Embed presentation

Downloaded 14 times

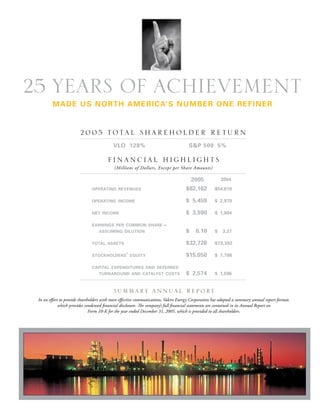

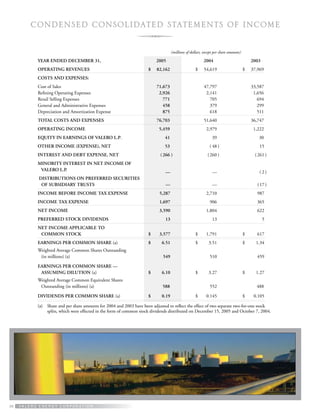

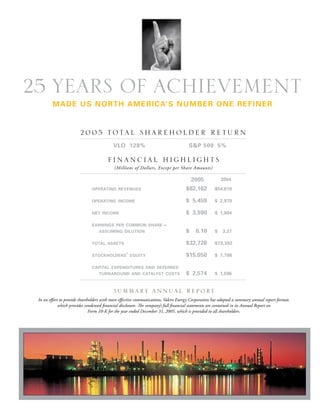

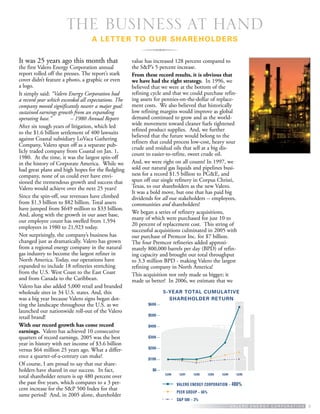

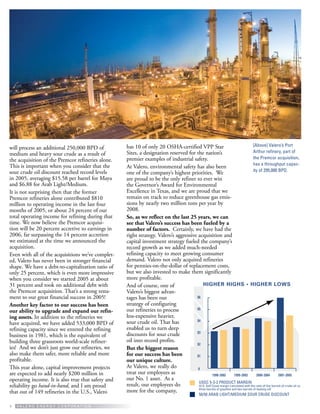

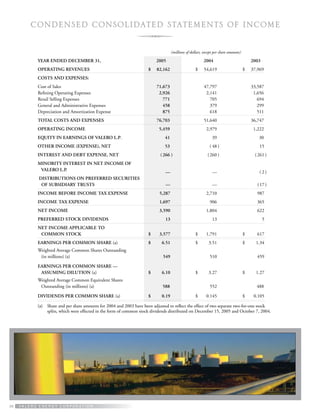

This document is Valero Energy Corporation's 2005 Summary Annual Report. It discusses Valero's 25-year history of growth and success, including becoming the largest refiner in North America through strategic acquisitions. In 2005, Valero achieved record earnings of $3.6 billion and strong total shareholder returns. The report attributes Valero's success to its strategy of investing in refineries capable of processing heavy sour crude oil, and to its caring corporate culture that prioritizes employees and communities.