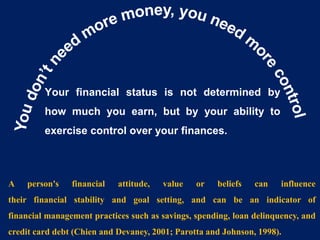

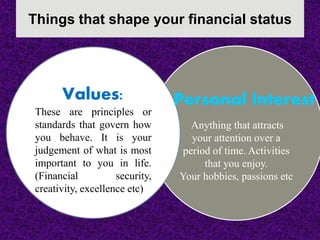

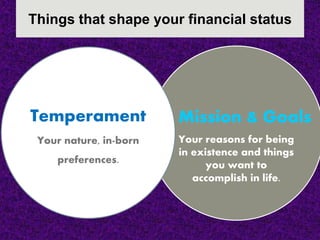

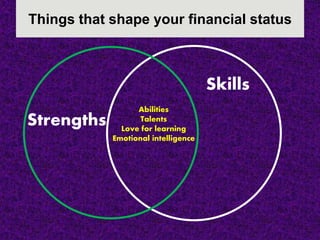

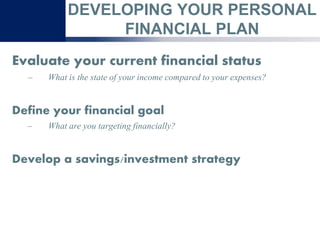

Understanding yourself is crucial for improving your financial status, as it is influenced by personal values, interests, and attitudes towards money. To enhance financial management, individuals should focus on self-discovery, increase financial literacy, save and invest wisely, and create a personal financial plan. The document emphasizes starting these practices early to benefit from time as a resource.