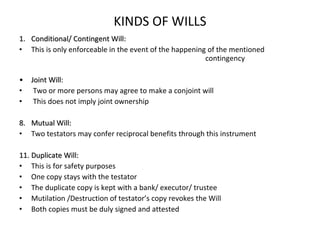

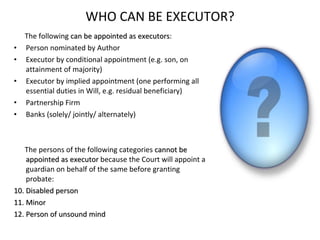

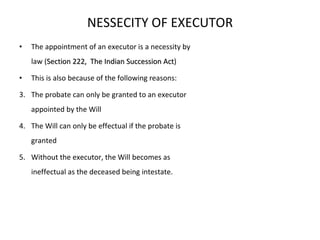

The document provides an overview of wills under Indian law, detailing their types, the process of creating and revoking them, and the role of executors. It outlines who is eligible to make a will, the necessity of registration, and the significance of probate and letters of administration. Additionally, it emphasizes the importance of having a clear testamentary capacity and provides guidelines for the appointment of executors.

![Flat No 903, Indra Prakash, 21, Barakhamba Road, New Delhi 110001 (India) Phone: +91 11 42492532 (Direct) Phone: +91 11 42492525 Ext 532 Mobile :- 9810081079 Fax: +91 11 23320484 email:- [email_address]](https://image.slidesharecdn.com/willsintheindianperspective-12869920909829-phpapp01/85/Wills-In-The-Indian-Perspective-17-320.jpg)