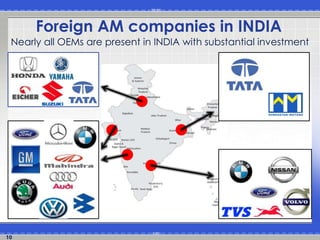

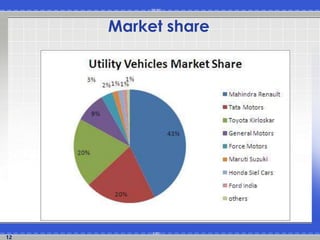

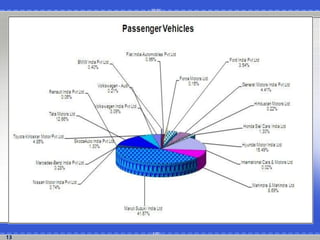

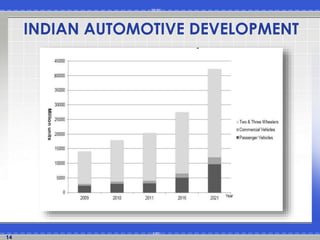

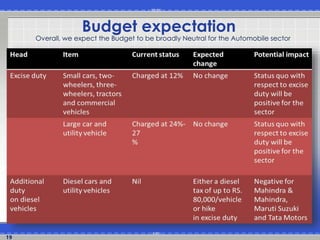

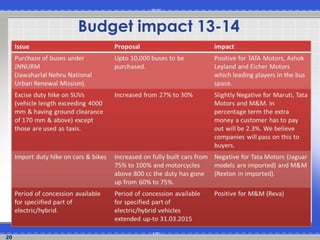

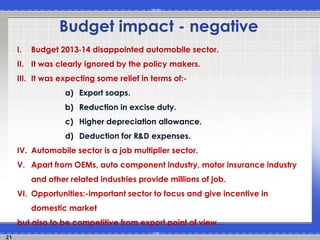

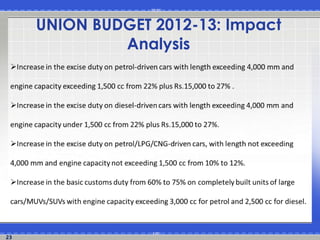

The document discusses the Indian automotive sector and the impact of the Union Budget of 2013. It provides an overview of the evolution and current state of the automotive industry in India. The SWOT analysis highlights strengths like foreign investments but also weaknesses such as low quality and labor productivity. The budget was expected to provide incentives but ended up disappointing the sector. While excise duties increased for some vehicles, exports saw no relief. The conclusion covers both the growth of the industry, contributing significantly to GDP and employment, but also challenges around fuel prices, policies and infrastructure.