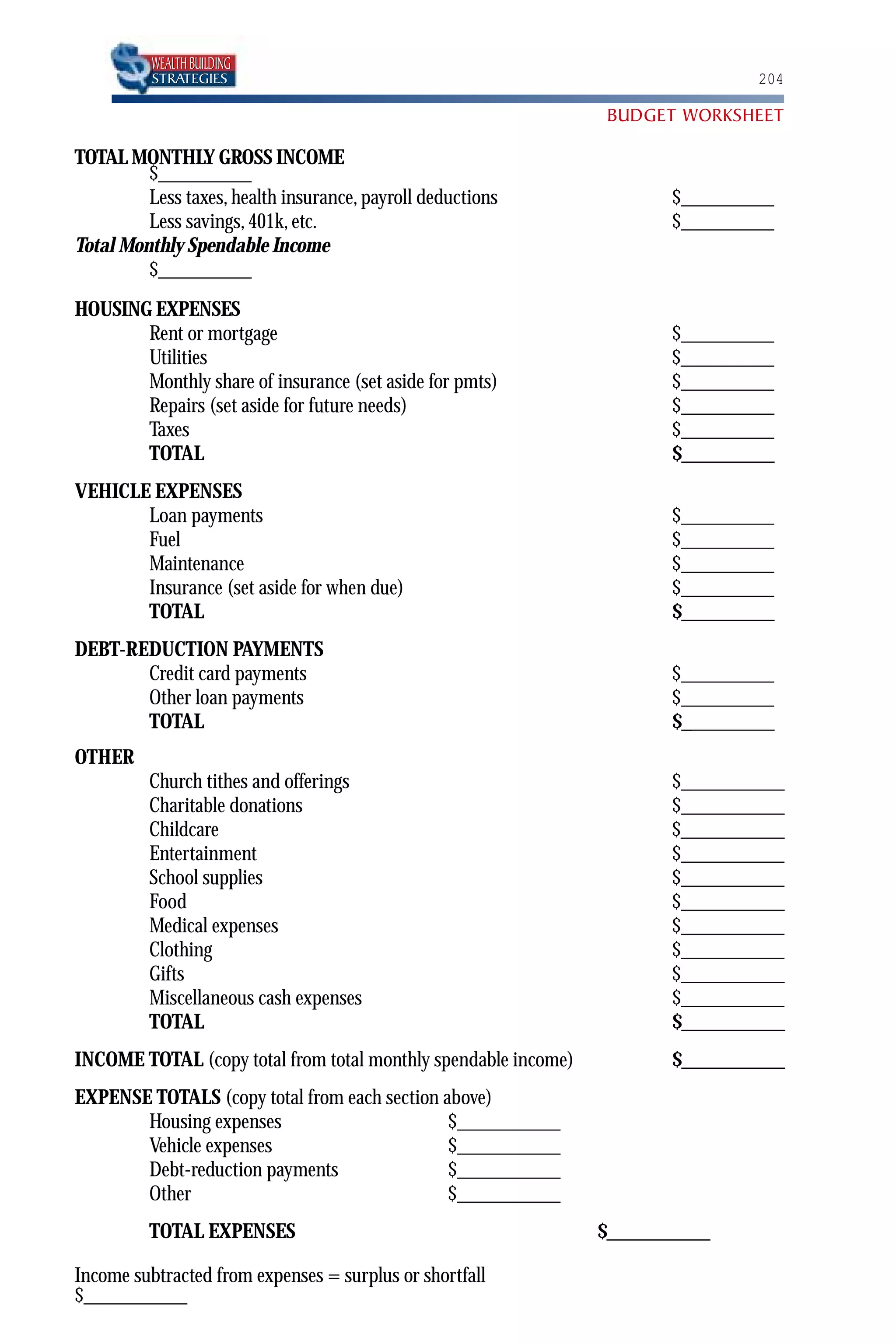

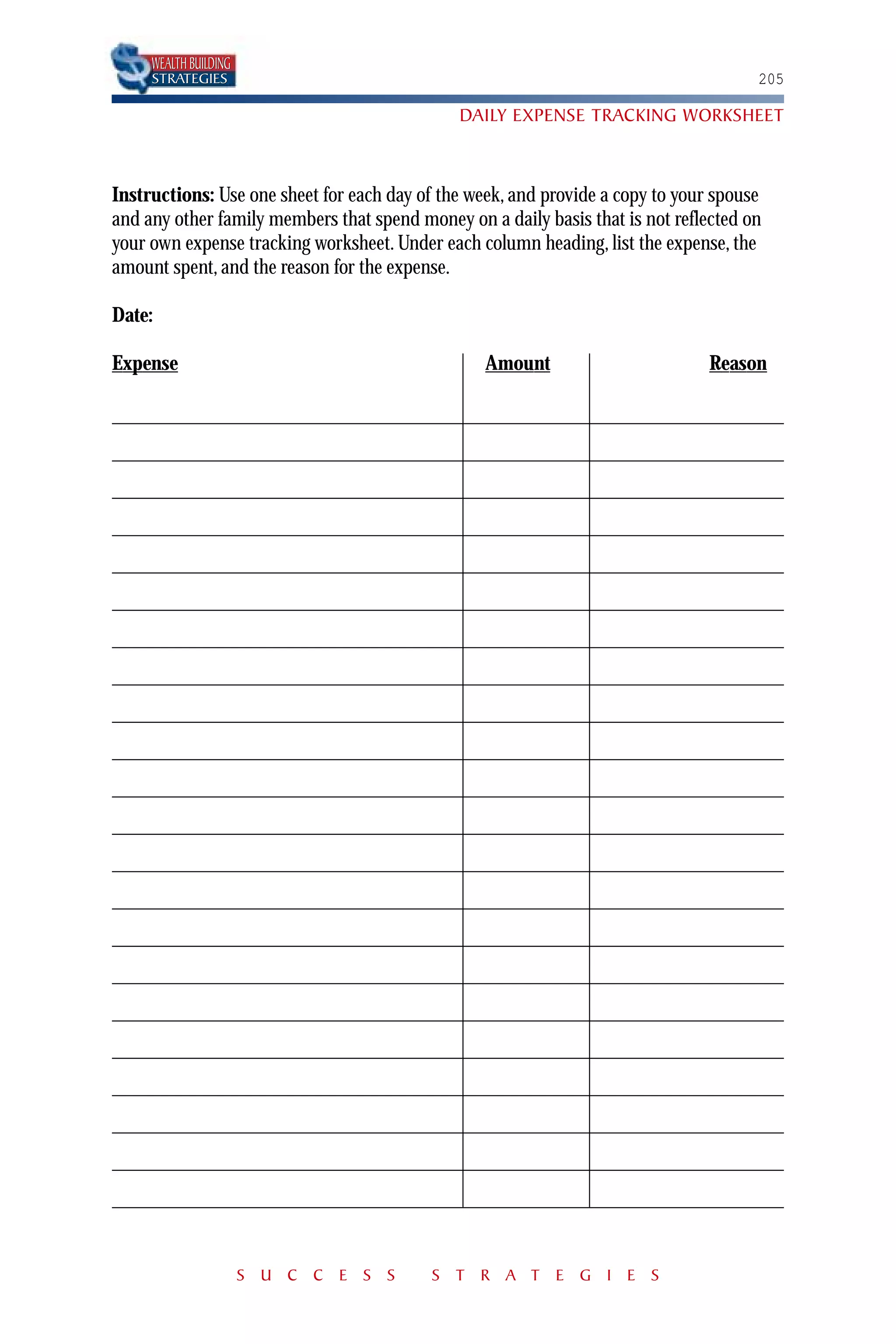

The document discusses the importance of setting financial goals, as goals provide a roadmap for building wealth over time. It notes that anyone can save money and invest, regardless of income, to work towards goals like financial security and retirement. Regular, disciplined savings and wise investments of even small amounts can significantly grow wealth over the long run.