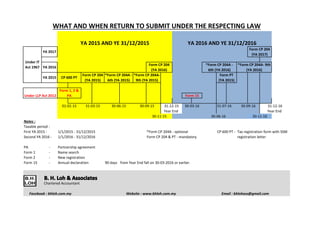

What and when to submit return under the respective law

- 1. Under IT Act 1967 YA 2017 YA 2016 YA 2015 Under LLP Act 2012 Notes : WHAT AND WHEN RETURN TO SUBMIT UNDER THE RESPECTING LAW YA 2015 AND YE 31/12/2015 YA 2016 AND YE 31/12/2016 Form CP 204 (YA 2016) *Form CP 204A- 9th (YA 2015) Form 15 30-09-15 31-12-15 30-03-16 Year End 30-11-15 *Form CP 204A - optional Form CP 204 & PT - mandatory *Form CP 204A - 6th (YA 2015) 30-06-15 Form CP 204 (YA 2015) CP 600 PT Form 1, 2 & PA 01-01-15 31-03-15 Taxable period : First YA 2015 - Second YA 2016 - 1/1/2015 - 31/12/2015 1/1/2016 - 31/12/2016 PA - Partnership agreement Form 1 - Name search Form 2 - New registration Form 15 - Annual declaration 90 days from Year End fall on 30-03-2016 or earlier. Chartered Accountant *Form CP 204A - 6th (YA 2016) Form PT (YA 2015) 31-07-16 30-06-16 Form CP 204 (YA 2017) *Form CP 204A- 9th (YA 2016) 31-12-16 Year End 30-09-16 30-11-16 CP 600 PT - Tax registration form with SSM registration letter Facebook : bhloh.com.my Website : www.bhloh.com.my Email : bhlohass@gmail.com

- 2. Section 14 (1) APPLICATION FOR RESERVATION OF NAME Fee (RM30) PROPOSED NAME PURPOSE (PLEASE SELECT ONE) NEW REGISTRATION OF LLP REGISTRATION OF FOREIGN LLP Name of LLP in Country of Origin : Registration No. in Country of : Origin (if any) Date of Registration in Country of Origin : Country of Origin : CONVERSION FROM PRIVATE COMPANY Existing Company Name : Company No. : CONVERSION FROM CONVENTIONAL PARTNERSHIP Existing Business Name : Business Registration No. : REGISTRATION OF PROFESSIONAL PRACTICE (CHARTERED ACCOUNTANT/ ADVOCATE & SOLICITOR / SECRETARY) Firm Name : Firm No. : CHANGE OF NAME Existing Name Of LLP : Registration No. : Reference No : (for Direction of Change of Name) CLARIFICATION If single letter(s) is used, please explain its meaning If the proposed name is not in Bahasa Malaysia or English, please explain its meaning √ 1

- 3. PARTICULARS OF COMPLIANCE OFFICER Name NRIC No Mobile Phone No Email AUTHORIZATION LETTER (IF ANY) If you have obtained approval or authorization from other authority/ LLP/ other entity or professional body for the use of the proposed name, please complete the following: Particulars of Agreement or Details of Approval Obtained from Other Authorities Name of Approval Authority/LLP/Other Entity/Professional Body Reference No. of Approval Letter Date of approval Letter Purpose of Approval Letter Signatory Name of Approval Letter Remarks (If Any) DECLARATION Declaration: I confirm that the facts and information stated in this document are true. Signed by Compliance officer: _______________ Name : Date of Application:

- 4. Attention: It is an offence under section 80 of the Limited Liability Partnerships Act 2012 to dishonestly make or authorize the making of a statement that you know is false or misleading and you may be liable, upon conviction, to imprisonment for a term not exceeding five years or to a fine not less than RM150,000 and not more than RM500,000 or to both. LODGER INFORMATION Name NRIC No. Address Phone No Email *Subject to the availability of the proposed name, the name will only be reserved for a period of 30 days from the date of approval.

- 5. Section 10 (1) & (2) APPLICATION FOR REGISTRATION OF NEW LLP 2 Fee: RM500 LLP NAME Proposed Name Name Approval Reference No PARTICULARS OF LLP Address of registered office Address of place of business (if different from above) Office Phone No. Fax No. Email Address of branches (if any): General nature of business of the proposed LLP: Principal Activities MSIC Code 1. 2. 3. LLP Agreement (if any) Date of Agreement No. of Partner Total Capital Contribution (RM)

- 6. PARTICULARS OF COMPLIANCE OFFICER Name NRIC No. Mobile Phone No. Email Capacity of Compliance Officer (choose one) Partner of LLP Person qualified to act as secretary Date of Appointment as Compliance Officer * For additional Compliance Officer(s) please use additional pages PARTICULARS OF PARTNERS (INDIVIDUAL) PARTNER 1 No of Partners (minimum 2) Name NRIC/ Passport No. Passport Expiry Date Date of Birth Gender Male Female Race Nationality Residential Address Phone No. Mobile Phone No. Email Date of Appointment as Partner PARTNER 2 Name NRIC/ Passport No. Passport Expiry Date Date of Birth Gender Male Female Race

- 7. Nationality Residential Address Phone No. Mobile Phone No. Email Date of Appointment as Partner * For additional Individual Partner(s) please use additional pages. PARTICULARS OF PARTNERS (BODY CORPORATE) Name Place of Incorporation Registration No Registered Address Date of Appointment as Partner Representative of Body Corporate Name NRIC/ Passport No. Passport Expiry Date Designation PARTICULARS OF BODY PARTNERS (BODY CORPORATE) If the body corporate is a Government Agency, please fill in this section Ministry Name of Agency Establishment Act (if any) Registered Address Office Phone No Fax No Email Date of Appointment as Partner Representative of the Government Agency

- 8. Name NRIC No. Designation * For additional Body Corporate Partner(s) please use additional pages. AUTHORIZATION LETTER Letter of Authorization from Professional Body/ Other Authorities/ related LLP is attached. DECLARATION Declaration: I confirm that the facts and information stated in this document are true. Signed by Compliance officer: __________________ Name : Date of Application: Attention: It is an offence under section 80 of the Limited Liability Partnerships Act 2012 to dishonestly make or authorize the making of a statement that you know is false or misleading and you may be liable, upon conviction, to imprisonment for a term not exceeding five years or to a fine not less than RM150,000 and not more than RM500,000 or to both.

- 9. LODGER INFORMATION Name NRIC No Address Phone No Email

- 10. 1 LLP Registration Number LLP Name [Section 68] ANNUAL DECLARATION BY A GENERAL LIMITED LIABILITY PARTNERSHIP Fee: RM200 Part I Name of LLP LLP Registration Number LLP Registered Office Address LLP Business Address Nature of Business Description Of Nature Of Business Business Code (MSIC Code) 1 2 3 15

- 11. Summary of Partners and Compliance Officer(s) as at the declaration date : 2 Partners: Name NRIC No. / Passport No. / Registration No. / Nationality Place of Residence / Registered Address Date of Appointment

- 12. 3 Compliance Officer(s): Name NRIC No. / Nationality Place of Residence Date of Appointment Total amount of capital contribution and reserves (RM) Total amount of indebtedness (RM) Particulars of secured indebtedness : Nature of indebtedness Date of creation Name of creditor Amount of Indebtedness

- 13. 4 Part II We, being the partners of _______________________________________ (name and registration no. of the LLP), do solemnly affirm and declare that we have made a full inquiry into the affairs of the limited liability partnership and we have formed an opinion that the limited liability partnership: (a) is able to pay its debts#; or (b) is not able to pay its debts# as they become due in the normal course of business as at the date to which the profit and loss accounts and balance sheets was made up on ____________________ # strike out whichever is not applicable Key Financial Indicators: Date of Financial Year End : _______________________ Balance Sheet Items RM Non-current assets Current assets Non-current liabilities Current liabilities Total capital contribution Reserves

- 14. Income Statement Items RM 5 Revenue Profit / loss Signed by: ____________________ _________________ Partner Partner Name: Name: Date: Date: * If a Partner of the LLP is a body corporate, the registered representative of the body corporate partner is required to sign the above declaration. Attention: It is an offence under section 68(6) of the Limited Liability Partnerships Act 2012 to make an annual declaration without having reasonable grounds for his/her opinion and shall, on conviction, be liable to a fine not exceeding two hundred and fifty thousand ringgit or to imprisonment for a term not exceeding two years or to both.

- 15. LODGER INFORMATION (COMPLIANCE OFFICER) 6 Name NRIC No. Address Phone No. Email

- 16. BORANG PENDAFTARAN FAIL CUKAI PENDAPATAN PERKONGSIAN LIABILITI TERHAD LEMBAGA HASIL DALAM NEGERI MALAYSIA 1 BAHAGIAN A MAKLUMAT ASAS A1 Nama Perkongsian Liabiliti Terhad A2 No. Pendaftaran Perkongsian Liabiliti Terhad A3 Tarikh Mula Operasi sebagai Perkongsian Liabiliti Terhad A4 Tarikh Mula Akaun (hh/bb/tttt) Tarikh Tutup Akaun (hh/bb/tttt) A5 Jenis Perniagaan Utama A6 Bilangan Pekongsi A7 Alamat Surat-menyurat Poskod Bandar Negeri A8 Alamat Premis Perniagaan Poskod Bandar Negeri A9 Alamat Berdaftar Poskod Bandar Negeri A10 No. Telefon A11 e-Mel A12 Pertukaran kepada Perkongsian Liabiliti Terhad 1 = Ya [Sila isi ruang A13 ] 2 = Tidak A13 No. Cukai Pendapatan sebelum pertukaran kepada Perkongsian Liabiliti Terhad BAHAGIAN B MAKLUMAT PEKONGSI ( sila gunakan helaian berasingan jika melebihi 3 pekongsi ) B1 Nama Pekongsi Utama B2 No. Pengenalan (No. Kad Pengenalan / Polis / Tentera) B3 No. Pasport B4 No. Cukai Pendapatan B5 No. Pendaftaran Syarikat B6 Nama Pekongsi II B7 No. Pengenalan (No. Kad Pengenalan / Polis / Tentera) B8 No. Pasport B9 No. Cukai Pendapatan B10 No. Pendaftaran Syarikat B11 Nama Pekongsi III B12 No. Pengenalan (No. Kad Pengenalan / Polis / Tentera) B13 No. Pasport B14 No. Cukai Pendapatan B15 No. Pendaftaran Syarikat CP 600PT

- 17. BAHAGIAN C MAKLUMAT PEGAWAI PEMATUHAN SILA KEMUKAKAN: Salinan surat pendaftaran Perkongsian Liabiliti Terhad daripada Suruhanjaya Syarikat Malaysia (SSM) 2 C1 Nama C2 No. Pengenalan (No. Kad Pengenalan / Polis / Tentera) C3 No. Pasport C4 No. Cukai Pendapatan C5 Alamat Poskod Bandar Negeri C6 No. Telefon C7 e-Mel BAHAGIAN D PENDAFTARAN FAIL MAJIKAN D1 Status Majikan* D2 Jumlah Pekerja D3 Bilangan Pekerja Terima Pendapatan Tahunan : (a) Kurang daripada RM 30,000 (b) Melebihi RM 30,000 BAHAGIAN E MAKLUMAT EJEN CUKAI E1 Nama Firma E2 No. Kelulusan Ejen Cukai / Lesen Audit E3 Alamat Firma Poskod Bandar Negeri E4 No. Telefon E5 e-Mel AKUAN PEGAWAI PEMATUHAN Saya No. Pengenalan / Pasport * Potong yang tidak berkenaan dengan ini mengakui bahawa maklumat yang diberikan di dalam borang ini adalah benar, betul dan lengkap. Tandatangan Tarikh Jawatan *Ruangan D1: Status Majikan Kerajaan Berkanun Swasta Pusat Pengajian Kerajaan Kerajaan Berkomputer Berkanun Berkomputer Swasta Berkomputer Pusat Pengajian Kerajaan Berkomputer Pusat Pengajian Swasta Pusat Pengajian Swasta Berkomputer Tentera UNTUK KEGUNAAN PEJABAT No. Rujukan Cukai PT No. Majikan E Kod Perniagaan Utama (Rujuk bahagian A5)

- 18. LEMBAGA HASIL DALAM NEGERI MALAYSIA Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 ANGGARAN CUKAI YANG KENA DIBAYAR OLEH SYARIKAT / PERKONGSIAN LIABILITI TERHAD / BADAN AMANAH / KOPERASI <>>>>>>? <>>>>>>? CP204 [Pin. 2014] <>>>>>>? <>>>>>>? <>>>>>>? <>>>>>>? <>>>>>>? <>>>>>>? <>>>>>>? Kepada: No. Rujukan (No. Pendaftaran): No. Cukai Pendapatan: Tarikh: Kembalikan kepada: LEMBAGA HASIL DALAM NEGERI MALAYSIA Jabatan Pemprosesan Makumat Menara Hasil No.3 Jalan 9/10, Seksyen 9 Karung Berkunci 206 43659 Bandar Baru Bangi, Selangor Telefon : 03-89133800 Faks : 03-89221801 Sila baca nota penerangan di muka belakang sebelum mengisi borang ini 1 Tahun Taksiran <2>0>? 2 Amaun Anggaran Cukai Yang Kena Dibayar RM <>_,>>_,>>_,>>_.>0?0 2.1 Anggaran ini adalah <? % daripada anggaran tahun sebelumnya. [rujuk perenggan (e) nota penerangan] 3 Tempoh Perakaunan 4 Tempoh Asas dari 2 0 Hari Bulan Tahun dari 2 0 Hari Bulan Tahun hingga 2 0 Hari Bulan Tahun hingga 2 0 Hari Bulan Tahun 5 Syarikat Baru: Nyatakan tarikh mula beroperasi Hari Bulan Tahun 5.1 Status SME syarikat yang layak sahaja [rujuk perenggan (c) nota penerangan] dari Tahun Taksiran <2>0>? hingga Tahun Taksiran <2>0>? 5.2 Nyatakan sama ada akaun disediakan bagi tempoh yang berakhir pada tarikh yang sama seperti syarikat-syarikat berkaitan dalam kumpulan yang sama Ya ! Tidak ! 6 Pengiraan Ansuran Bulanan: [rujuk perenggan (h) nota penerangan] Amaun Ansuran Bulanan 6.1 6.2 Ansuran Pertama hingga ke <? Ansuran Akhir RM <>_,>>_,>>_,>>_.>0?0 RM <>_,>>_,>>_,>>_.>0?0 7 Ruangan ini perlu diisi oleh syarikat baru atau jika terdapat perubahan disebabkan pertukaran tarikh penutupan akaun 7.1 Tempoh Asas Tahun Taksiran berikutnya 2 0 Hari Bulan Tahun hingga 2 0 Hari Bulan Tahun 7.2 Tempoh Asas Tahun Taksiran ke-2 berikutnya 2 0 Hari Bulan Tahun hingga 2 0 Hari Bulan Tahun 8 Alamat surat-menyurat sekarang: [jika berlainan dari di atas] Akuan Saya dengan ini mengaku bahawa butir-butir yang diberikan di atas adalah benar. Nama: Tandatangan: No. Pengenalan: Jawatan: [Pengarah / Setiausaha atau jawatan yang setaraf] No. Telefon: Tarikh: Untuk Kegunaan Pejabat <>>>>>>>>>>>>>>>?

- 19. NOTA PENERANGAN BORANG CP204 ANGGARAN CUKAI YANG KENA DIBAYAR OLEH SYARIKAT / PERKONGSIAN LIABILITI TERHAD / KOPERASI / BADAN AMANAH Contoh: a b c Amaun Anggaran (RM) 130,000 130,000 130,000 Bilangan ansuran dalam tempoh asas 12 10 15 Ansuran : Bilangan dan amaun (RM) 130,000 / 12 = 10,833.33 130,000 / 10 = 13,000.00 130,000 / 15 = 8,666.67 Pertama hingga ke 11 : 10,833 Pertama hingga ke 9 : 13,000 Pertama hingga ke 14: 8,666 Ke 12 : 10,837 Ke 10 : 13,000 Ke 15 : 8,676 (a) Borang CP204 Gunakan borang ini apabila membuat anggaran cukai yang kena dibayar. Isi ruangan dengan HURUF BESAR menggunakan pen dakwat hitam. (b) Tempoh Asas Penerangan terperinci mengenai tempoh asas boleh didapati di dalam Ketetapan Umum No.7/200 1[Tempoh Asas Bagi Pendapatan Perniagaan & Bukan Perniagaan(Syarikat)] (c) Syarikat baru di bawah kategori SME Syarikat baru beroperasi dibawah kategori SME di kecualikan dari mengemukakan anggaran cukai mengikut seksyen 107C(4A) ACP 1967 tidak perlu mengisi butiran 2 dan 6. (d) Tarikh borang CP204 perlu dikemukakan Kemukakan anggaran cukai tidak kurang daripada 30 hari sebelum bermulanya tempoh asas bagi sesuatu tahun taksiran. Bagi syarikat baru anggaran cukai perlu dikemukakan dalam tempoh 3 bulan selepas tarikh syarikat mula beroperasi. Jika anggaran cukai tidak diterima, arahan anggaran cukai akan dikeluarkan oleh Ketua Pengarah Hasil Dalam Negeri (Notis Bayaran Ansuran CP205). (e) Amaun anggaran cukai yang kena dibayar Amaun anggaran cukai yang kena dibayar hendaklah tidak kurang daripada anggaran cukai terkini iaitu sekurang-kurangnya 85% daripada anggaran cukai dipinda atau 85% daripada anggaran cukai jika tiada anggaran cukai dipinda bagi tahun taksiran sebelumnya. (f) Anggaran cukai terkurang Jika perbezaan antara cukai sebenar dengan anggaran cukai kena dibayar dipinda atau anggaran cukai jika tiada anggaran cukai dipinda dikemukakan melebihi 30% daripada cukai sebenar, maka cukai akan dinaikkan sejumlah 10% atas perbezaan yang melebihi 30% tanpa sebarang notis. Formula pengiraan cukai dinaikkan ialah: [(CS-AC) - (30% x CS)] x 10% di mana CS: cukai sebenar yang kena dibayar AC: anggaran cukai (g) Bila bayaran ansuran perlu dimulakan Bayaran ansuran perlu dibuat secara bulanan mulai bulan kedua dalam tempoh asas . Bagi syarikat baru, ansuran perlu dimulakan dalam bulan ke-6 selepas syarikat mula beroperasi. (h) Pengiraan amaun ansuran bulanan Amaun ansuran bulanan dikira dengan membahagikan anggaran cukai dengan bilangan bulan dalam tempoh asas. Jika terdapat angka sen apabila anggaran cukai dibahagi dengan bilangan bulan dalam tempoh asas, amaun sen hendaklah ditambah kepada ansuran terakhir. (i) Pindaan anggaran cukai kena dibayar Anggaran cukai boleh dipinda dalam bulan ke-6 atau bulan ke-9 atau kedua-duanya dalam tempoh asas dengan menggunakan borang CP204A (j) Slip pengiriman bayaran – Borang CP207 Gunakan slip pengiriman bayaran apabila membuat bayaran. Salinan fotostat borang CP207 boleh digunakan. Slip pengiriman bayaran penting supaya bayaran cukai dapat dikreditkan kepada cukai bagi tahun taksiran yang berkaitan. Borang CP207 boleh didapati di www.hasil.gov.my. (k) Tarikh bayaran ansuran bulanan perlu diterima Bayaran perlu diterima selewat- lewatnya pada 10 haribulan bulan ansuran berkenaan . Pembayaran boleh di buat di: Bank - Kaunter CIMB Bank, Public Bank, Maybank, Affin Bank, RHB Bank dan Bank Rakyat - Perbankan internet CIMB, PBB, Maybank, Hong Leong Bank, RHB Bank & perbankan internet Maybank - Auto Teller Machine (ATM) CIMB, PBB dan Maybank LHDNM - ByrHASIL m e l a l u i F P X ( F i n a n c i a l P r o c e s s E x c h a n g e ) di www.hasil.gov.my. - Kaunter Bayaran LHDNM atau melalui pos Cek, kiriman wang dan draf bank hendaklah dipalang dan dibayar kepada Ketua Pengarah Hasil Dalam Negeri. Pos Malaysia Berhad – Kaunter dan Pos Online Cukai akan dinaikkan sejumlah 10% atas amaun yang tidak dibayar dalam tempoh ditetapkan tanpa sebarang notis. (l) Pertukaran tarikh penutupan akaun Kemukakan Borang CP204B jika terdapat pertukaran tarikh penutupan akaun. Borang perlu diterima selewat - lewatnya seperti berikut: Tempoh perakaunan dipendekkan: Satu bulan sebelum tarikh permulaan tempoh perakaunan yang baru Tempoh perakaunan dipanjangkan: Satu bulan sebelum tarikh penutupan akaun yang asal.

- 20. LEMBAGA HASIL DALAM NEGERI MALAYSIA Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 CP204A [Pin. 2014] PINDAAN ANGGARAN CUKAI YANG KENA DIBAYAR OLEH SYARIKAT / PERKONGSIAN LIABILITI TERHAD / BADAN AMANAH / KOPERASI No. Rujukan (No. Pendaftaran): No. Cukai Pendapatan: Tarikh: Kembalikan kepada: LEMBAGA HASIL DALAM NEGERI MALAYSIA Jabatan Pemprosesan Makumat Menara Hasil No.3 Jalan 9/10, Seksyen 9 Karung Berkunci 206 43659 Bandar Baru Bangi, Selangor Telefon : 03-89133800 Faks : 03-89221801 Sila baca nota penerangan di muka belakang sebelum mengisi borang ini Akuan RM Saya dengan ini mengaku bahawa butir-butir yang diberikan di atas adalah benar. Nama: Tandatangan: No. Pengenalan: Jawatan: Amaun Ansuran Bulanan [Pengarah / Setiausaha atau jawatan yang setaraf] No. Telefon: Tarikh: Untuk Kegunaan Pejabat <>>>>>>>>>>>>>>>? Nama Syarikat / Perkongsian Liabiliti Terhad /Badan /Amanah / Koperasi <>>>>>>>>>>>>>>>>>>>>>>>? <>>>>>>>>>>>>>>>>>>>>>>>? Tahun Taksiran Tempoh Perakaunan Hingga Hari Bulan Tahun <>>>>>>? Hari Bulan Tahun <>>>>>>? Hingga Tempoh Asas Hari Bulan Tahun <>>>>>>? Hari Bulan Tahun <>>>>>>? Anggaran cukai kena dibayar yang dipinda <_>>_>>_>>_>? , , , . Tolak: Jumlah telah dibayar hingga kini <_>>_>>_>>_>? , , , . Pindaan Bulan ke -6 atau ke -9 ( tandakan √ dalam petak berkenaan ) <>>? Baki anggaran kena dibayar <_>>_>>_>>_>? , , , . Pengiraan Ansuran Bulanan : [ rujuk nota penerangan diperenggan ( C) ] Ansuran ke-5/ke8 ! ke-6/ke-9 ! hingga ke - !! <_>>_>>_>>_>? , , , . ( tandakan √ dalam petak berkenaan ) Ansuran akhir <_>>_>>_>>_>? , , , . Alamat surat-menyurat sekarang: [jika berlainan dari di atas] RM RM RM RM dari dari 1 2 3 4 5 6 6.1 6.2 7 0 0 0 0 0 0 0 0 0 0 2 0 2 0 2 0 2 0 2 0

- 21. NOTA PENERANGAN BORANG CP204A PINDAAN ANGGARAN CUKAI YANG KENA DIBAYAR OLEH SYARIKAT / PERKONGSIAN LIABILITI TERHAD / BADAN AMANAH / KOPERASI (a) Borang CP204A Gunakan borang ini apabila membuat pindaan anggaran cukai yang kena dibayar. Isi ruangan dengan HURUF BESAR menggunakan pen dakwat hitam. (b) Bila pindaan kepada anggaran boleh dibuat Anggaran cukai bagi sesuatu tahun taksiran hanya boleh dipinda dalam bulan ke-6 atau ke-9 atau kedua-duanya dalam tempoh asas. Jika anggaran cukai yang dipinda melebihi ansuran yang telah dibayar, baki cukai mestilah dibayar secara ansuran mengikut baki tempoh bayaran yang ada. (c) Pengiraan amaun ansuran yang dipinda Kira amaun ansuran yang baru dan teruskan bayaran ansuran mengikut cadangan pindaan. Amaun ansuran bulanan yang dipinda dikira dengan membahagikan baki anggaran cukai yang belum dibayar dengan baki tempoh bayaran. Amaun sen (jika ada) hendaklah ditambah kepada ansuran terakhir. Jika anggaran cukai yang dipinda kurang daripada jumlah yang telah dibayar, syarikat bolehlah memberhentikan bayaran ansuran seterusnya. Contoh: Borang Pindaan dikeluarkan di antara 1hb -10hb Jun dan bayaran telah dibuat sehingga bulan Mei Borang Pindaan dikeluarkan selepas 10hb Jun dan bayaran telah dibuat sehingga bulan Jun Anggaran cukai dipinda (RM) Februari - Mei (RM 10,833 x 4) RM 150,000.00 RM 150,000.00 Tolak: Ansuran telah dibayar RM 43,332.00 Februari - Jun (RM 10,833 x 5) RM 54,165.00 Baki ansuran RM 106,668.00 RM 95,835.00 Ansuran bulanan dipinda (RM 106,668) ÷ 8 (RM 95,835) ÷ 7 RM 13,333.50 RM 13,690.71 Jun (ke-5) - Disember (ke-11) RM 13,333.00 Julai (ke-6) - Disember (ke-11) RM 13,690.00 Januari (Ansuran akhir) RM 13,337.00 Januari (Ansuran akhir) RM 13,695.00 (d) Anggaran terkurang Jika perbezaan antara cukai sebenar dengan anggaran cukai kena dibayar dipinda atau anggaran cukai jika tiada anggaran cukai dipinda dikemukakan melebihi 30% dari cukai sebenar, maka cukai akan dinaikkan sejumlah 10% atas perbezaan yang melebihi 30% tanpa sebarang notis. Formula pengiraan cukai dinaikkan ialah: [(CS-AC) - (30% x CS)] x 10% di mana CS: cukai sebenar yang kena dibayar AC: anggaran cukai (e) Slip pengiriman bayaran - CP207 Gunakan slip pengiriman bayaran apabila membuat bayaran. Salinan fotostat borang CP 207 boleh digunakan. Slip pengiriman bayaran penting supaya bayaran cukai dapat dikreditkan kepada cukai bagi tahun taksiran yang berkaitan. Borang CP207 boleh didapati di www.hasil.gov.my. (f) Tarikh bayaran ansuran bulanan perlu diterima Bayaran perlu diterima selewat- lewatnya pada 10 haribulan bulan ansuran berkenaan . Pembayaran boleh di buat di: Bank - Kaunter CIMB Bank, Public Bank, Maybank, Affin Bank, RHB Bank dan Bank Rakyat - Perbankan internet CIMB, PBB, Maybank, Hong Leong Bank, RHB Bank & perbankan internet Maybank - Auto Teller Machine (ATM) CIMB, PBB dan Maybank LHDNM - ByrHASIL m e l a l u i F P X ( F i n a n c i a l P r o c e s s E x c h a n g e ) di www.hasil.gov.my. - Kaunter Bayaran LHDNM atau melalui pos: Cek, kiriman wang dan draf bank hendaklah dipalang dan dibayar kepada Ketua Pengarah Hasil Dalam Negeri. Pos Malaysia Berhad – Kaunter dan Pos Online Cukai akan dinaikkan sejumlah 10% atas amaun yang tidak dibayar dalam tempoh ditetapkan tanpa sebarang notis. (g) Pertukaran tarikh penutupan akaun Kemukakan Borang CP204B jika terdapat pertukaran tarikh penutupan akaun. Borang perlu diterima selewat-lewatnya seperti berikut: Tempoh perakaunan dipendekkan: Satu bulan sebelum tarikh permulaan tempoh perakaunan yang baru Tempoh perakaunan dipanjangkan: Satu bulan sebelum tarikh penutupan akaun yang asal. ANGAN BORANG CP204B PEMBERITAHUAN PERTUKARAN TARIKH PENUTUPAN AKAUN OLEH SYARIKAT / PERKONGSIAN LIABILITI TERHAD / BADAN AMANAH /

- 22. RETURN FORM OF A LIMITED LIABILITY PARTNERSHIP UNTDER SECTION 77A OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 PT 2014 USE BLACK INK PEN & DO NOT FOLD FORM PT 2014 For Enquiries:- LHDNM Branch Tol Free Line : 1-800-88-5436 (LHDN) Calls From Overseas : 603-77136666 Official Portal : http://www.hasil.gov.my Form YEAR OF ASSESSMENT CP3PT - Pin. 2014 Lembaga Hasil Dalam Negeri Malaysia Reference No. (Registration No.) : Income Tax No. : Date : FOR OFFICE USE Date received (1) Date received (2)

- 23. RETURN FORM OF A LIMITED LIABILITY PARTNERSHIP UNDER SECTION 77A OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 PT BASIC PARTICULARS 1 Name of Limited Liability Partnership 2 Income Tax No. PT 3 Reference No. (Registration No.) 4 Accounting Period From (dd/mm/yyyy) To (dd/mm/yyyy) 5 Basis Period From (dd/mm/yyyy) To (dd/mm/yyyy) 6 Country of Residence (use Country Code) 7 Employer No. E 8 Limited Liability Partnership with capital contribution of RM2.5 million and below at the beginning of the basis period 1 = Yes 2 = No PART A : PARTICULARS OF PARTNERS A1 Name of Partner’s : A2 Partner’s Identification / Passport / Registration No. : A1a Partner I A2a Partner I A1b Partner II A2b Partner II A1c Partner III A2c Partner III PART B: STATUTORY INCOME, TOTAL INCOME , CHARGEABLE INCOME & TAX PAYABLE RM Sen B1 Aggregate Statutory Income from Business B1 .00 B2 Less : Business losses brought forward ( restricted to B1 ) B2 .00 B3 TOTAL ( B1 – B2 ) B3 .00 Other statutory income: B4 Interest and discounts B4 .00 B5 Rents, royalties and premiums B5 .00 B6 Other income B6 .00 B7 AGGEGATE INCOME ( B3 to B6 ) B7 .00 B8 Less : Current year business losses ( restricted to B7 ) B8 .00 B9 Approved donations / gifts / contributions B9 .00 B10 Zakat perniagaan ( restricted to 2.5% aggregate income in B7 ) B10 .00 B11 TOTAL INCOME [ B7 – ( B8 to B10 ) ] ( enter ‘0’ if value is negative ) B11 .00 B12 Statutory income from dividends B12 .00 B13 CHARGEABLE INCOME ( B11 + B12 ) B13 .00 B14 Division of Chargeable Income Rate (%) Income Tax B14a .00 20 B14a . B14b .00 25 B14b . B14c .00 B14c . B14d .00 B14d . B14e .00 B14e . B15 TOTAL INCOME TAX CHARGED ( B14a to B14e ) B15 . B16 Less: Section 51 Income Tax Act 2007 (dividends) . Section 110(others) . Section 132 and 133 . B16 . B17 TAX PAYABLE ( B15 - B16 ) B17 . B18 Or TAX REPAYABLE ( B16 – B15 ) B18 . B19 Installment payments made B19 . B20 Balance of tax payable ( B17 – B19 ) / Tax paid in excess ( B19 - B17 ) B20 . (Enter ‘ X ’ if tax paid in excess) DECLARATION BY COMPLIANCE OFFICER I Identification / passport no. (Delete whichever is not relevant) hereby declare that the information given in this return form is true, complete and correct pertaining to the income tax of the limited liability partnership as required under the Income Tax Act 1967 Date Signature Form YEAR OF ASSESSMENT Lembaga Hasil Dalam Negeri Malaysia CP3PT – Pin.2014 1

- 24. PART C: FINANCIAL PARTICULARS OF LIMITED LIABILITY PARTNERSHIP [ MAIN BUSINESS ONLY ] C1 Name of Business C2 Business Code Fixed Assets : C3 Sales / Turnover . 00 C30 Motor Vehicles . 00 LESS : C31 Plant and Machinery . 00 C4 Opening Stock . 00 C32 Land and Buildings . 00 C5 Purchases . 00 C33 Other Fixed Assets . 00 C6 Cost of Production . 00 C34 TOTAL OF FIXED ASSETS . 00 C7 Closing Stock . 00 C35 Total cost of fixed assets acquired in the basis period . 00 C8 Cost of Sales . 00 C36 Investments . 00 C9 GROSS PROFIT / LOSS ( C3 – C8 ) . 00 Current Assets : ( Enter ‘X’ if negative ) C37 Trade Debtors . 00 C10 Foreign Currency Exchange Gain . 00 C38 Other Debtors . 00 C11 Other Business Income . 00 C39 Stock . 00 C12 Other Income . 00 C40 Loans to Partners . 00 C13 Non-taxable Profits . 00 C41 Cash in hand and cash at bank . 00 EXPENDITURE ( Enter ‘X’ if negative ) C14 Interest . 00 C42 Other Current Assets . 00 C15 Professional, technical, management and legal fees . 00 C43 TOTAL CURRENT ASSETS . 00 C16 Technical fee payments to non-resident recipients . 00 C44 TOTAL ASSETS ( C34 + C36 + C43 ) . 00 C17 Contract Payments . 00 LIABILITIES AND PARTNERSHIP CAPITAL C18 Non-partner’s Salaries and wages . 00 Current Liabilities : C18a Partners’ Salaries and wages . 00 C45 Loans and Overdrafts . 00 C19 Royalties . 00 C46 Trade Creditors . 00 C20 Rental / Lease . 00 C47 Other Creditors . 00 C21 Maintenance and repairs . 00 C48 Loans from Partners . 00 C22 Research and development . 00 C49 Other Current Liabilities . 00 C23 Promotion and advertising . 00 C50 TOTAL CURRENT LIABILITIES . 00 C24 Travelling and accommodation . 00 C51 Long-term Liabilities . 00 C25 Foreign Currency Exchange Loss . 00 C52 TOTAL LIABILITIES . 00 C26 Other Expenditure . 00 Partners’ Capital: C27 TOTAL EXPENDITURE . 00 C53 Capital Contributions . 00 C28 NET PROFIT / LOSS . 00 C54 Profit / Loss Appropriation Account . 00 ( Enter ‘X’ if negative ) ( Enter ‘X’ if negative ) C29 Non-allowable Expenses . 00 C55 Reserve Account . 00 C56 Total Capital . 00 ( Enter ‘X’ if negative ) C57 TOTAL LIABILITIES AND CAPITAL . 00 ( Enter ‘X’ if negative ) 2 Name : ……………………………………………………………………………………… ………………………………………………………………………………………………... ………..……………………………. Income Tax No. : PT………………………………………………………

- 25. Name : ……………………………………………………………….. …………………………………………………………………………. PART D: PARTICULARS OF WITHHOLDINGS TAXES Section Gross Amount Paid Income Tax No. : PT ……………………………... Total Tax Withheld and Remitted to LHDNM Total Net Amount Paid D1 107A . . . D2 109 . . . D3 109A . . . D4 109B . . . D5 109F . . . PART E: OTHER PARTICULARS E1 Telephone No. E2 Website Address (if any) E3 Name of Bank E4 Bank Account No. Note : Enter the name of the bank and bank account no. for the purpose of electronic income tax refund E5 Disposal of assets under the Real Property Gains Tax Act 1976? 1 = Yes 2 = No E6 Has the disposal been declared to LHDNM? ( If E5=1) 1 = Yes 2 = No PART F : PARTICULARS OF COMPLIANCE OFFICER F1 Name F2 Identification No. F3 Passport No. F4 Income Tax No. F5 Correspondence Address Postcode City State F6 Telephone No. F7 e – Mail PART G : PARTICULARS OF THE FIRM AND SIGNATURE OF THE PERSON WHO COMPLETE THIS RETURN FORM G1 Name of Firm G2 Telephone No. G5 Signature G3 Tax Agent’s Approval No. G4 e-Mail IMPORTANT REMINDER Complete all relevant items in BLOCK LETTERS and use black ink pen Due date to furnish the form and pay the balance of tax payable : 7 months from the closing date of accounts METHOD OF PAYMENT 1. Payment can be made as follows: 1.1 Bank - Information regarding payment via bank is available at the LHDNM official portal, http://www.hasil.gov.my 1.2 LHDNM - ByrHASiL through FPX (Financial Process Exchange) at the LHDNM official portal, http://www.hasil.gov.my - Payment counters of LHDNM in Peninsular Malaysia (LHDNM Payment Center in Kuala Lumpur), Sabah and FT Labuan (LHDNM Payment Center in Kota Kinabalu) and Sarawak (LHDNM Payment Center in Kuching) or by mail: Cheques, money orders and bank drafts must be crossed and made payable to the Director General of Inland Revenue. Use the Remittance Slip (CP207) which is available at the LHDNM official portal, http://www.hasil.gov.my when making payment. 1.3 Pos Malaysia Berhad - Counter and Pos Online 2. Write down the name, address, telephone number, income tax number, year of assessment and payment code on the reverse side of the financial instrument. 3. Check the receipts / bank payment slips before leaving the payment counter. In accordance with section 89 of the Income Tax Act 1967, a change of address must be furnished to LHDNM within 3 months of the change. Notification can be made via e-Kemaskini or by using Form CP600B (Notification of Change of Address) which can be obtained from the LHDNM official portal, http://hasil .gov.my 3