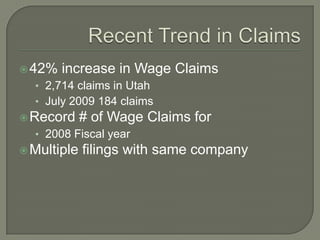

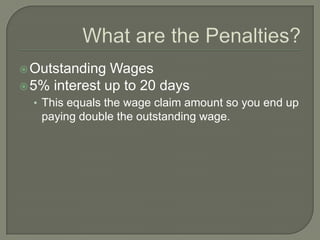

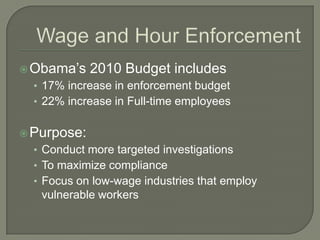

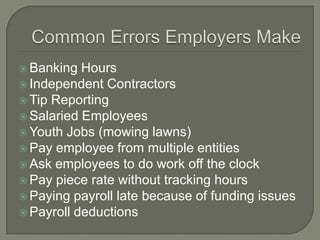

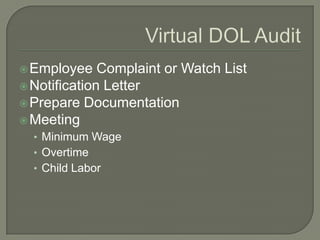

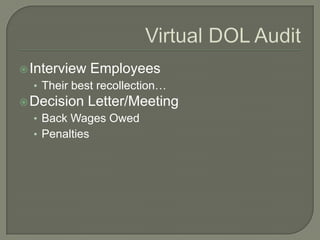

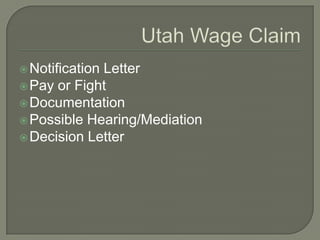

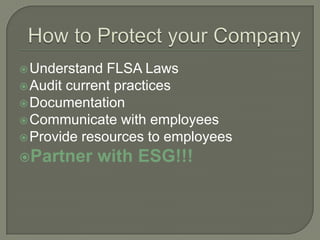

In the current economic environment, employees are more likely to file wage claims against their employer. To take control of this situation, employers should understand and comply with FLSA laws by auditing their pay practices, ensuring proper documentation, communicating policies to employees, and partnering with experts if needed. Non-compliance can result in penalties such as paying double the outstanding wages and facing investigations and wage claims.