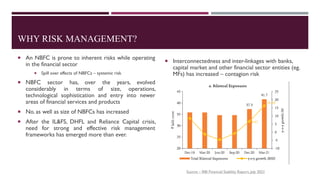

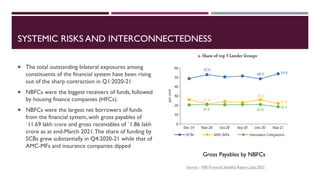

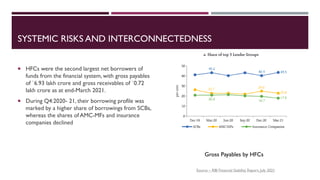

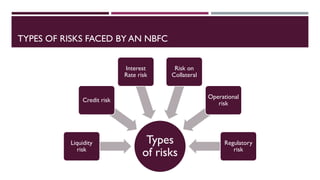

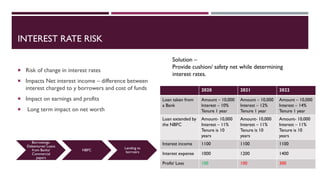

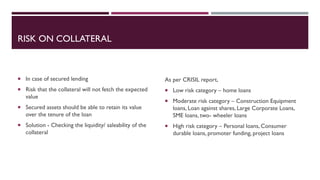

This document discusses the importance of risk management frameworks for non-banking financial companies (NBFCs) in India. It outlines several types of risks NBFCs face, including credit, liquidity, interest rate, and operational risks. It also describes how NBFCs are interconnected with banks and other financial institutions, creating systemic risks. The document then examines key aspects of risk management frameworks for NBFCs in India, such as liquidity risk management, risk-based internal auditing, and capital adequacy requirements. It emphasizes the need for robust risk management practices given recent crises among some large NBFCs.