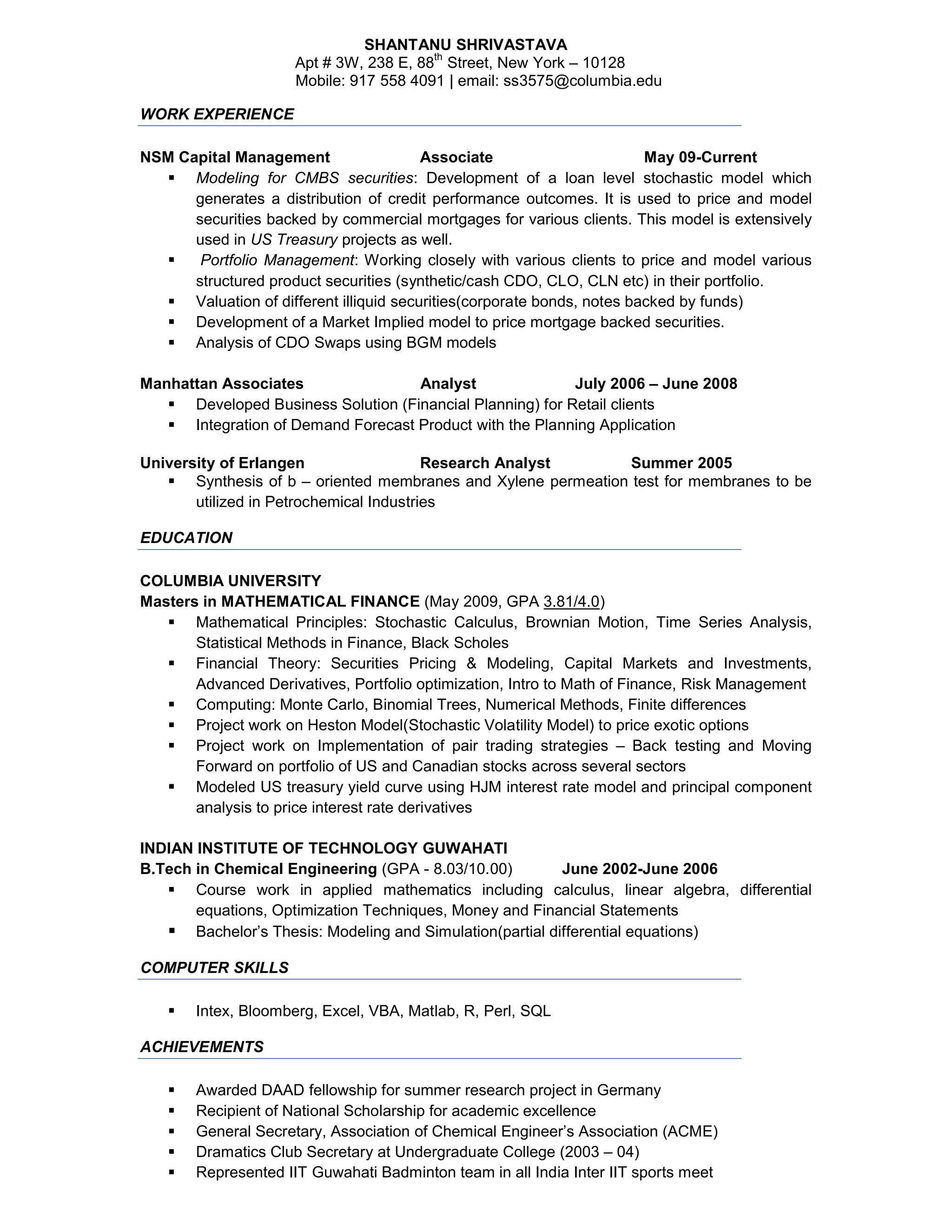

This document contains a resume for Shantanu Shrivastava. It summarizes his work experience in financial modeling and analysis at NSM Capital Management and Manhattan Associates. It also lists his education including a Master's degree in Mathematical Finance from Columbia University and a Bachelor's degree in Chemical Engineering from Indian Institute of Technology Guwahati. His skills include financial modeling, quantitative analysis, and programming languages.