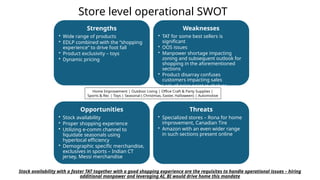

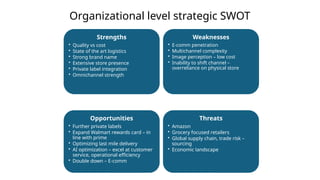

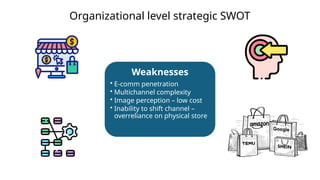

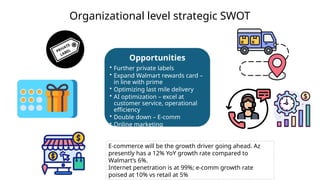

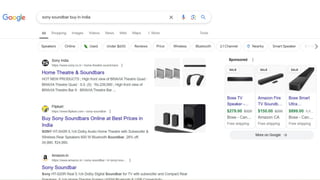

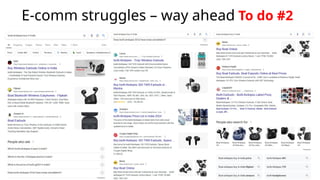

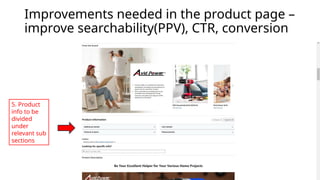

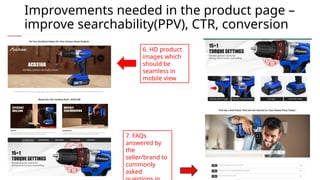

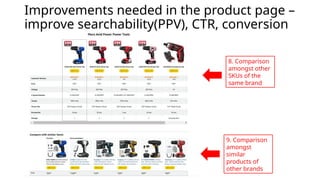

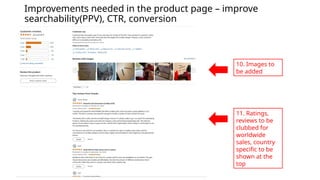

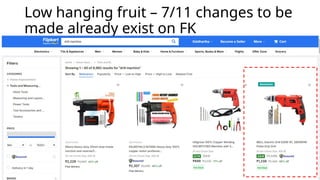

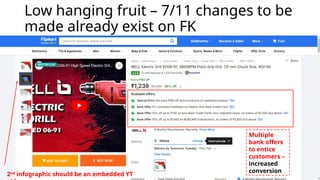

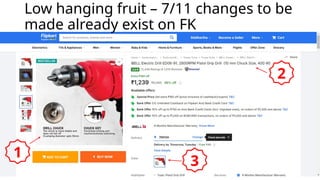

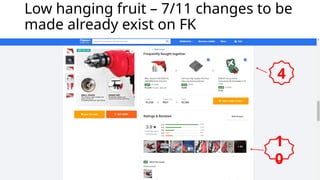

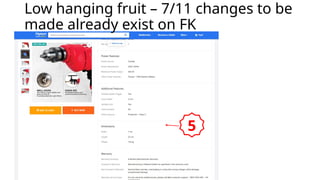

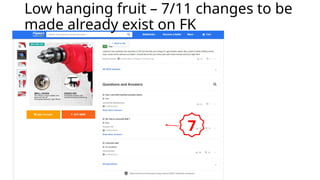

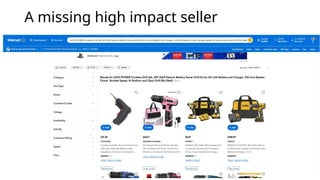

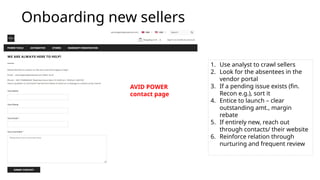

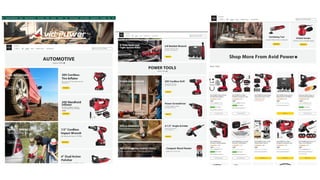

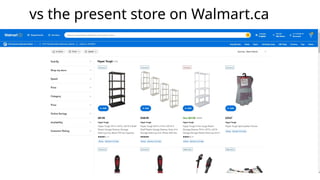

During my 2nd round interview with Walmart Canada for a KAM role, I developed this slide presenting upgradation for Walmart.ca website vis a vis Flipkart, a comparative analysis of walmart.ca with its biggest rival and a strategic breakdown of my plans for the future