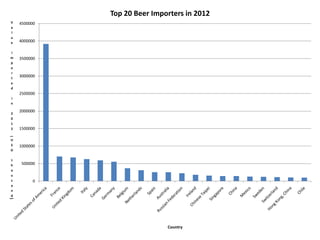

This document presents a preliminary analysis of international expansion opportunities for US beer exports, identifying the top ten markets based on various economic metrics such as GDP, beer consumption, and import values for the year 2012. Key insights include significant growth in markets like Canada and Mexico, alongside lower performance in countries like the UK and France. Additionally, the analysis provides demographic and business climate indicators to inform potential market entry strategies.