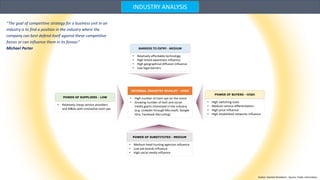

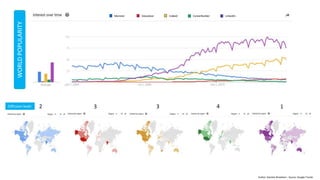

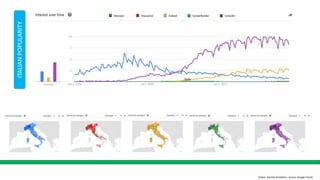

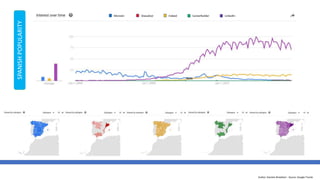

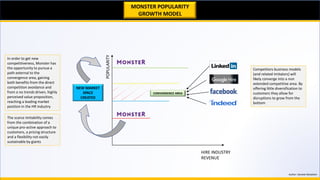

The document analyzes the competitive landscape of the online recruiting industry, focusing on major players like LinkedIn, Indeed, and Monster. It discusses barriers to entry, market dynamics, and the strengths and weaknesses of these platforms, highlighting LinkedIn's significant growth and challenges it faces from emerging competitors. Additionally, it emphasizes the need for companies to adapt their strategies in response to shifting market conditions and competitive pressures.