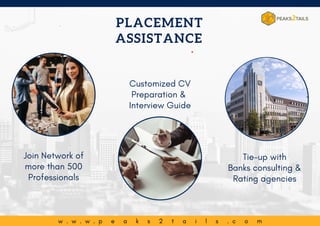

Peak2tails LLP is a risk training and consulting firm founded in 2019 that specializes in simplifying complex quantitative concepts through intuitive spreadsheet models. It offers risk training programs and risk consulting services focused on credit risk and market risk. The firm's training courses have successfully trained over 1,000 professionals. Peak2tails LLP excels at translating intricate financial theories into practical models that are easy for clients to understand and use to make informed decisions and effectively manage risks.