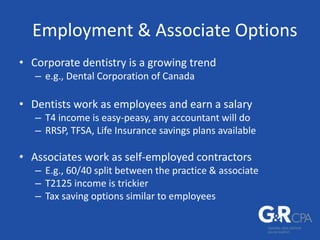

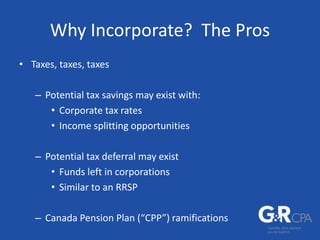

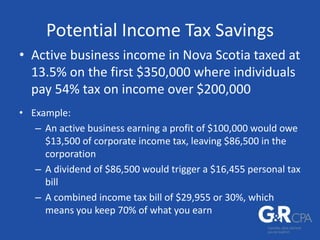

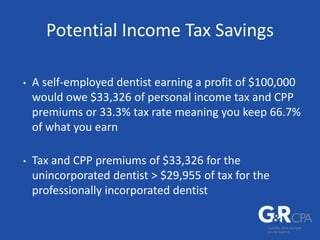

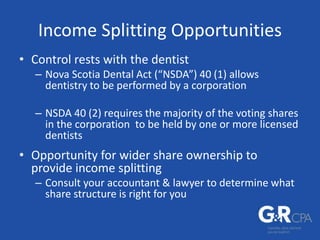

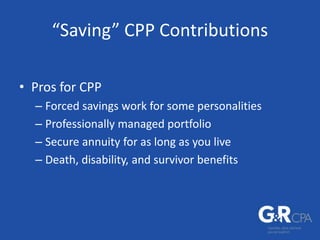

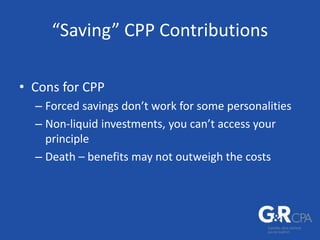

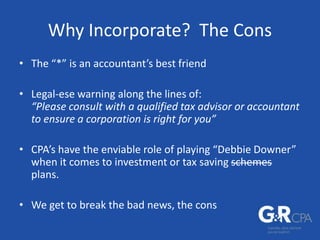

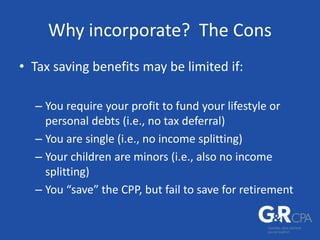

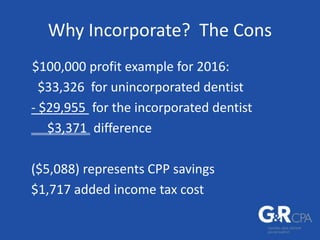

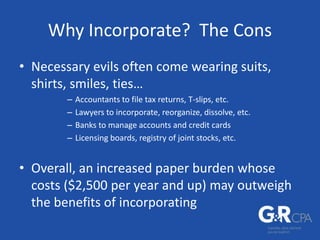

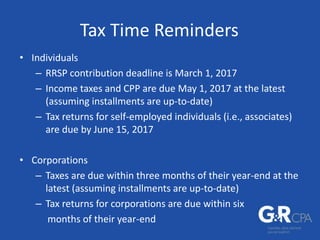

Steven Gray, a CPA, will discuss employment and associate options for dental students, acquiring and incorporating a dental practice, and tax time reminders. He will cover the pros and cons of being an employee or associate, steps to take when acquiring a practice, potential tax benefits and costs of incorporation, and upcoming tax deadlines. The presentation aims to provide dental students insights into the business aspects of dentistry from an accountant's perspective.