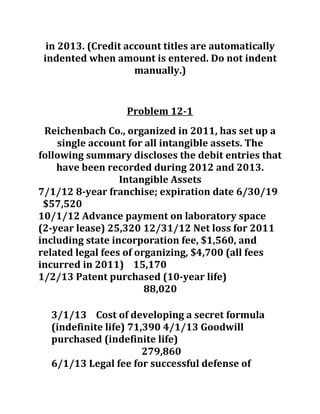

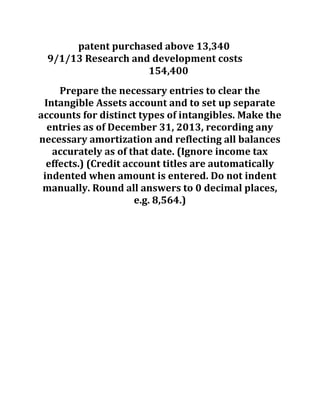

The document provides various accounting exercises related to depreciation, depletion, and intangible assets. It includes scenarios for different companies, such as Wenner Furnace Corp.'s machinery depreciation and Conan O'Brien Logging's timberland and extraordinary loss due to a natural disaster. Additionally, it addresses research and development costs for Margaret Avery Company and Reichenbach Co.'s management of intangible assets, requiring the preparation of journal entries for each situation.