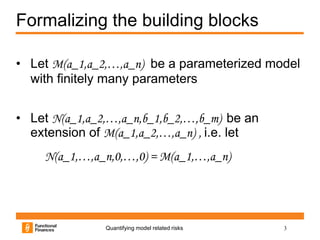

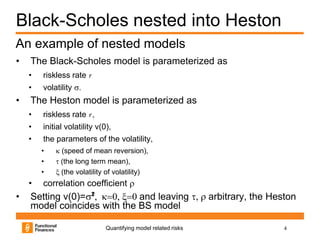

The document discusses a nested-model framework for quantifying model-related risks, focusing on various aspects such as model specification and assumption risks. It provides an example of the Black-Scholes model nested within the Heston model and describes the statistical methods for testing model validity and assumptions. The framework has advantages like flexibility and economic interpretability, but also presents drawbacks such as increasing complexity in theoretical research.