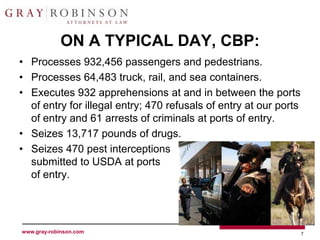

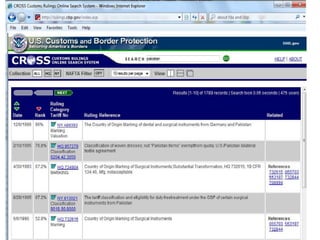

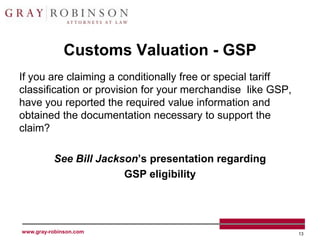

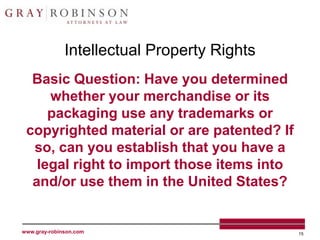

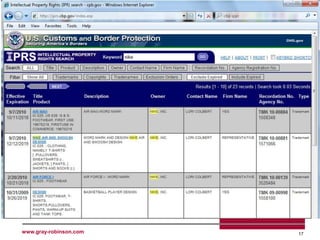

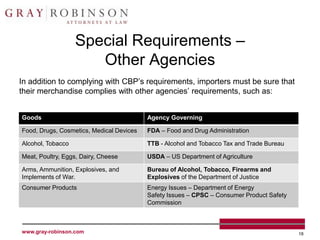

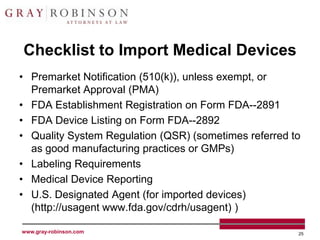

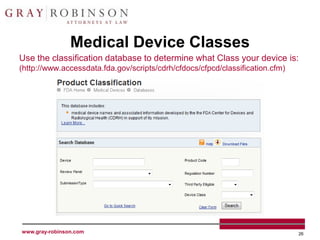

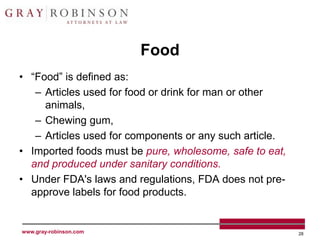

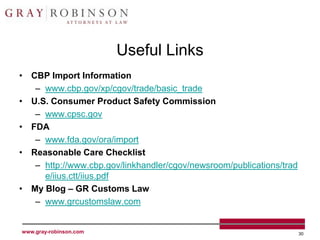

The document outlines the U.S. Customs and Border Protection (CBP) regulations and the responsibilities of importers regarding customs compliance and enforcement, emphasizing the importance of accurate merchandise description, tariff classification, and adherence to various agency requirements for goods like cosmetics, drugs, and food. It highlights the role of CBP in managing imports, preventing illegal entry, and securing the supply chain against terrorism. Additionally, specific checkpoints and programs such as the Customs Trade Partnership Against Terrorism (C-TPAT) and Fair Use of trademarks are discussed to guide businesses in ensuring compliance.