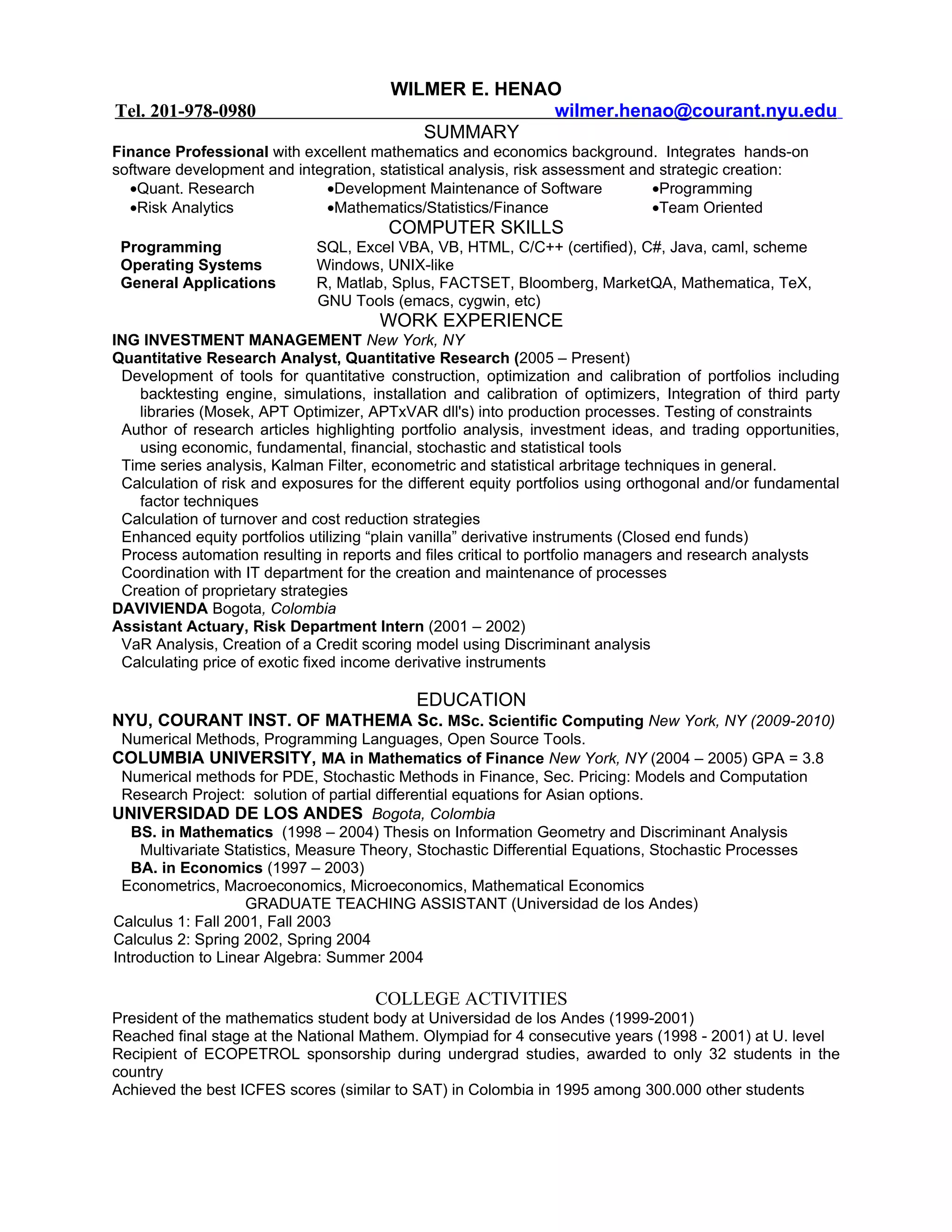

This document provides a summary of Wilmer E. Henao's background and qualifications. It outlines his extensive experience in quantitative research and software development for finance and risk management. It also details his education including a MSc in Scientific Computing from NYU and a MA in Mathematics of Finance from Columbia University. His skills include programming, statistical analysis, and working with financial software packages.