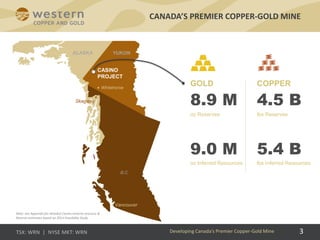

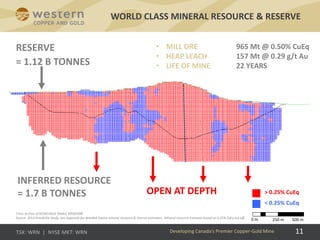

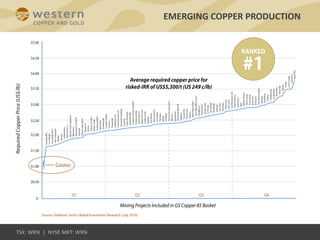

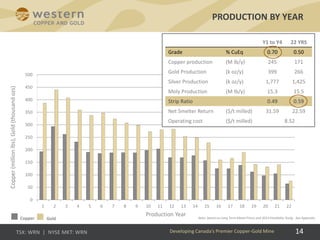

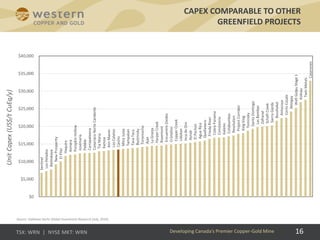

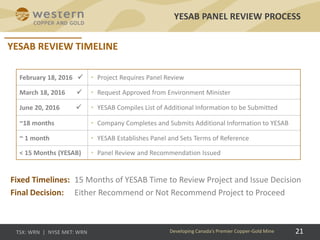

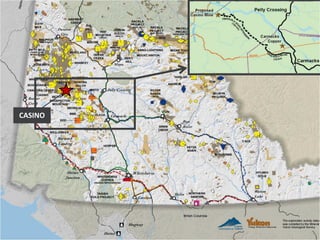

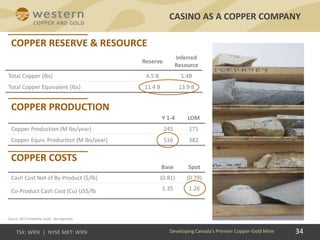

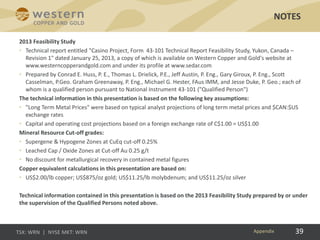

Western Copper and Gold Corporation is developing the Casino Project in Yukon, Canada into Canada's premier copper-gold mine. The Casino Project hosts over 4.5 billion pounds of copper reserves and 8.9 million ounces of gold reserves based on a 2013 feasibility study. The project is expected to have an after-tax internal rate of return of over 19% at current metal prices and payback within 3 years. Western Copper has made significant progress in permitting and engineering to advance the Casino Project towards production in the next 5-7 years.