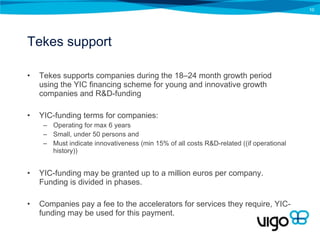

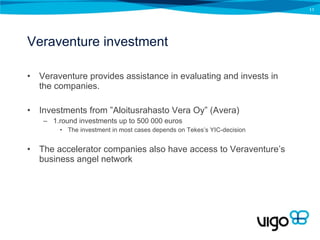

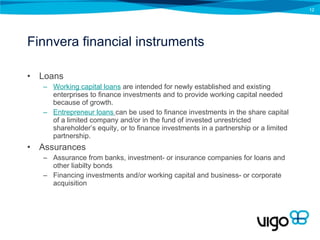

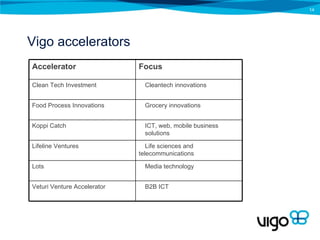

The document describes the Vigo Accelerator Program in Finland, which aims to combine startups, experienced business developers, and public financing to increase the number of successful growth companies. The program will create investor-driven business accelerators to improve early growth companies' investment attractiveness and ensure them growth financing. Accepted companies will receive funding, expertise, networking opportunities and access to speeded public funding processes from Tekes and Veraventure totaling up to 2.2 million euros per company. The accelerators will take an active role in mentoring companies and revenue will be based on companies' eventual exit value and monthly fees.

![Food Process Innovations Food Process Innovations Ltd. accelerates human nutrition related innovations and businesses with intellectual property edge. FPI offering combines versatile food industry business expertise with scientific research, innovations, consumer and customer marketing as well as utilizing immaterial property rights. Food Process Innovations Oy Tehtaankatu 27 A 00150 Helsinki [email_address] Managers: Marko Saapunki Minna Isotupa Harry Salonaho Seppo Paatelainen Heikki Järvensivu Antti Kosunen Reijo Vihko](https://image.slidesharecdn.com/vigopresentationcompaniesfinal-100614032610-phpapp02/85/Vigo-16-320.jpg)

![Lots Lots is the Finnish expert in commercializing media technology products and services. For example gaming, graphics technology, user interfaces, and all digital content creation are media technologies. LOTS Ltd Bulevardi 1 FI 00100 Helsinki Finland [email_address] www.lots.fi Managers Ville Miettinen Panu Wilska Harri Holopainen](https://image.slidesharecdn.com/vigopresentationcompaniesfinal-100614032610-phpapp02/85/Vigo-19-320.jpg)

![Veturi Venture Partners Veturi is a venture accelerator that helps entrepreneurs turn innovative ideas into growth businesses. Veturi focuses on innovation-based B2B ICT or ICT enabled growth businesses. Veturi Venture Accelerator Betonimiehenkuja 5 (Design Factory) 02150 Espoo [email_address] Managers: Jussi Harvela Moaffak Ahmed](https://image.slidesharecdn.com/vigopresentationcompaniesfinal-100614032610-phpapp02/85/Vigo-20-320.jpg)

![More information PROFict Partners Oy Seppo Ruotsalainen [email_address] Marit Tuominen [email_address] Veraventure Keith Bonnici [email_address] Tekes Liisa Rosi [email_address]](https://image.slidesharecdn.com/vigopresentationcompaniesfinal-100614032610-phpapp02/85/Vigo-21-320.jpg)