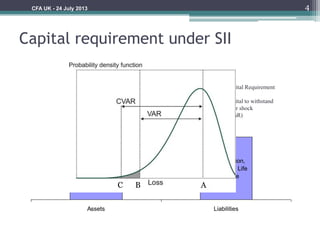

This document discusses various topics related to working in the insurance industry such as capital requirements under Solvency II, differences between insurance companies and pension funds, career paths within insurance including working for a life insurance company or as a consultant, and what a typical day might involve. It also provides references and links for further information on actuarial topics and qualifications as well as background on the presenter, Servaas Houben.