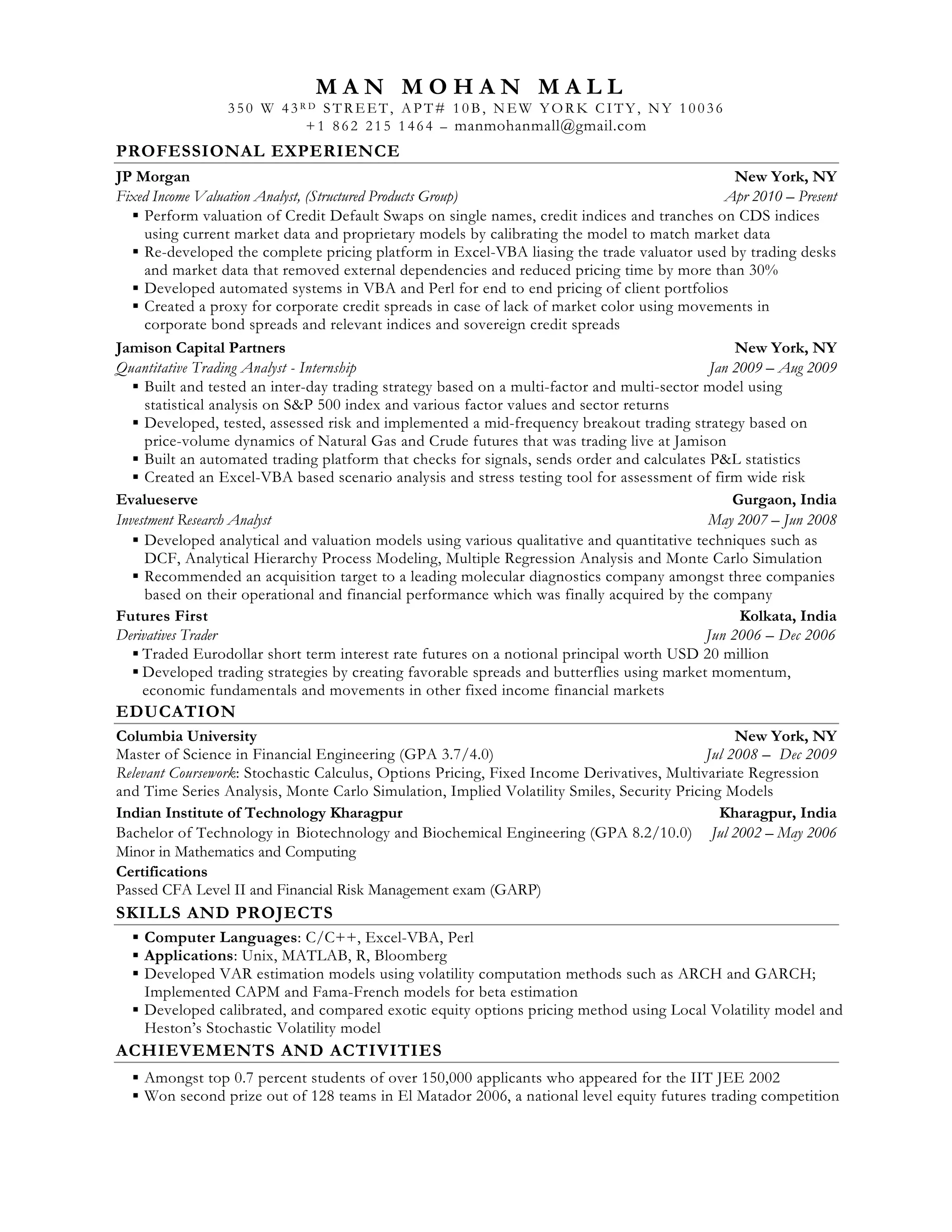

Man Mohan Mall has over 10 years of experience in quantitative finance roles including fixed income valuation, quantitative trading, and investment research. He currently works as a Fixed Income Valuation Analyst at JP Morgan where he values credit default swaps and developed automated pricing systems. Previously he developed trading strategies at Jamison Capital Partners and valuation models during his time at Evalueserve and Futures First in India. Mall holds a Master's in Financial Engineering from Columbia University and Bachelor's in Biotechnology from IIT Kharagpur.