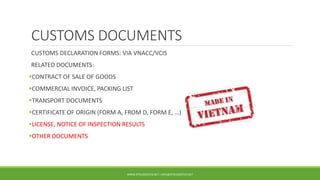

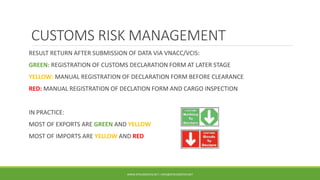

Vietnam has updated its customs procedures in 2015, moving to a fully electronic customs declaration system called VNACCS/VCIS. Importers and exporters must have an account with customs and a digital signature to use this system. The types of documents required for customs declarations include commercial invoices, packing lists, transport documents, certificates of origin, licenses, and other documents depending on the commodity. The customs value of imports is based on the C&F or CPT value on the commercial invoice, and customs may apply a tariff price if this value is doubted. Restricted and prohibited goods include used consumable items and some used materials and equipment.