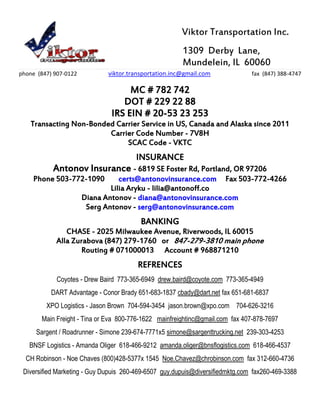

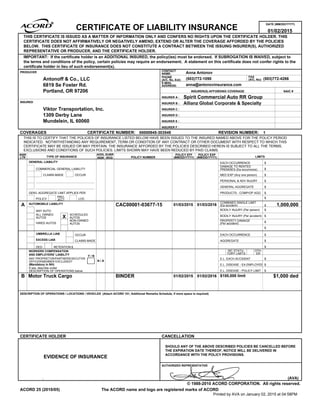

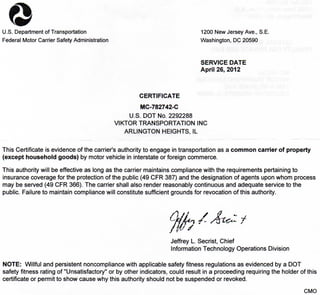

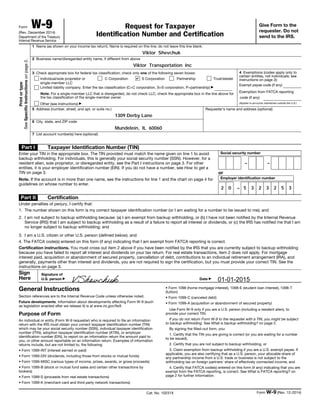

This document provides key information about Viktor Transportation Inc. including their contact information, license and registration numbers, insurance details, banking information, and client references. Viktor Transportation Inc. is a non-bonded carrier service operating in the US, Canada, and Alaska since 2011, with offices located in Mundelelein, Illinois. Their insurance is provided by Antonov Insurance and their primary bank is Chase, located in Riverwoods, Illinois. The document lists several large client references for Viktor Transportation Inc.