes, wine and pork, there’s a much

bigger agenda. “What they are fight-

ing is not really a trade war, it’s a

tech war. A tech war is also a man-

ufacturing war,” according to Terry

Gou, chairman of Foxconn.

The Taiwanese electronics com-

pany should know; it employs more

than a million workers, many in

mainland China, and is a big sup-

plier to Apple. These tensions have

profound implications for the

extended reality (XR) industries.

Chinese investment in US tech firms

has officially been soured as the

Trump administration gets spikey

over alleged intellectual property

theft and unfair trade practices.

“Both the US and China see them-

selves as having a manifest destiny

to determine world affairs, and per-

ceive their economic and cultural

outputs as crucial to shaping how

the 21st century plays out globally,”

says Tim Mulligan, senior analyst

at MIDiA Research. “Technological

innovation is a crucial strand in

establishing global leadership.”

Alibaba, JD and Tencent are

among the Chinese tech giants

that have made big investments in

America. Alibaba is of note hav-

ing lavished hundreds of millions

of dollars on ultra-secretive Magic

Leap, a virtual reality (VR) startup

that’s arguably had difficulty mov-

ing beyond its own hype.

“Magic Leap will struggle to

continue development with the

likes of Alibaba not being able to

supplement their earlier invest-

ment rounds. This is true of other

US-based AR [augmented reality]

and VR ventures that have received

speculative investments from

China,” explains Mr Mulligan.

“However, money pumped into

mixed reality companies are going

to be subject to less US regulatory

oversight than say investments in

technology and telecoms infrastruc-

ture or back-end providers.”

You only have to look at the ban on

US companies selling vital compo-

nents to ZTE, China’s second-larg-

est telecoms hardware provider, to

realise this. Huawei is also banned

in the United States.

The numbers speak for them-

selves; in the first five months of

2018, overall Chinese investments

in the US fell to their lowest level in

seven years, a drop of 92 per cent,

according to Rhodium Group. It

doesn’t help that there’s been little

or no return on investment from the

nascent XR sector.

“Chinese companies don’t look

at foreign investments with a huge

appetite; it’s often more a vanity

investment than core to their strat-

egy. Chinese tech companies are

more obsessed with local develop-

ments because losing their domes-

tic market share is a much bigger

threat at this stage,” says Shann

Biglione, head of strategy at Zenith

USA and former head of business

transformation at Publicis Media

Greater China.

Rhodium points out that the tight-

ening of rules could have a chilling

impact on Chinese inward invest-

ment into the US, including money

moving into research and devel-

opment, as well as other innova-

tion-intensive activities. The trade

spat has also led to a mad scramble

in the tech sector before sanctions

kick in.

“Device-makers are aware of the

tensions. Faced with the rising

uncertainties, some vendors have

already begun increasing their pro-

duction and exports early to fulfil

the expected increase in demand

in the coming Q4 holiday season,

as well as in early-2019,” says Jason

Low, Shanghai-based senior ana-

lyst at Canalys.

“The big issue is that China and

its companies have to invest to stay

ahead of the game domestically.

XR is one of the top areas where

the country has put in a lot of time

and effort to create frameworks

to streamline this development,

as the industry requires key play-

ers from different areas, including

hardware, network operators, con-

tent providers and developers, to

work together.”

In the past, China’s tech giants

have looked for US startups, which

help them learn about new tech

and cutting-edge trends emanat-

ing from Silicon Valley, as well as

businesses that can complement

their core e-commerce offerings

at home. Their eyes are firmly on

the main prize of making money

out of China’s 900 million-plus,

hyper-connected consumers.

“There is enough growth to be

had in China. By 2020 you will have

600 million middle-class consum-

ers and companies will sell an extra

$2.3 trillion of goods each year by

that time,” says Tom Goodwin, head

of innovation at Zenith Media.

“At senior levels in Chinese corpo-

rations, they’re adamant that they

don’t need help when it comes to

tech. I’ve seen this time and time

again. From Huawei to Alibaba to

China Mobile to DJI. They are very

clear they ‘have tech covered’. It’s

not arrogance; they just have total

clarity on where their strengths lie,

and they feel software and manufac-

turing are perfect for their skillsets.”

It helps that there are five million

science and technology graduates

in China every year and their com-

petence levels are extraordinarily

high. They also have huge markets

to experiment in. Asia accounts for

59 per cent of the global popula-

tion. How consumers adopt XR here

today could be crucial to how it’s

rolled out worldwide tomorrow.

Asia has the fastest-growing mar-

kets when it comes to disposable

incomes. Consumers are crucially

leap-frogging traditional ways

of engagement when it comes to

digital experiences.

China also has a grand plan, con-

cocted by Beijing’s apparatchiks,

called Made in China 2025. It’s a

concerted national effort to domi-

nate high-tech industries globally,

moving China up the value chain as

labour costs grow.

The leading Chinese tech compa-

nies are vast, but their Achilles’ heel

is they conduct 90 per cent of their

business within the country. Even

so, such plans give Washington

law-makers the jitters.

By closing themselves off to China,

America could lose out. Chinese

companies will develop core tech-

nologies, including XR, whether

they get help from Silicon Valley or

not. They will also look elsewhere to

invest and are likely to be welcomed

with open arms. China is already

active in many other countries and

will increase this collaboration as it

is increasingly frowned upon in the

United States.

“Don’t forget that the reliance on

Chinese capital in Europe is far more

evident than in the US,” says Nick

Cooper, executive director and global

head of insights at Landor Associates.

“It is easy to overlook the fact that

innovation is thriving in multiple

locations around the world now.

Not only on London’s own Silicon

Roundabout and indeed Silicon Fen

in Cambridge. This emphasises the

UK’s lead in tech startups and invest-

ment within Europe. However, there

are many other vibrant centres of

tech excellence now, including Berlin,

Stockholm and Helsinki, and else-

where,suchasParisandAmsterdam.”

In many ways, being shut out of the

US could be a boon for China. It will

be forced to be more self-reliant when

it comes to the XR sector and other

tech developments, which it will incu-

bate, grow, exploit and then export.

Watch out.

NICK EASEN

Tech is targ et in US-China sanctions battle

Economic hostility and sanctions

exchanged between the United States

and China will impact development of

reality technologies, with winners and

losers on both sides of the trade war

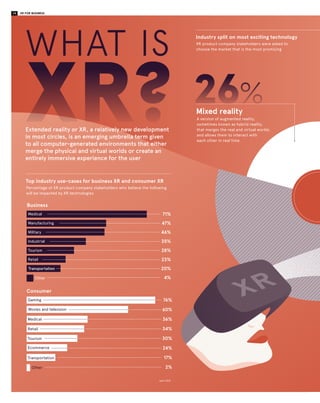

Market leaders in VR

Revenue forecasts for the three largest virtual reality markets ($bn)

PwC/Statista 2017

Chinese companies

will develop core

technologies,

including XR, whether

they get help from

Silicon Valley or not

360-degree view

of the Temple

of Heaven in

Beijing, China

IdeaImagesviaGettyImages

TRADE WAR

2016 2017 2018 2019 2020 2021

5

4

3

2

1

0

US

China

Japan

Compound

annual

growth rate

47%

103%

65%

Commercial feature

F

or the last few years, virtual real-

ity in business has been much

discussed, but less widely har-

nessed. Today, far from being

a notional advantage for the future,

some of the world’s biggest companies

are seeing the benefits for their train-

ing programmes.

“Many industries from manufactur-

ing and mining to healthcare, trans-

port and energy, have moved beyond

the tyre-kicking stage with VR train-

ing,” says Tom Symonds, founder and

chief executive of VR training com-

pany Immerse.io, whose clients include

Shell, DHL and GE Healthcare. “With

large businesses already using the

technology to help people train more

effectively, it’s important for others to

consider it so they are not left behind.”

By using the company’s VR plat-

form, up to ten people anywhere in

the world can enter an immersive vir-

tual environment and interact with one

another, with additional people view-

ing a 2D version on their web browser.

During or after the training, educators

can comment on steps taken or guide

participants. The technology is used

across industries, from manufacturing

processes to delivery firms, defence to

flight, healthcare to mining, energy to

communications and beyond.

In addition to optimising broader

business processes through analysis

of the usage data, organisations can

gain cost-savings within the delivery

of training, simply because so much

less travelling and ongoing investment

is required thanks to the live and dis-

tributed nature of the platform. The

sheer immersive nature of VR train-

ing enables learning experiences that

VR is revolutionising

the way businesses

approach training

Virtual reality holds huge promise for businesses,

reducing the costs of training and dramatically

improving results through immersive experiences

impact learners on a deep level, driving

improved knowledge retention.

“Everyone learns best when they’re

focused and even the most brilliant

trainer cannot hold learners’ attention

for 100 per cent of the time. There are

so many distractions in a normal office

environment that people’s minds nat-

urally wander,” Mr Symonds explains.

“But once learners are in a VR headset,

being handed a virtual object by a col-

league, they are fully focused as there

is an immediate imperative to act and

to interact.”

For industries such as oil and gas,

where safety issues are of utmost

importance, the capacity for VR train-

ing to avoid potentially dangerous out-

comes is critical. Energy giant Shell is

using the systems to train for emer-

gency response.

“We can show a person the impact

of a delay in shutting down a defec-

tive piece of equipment by a few sec-

onds. This ability to recreate differ-

ent working scenarios means learners

understand and experience the conse-

quences of one decision over another.

They wouldn’t forget this training in a

hurry,” says Mr Symonds. “That offers

real value for businesses where main-

taining the highest levels of worker

safety is paramount.”

Immerse.io’s VR platform is under-

pinned by training data capture on

a large scale, empowering live or

post-session assessment. Managers

can see how well trainees have per-

formed in a given VR scenario and

they are able then to pinpoint where

improvements can be made.

The technology company’s in-house

developers work closely with clients

to create bespoke VR training envi-

ronments, but Mr Symonds says busi-

nesses also use his company’s platform

independently to create their own per-

sonalised environments.

“We’ve created a software devel-

opment kit that allows our clients to

create their own content or to import

CAD [computer-aided design] models

to run on the platform,” he says. “This

means companies can quickly and

repeatedly build the virtual environ-

ments they need, enabling them to

take enterprise-wide training to the

next level and deliver massive change

in their organisation.”

To find out more about providing

accessible, immersive VR training

across your business please visit

immerse.io

With large

businesses already

using the technology

to help people train

more effectively, it’s

important for others

to consider it so they

are not left behind

Two trainees

work together in

a collaborative

virtual space

to identify and

prevent a gas leak](https://image.slidesharecdn.com/xr-for-business-2018-181206111126/85/XR-for-Business-2018-10-320.jpg)

![10 RACONTEUR.NET 11XR FOR BUSINESS

T

he ongoing trade spat

between Washington and

Beijing certainly makes

headline news, but behind

the ruffling of feathers over steel

pipes, wine and pork, there’s a much

bigger agenda. “What they are fight-

ing is not really a trade war, it’s a

tech war. A tech war is also a man-

ufacturing war,” according to Terry

Gou, chairman of Foxconn.

The Taiwanese electronics com-

pany should know; it employs more

than a million workers, many in

mainland China, and is a big sup-

plier to Apple. These tensions have

profound implications for the

extended reality (XR) industries.

Chinese investment in US tech firms

has officially been soured as the

Trump administration gets spikey

over alleged intellectual property

theft and unfair trade practices.

“Both the US and China see them-

selves as having a manifest destiny

to determine world affairs, and per-

ceive their economic and cultural

outputs as crucial to shaping how

the 21st century plays out globally,”

says Tim Mulligan, senior analyst

at MIDiA Research. “Technological

innovation is a crucial strand in

establishing global leadership.”

Alibaba, JD and Tencent are

among the Chinese tech giants

that have made big investments in

America. Alibaba is of note hav-

ing lavished hundreds of millions

of dollars on ultra-secretive Magic

Leap, a virtual reality (VR) startup

that’s arguably had difficulty mov-

ing beyond its own hype.

“Magic Leap will struggle to

continue development with the

likes of Alibaba not being able to

supplement their earlier invest-

ment rounds. This is true of other

US-based AR [augmented reality]

and VR ventures that have received

speculative investments from

China,” explains Mr Mulligan.

“However, money pumped into

mixed reality companies are going

to be subject to less US regulatory

oversight than say investments in

technology and telecoms infrastruc-

ture or back-end providers.”

You only have to look at the ban on

US companies selling vital compo-

nents to ZTE, China’s second-larg-

est telecoms hardware provider, to

realise this. Huawei is also banned

in the United States.

The numbers speak for them-

selves; in the first five months of

2018, overall Chinese investments

in the US fell to their lowest level in

seven years, a drop of 92 per cent,

according to Rhodium Group. It

doesn’t help that there’s been little

or no return on investment from the

nascent XR sector.

“Chinese companies don’t look

at foreign investments with a huge

appetite; it’s often more a vanity

investment than core to their strat-

egy. Chinese tech companies are

more obsessed with local develop-

ments because losing their domes-

tic market share is a much bigger

threat at this stage,” says Shann

Biglione, head of strategy at Zenith

USA and former head of business

transformation at Publicis Media

Greater China.

Rhodium points out that the tight-

ening of rules could have a chilling

impact on Chinese inward invest-

ment into the US, including money

moving into research and devel-

opment, as well as other innova-

tion-intensive activities. The trade

spat has also led to a mad scramble

in the tech sector before sanctions

kick in.

“Device-makers are aware of the

tensions. Faced with the rising

uncertainties, some vendors have

already begun increasing their pro-

duction and exports early to fulfil

the expected increase in demand

in the coming Q4 holiday season,

as well as in early-2019,” says Jason

Low, Shanghai-based senior ana-

lyst at Canalys.

“The big issue is that China and

its companies have to invest to stay

ahead of the game domestically.

XR is one of the top areas where

the country has put in a lot of time

and effort to create frameworks

to streamline this development,

as the industry requires key play-

ers from different areas, including

hardware, network operators, con-

tent providers and developers, to

work together.”

In the past, China’s tech giants

have looked for US startups, which

help them learn about new tech

and cutting-edge trends emanat-

ing from Silicon Valley, as well as

businesses that can complement

their core e-commerce offerings

at home. Their eyes are firmly on

the main prize of making money

out of China’s 900 million-plus,

hyper-connected consumers.

“There is enough growth to be

had in China. By 2020 you will have

600 million middle-class consum-

ers and companies will sell an extra

$2.3 trillion of goods each year by

that time,” says Tom Goodwin, head

of innovation at Zenith Media.

“At senior levels in Chinese corpo-

rations, they’re adamant that they

don’t need help when it comes to

tech. I’ve seen this time and time

again. From Huawei to Alibaba to

China Mobile to DJI. They are very

clear they ‘have tech covered’. It’s

not arrogance; they just have total

clarity on where their strengths lie,

and they feel software and manufac-

turing are perfect for their skillsets.”

It helps that there are five million

science and technology graduates

in China every year and their com-

petence levels are extraordinarily

high. They also have huge markets

to experiment in. Asia accounts for

59 per cent of the global popula-

tion. How consumers adopt XR here

today could be crucial to how it’s

rolled out worldwide tomorrow.

Asia has the fastest-growing mar-

kets when it comes to disposable

incomes. Consumers are crucially

leap-frogging traditional ways

of engagement when it comes to

digital experiences.

China also has a grand plan, con-

cocted by Beijing’s apparatchiks,

called Made in China 2025. It’s a

concerted national effort to domi-

nate high-tech industries globally,

moving China up the value chain as

labour costs grow.

The leading Chinese tech compa-

nies are vast, but their Achilles’ heel

is they conduct 90 per cent of their

business within the country. Even

so, such plans give Washington

law-makers the jitters.

By closing themselves off to China,

America could lose out. Chinese

companies will develop core tech-

nologies, including XR, whether

they get help from Silicon Valley or

not. They will also look elsewhere to

invest and are likely to be welcomed

with open arms. China is already

active in many other countries and

will increase this collaboration as it

is increasingly frowned upon in the

United States.

“Don’t forget that the reliance on

Chinese capital in Europe is far more

evident than in the US,” says Nick

Cooper, executive director and global

head of insights at Landor Associates.

“It is easy to overlook the fact that

innovation is thriving in multiple

locations around the world now.

Not only on London’s own Silicon

Roundabout and indeed Silicon Fen

in Cambridge. This emphasises the

UK’s lead in tech startups and invest-

ment within Europe. However, there

are many other vibrant centres of

tech excellence now, including Berlin,

Stockholm and Helsinki, and else-

where,suchasParisandAmsterdam.”

In many ways, being shut out of the

US could be a boon for China. It will

be forced to be more self-reliant when

it comes to the XR sector and other

tech developments, which it will incu-

bate, grow, exploit and then export.

Watch out.

NICK EASEN

Tech is targ et in US-China sanctions battle

Economic hostility and sanctions

exchanged between the United States

and China will impact development of

reality technologies, with winners and

losers on both sides of the trade war

Market leaders in VR

Revenue forecasts for the three largest virtual reality markets ($bn)

PwC/Statista 2017

Chinese companies

will develop core

technologies,

including XR, whether

they get help from

Silicon Valley or not

360-degree view

of the Temple

of Heaven in

Beijing, China

IdeaImagesviaGettyImages

TRADE WAR

2016 2017 2018 2019 2020 2021

5

4

3

2

1

0

US

China

Japan

Compound

annual

growth rate

47%

103%

65%

Commercial feature

F

or the last few years, virtual real-

ity in business has been much

discussed, but less widely har-

nessed. Today, far from being

a notional advantage for the future,

some of the world’s biggest companies

are seeing the benefits for their train-

ing programmes.

“Many industries from manufactur-

ing and mining to healthcare, trans-

port and energy, have moved beyond

the tyre-kicking stage with VR train-

ing,” says Tom Symonds, founder and

chief executive of VR training com-

pany Immerse.io, whose clients include

Shell, DHL and GE Healthcare. “With

large businesses already using the

technology to help people train more

effectively, it’s important for others to

consider it so they are not left behind.”

By using the company’s VR plat-

form, up to ten people anywhere in

the world can enter an immersive vir-

tual environment and interact with one

another, with additional people view-

ing a 2D version on their web browser.

During or after the training, educators

can comment on steps taken or guide

participants. The technology is used

across industries, from manufacturing

processes to delivery firms, defence to

flight, healthcare to mining, energy to

communications and beyond.

In addition to optimising broader

business processes through analysis

of the usage data, organisations can

gain cost-savings within the delivery

of training, simply because so much

less travelling and ongoing investment

is required thanks to the live and dis-

tributed nature of the platform. The

sheer immersive nature of VR train-

ing enables learning experiences that

VR is revolutionising

the way businesses

approach training

Virtual reality holds huge promise for businesses,

reducing the costs of training and dramatically

improving results through immersive experiences

impact learners on a deep level, driving

improved knowledge retention.

“Everyone learns best when they’re

focused and even the most brilliant

trainer cannot hold learners’ attention

for 100 per cent of the time. There are

so many distractions in a normal office

environment that people’s minds nat-

urally wander,” Mr Symonds explains.

“But once learners are in a VR headset,

being handed a virtual object by a col-

league, they are fully focused as there

is an immediate imperative to act and

to interact.”

For industries such as oil and gas,

where safety issues are of utmost

importance, the capacity for VR train-

ing to avoid potentially dangerous out-

comes is critical. Energy giant Shell is

using the systems to train for emer-

gency response.

“We can show a person the impact

of a delay in shutting down a defec-

tive piece of equipment by a few sec-

onds. This ability to recreate differ-

ent working scenarios means learners

understand and experience the conse-

quences of one decision over another.

They wouldn’t forget this training in a

hurry,” says Mr Symonds. “That offers

real value for businesses where main-

taining the highest levels of worker

safety is paramount.”

Immerse.io’s VR platform is under-

pinned by training data capture on

a large scale, empowering live or

post-session assessment. Managers

can see how well trainees have per-

formed in a given VR scenario and

they are able then to pinpoint where

improvements can be made.

The technology company’s in-house

developers work closely with clients

to create bespoke VR training envi-

ronments, but Mr Symonds says busi-

nesses also use his company’s platform

independently to create their own per-

sonalised environments.

“We’ve created a software devel-

opment kit that allows our clients to

create their own content or to import

CAD [computer-aided design] models

to run on the platform,” he says. “This

means companies can quickly and

repeatedly build the virtual environ-

ments they need, enabling them to

take enterprise-wide training to the

next level and deliver massive change

in their organisation.”

To find out more about providing

accessible, immersive VR training

across your business please visit

immerse.io

With large

businesses already

using the technology

to help people train

more effectively, it’s

important for others

to consider it so they

are not left behind

Two trainees

work together in

a collaborative