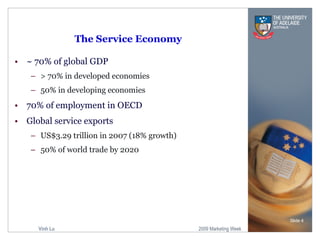

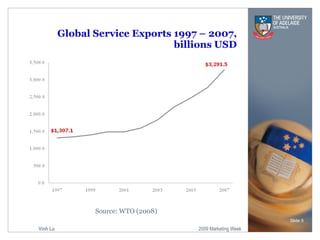

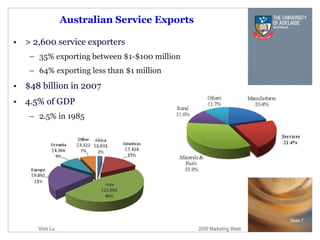

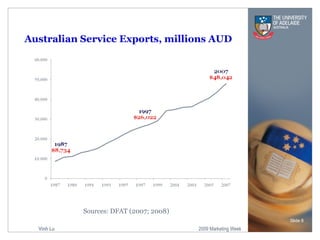

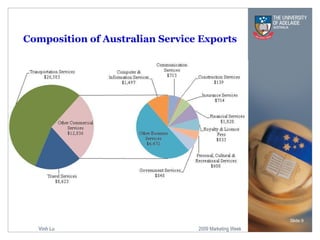

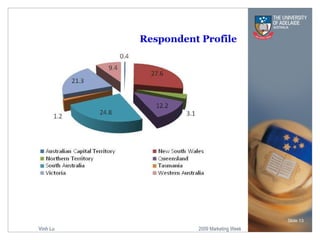

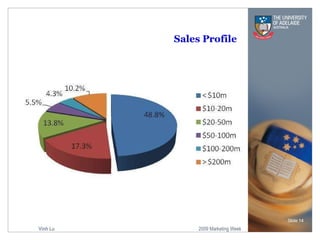

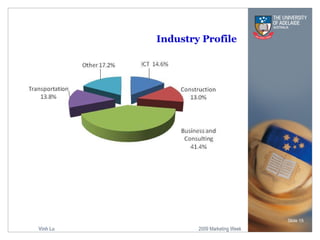

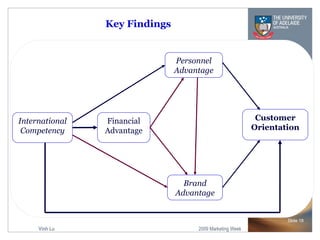

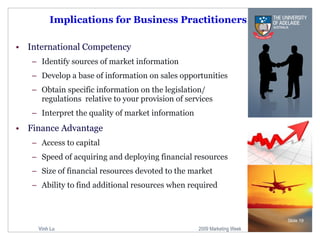

This document summarizes research on lessons that can be learned from Australian service exporters in satisfying international customer needs. The research involved interviews and surveys of Australian service exporters. The key findings were that international competency, personnel advantages, strong brands, financial advantages, and strong customer orientation help service exporters better satisfy customer needs overseas. The implications discussed were how businesses can develop these capabilities and ways that policymakers can provide export assistance to support emerging service exporters.

![Thank you! [email_address] Slide](https://image.slidesharecdn.com/warroom-090922001714-phpapp02/85/War-Room-25-320.jpg)