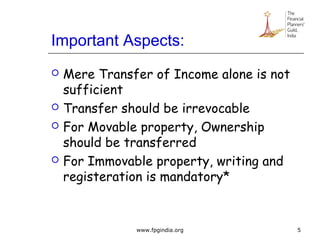

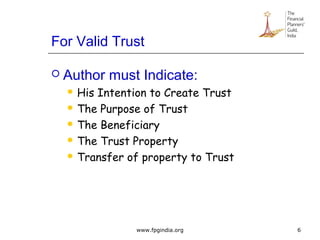

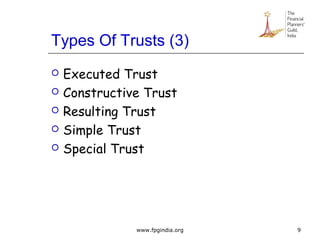

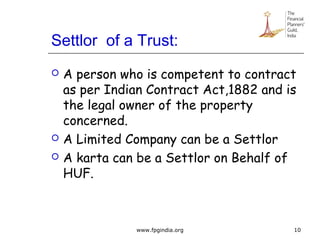

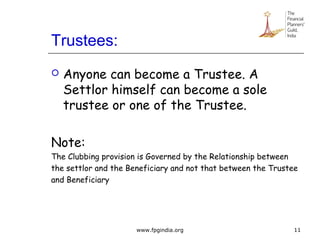

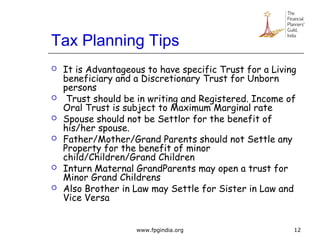

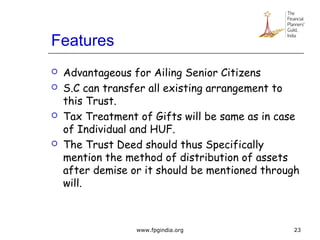

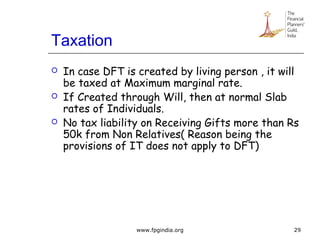

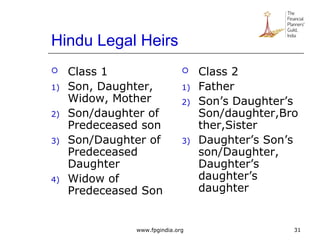

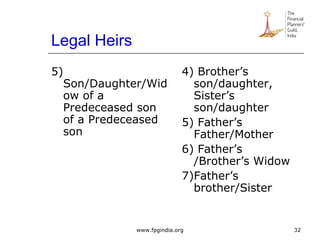

The document discusses trusts and wills under Indian law. It defines a trust and outlines the key parties - author/settlor, trustee, and beneficiary. It describes different types of trusts like specific, discretionary, public and private trusts. It also discusses wills and succession planning for Hindus, including legal heirs. Key points covered include drafting a valid will, advantages of wills, terms associated with wills, and tax planning opportunities through trusts and wills.