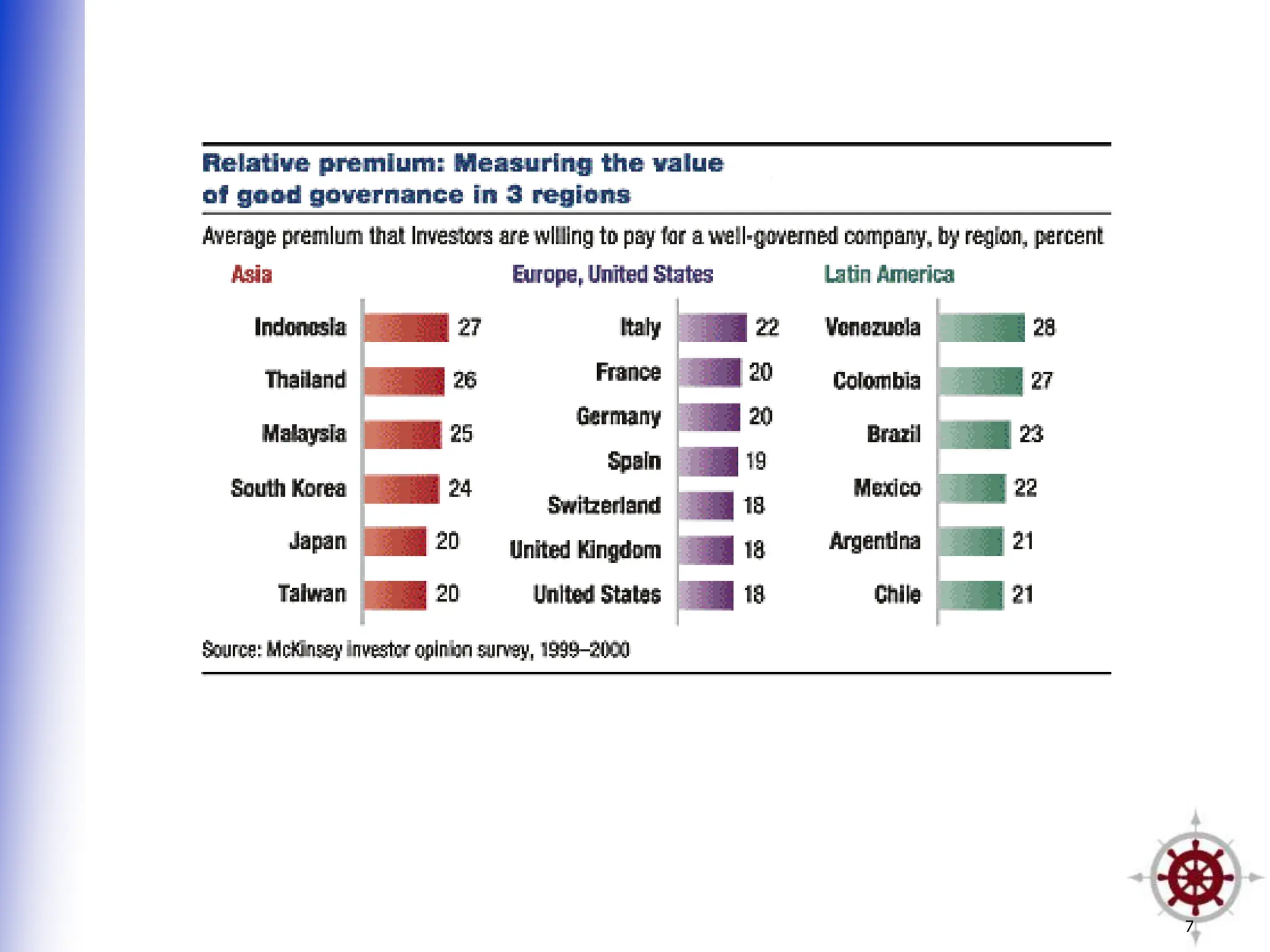

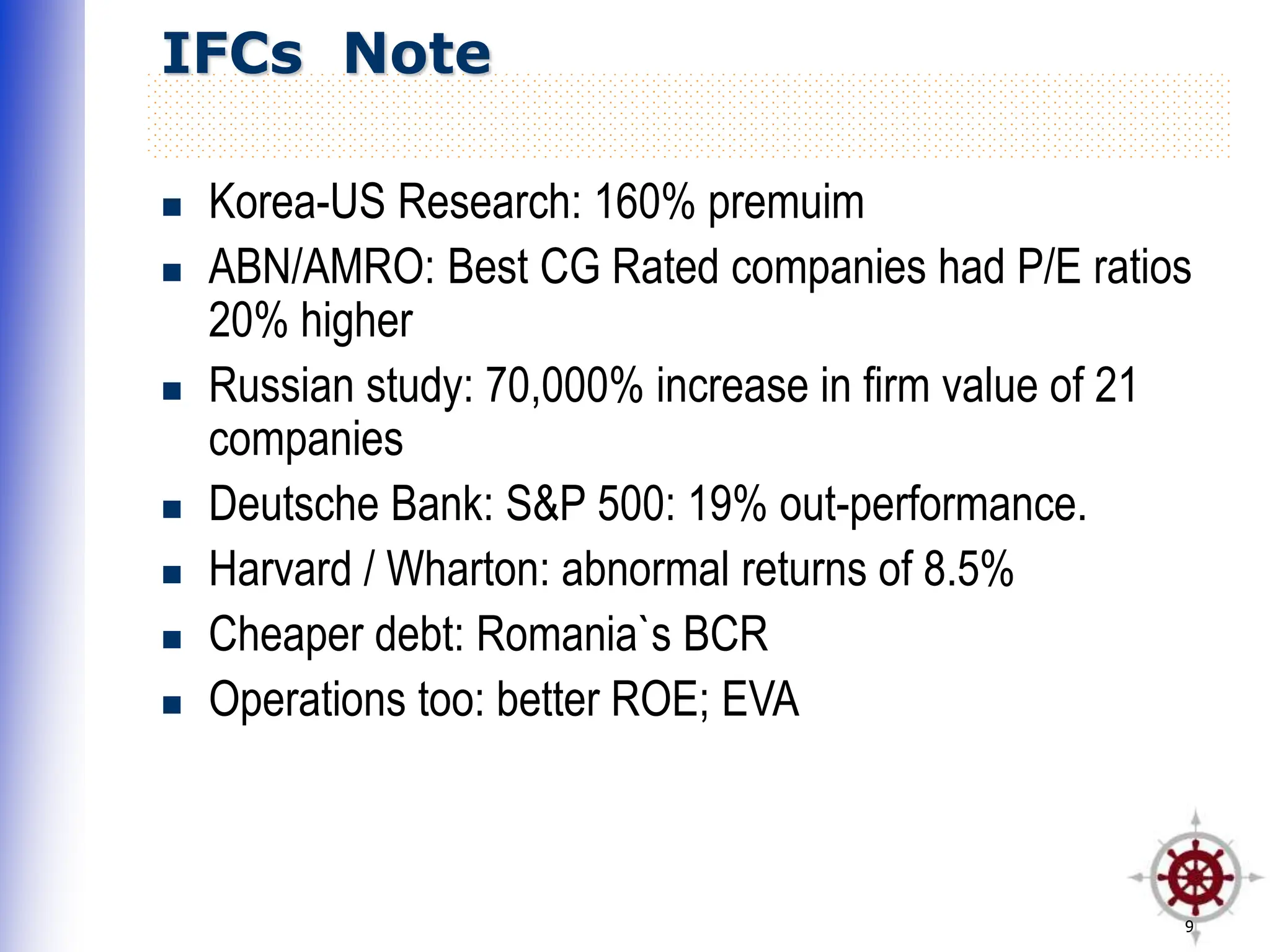

Governance involves principles of fairness, transparency, responsibility and accountability that can lead to achieving development goals. There are two approaches to governance - strengthening public policy and decision making structures, and improving efficiency and transparency in service delivery. Corporate governance became important in the 1990s due to concerns over investor confidence and financial crises. Studies show companies with better corporate governance have higher stock prices and returns. However, state-owned enterprises face challenges of dispersed responsibility and need governance reforms to interfaces between regulatory bodies and boards. Approaches to reform include advocacy, building competencies in governance skills, and developing roadmaps at the policy, sector and firm levels.