Wells Econ Update 10 09

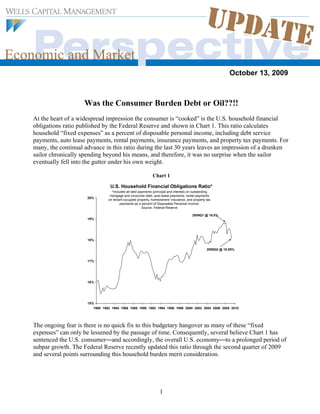

- 1. October 13, 2009 Was the Consumer Burden Debt or Oil??!! At the heart of a widespread impression the consumer is “cooked” is the U.S. household financial obligations ratio published by the Federal Reserve and shown in Chart 1. This ratio calculates household “fixed expenses” as a percent of disposable personal income, including debt service payments, auto lease payments, rental payments, insurance payments, and property tax payments. For many, the continual advance in this ratio during the last 30 years leaves an impression of a drunken sailor chronically spending beyond his means, and therefore, it was no surprise when the sailor eventually fell into the gutter under his own weight. Chart 1 U.S. Household Financial Obligations Ratio* *Includes all debt payments (principal and interest) on outstanding mortgage and consumer debt, auto lease payments, rental payments 20% on tenant-occupied property, homeowners' insurance, and property tax payments as a percent of Disposable Personal Income. Source: Federal Reserve 2008Q1 @ 18.8% 19% 18% 2009Q2 @ 18.05% 17% 16% 15% 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 The ongoing fear is there is no quick fix to this budgetary hangover as many of these “fixed expenses” can only be lessened by the passage of time. Consequently, several believe Chart 1 has sentenced the U.S. consumer—and accordingly, the overall U.S. economy—to a prolonged period of subpar growth. The Federal Reserve recently updated this ratio through the second quarter of 2009 and several points surrounding this household burden merit consideration. 1

- 2. Examining the Financial Obligations Ratio?!?? As illustrated in Chart 1, the financial obligations ratio has improved surprisingly fast since it peaked in the first quarter of 2008. Already, the burden has dropped from 18.8 percent to about 18 percent due to a combination of write downs of bad debt, some runoff of debt not replaced, and lowered payments through refinancing. In any event, from its peak, the ratio has already declined by more in the last five quarters than it rose between the end of 2001 and the beginning of 2008! Lest you think a 0.75 percent drop in the obligations ratio is not much to consider since the mid-1980s this ratio has rarely been outside the range of 17 percent to 19 percent. At about 18 percent, it has already retraced almost 50 percent (about 1 percent of a 2 percent range) of its historic range during the last 25 years, it is little different than it was in 1987 and less than it was in 2001. We also note the financial obligations ratio has changed little in the last decade. Although it rose some between 2006 and 2007, does the rise in recent years really explain the complete collapse of consumer spending and the economy in 2008? Or, could other factors be equally responsible? In particular, was the 2008 economic collapse primarily the result of a rising household financial obligations ratio or was it due to a surge in household energy costs? 2008 Crisis ….. A Debt Crisis or an Energy Crisis???! We fail to understand why energy cost (also an essential and largely “fixed expense” for most households) is not included in the household obligations ratio (particularly since the obligations ratio seems to include almost every other “necessary” household expense). Chart 2 illustrates the U.S. household energy obligations ratio (i.e., household spending on energy goods and services as a percent of disposable personal income). In the last 30 years, as a proportion of overall disposable personal income, the oscillation in the energy burden has actually been larger than changes in the financial obligations burden. Since 1980, the energy burden has fluctuated by about five percentage points (between about 3.5 percent and 8.5 percent), whereas the obligations ratio has swung by only about 3.5 percent (from 15.5 percent to about 19 percent). Therefore, changes in the energy burden are at least as important as changes in the financial obligations ratio in determining household behaviors. Indeed, is the household recession of 2008 better explained by an approximate 1 percent increase in the financial obligations ratio during the recovery or by the almost 3 percent surge in the household energy burden over the same period? 2

- 3. Chart 2 U.S. Household ENERGY Obligations Ratio** **Total Household Expenditures on Energy Goods and Services as a percent of Disposable Personal Income. 8.5% 8.0% 7.5% 7.0% 2008Q3 @ 6.3% 6.5% 6.0% 5.5% 5.0% 4.5% 4.0% 2009Q2 @ 4.4% 3.5% 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 Is the U.S. Consumer Rational or Simply Foolish???? A widespread and common perception is the U.S. consumer has simply been irresponsible! For the last 30 years, U.S. households have continuously spent beyond their means, destroying savings and leading to an ever-rising debt burden. For many, the secular rise in the financial obligations ratio shown in Chart 1 reflects years of consumer imprudence, which has now sentenced the U.S. consumer to a prolonged period of slower “new-normal” growth. However, a very different interpretation emerges when Chart 2 is considered in conjunction with Chart 1. The chronic rise in the financial obligations ratio may simply reflect a rational augmentation of debt in substitution for energy budget savings (i.e., a persistent decline in the household energy obligations ratio). The consumer, rather than illustrating ignorance about long-run financial health, simply took rational advantage of energy savings to raise commitments elsewhere. For example, between 1980 and 2004, even though the financial obligations ratio rose by about 2 percent, the energy obligations ratio declined during the same period by almost 4 percent! The fact the consumer chronically took on more debt and persistently increased their financial obligations ratio during this period was not evidence of foolishness. Rather, considering the energy obligations burden declined faster than the financial obligations ratio rose, this period actually illustrated an era of household conservatism! The “TOTAL” Household Burden!?!? Chart 3 combines the financial obligations ratio with the energy obligations ratio to illustrate the U.S. household “total” obligations ratio. Despite a persistent rise in the financial obligations ratio (Chart 1), the total household obligations ratio persistently declined between 1980 and 2000 and remained very modest until 2006. Compared to the financial obligations ratio, we believe the “total” household obligations ratio better explains why U.S. consumption has remained stronger than most thought 3

- 4. possible during much of the last couple decades, why the consumer did not recess during the 2001 recession (even though the financial obligations ratio was very high by historic standards) and why the U.S. consumer finally capitulated in 2008 once the “total” obligations ratio surged above its record 1980 levels. Chart 1 suggests the U.S. consumer went on a spending spree for almost 30 years even though its “fixed expenses” burden was chronically rising to record highs. By contrast, Chart 3 shows a steady decline in the total household burden (including energy costs) is probably what sustained the prolonged U.S. household spending spree. Chart 1 leaves a conundrum as to why the record high financial obligations ratio in 2000 did not produce a consumer recession. Chart 3 shows the consumer did not shut down in 2000 because the “total” obligations ratio was near a record low! Finally, Chart 1 does not show a rise in the obligations ratio commensurate with the severity of the 2008 calamity, whereas Chart 3 clearly shows a surge in the household “total” obligations ratio prior to the recessionary collapse. Chart 3 U.S. TOTAL Household Financial Obligations Ratio Adjusted for Energy Outlays*** ***Includes all debt payments (principal and interest) on outstanding mortgage and consumer debt, auto lease payments, rental payments on tenant-occupied 25.0% property, homeowners' insurance and property tax payments, AND Total Household Expenditures on Energy Goods and Services. All these outlays shown as a percent of Disposable Personal Income. 24.5% 2008Q1 @ 24.9% 24.0% 23.5% 23.0% 22.5% 22.0% 2009Q2 @ 22.5% 21.5% 21.0% 20.5% 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 Hope for the U.S. Consumer???! The household financial obligations ratio illustrated in Chart 1 does not give much hope for a quick revival in U.S. consumption spending. Although the obligations ratio has declined some from its peak in 2008, its decline thus far is only modest (less than 1 percent). Moreover, debt burdens can only improve slowly over time as new debt is postponed, or existing debt is either written off or refinanced. Consequently, this chart supports the widely held contention that U.S. consumer spending will likely remain anemic for several years. However, the “total” household obligations ratio (Chart 3) has already experienced substantial improvement. This ratio has declined by 2.5 percent from its high in early 2008 and is as low today as it was in 2000! Moreover, the total obligations ratio is currently below its average since 1980. The swift and significant drop in the U.S. household “total” obligations ratio since the first quarter of 2008 suggests a quicker and more substantial consumer revival than most now anticipate. 4

- 5. Summary …… Perhaps the U.S. Consumer will Surprise?!?! A widespread perception the U.S. consumer is buried under a mountainous debt burden has given rise to a strongly held consensus view that household spending and the overall U.S. economy is sentenced to a prolonged period of subpar “new-normal” growth. However, as this note suggests, perhaps surging energy costs during 2007-08 rather than oppressive debt burdens is what ultimately pushed the consumer into recession. If this is the case, then a near-term revival in job creation combined with a significant 2.5 percent decline in the “total” U.S. household obligations ratio may produce a consumer recovery next year that proves swifter and stronger than most now anticipate!?! Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. This material has been distributed for educational/informational purposes only, and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product. The material is based upon information we consider reliable, but its accuracy and completeness cannot be guaranteed. Past performance is not a guarantee of future returns. As with any investment vehicle, there is a potential for profit as well as the possibility of loss. For additional information on Wells Capital Management and its advisory services, please view our web site at www.wellscap.com, or refer to our Form ADV Part II, which is available upon request by calling 415.396.8000. 5