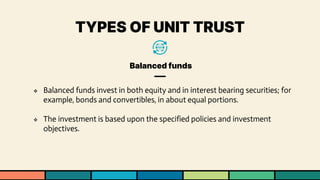

This document contains information about unit trusts, including:

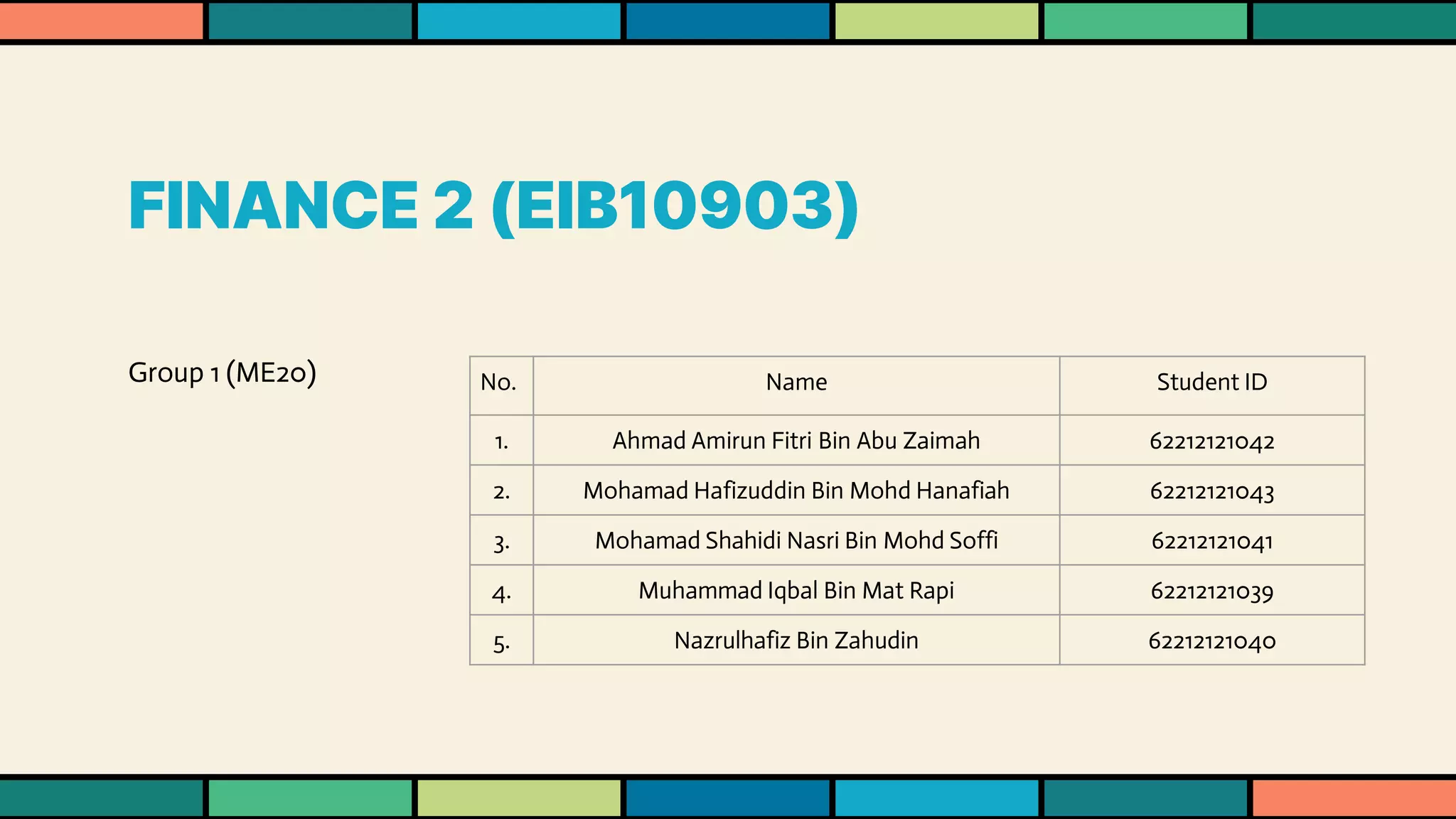

1. Definitions of unit trust and its key characteristics such as professional fund management and high liquidity.

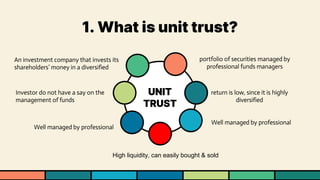

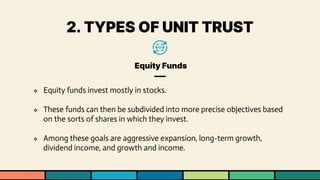

2. Descriptions of the main types of unit trusts - equity, balanced, bond, money market and Islamic funds.

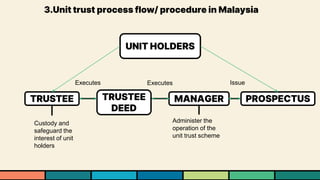

3. An overview of the typical unit trust process in Malaysia including the roles of the trustee, manager and unit holders.

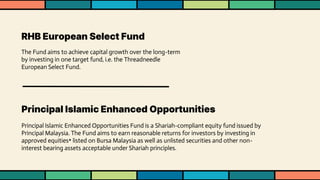

4. Examples of four unit trust companies and some of their funds in Malaysia.

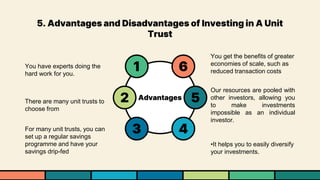

5. Advantages of unit trusts such as diversification and lower costs, and disadvantages like additional fees and potential liquidity issues.