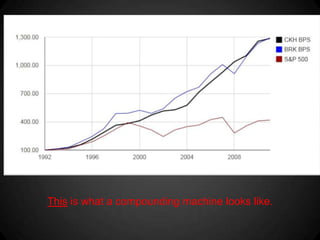

The WOAPIC Meeting 2013 document summarizes an investment conference. It discusses 3 value investment themes: serial compounding machines, event driven special situations, and cigar butts. It outlines 3 pillars of value investing - management, moat, and mispricing. Several company examples and case studies are presented to illustrate these themes and pillars. The document concludes with a Q&A section.