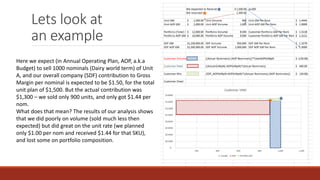

The document describes a Volume Revenue Mix (VRM) model implemented at Saputo Inc. to understand deviations from budgets and analyze the impact of volume, rate, and mix changes. VRM breaks down financial performance by looking at whether variance was from selling more/less units (volume), higher/lower prices (rate), or different product mix (mix). It provides an example comparing actual vs. budget performance and shows volume was lower but rate was higher, indicating mix changes impacted results. VRM is calculated monthly and stored in a data cube to allow flexible analysis and flag areas needing attention or justify pricing/portfolio decisions.