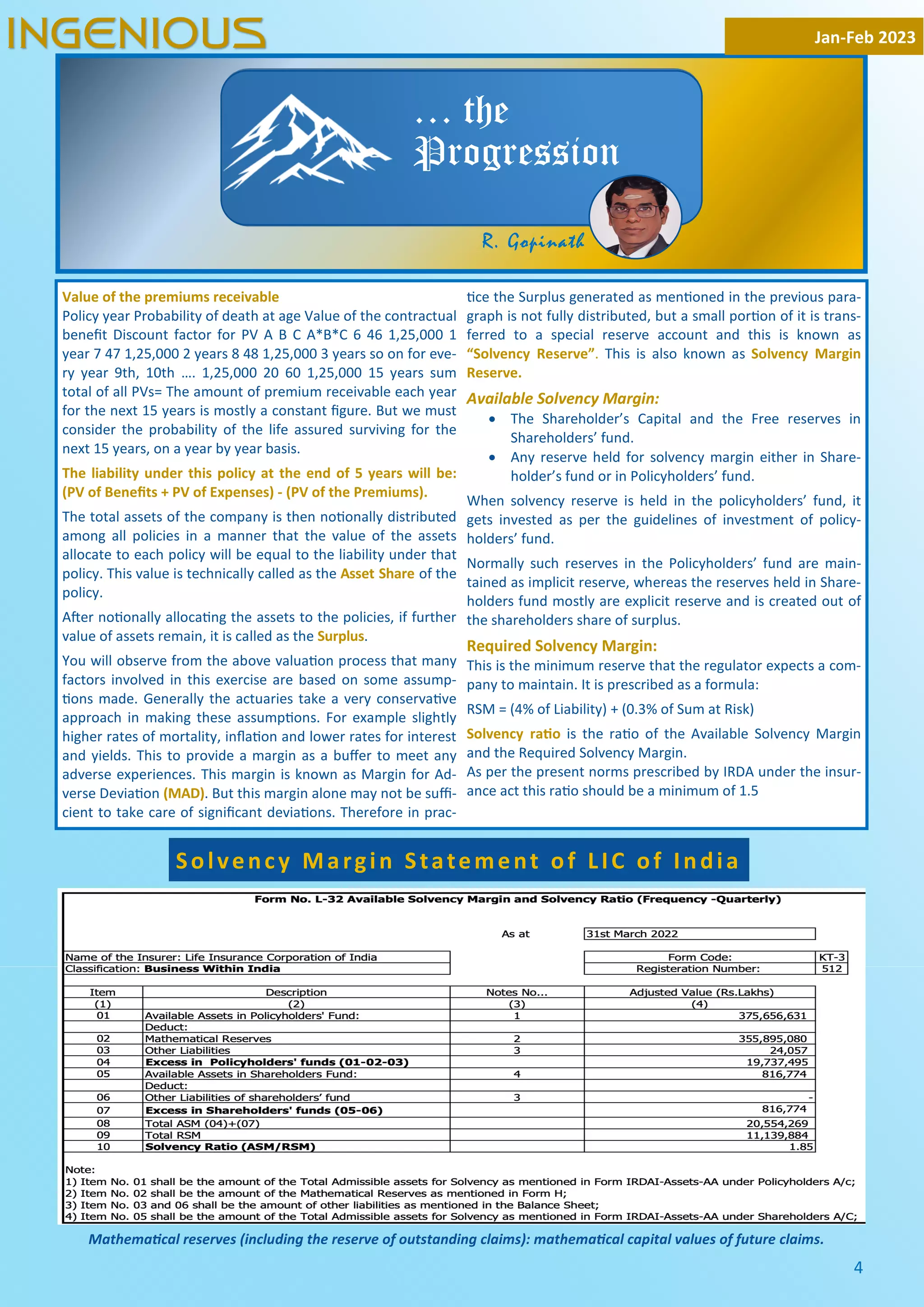

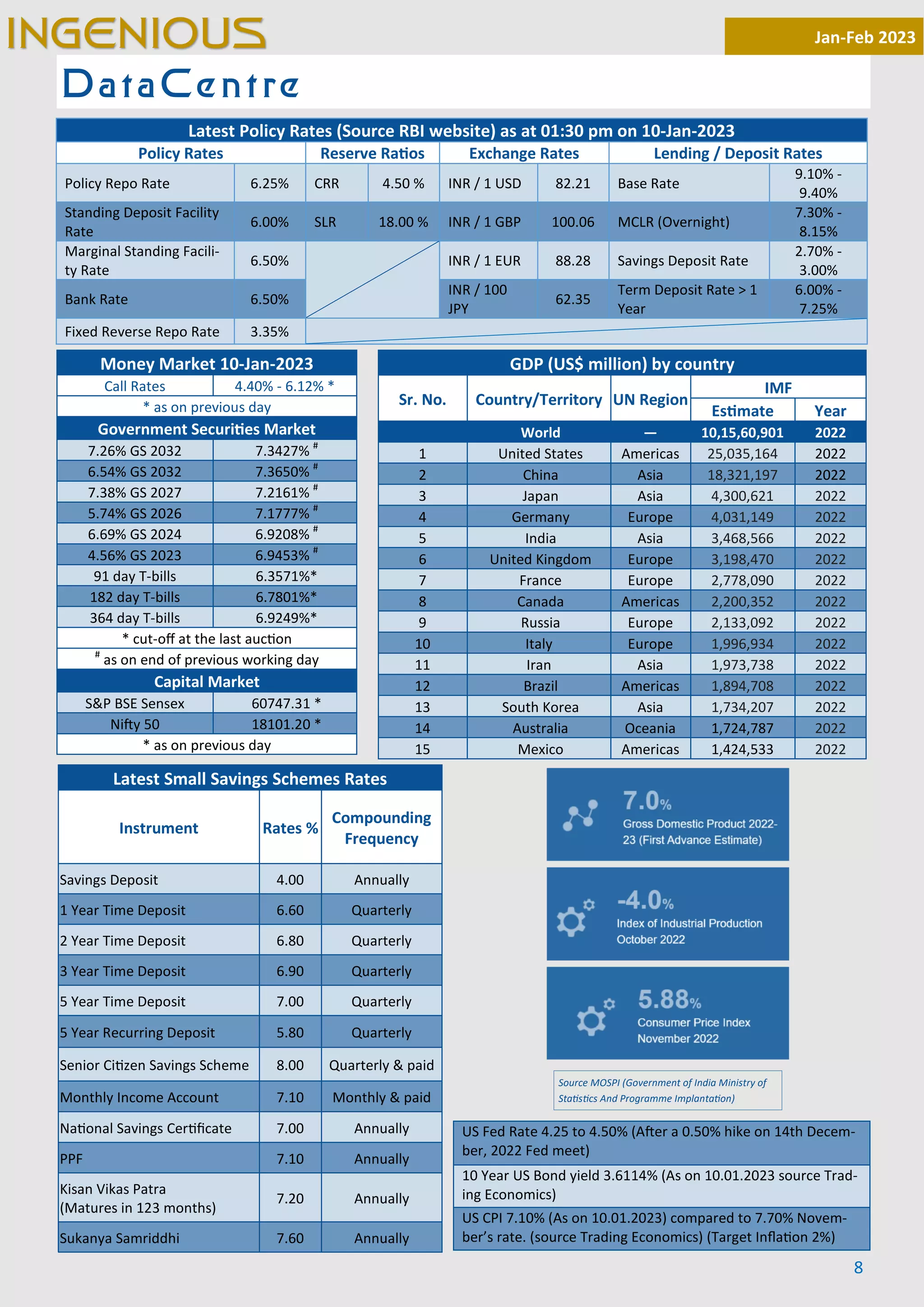

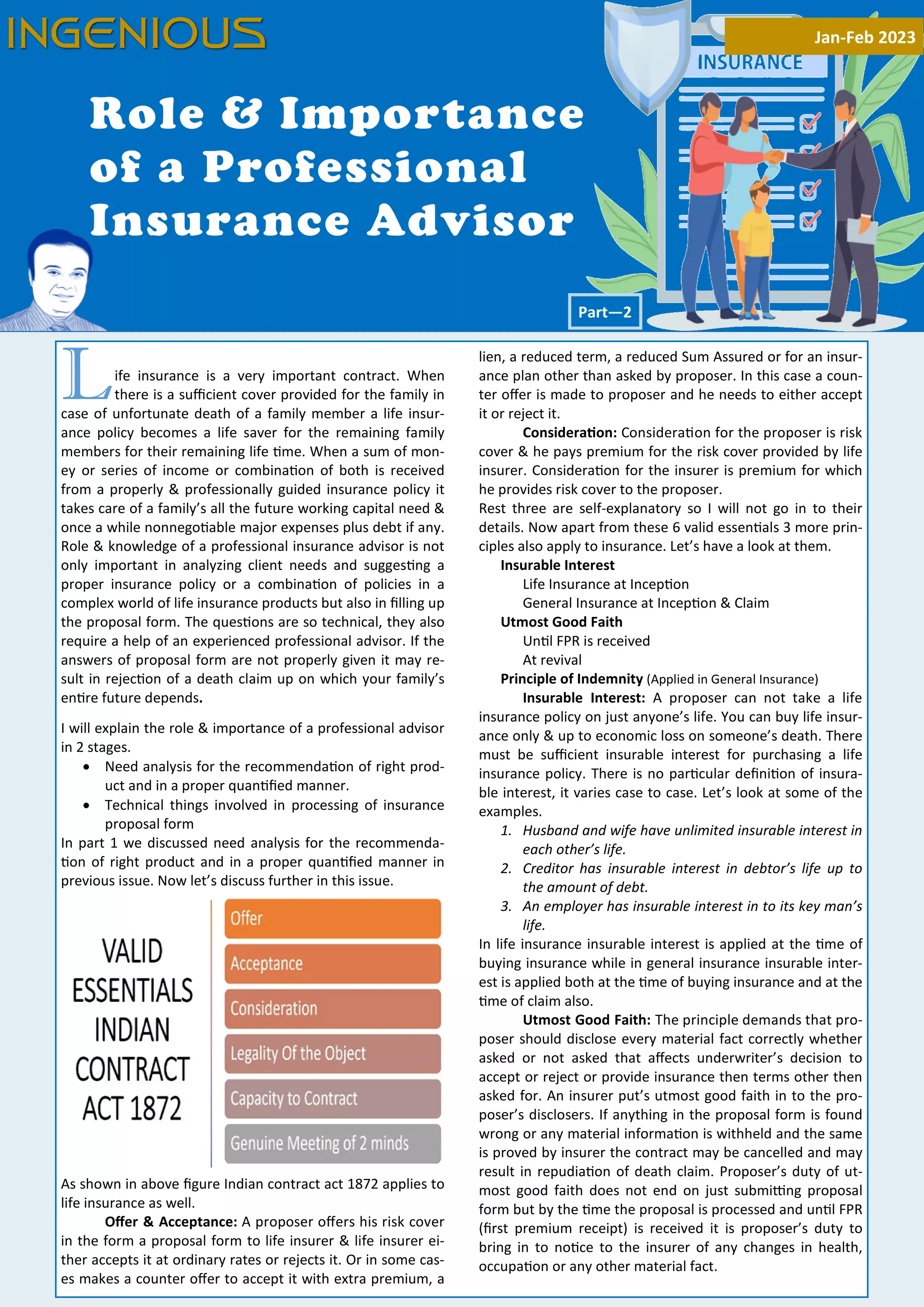

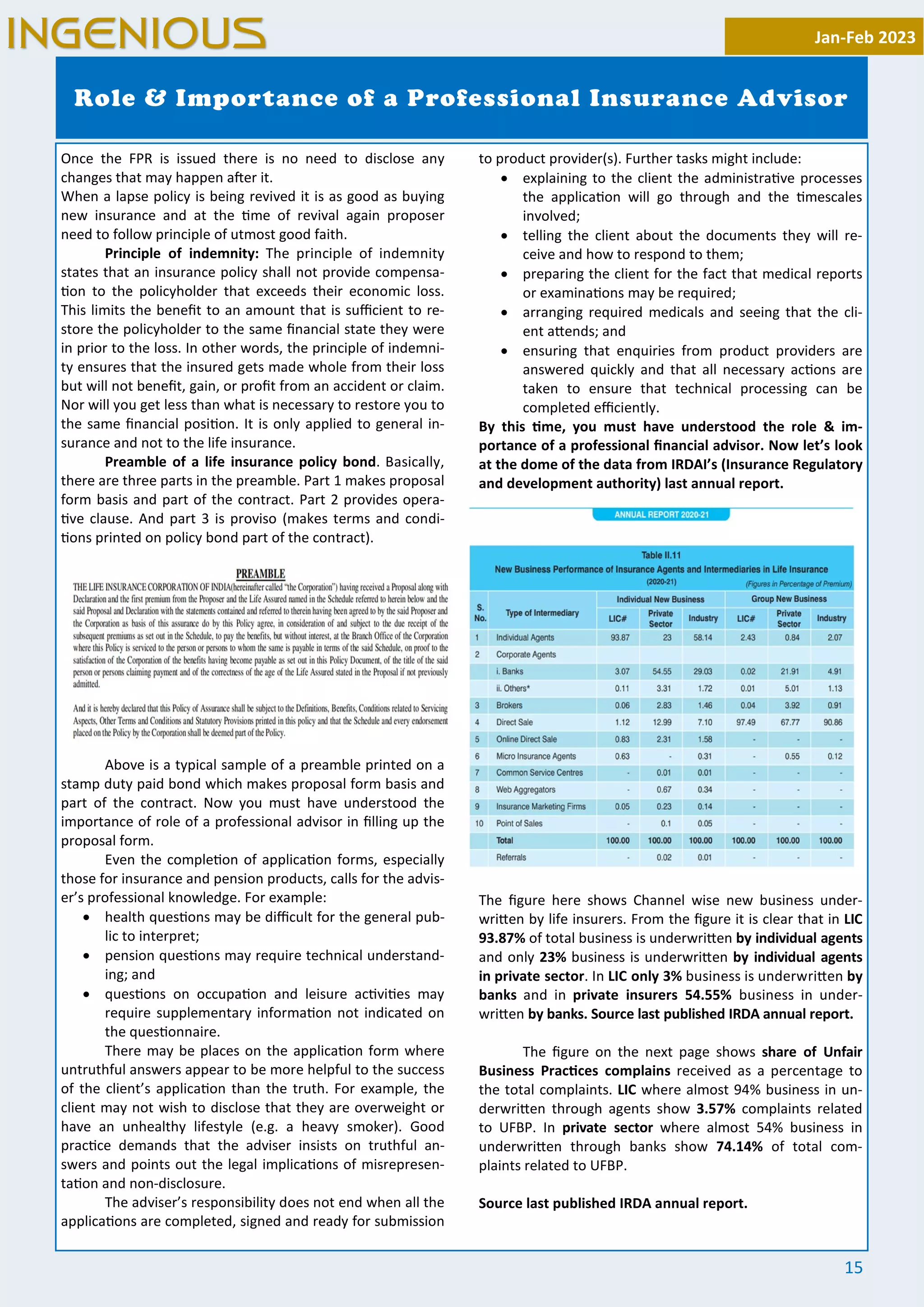

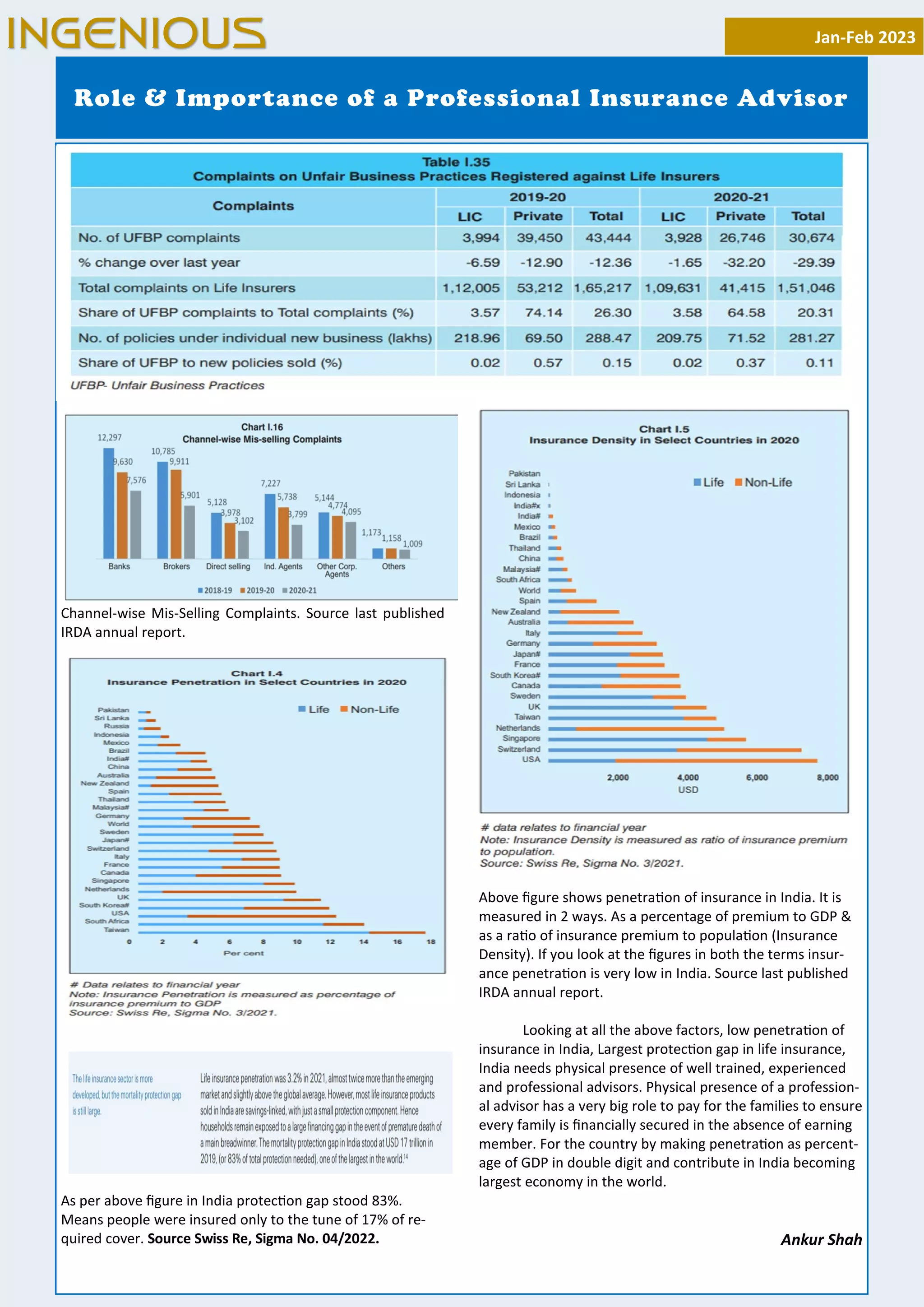

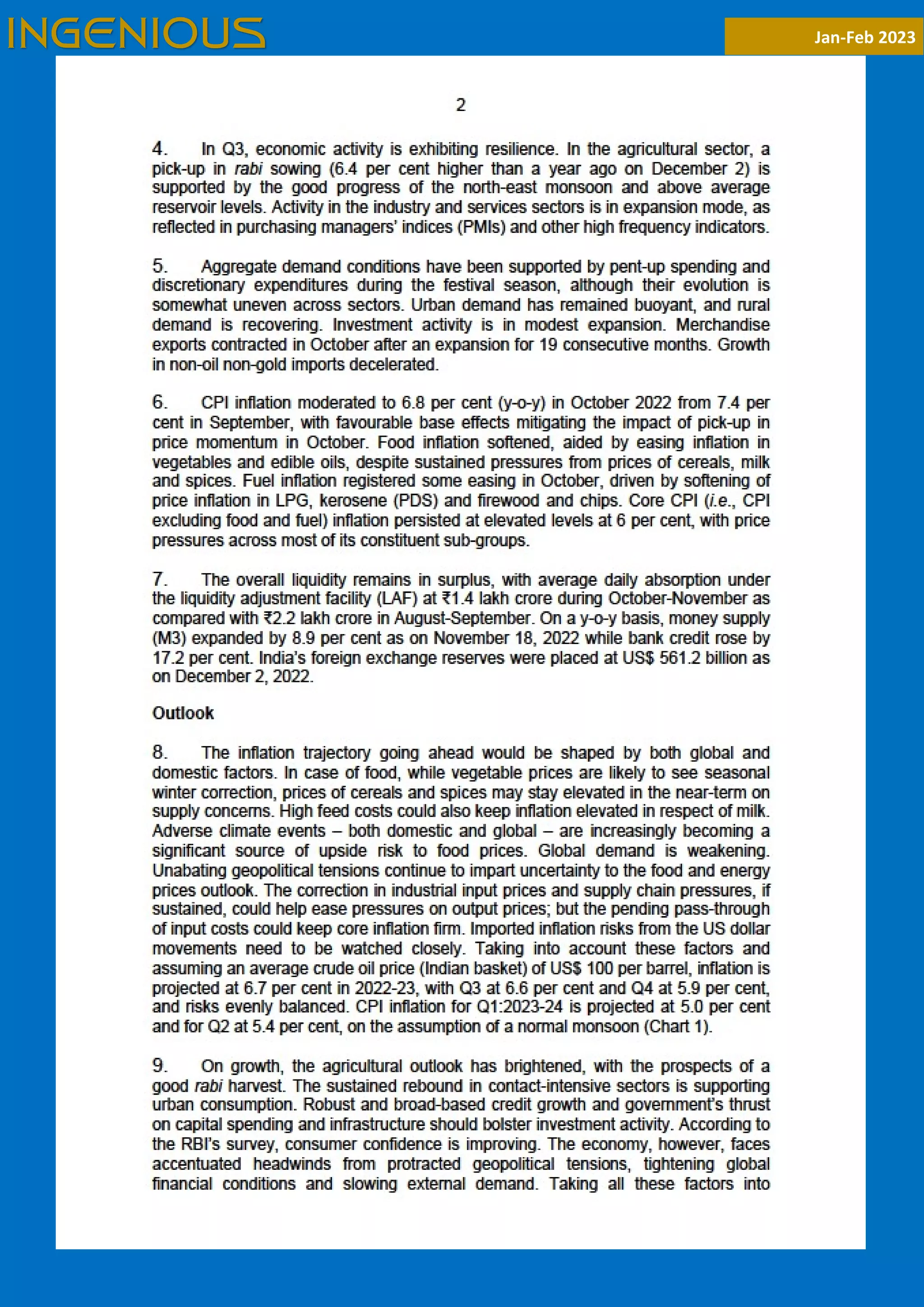

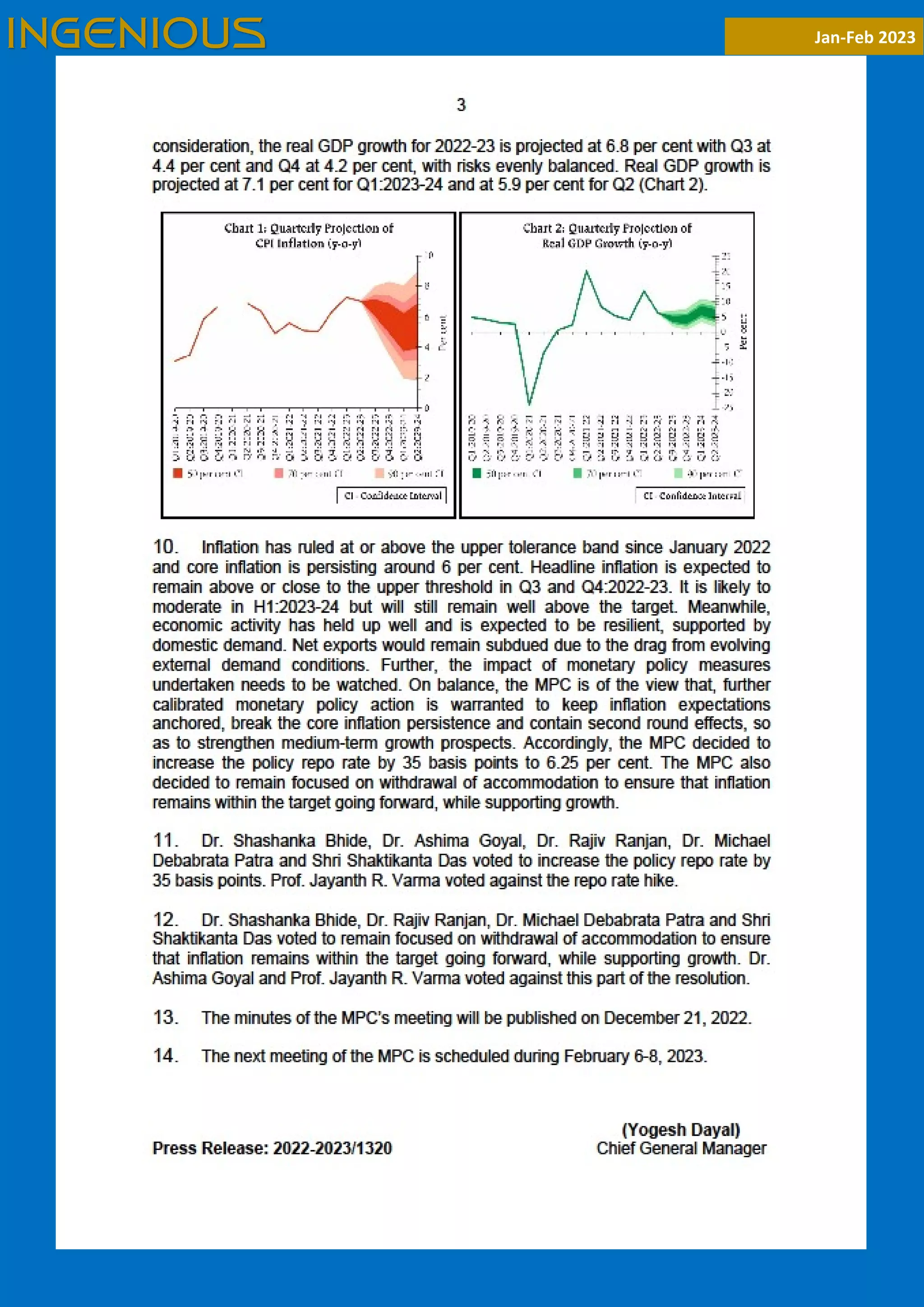

The document is the third issue of the 'Ingenious Magazine' for January-February 2023, aimed at members of the Foundation Course in Financial Planning. It features articles on topics such as India's trade infrastructure, the rise and fall of crypto exchanges, and the importance of solvency margins in insurance. The magazine expresses gratitude to its readers for their support in the previous year while providing insights and updates on financial products and news in the economy, finance, and insurance sectors.