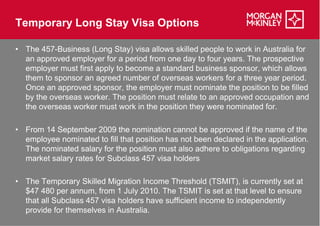

Sydney and Melbourne are the two largest cities in Australia, with Sydney known as the most livable city and Melbourne considered the cultural capital. The Australian economy performed well compared to other developed nations during the global financial crisis. Several visa options exist for foreign workers to work temporarily or permanently in Australia, including working holiday, skilled migrant, and employer sponsored visas.