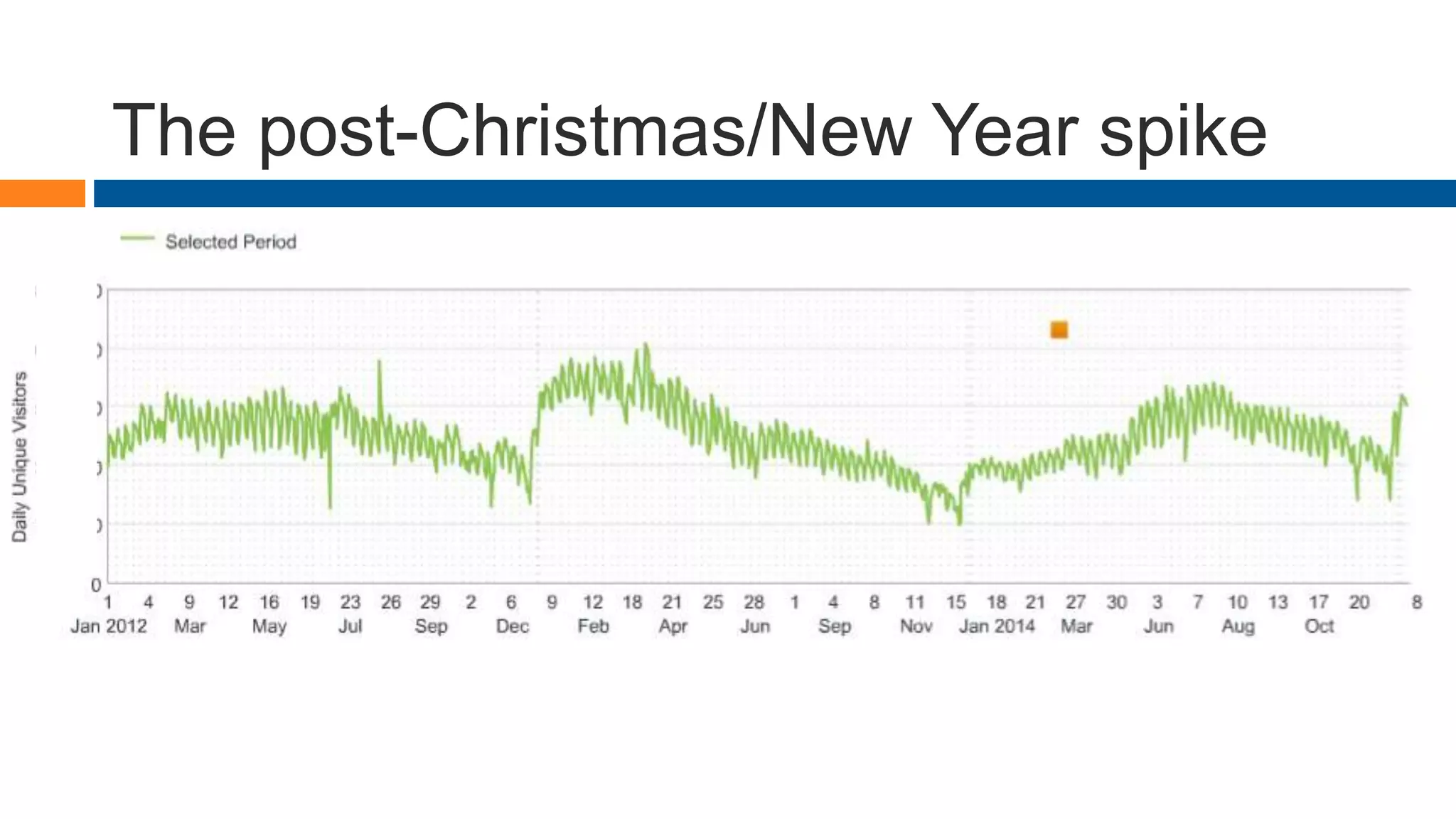

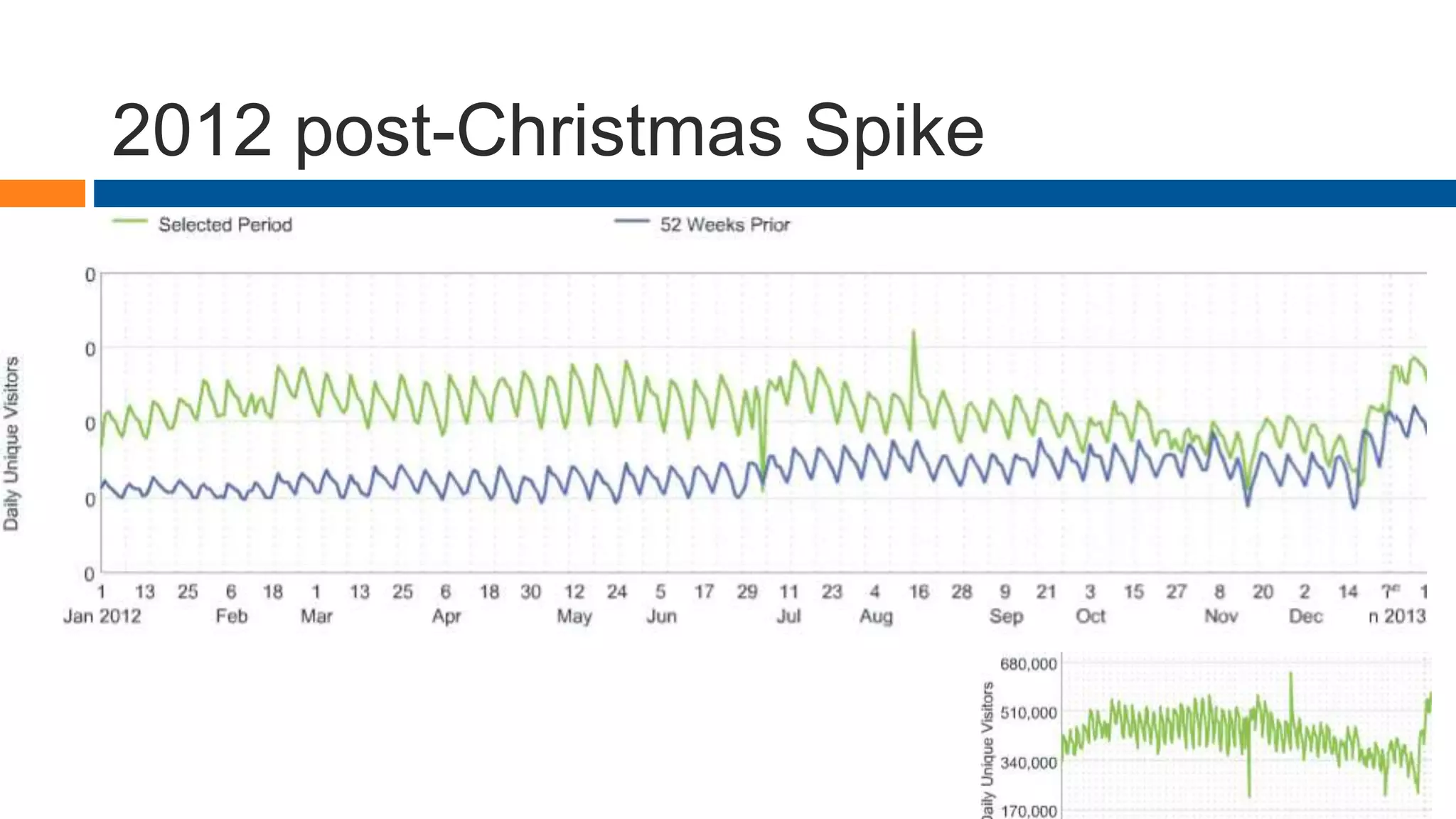

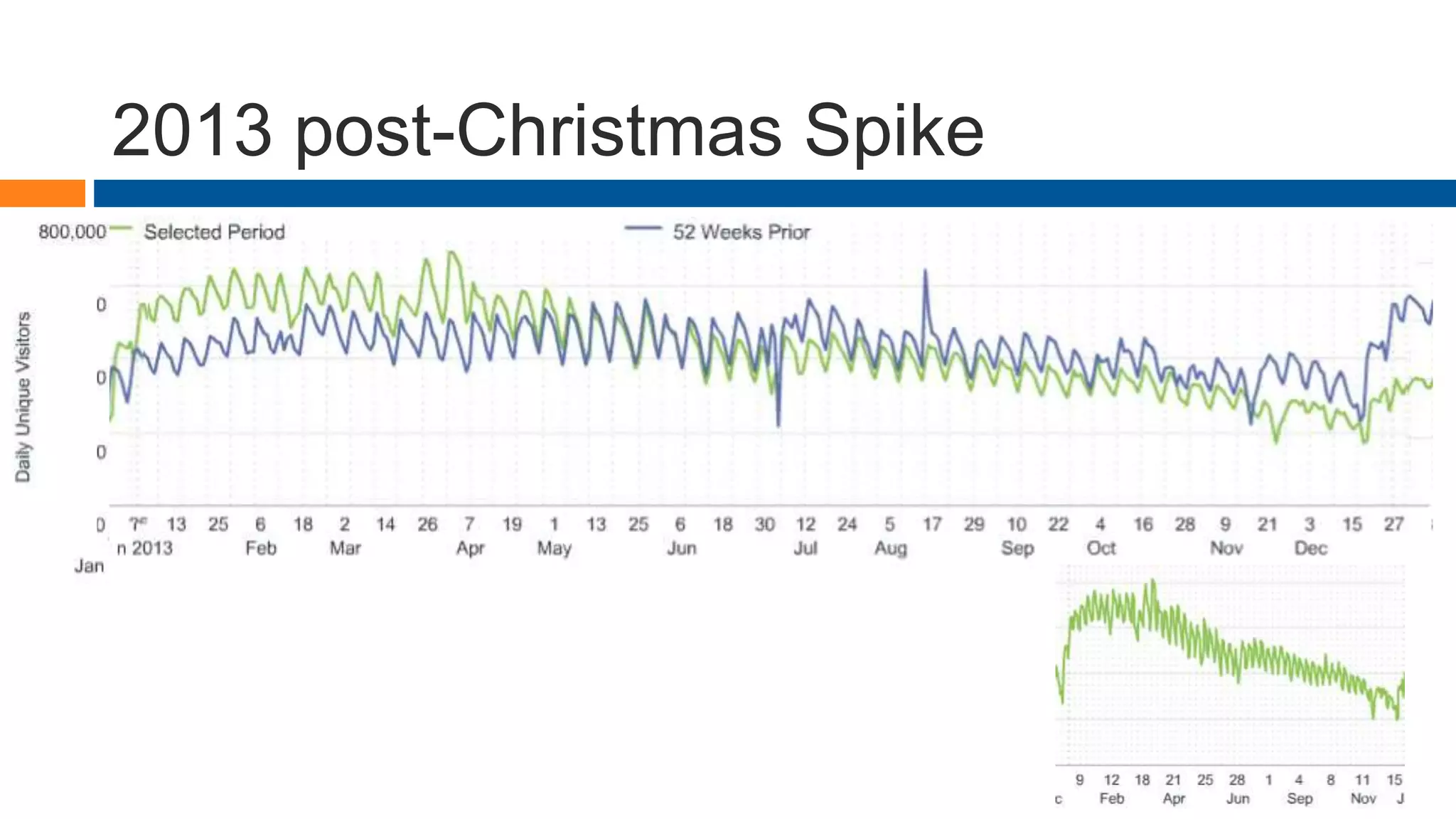

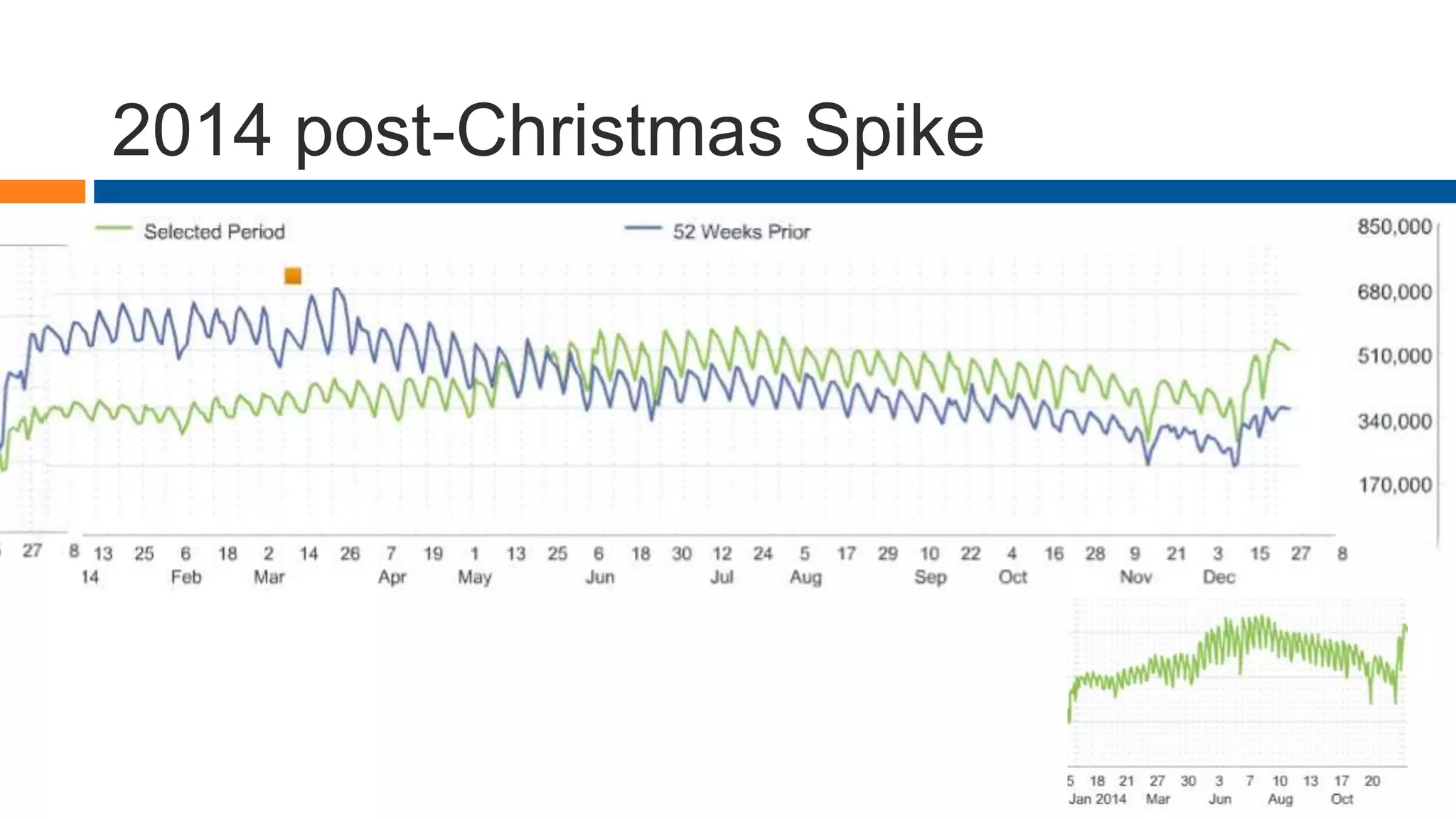

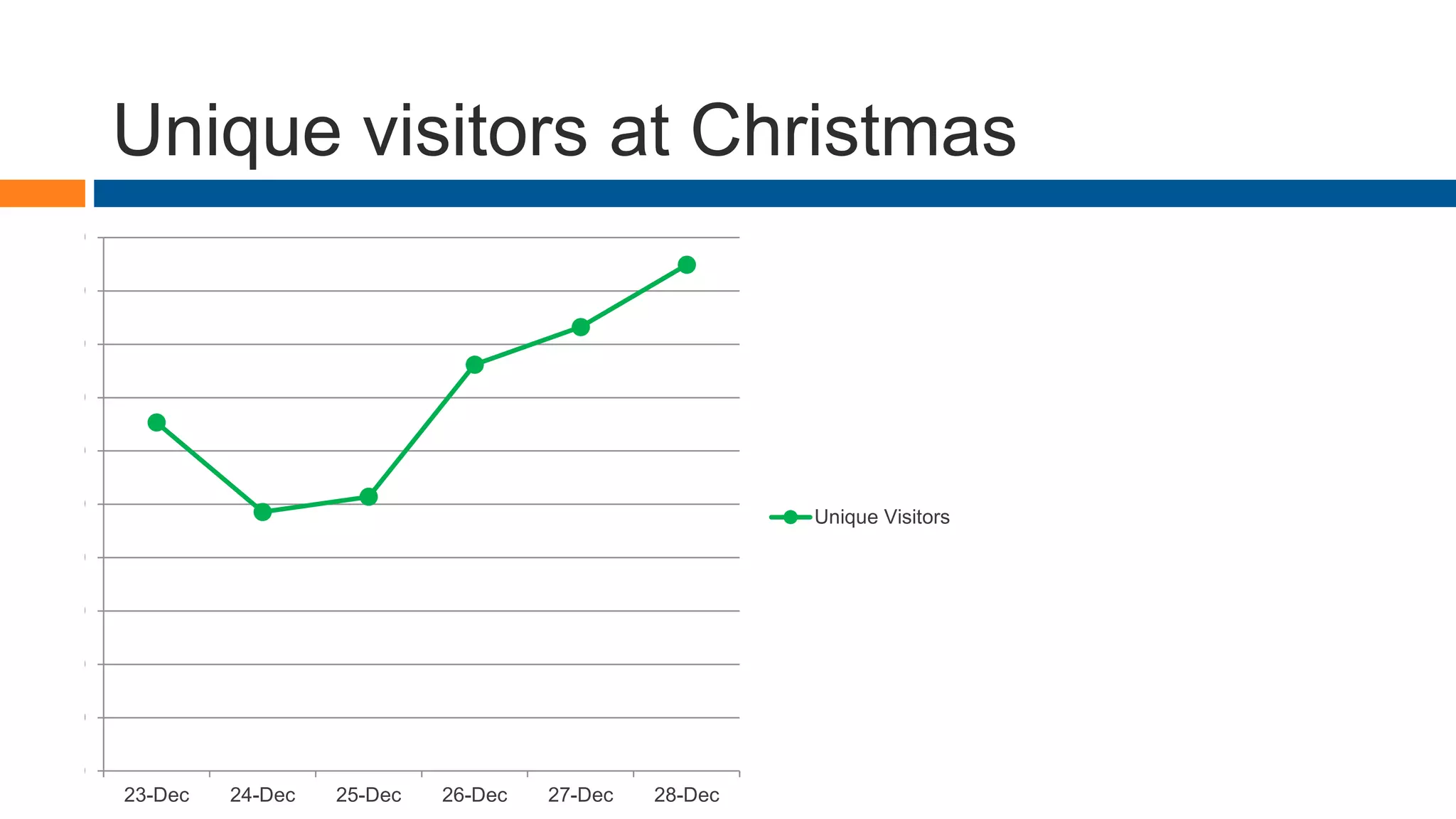

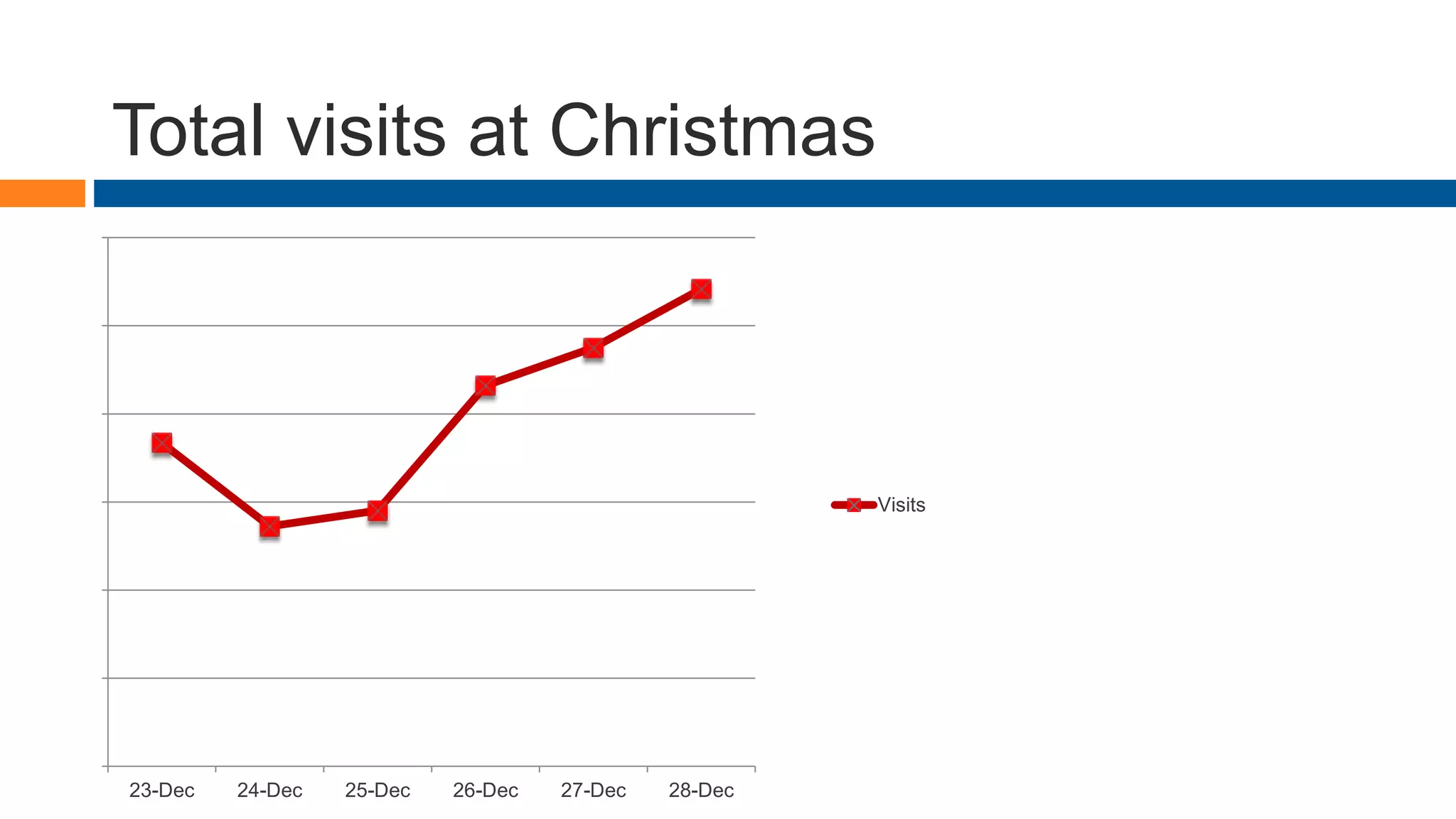

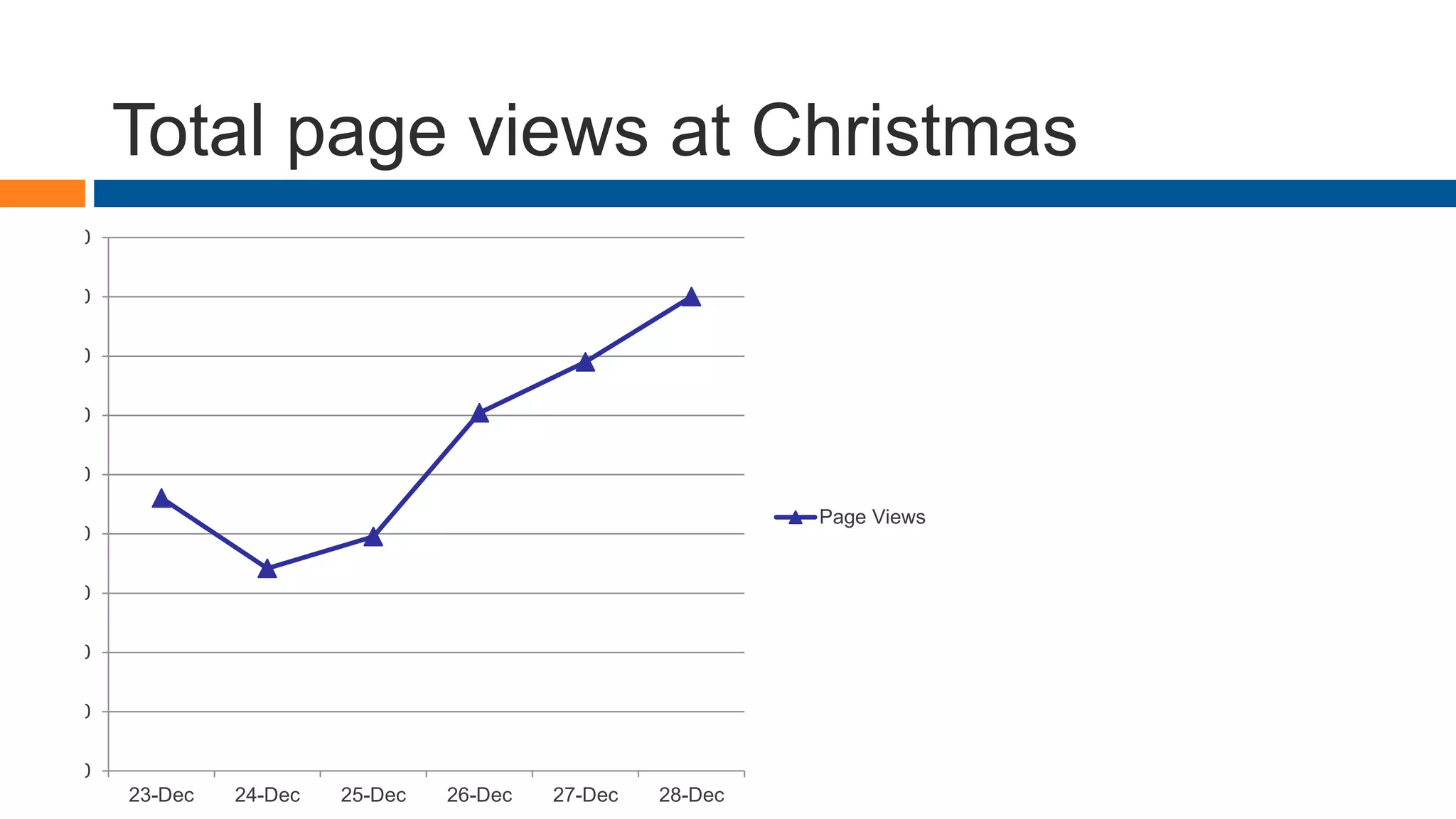

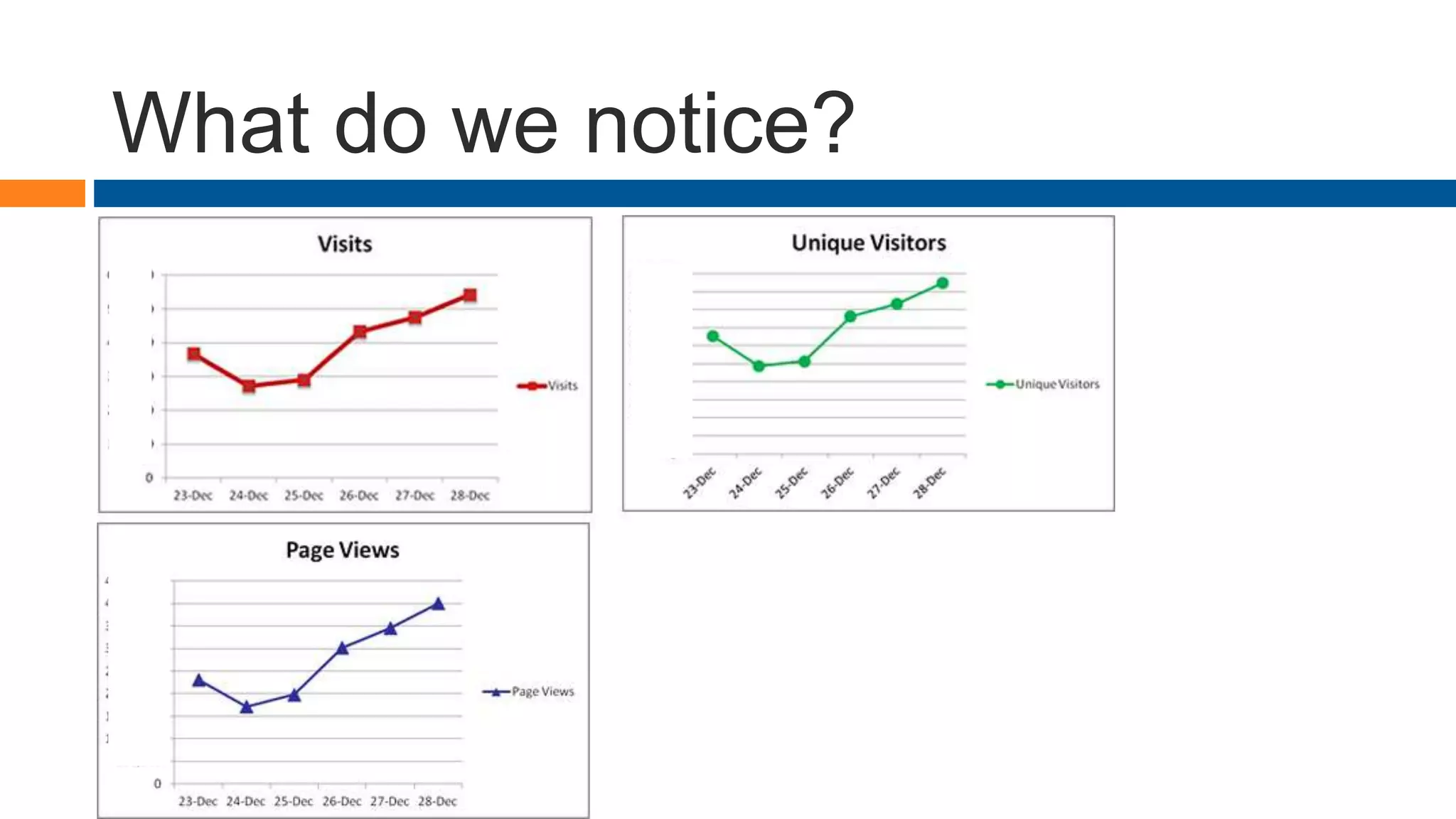

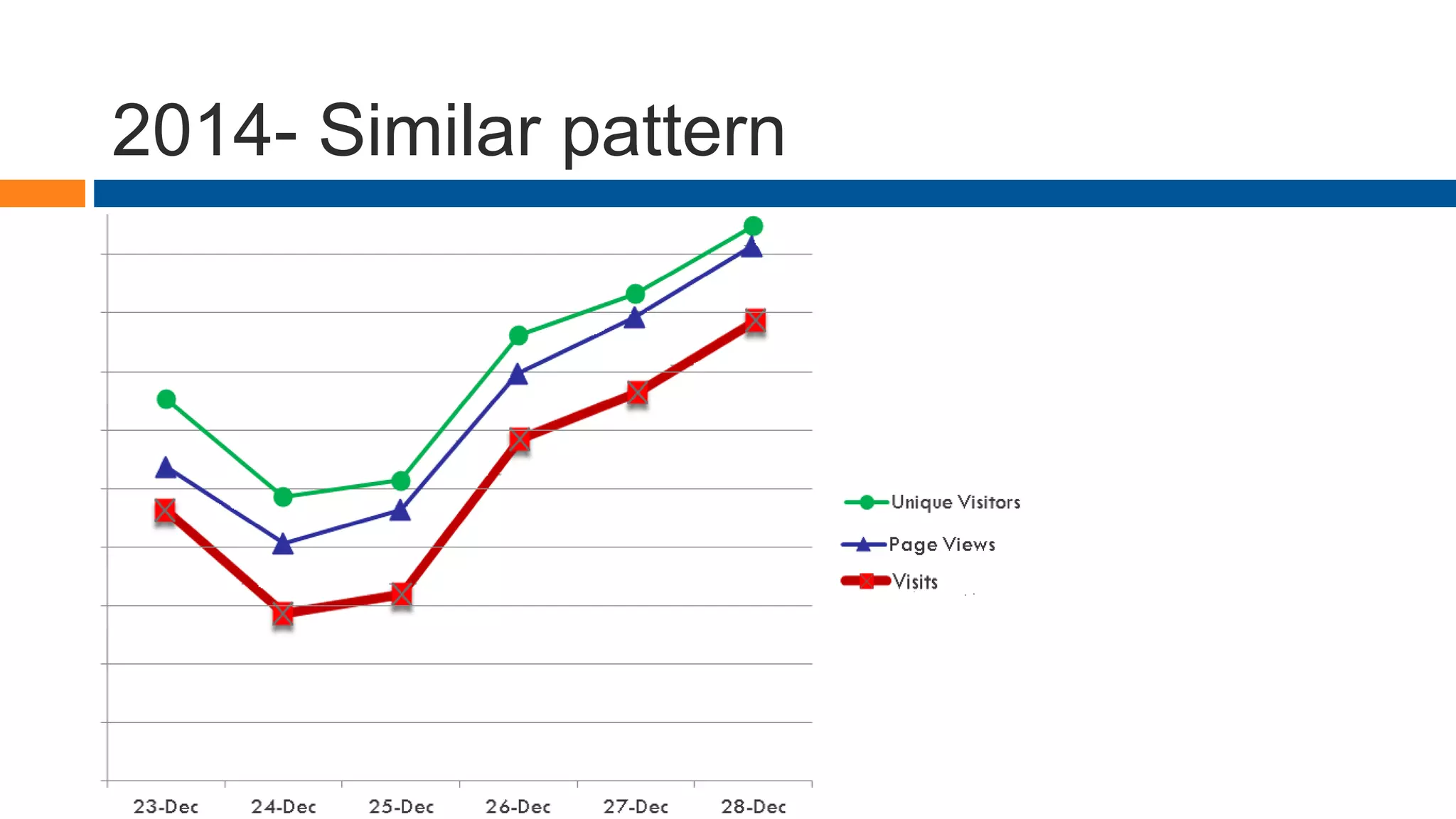

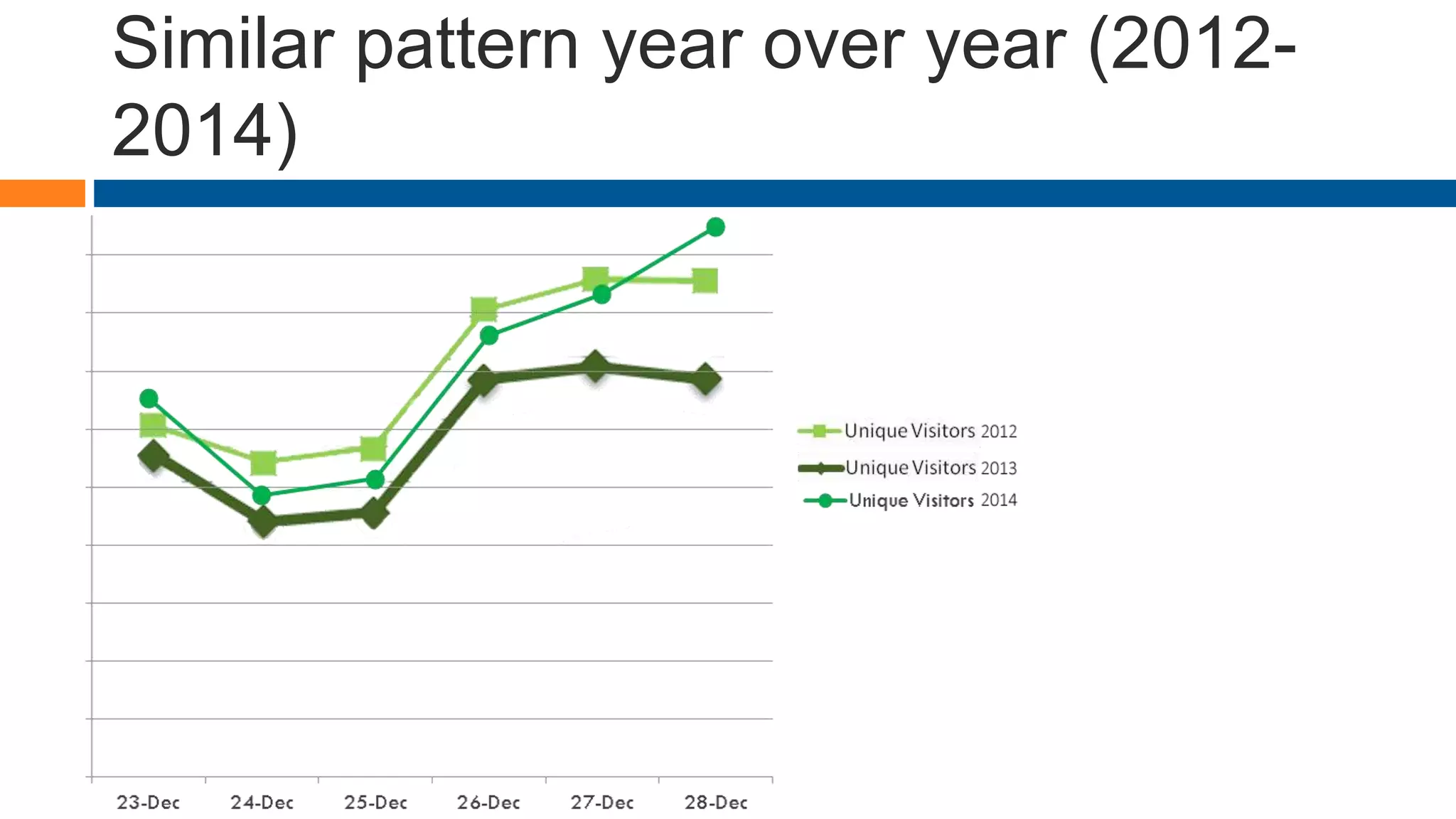

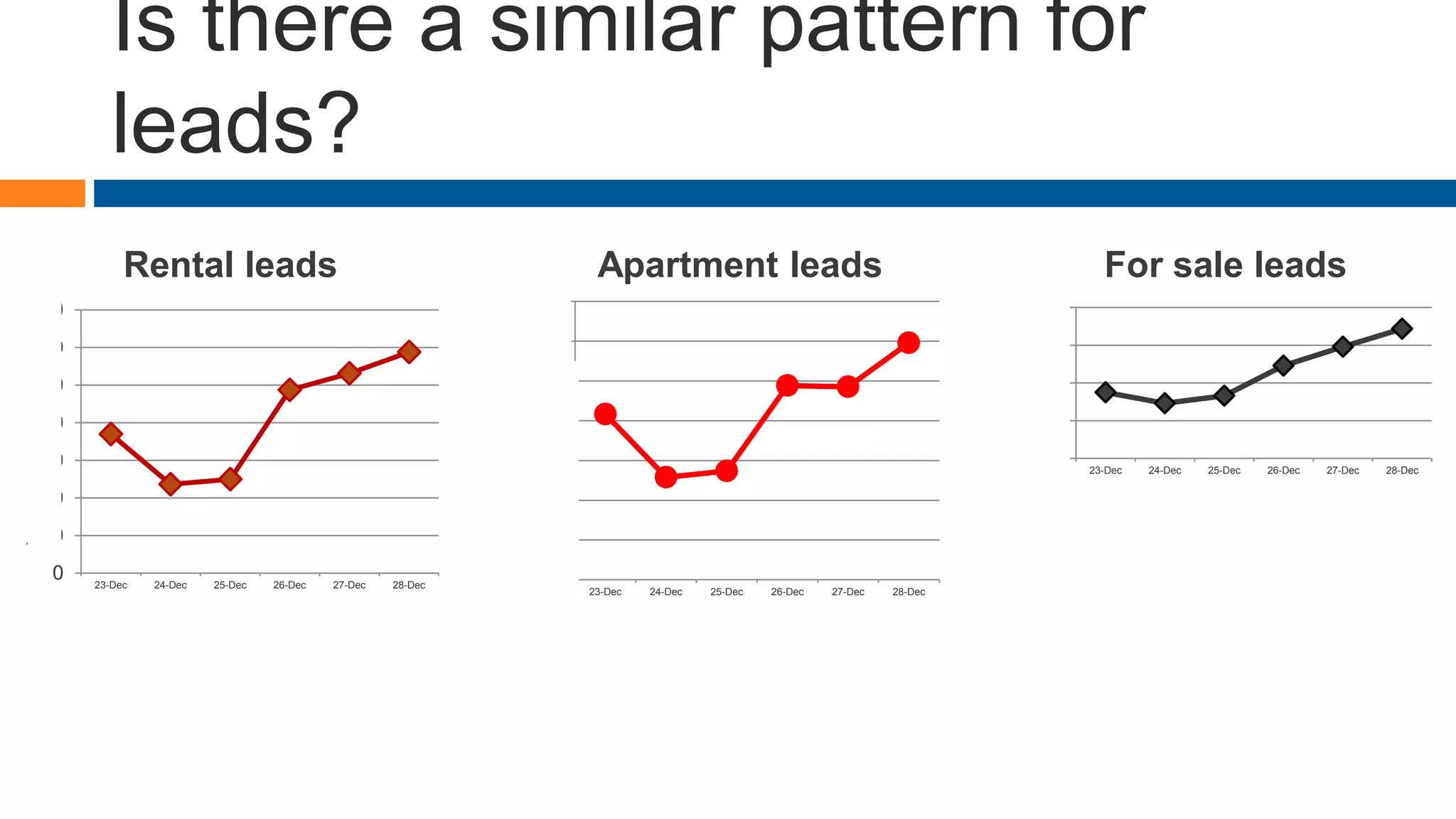

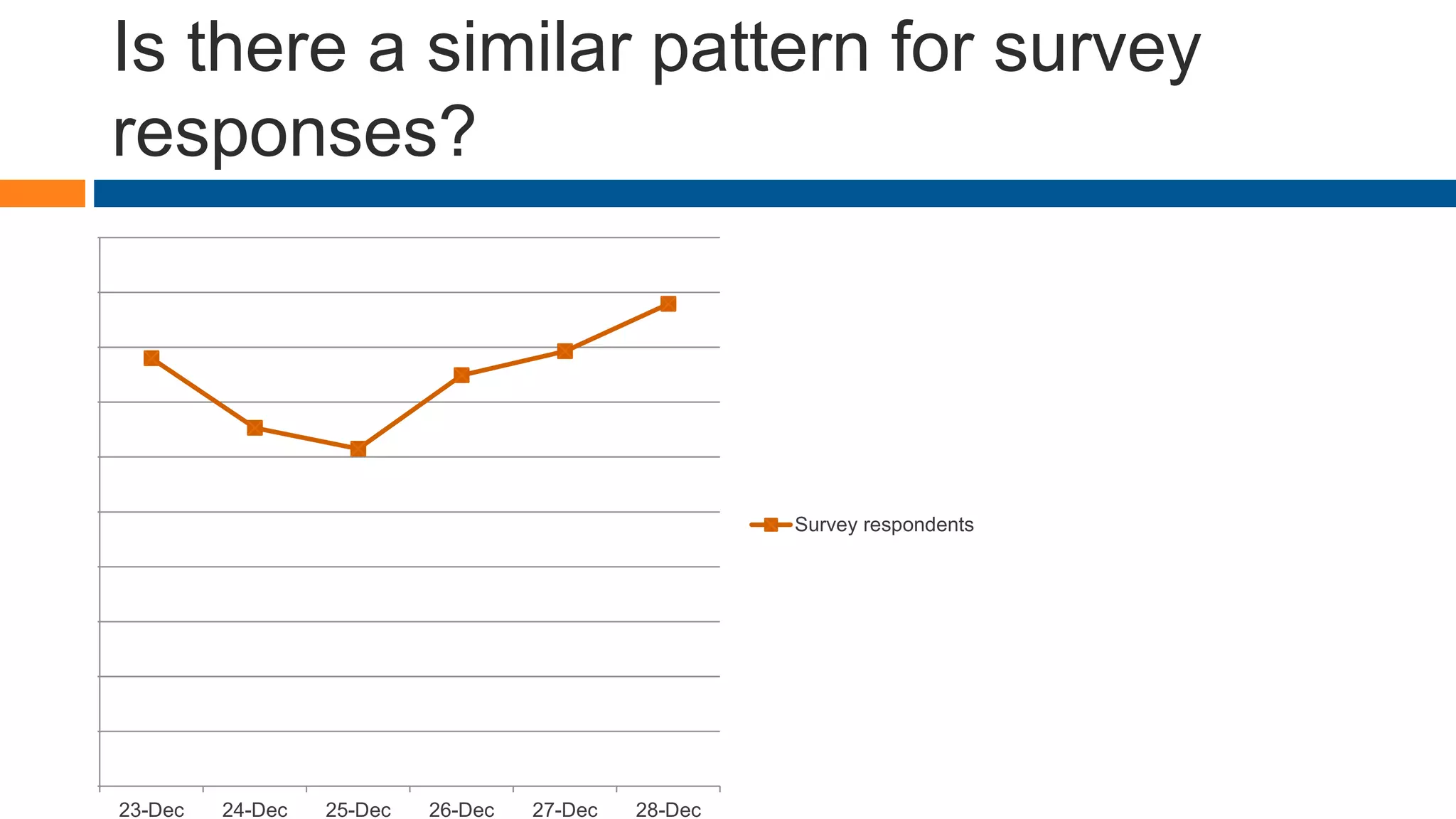

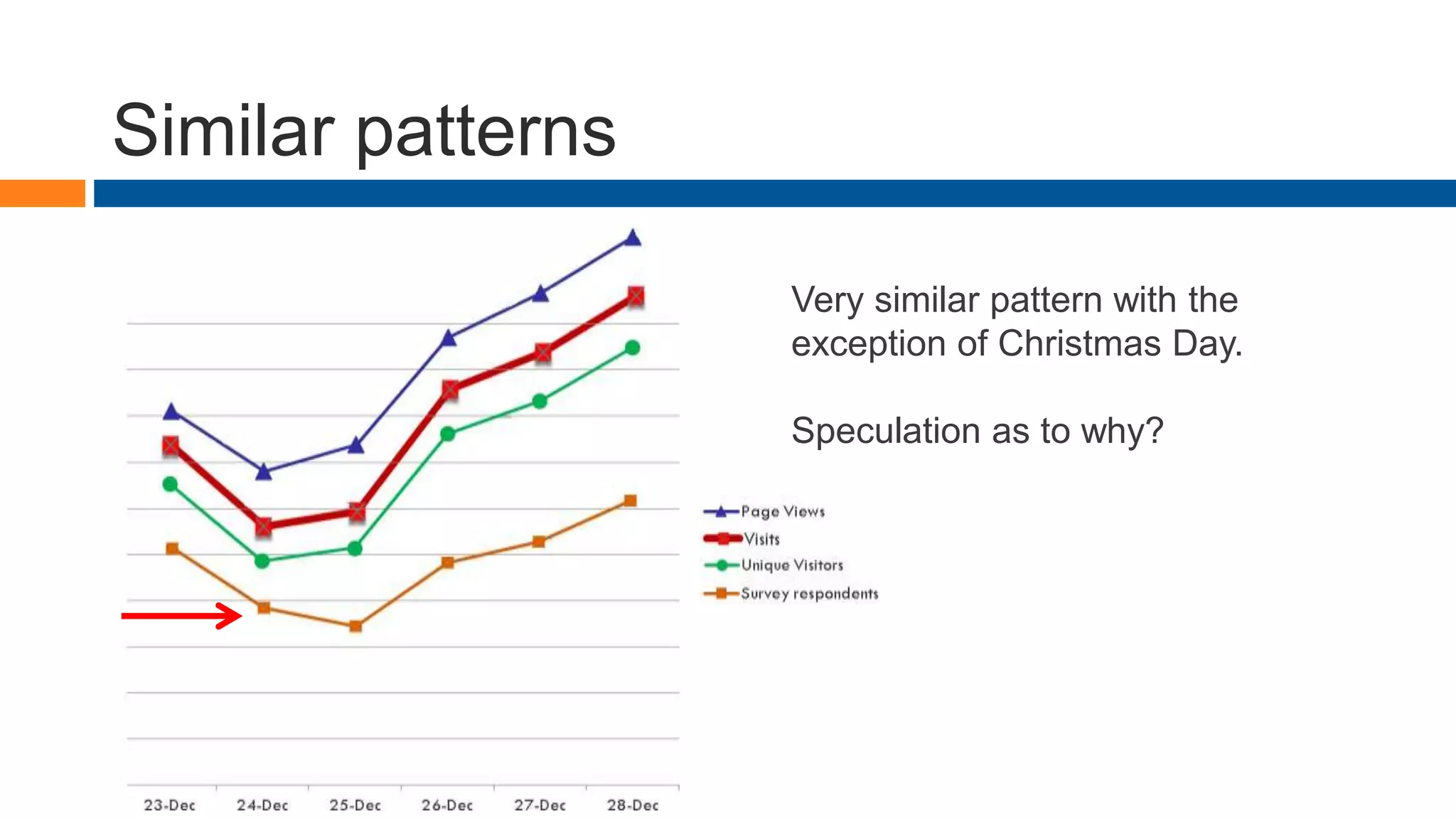

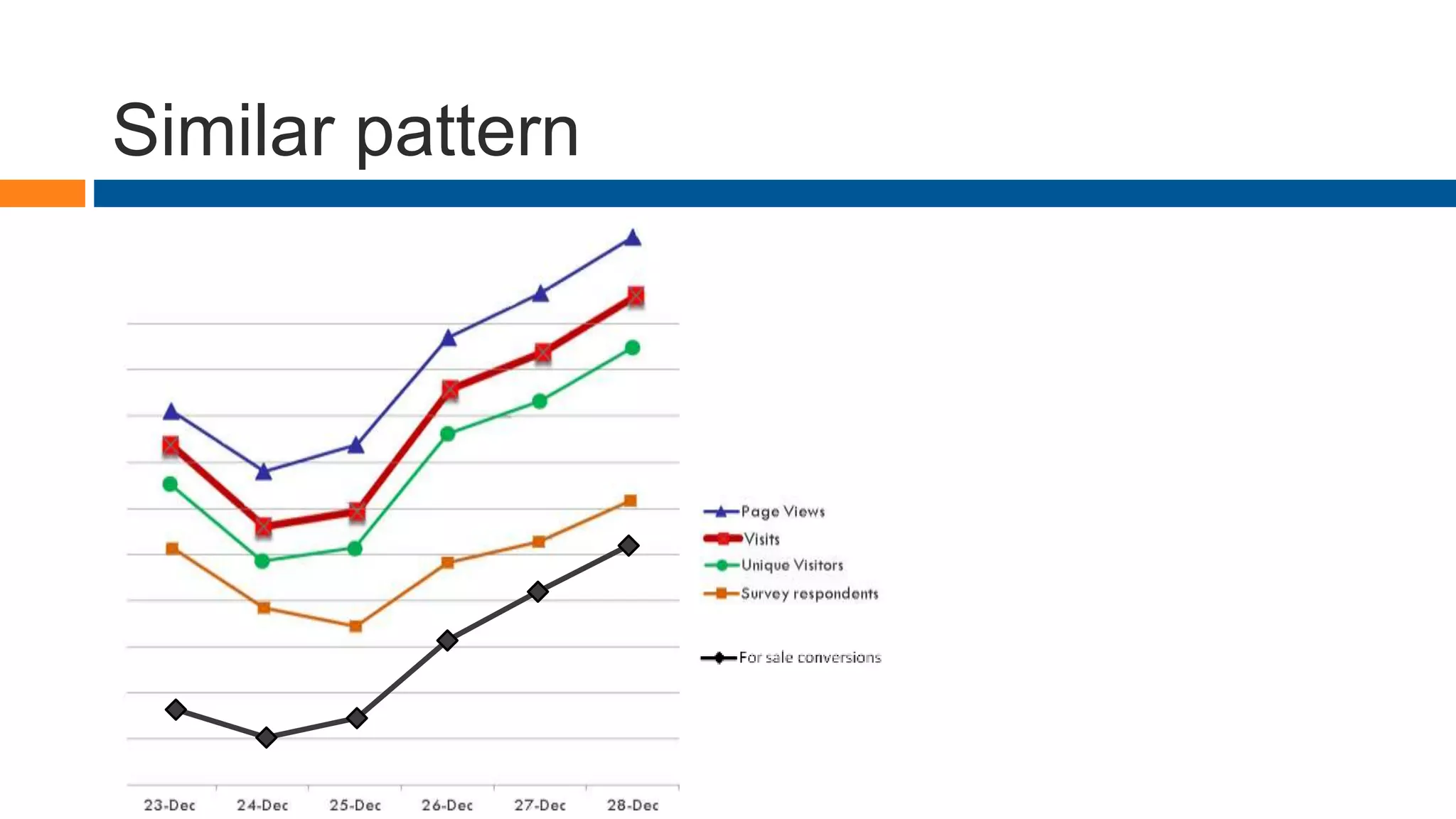

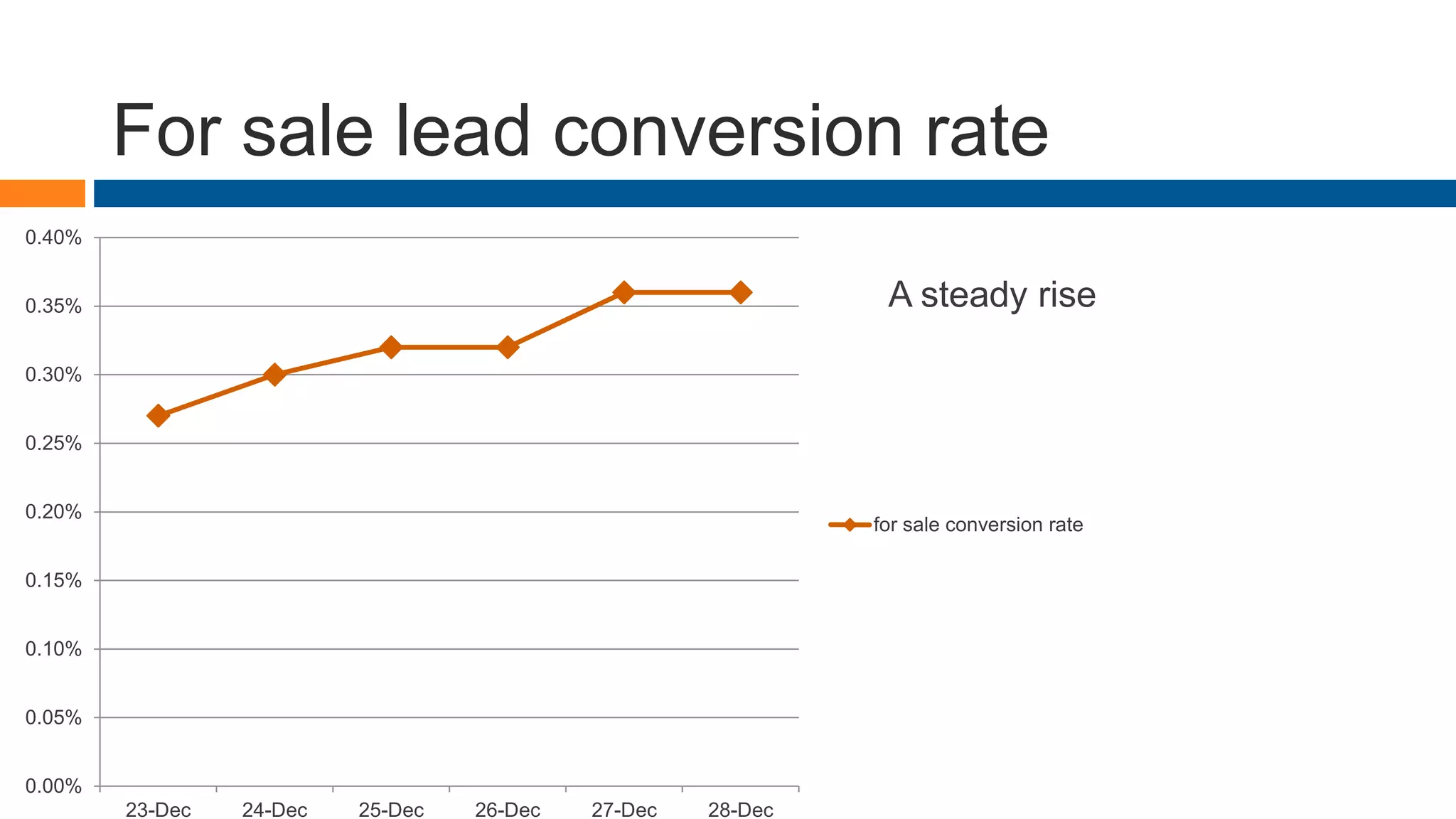

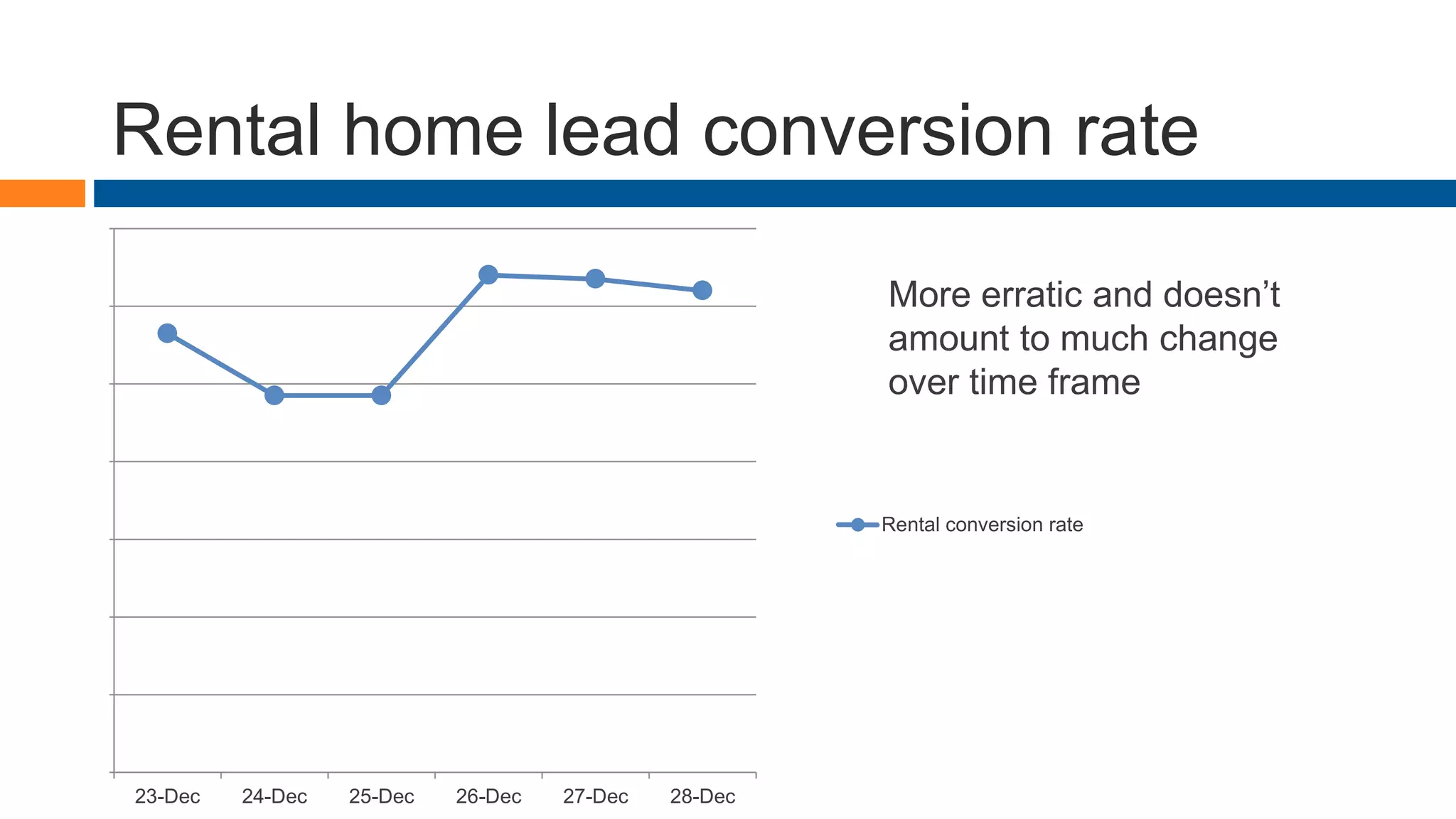

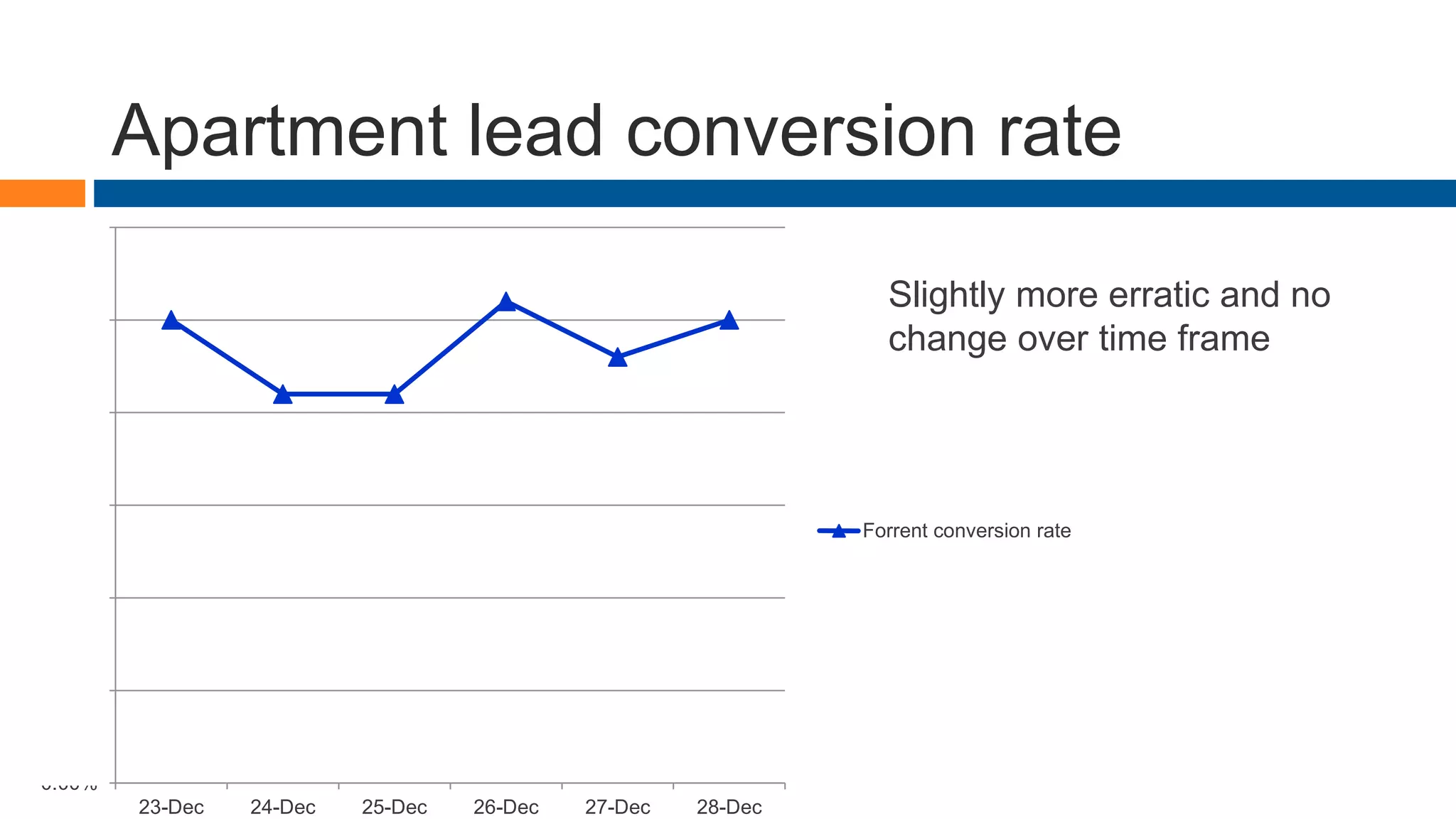

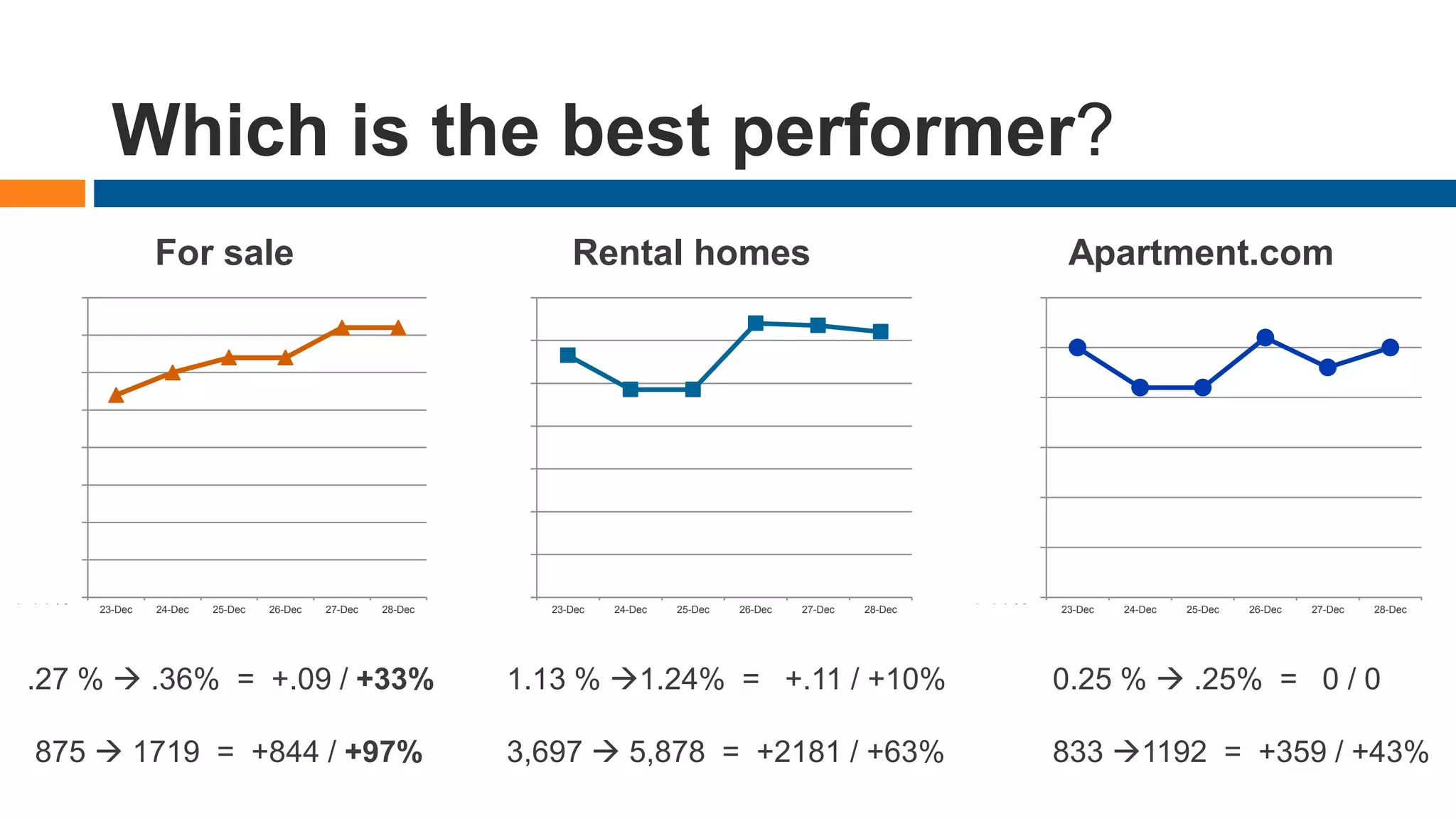

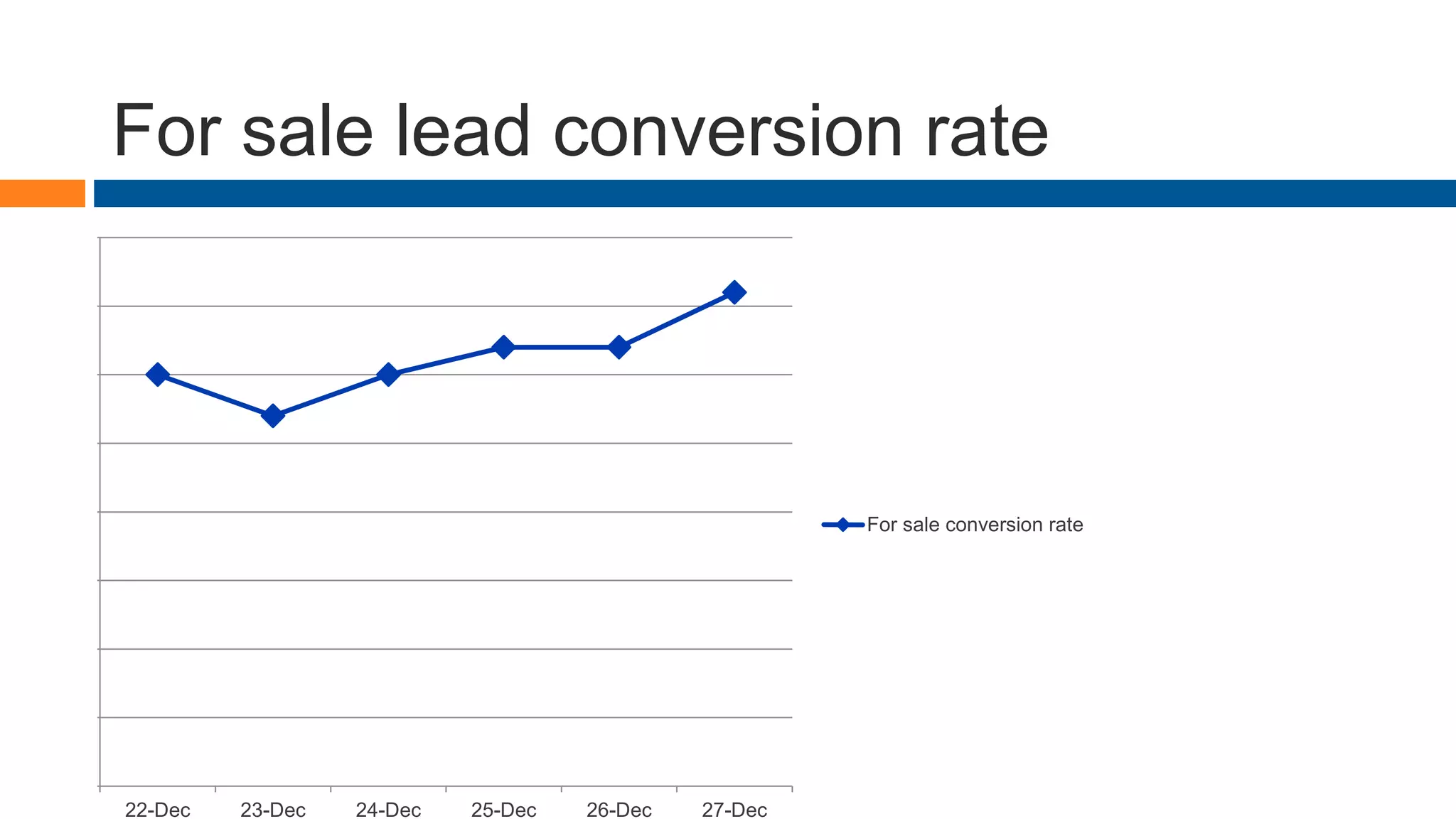

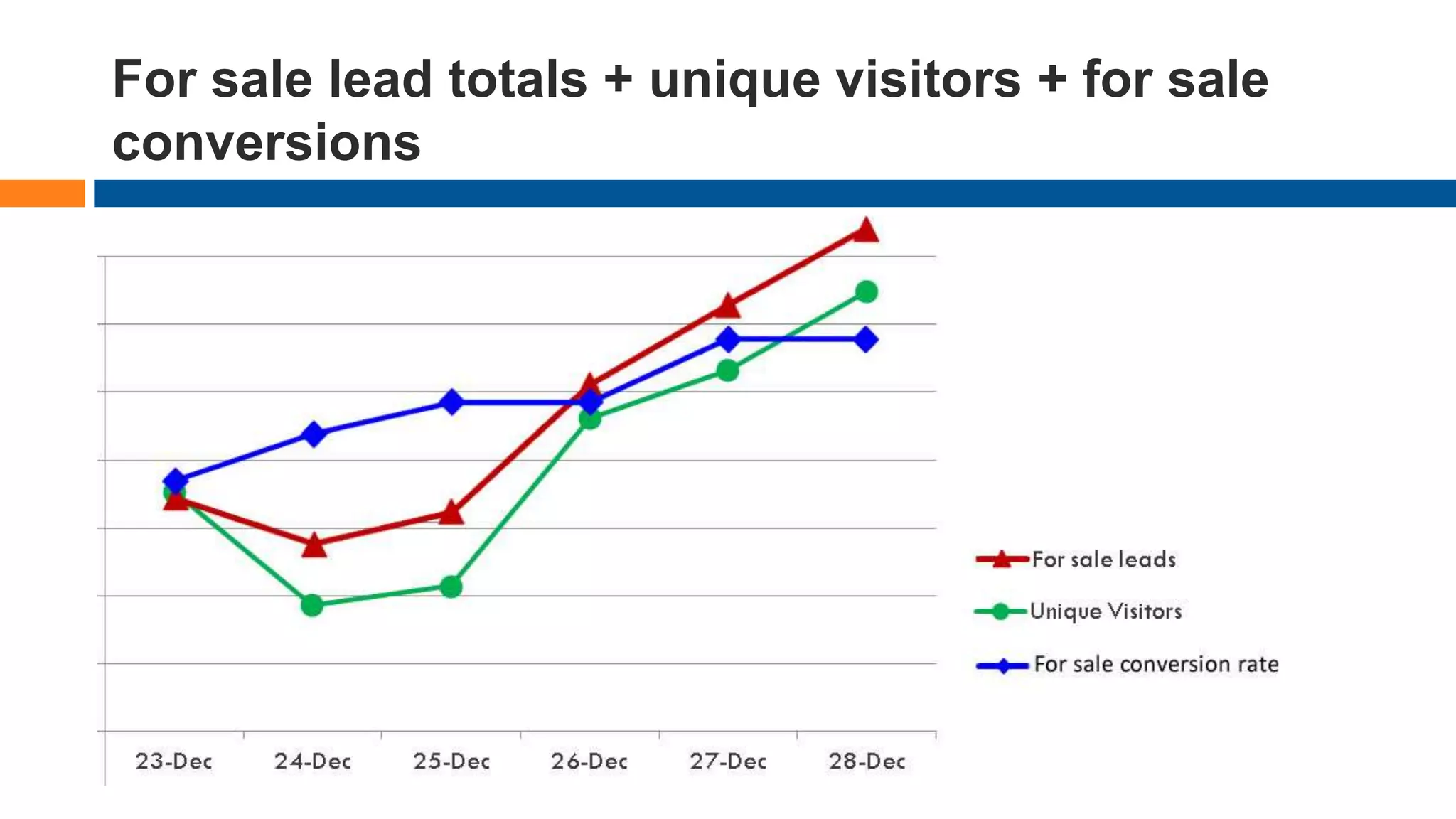

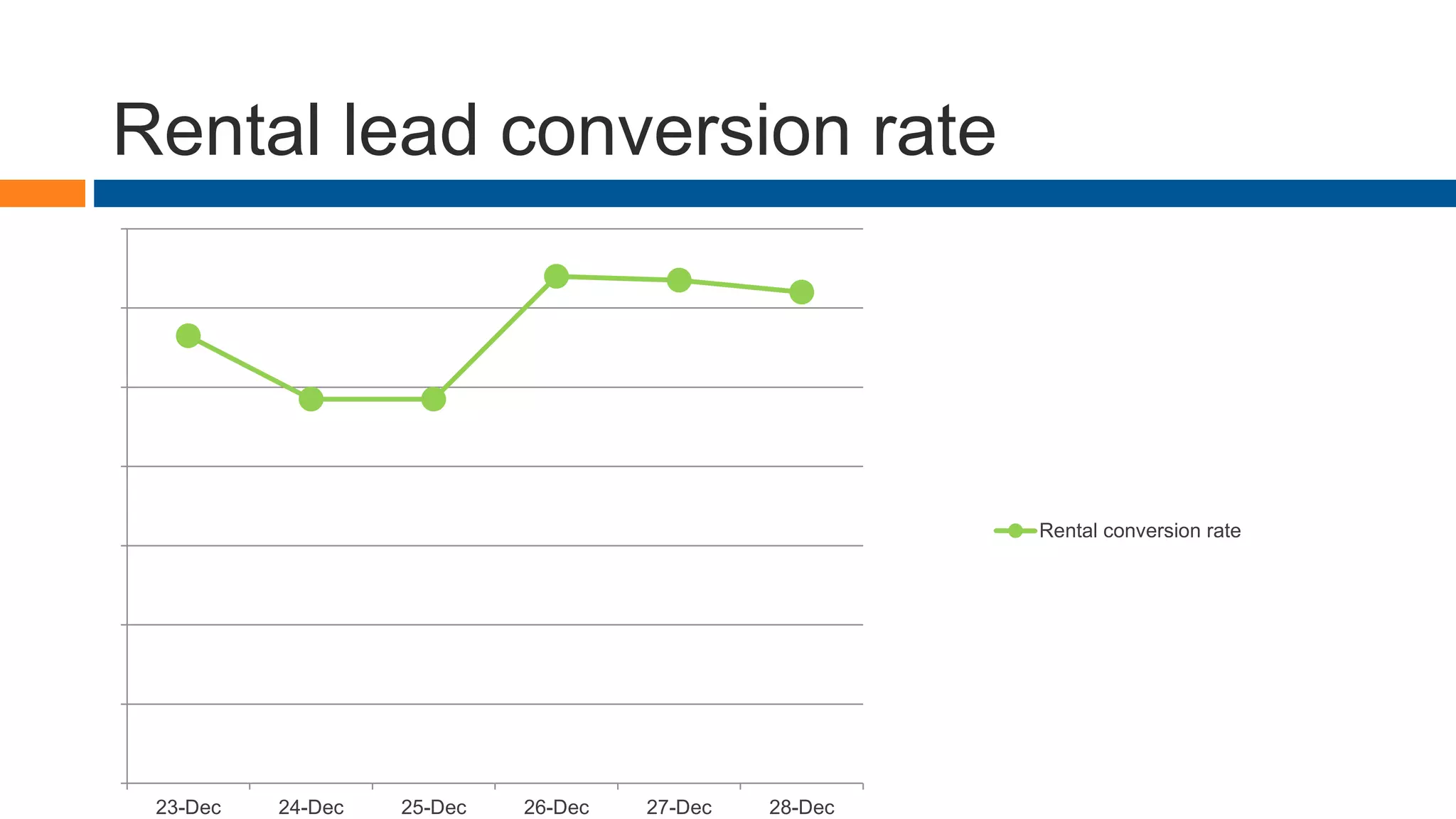

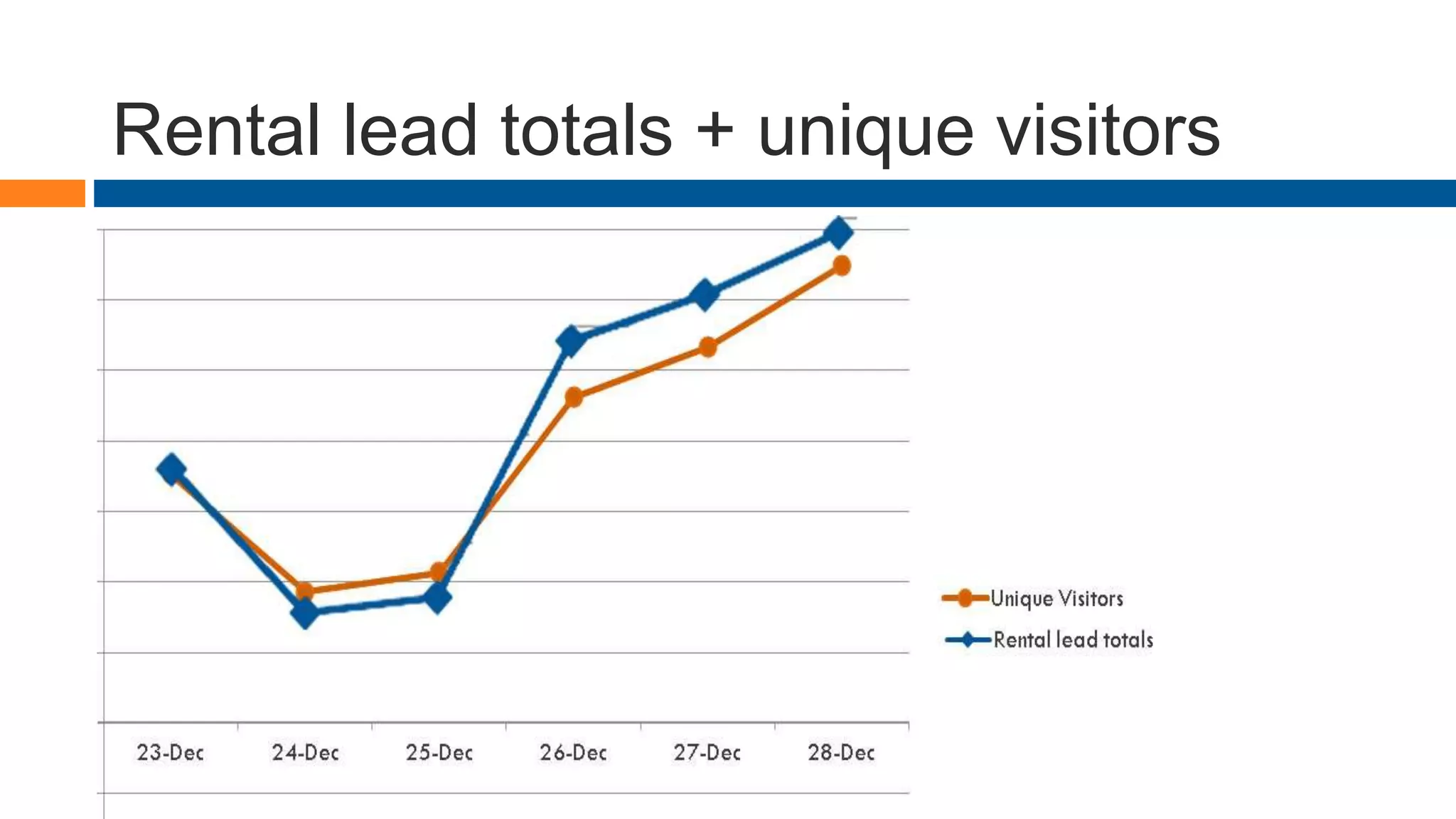

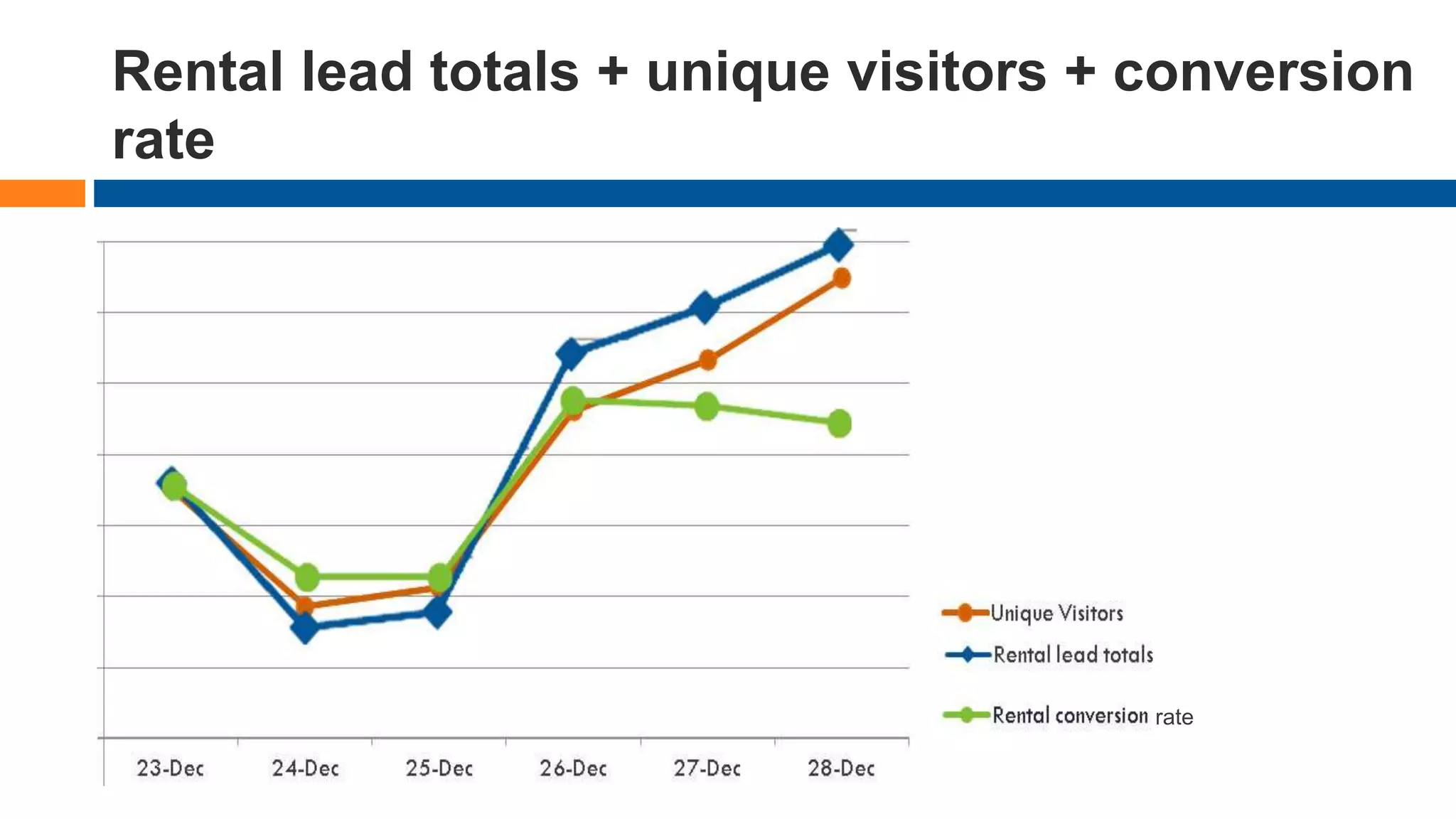

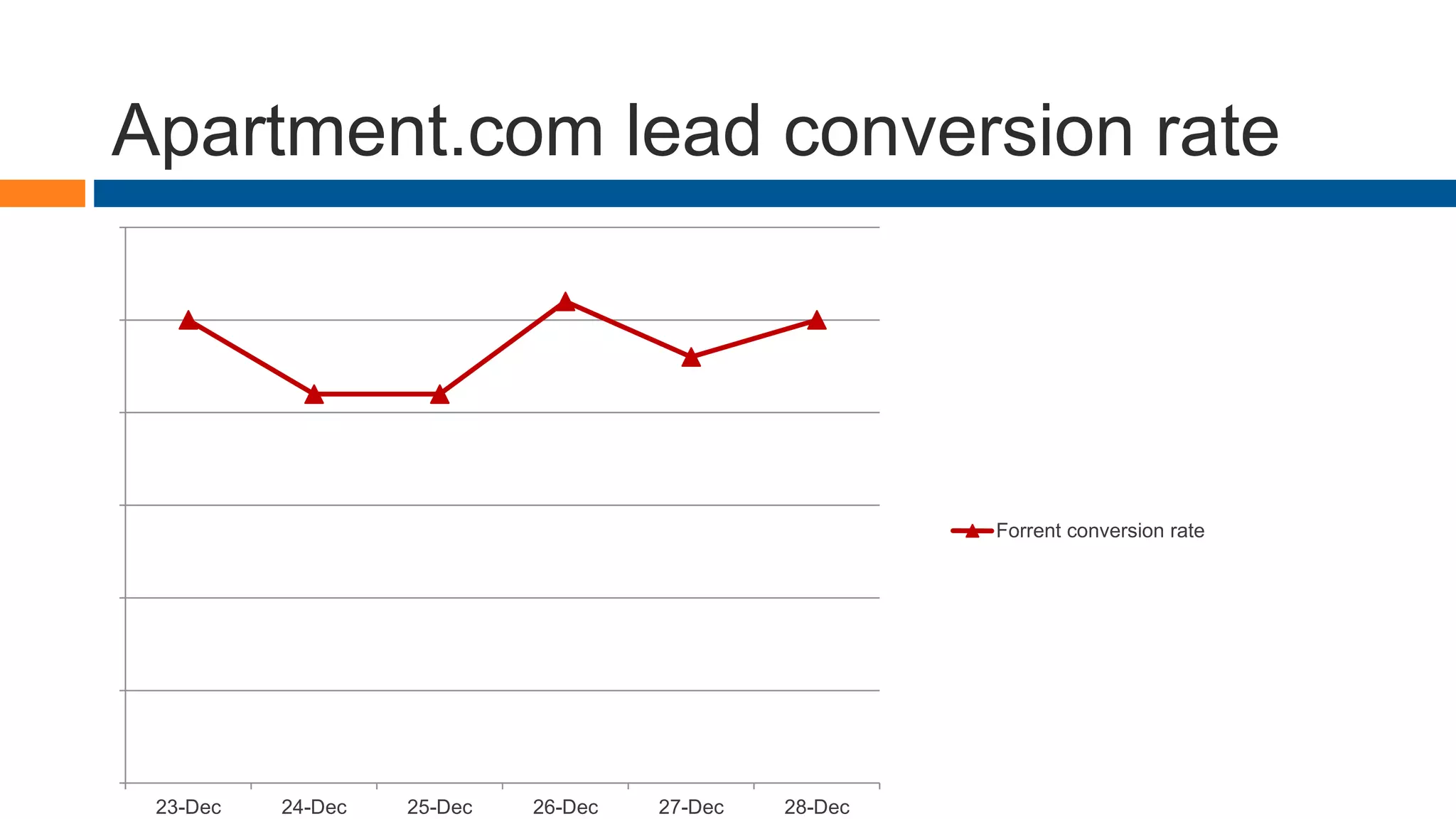

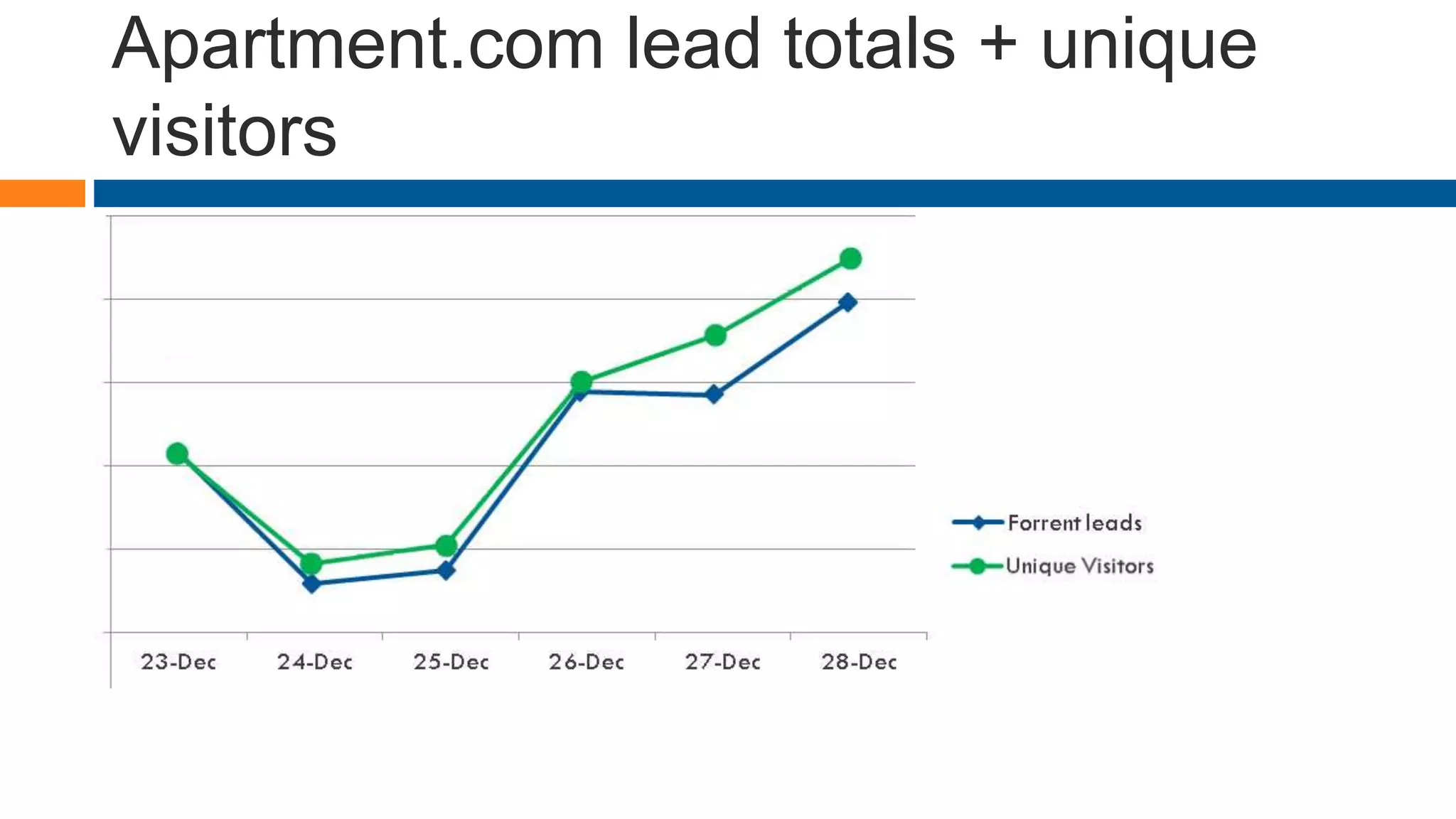

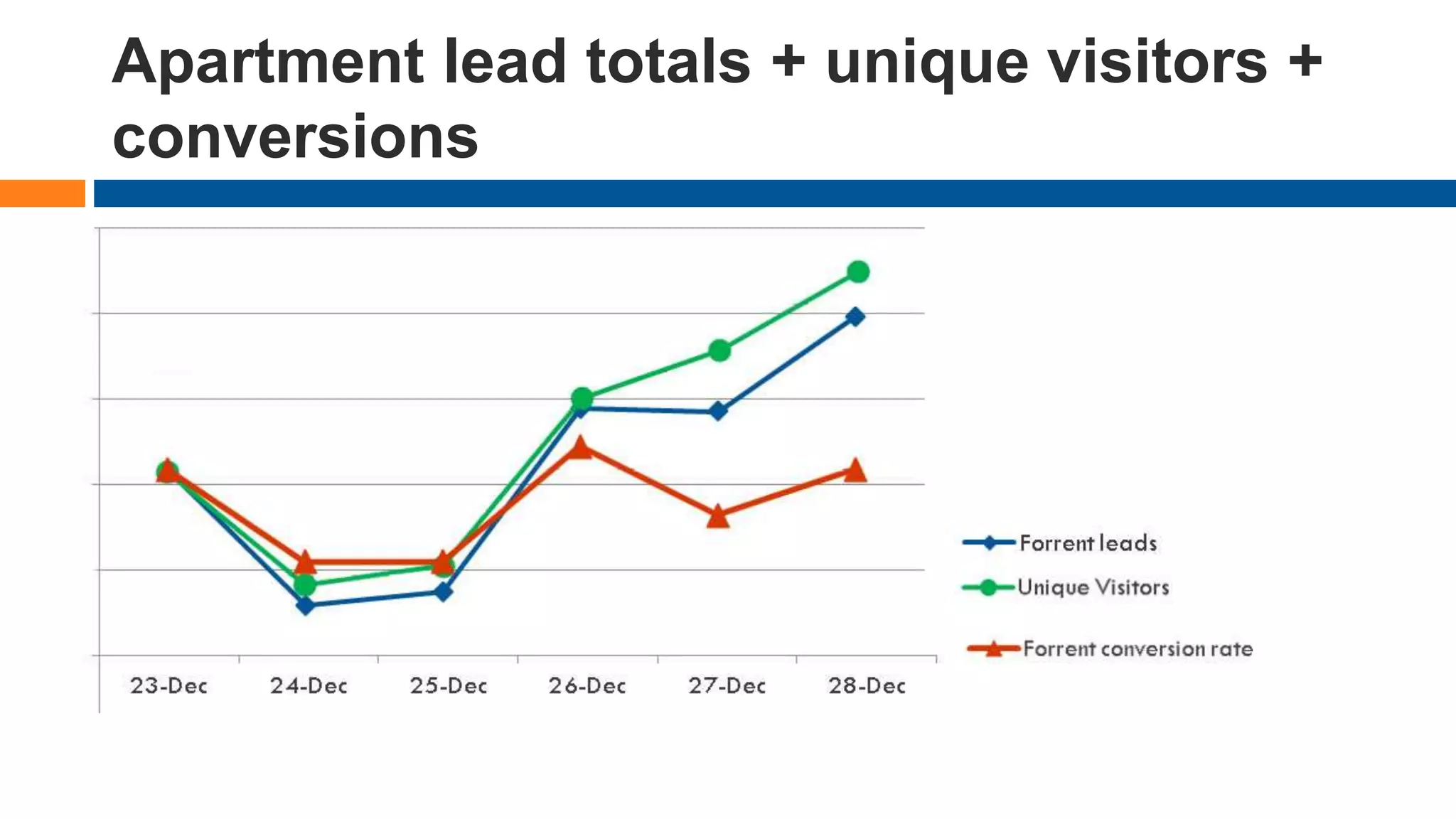

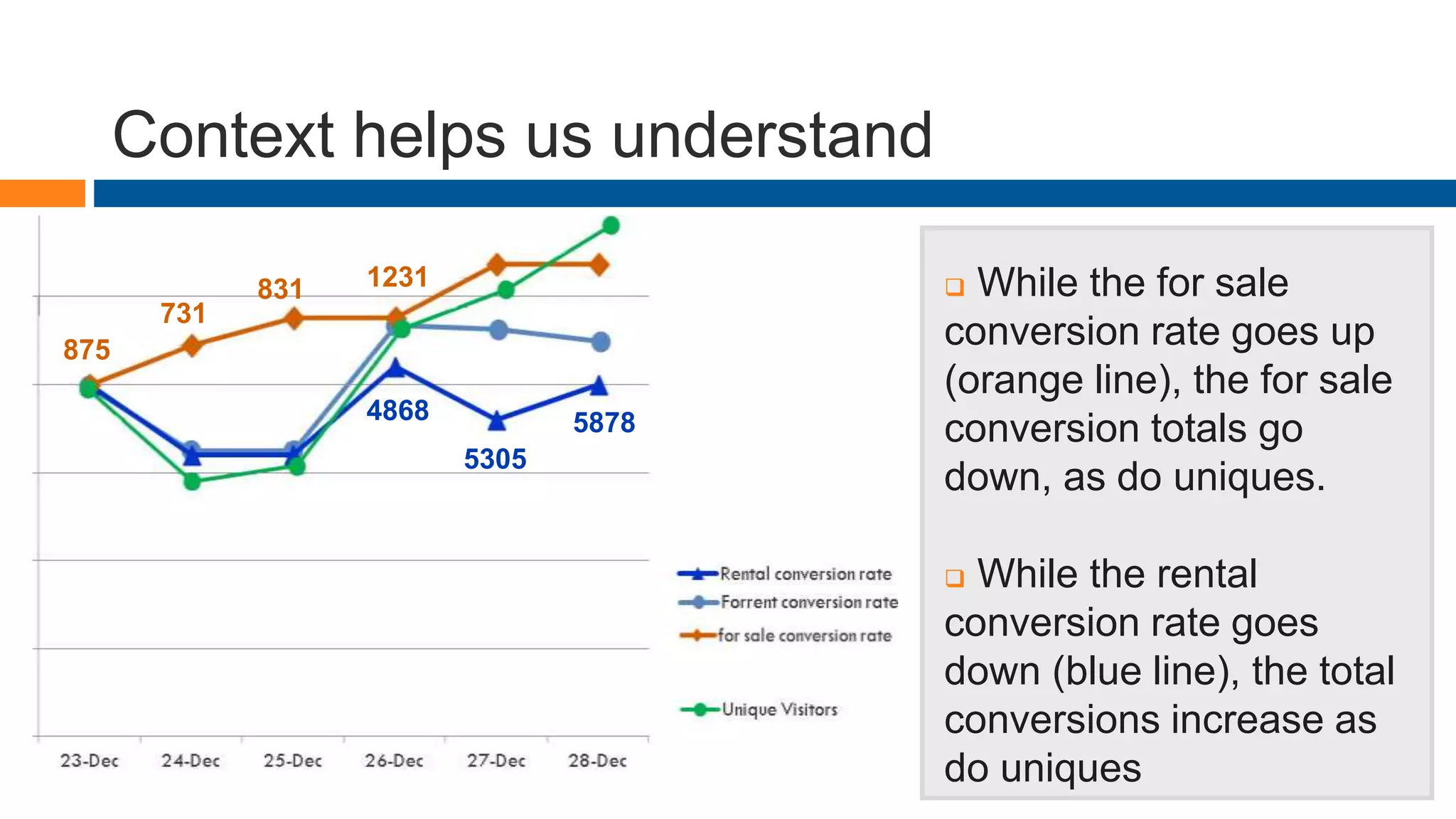

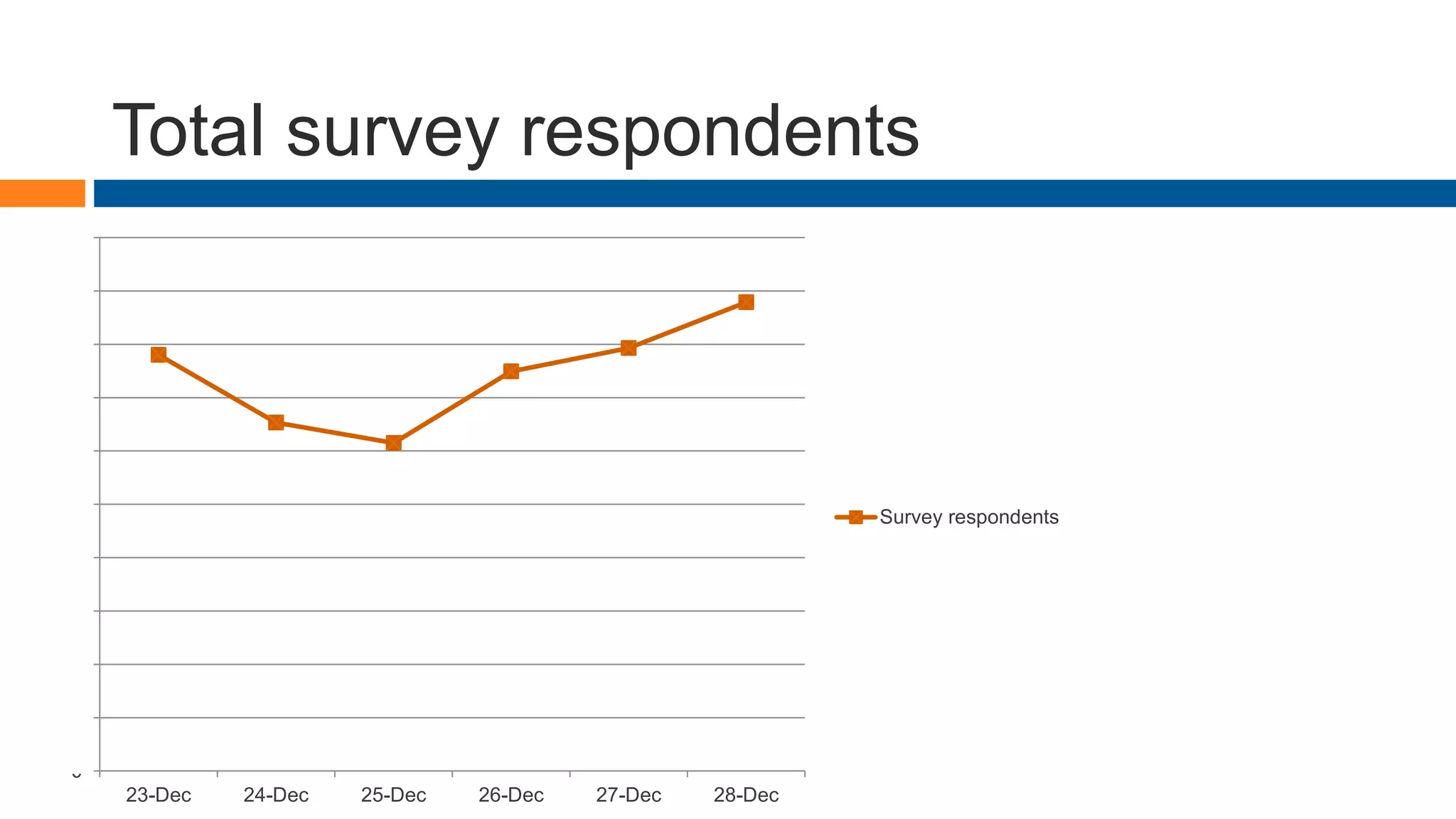

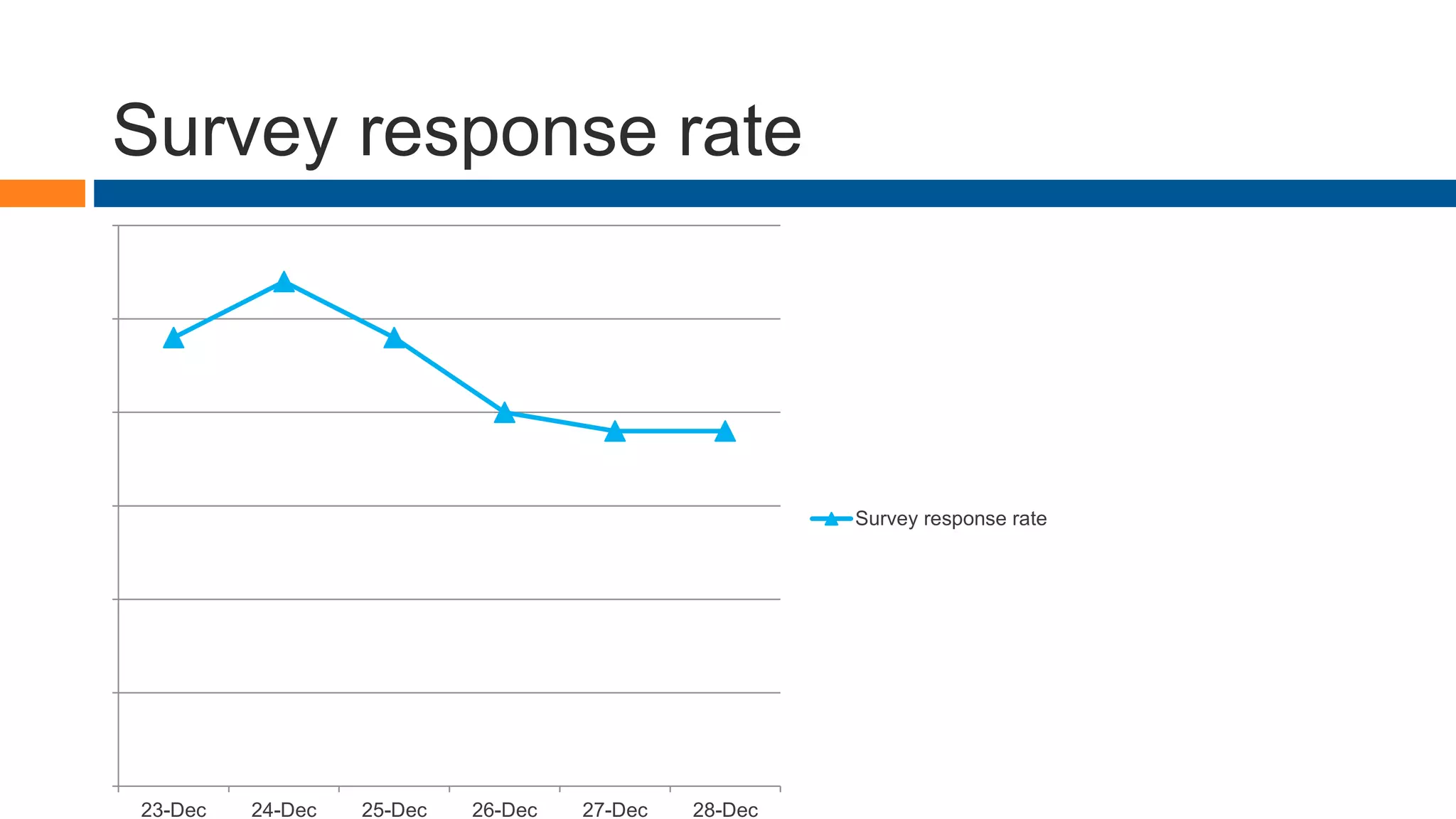

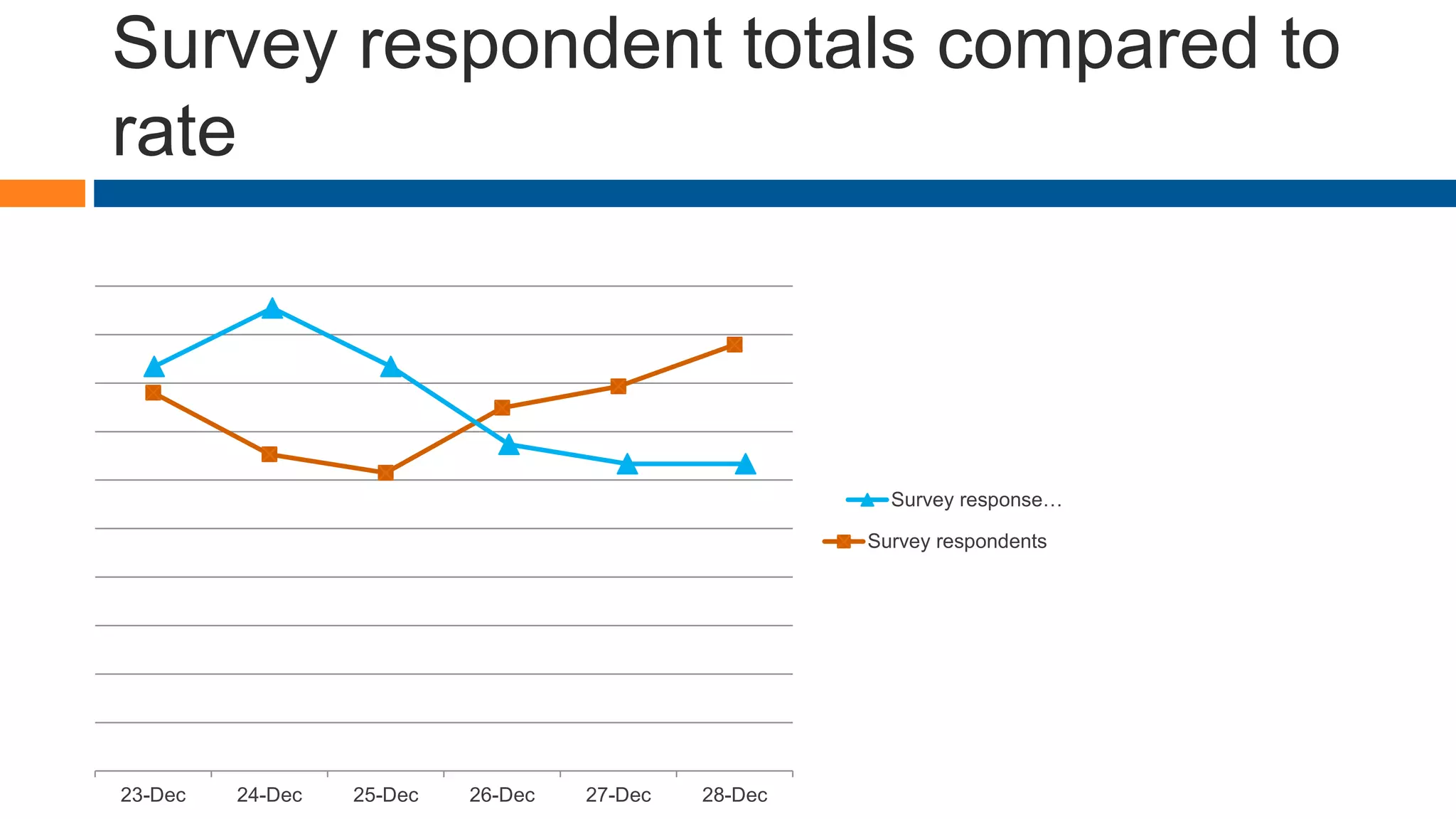

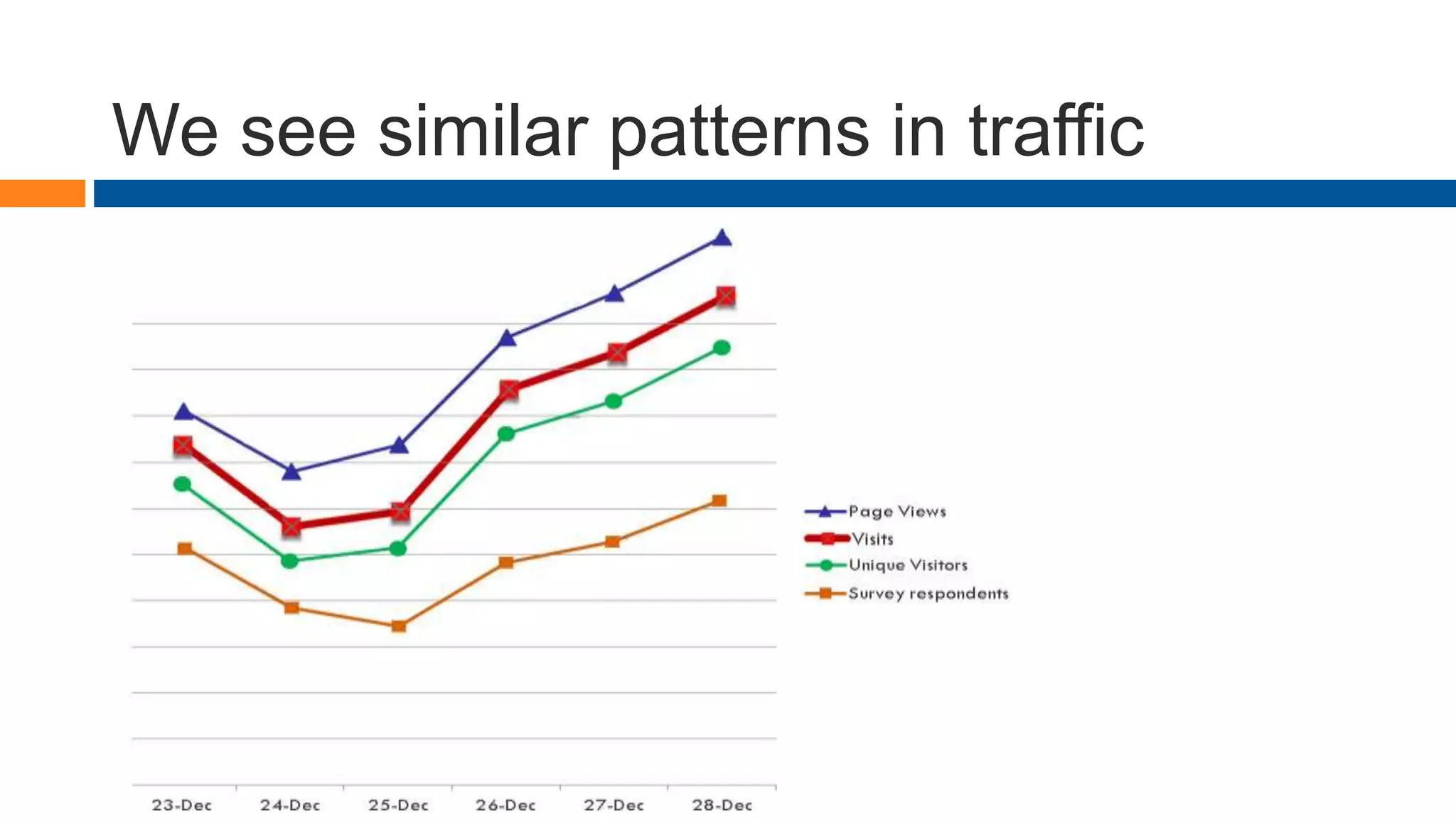

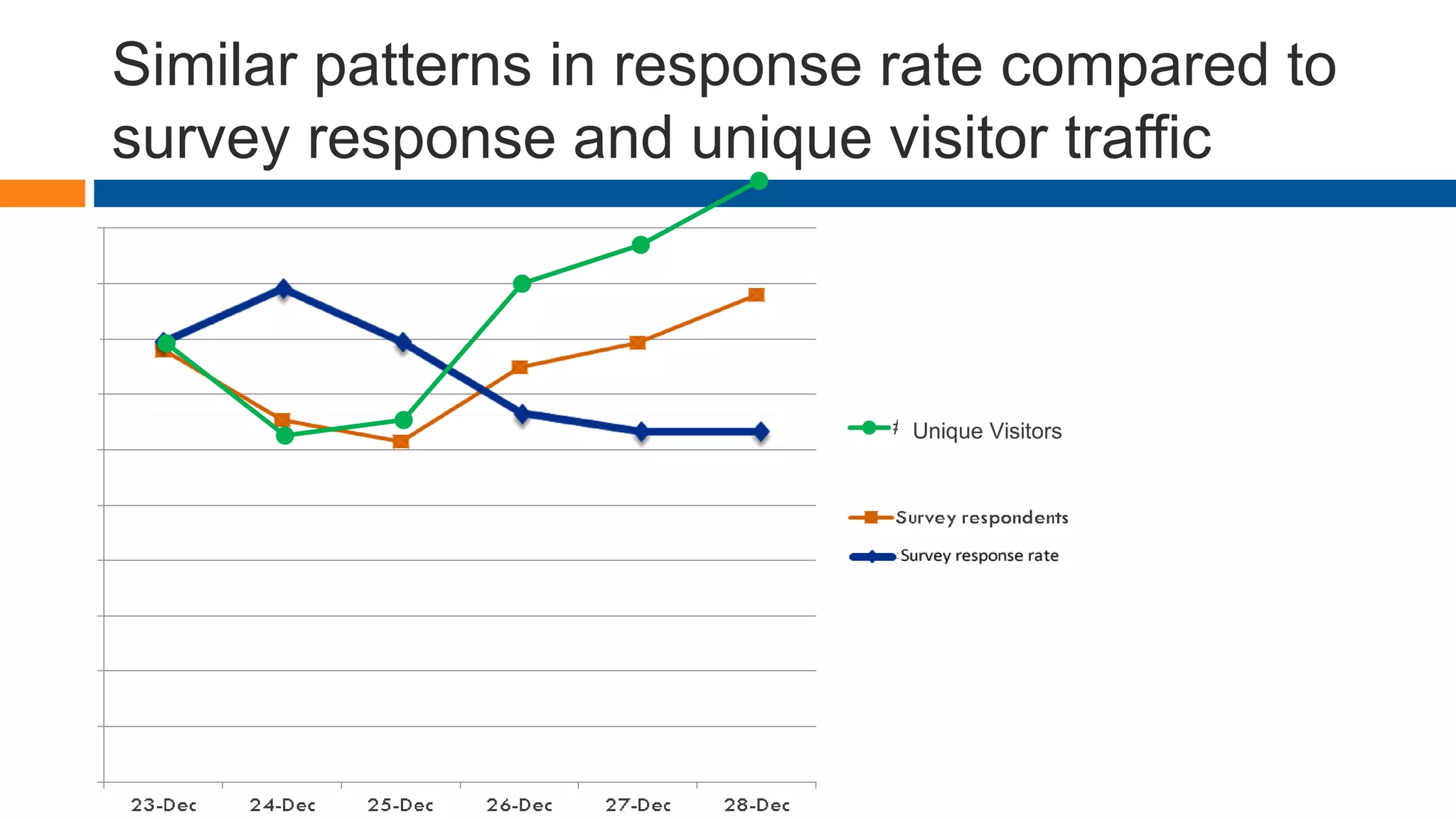

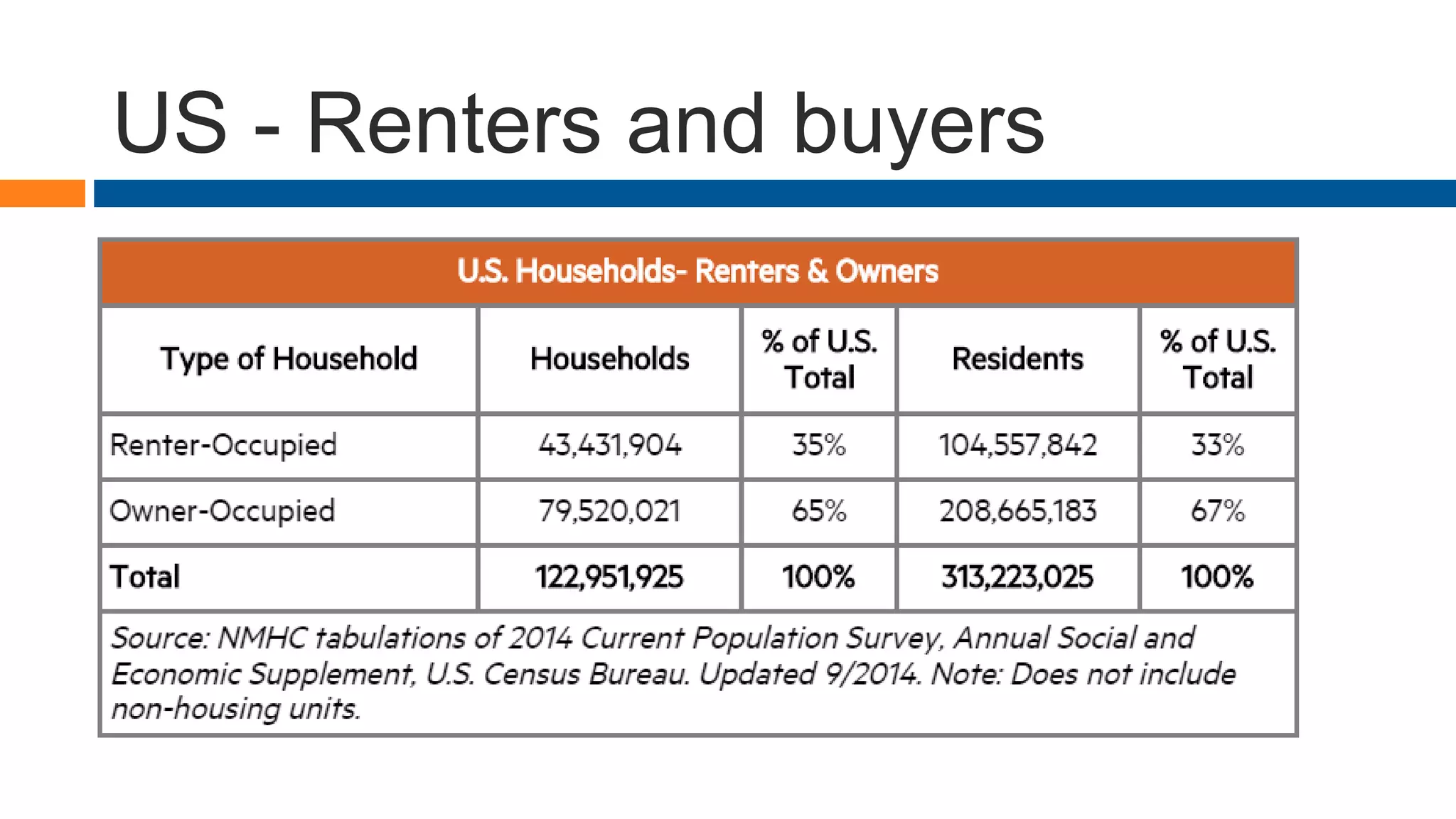

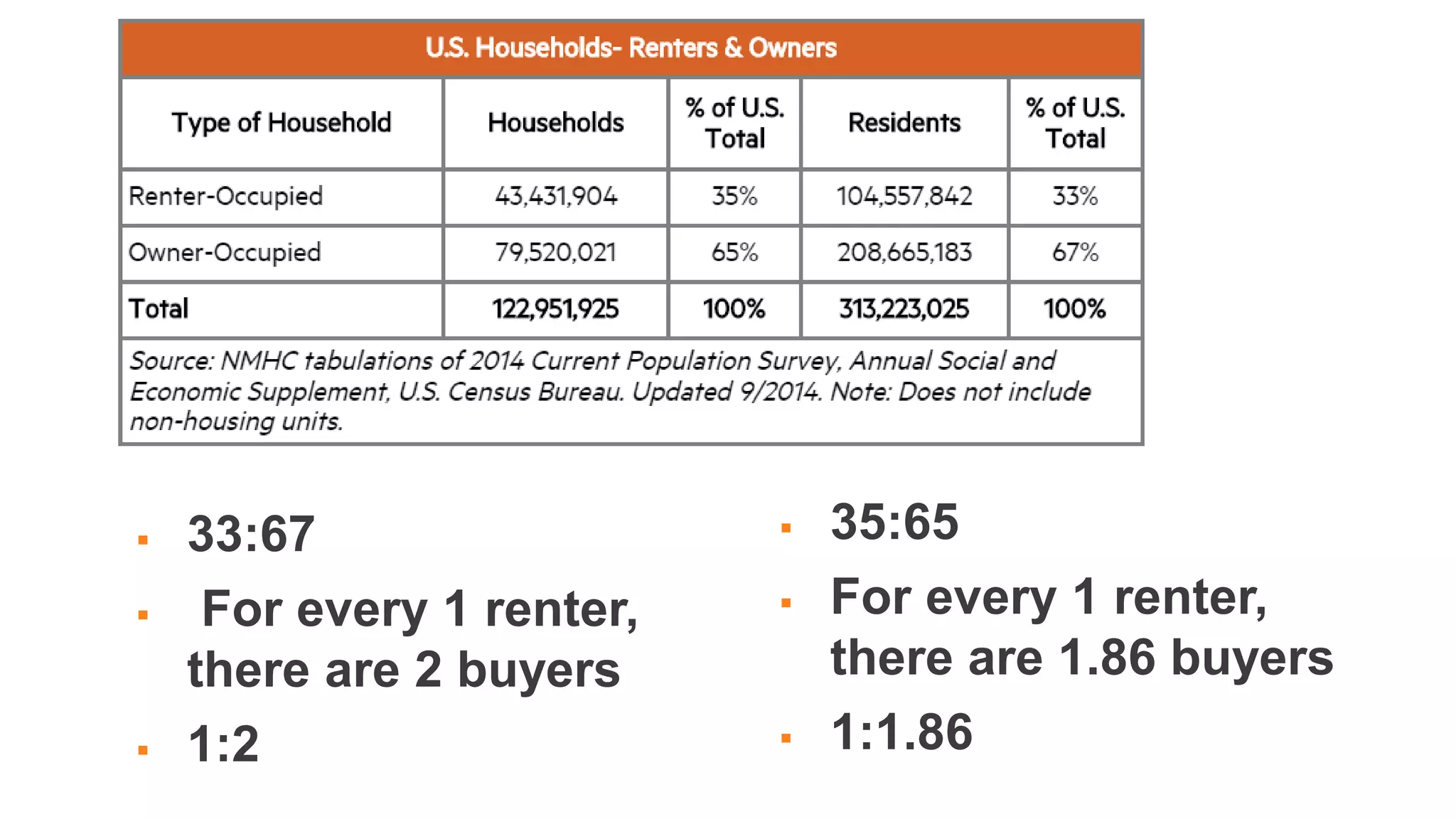

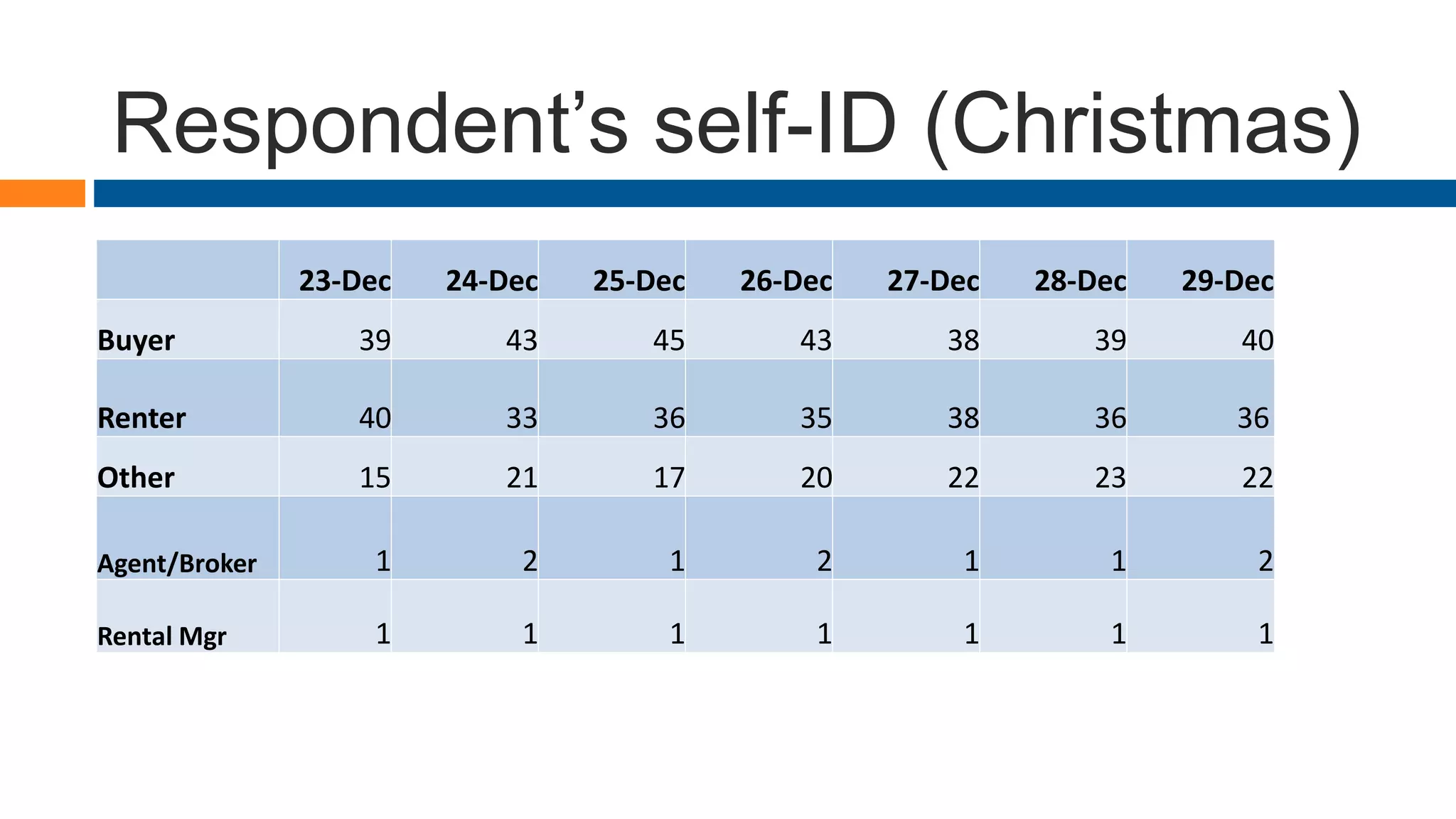

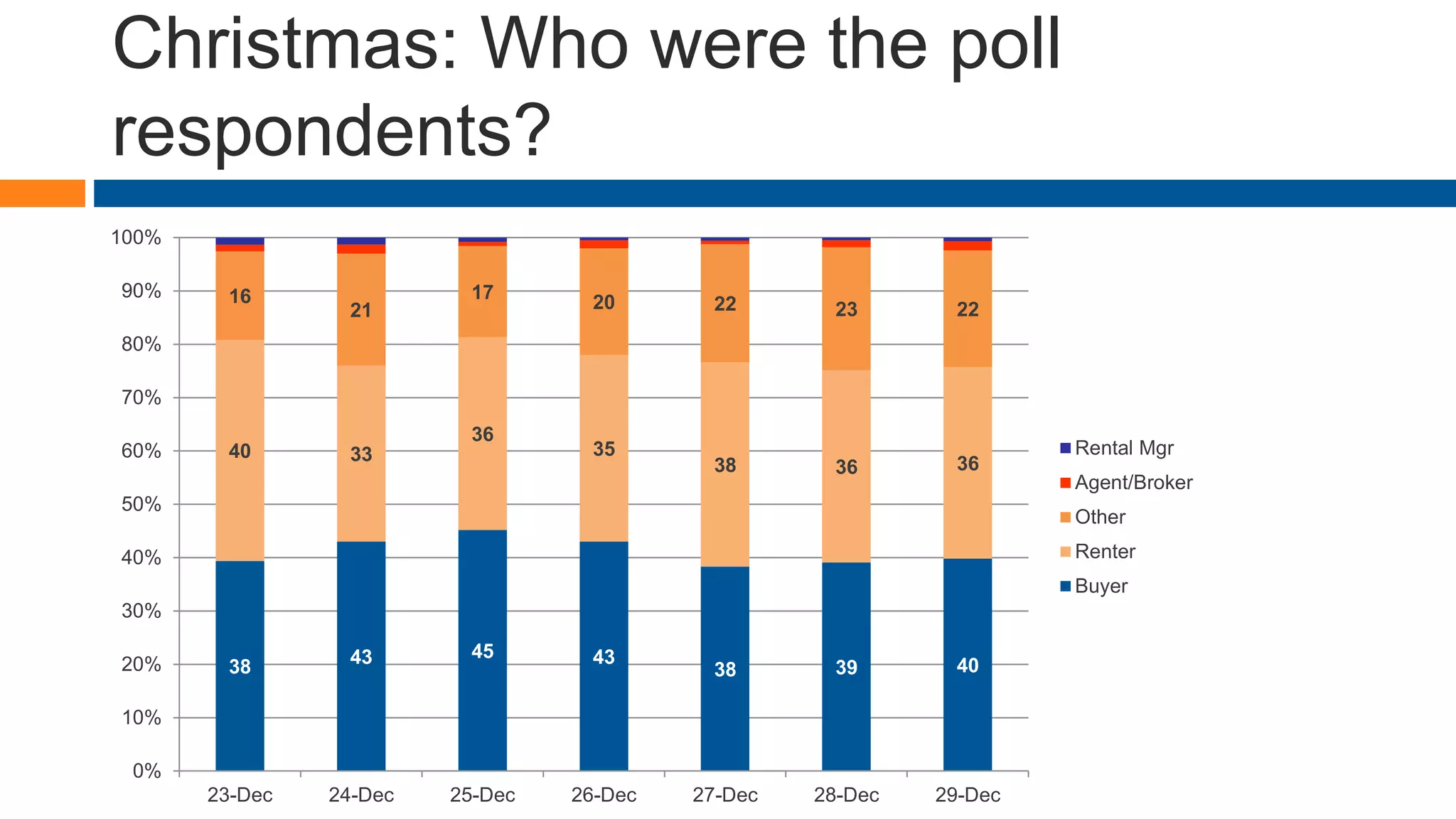

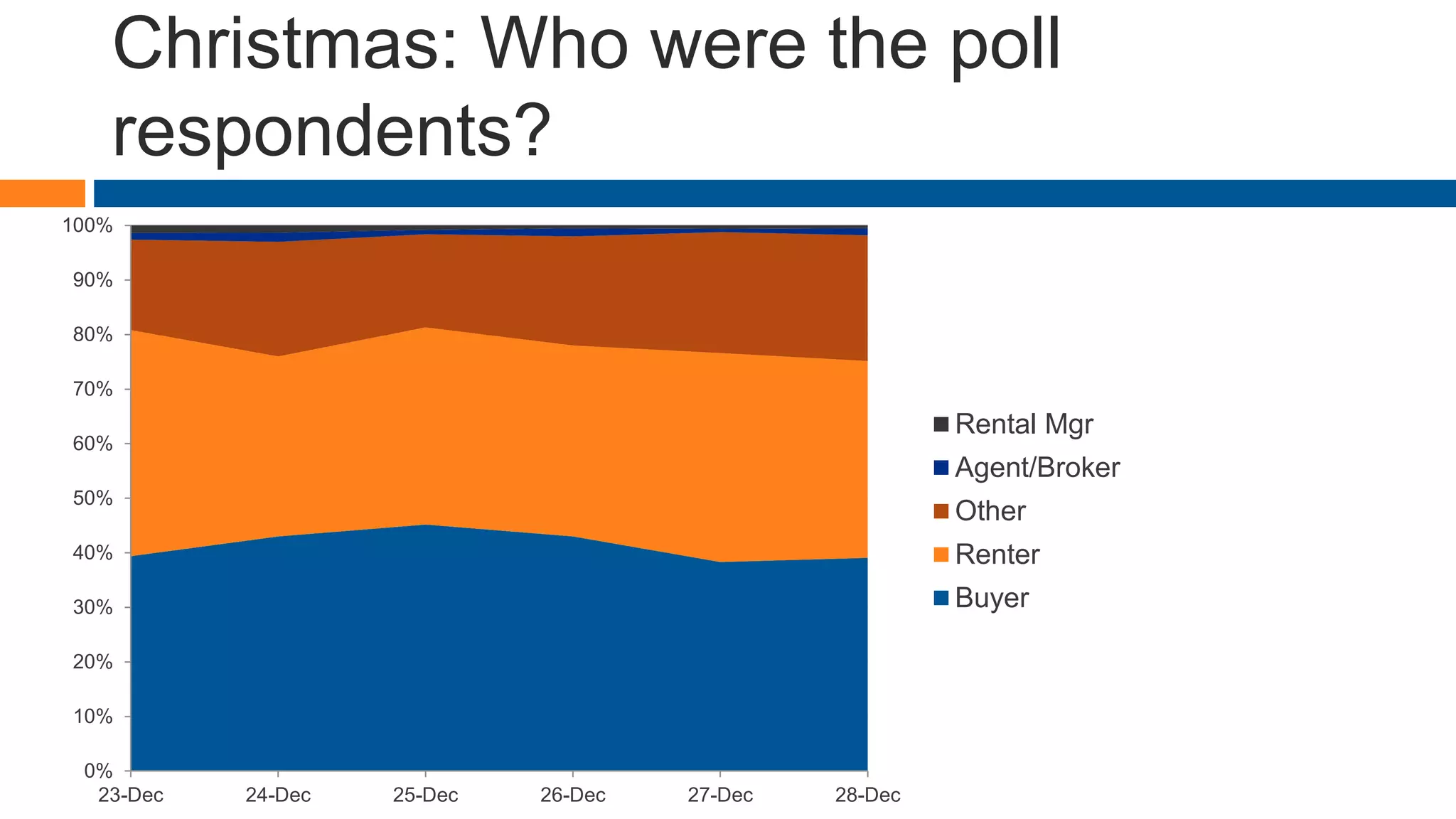

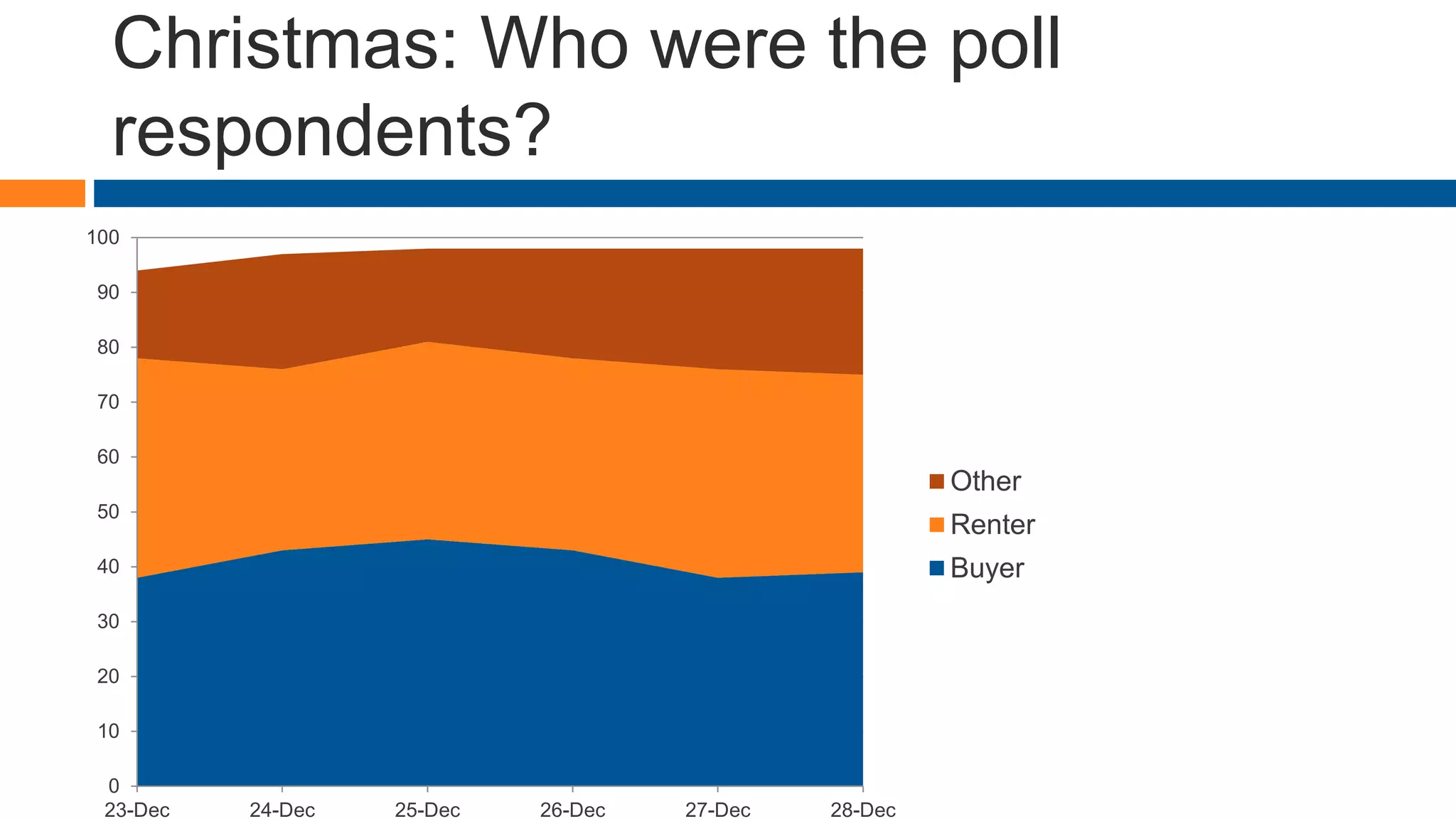

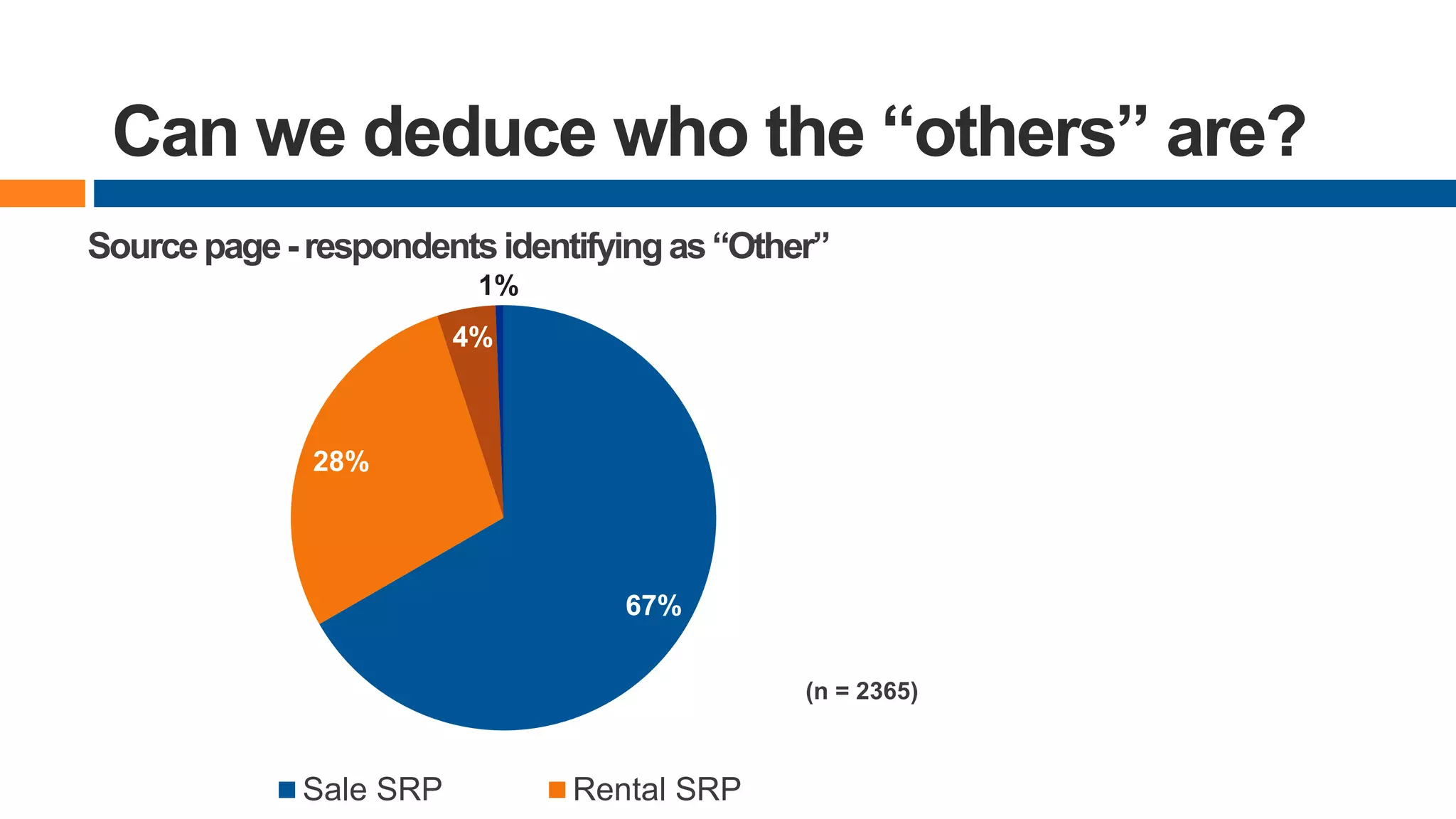

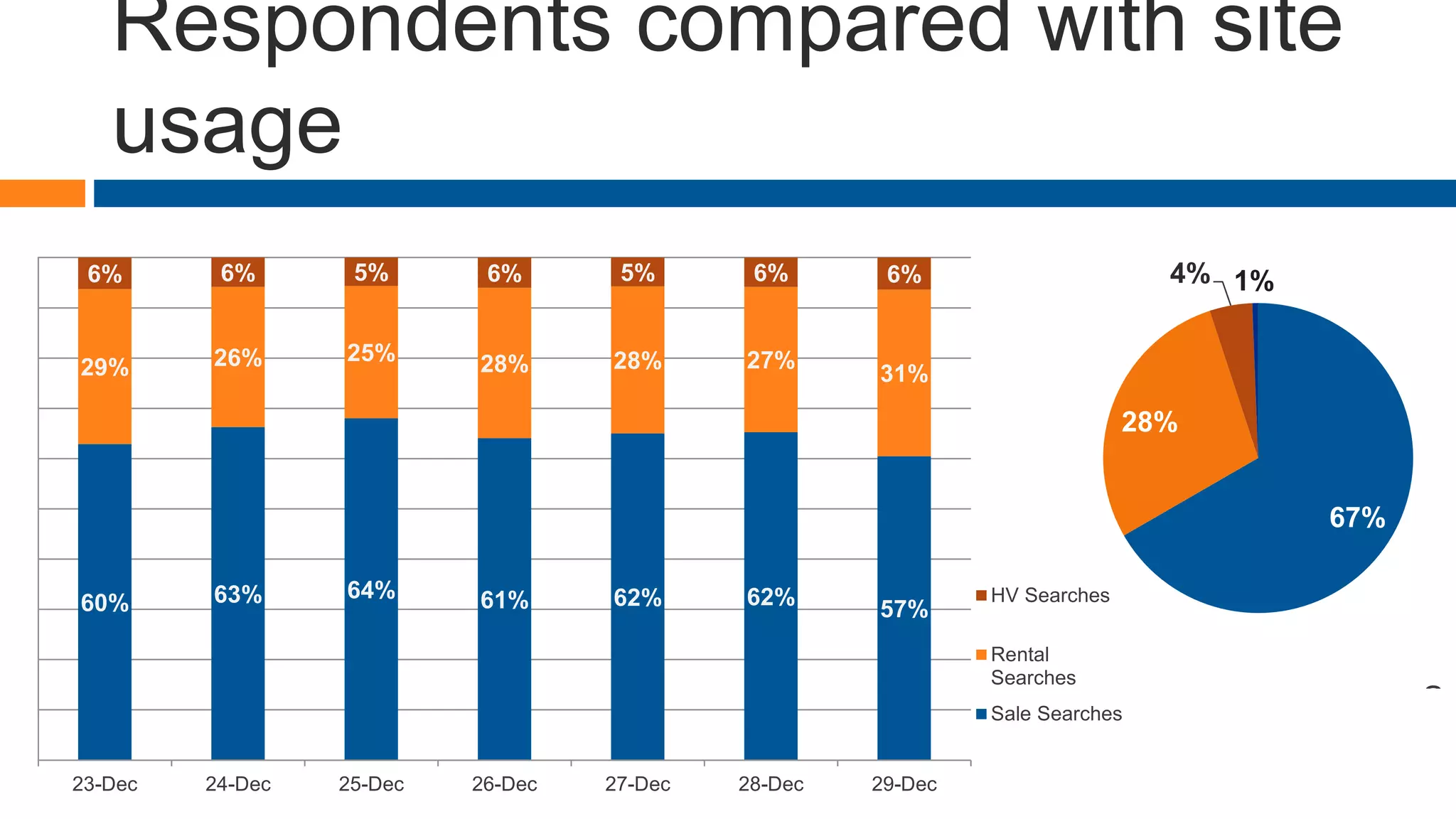

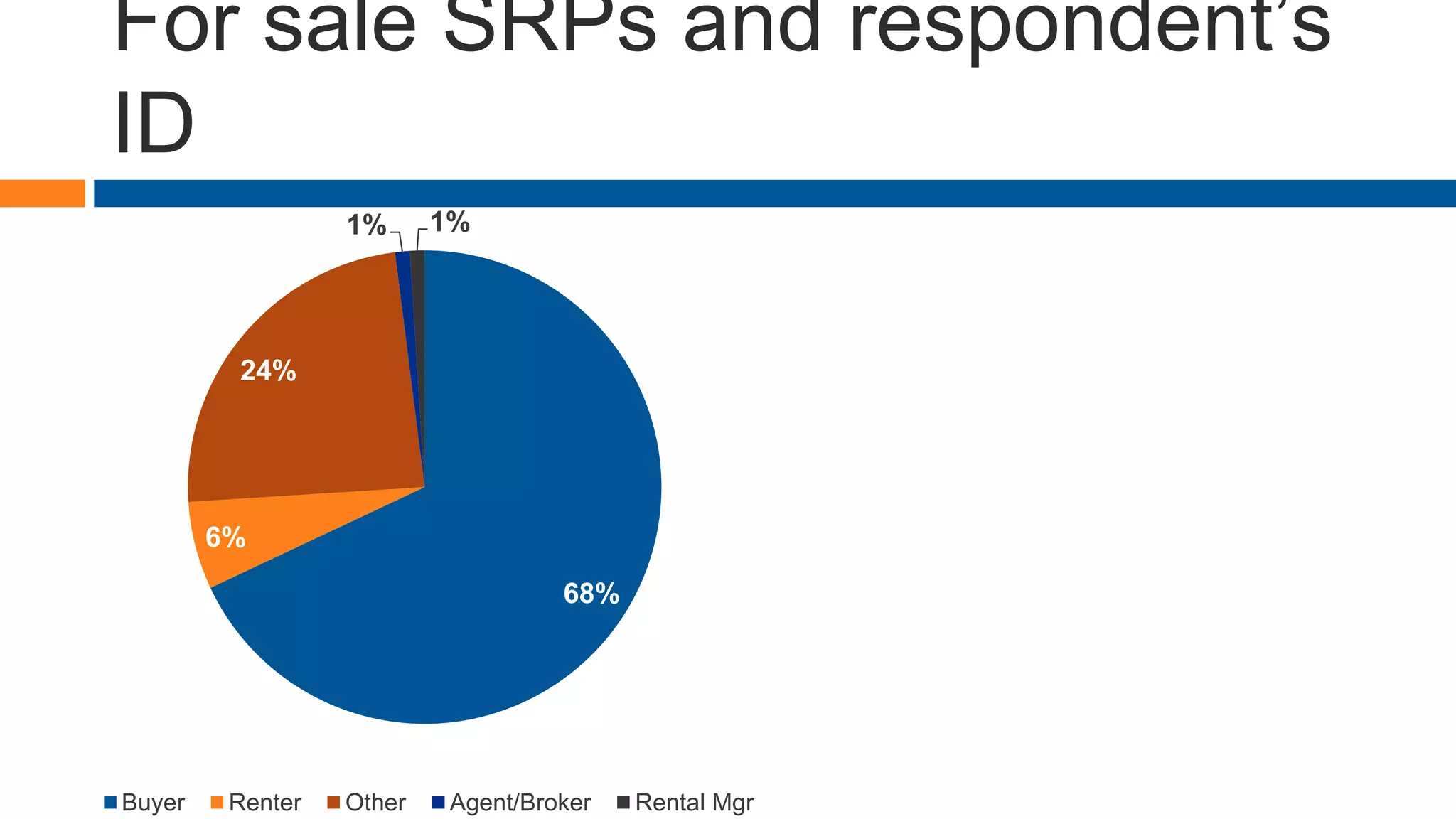

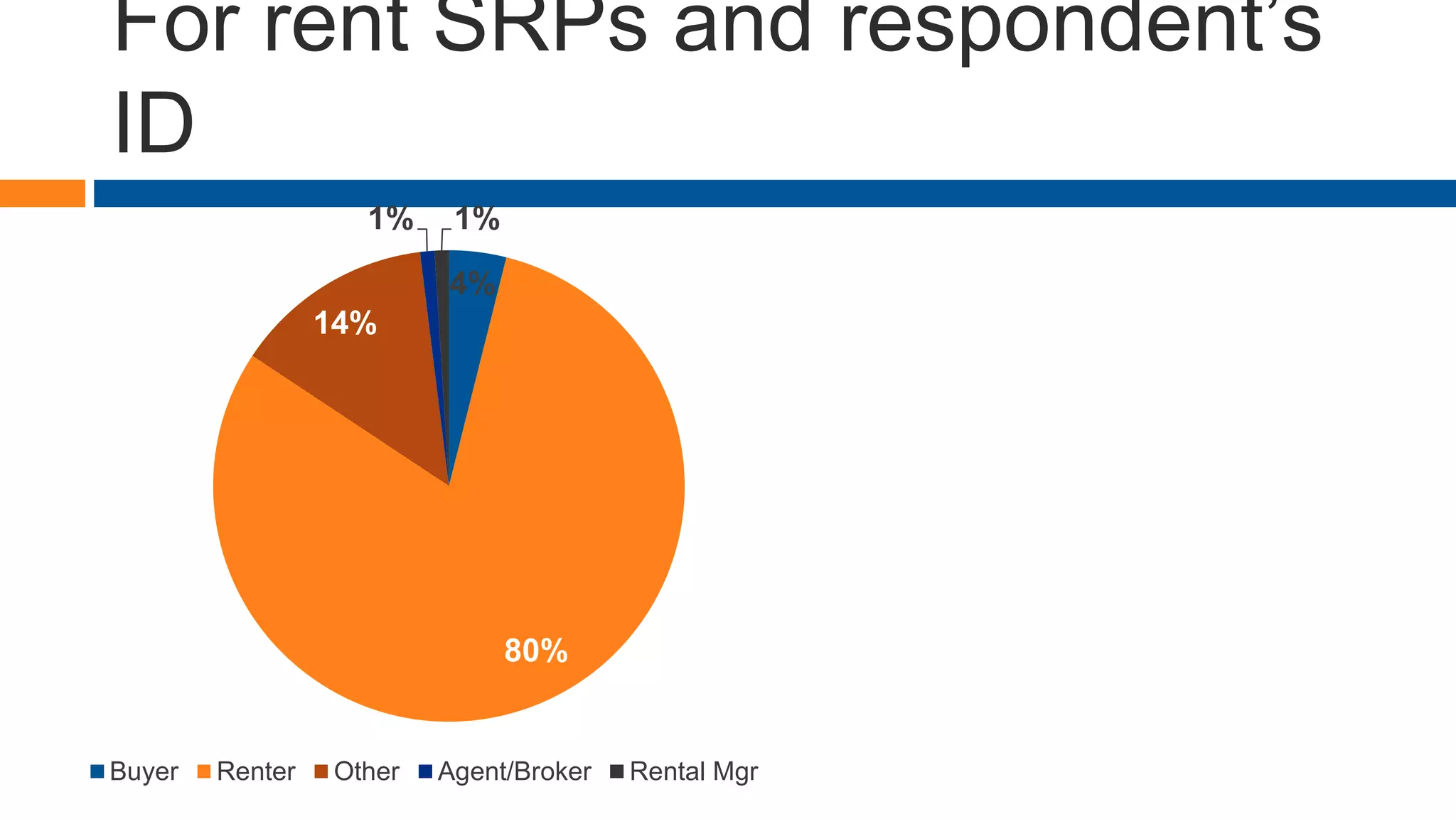

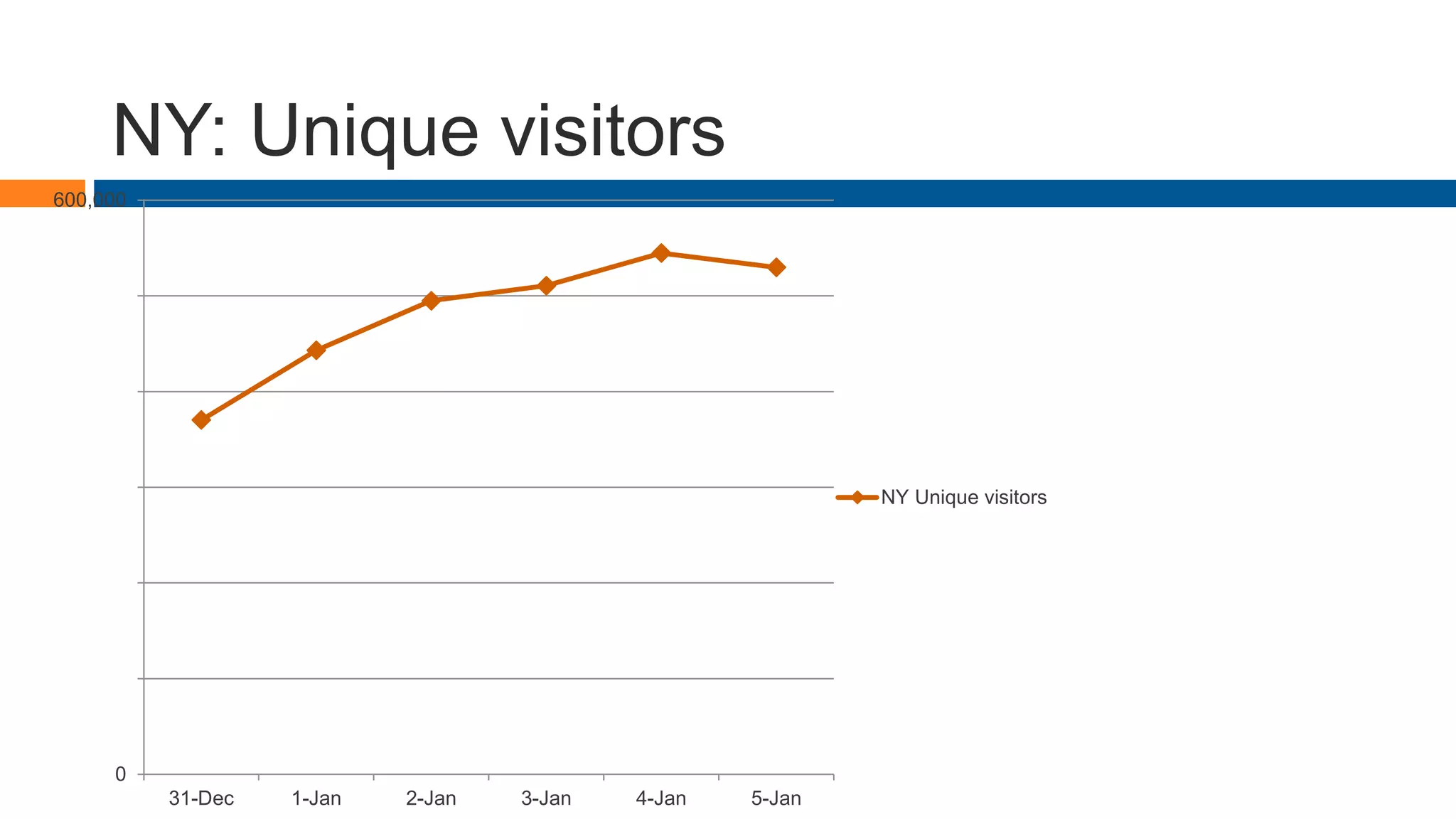

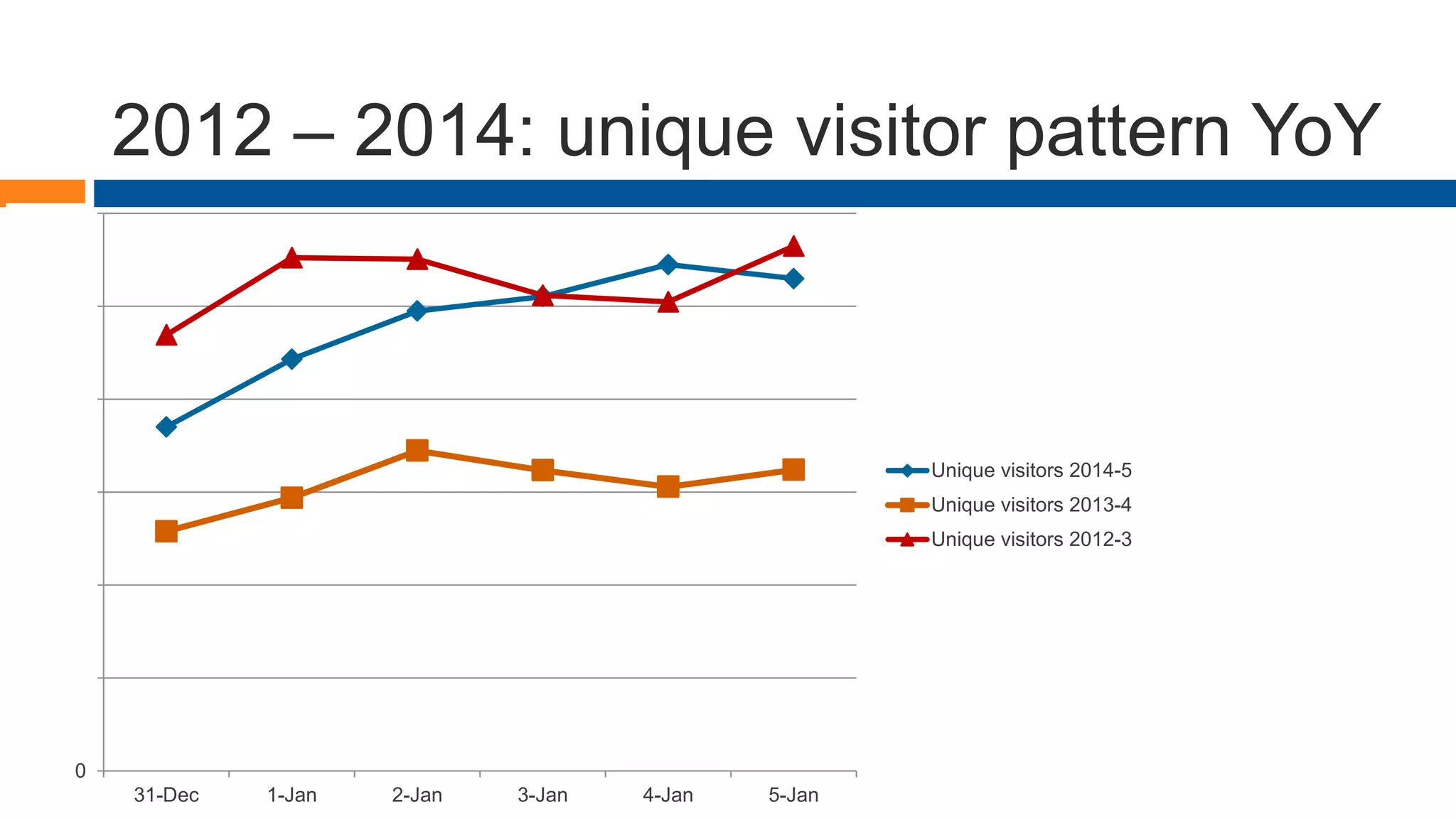

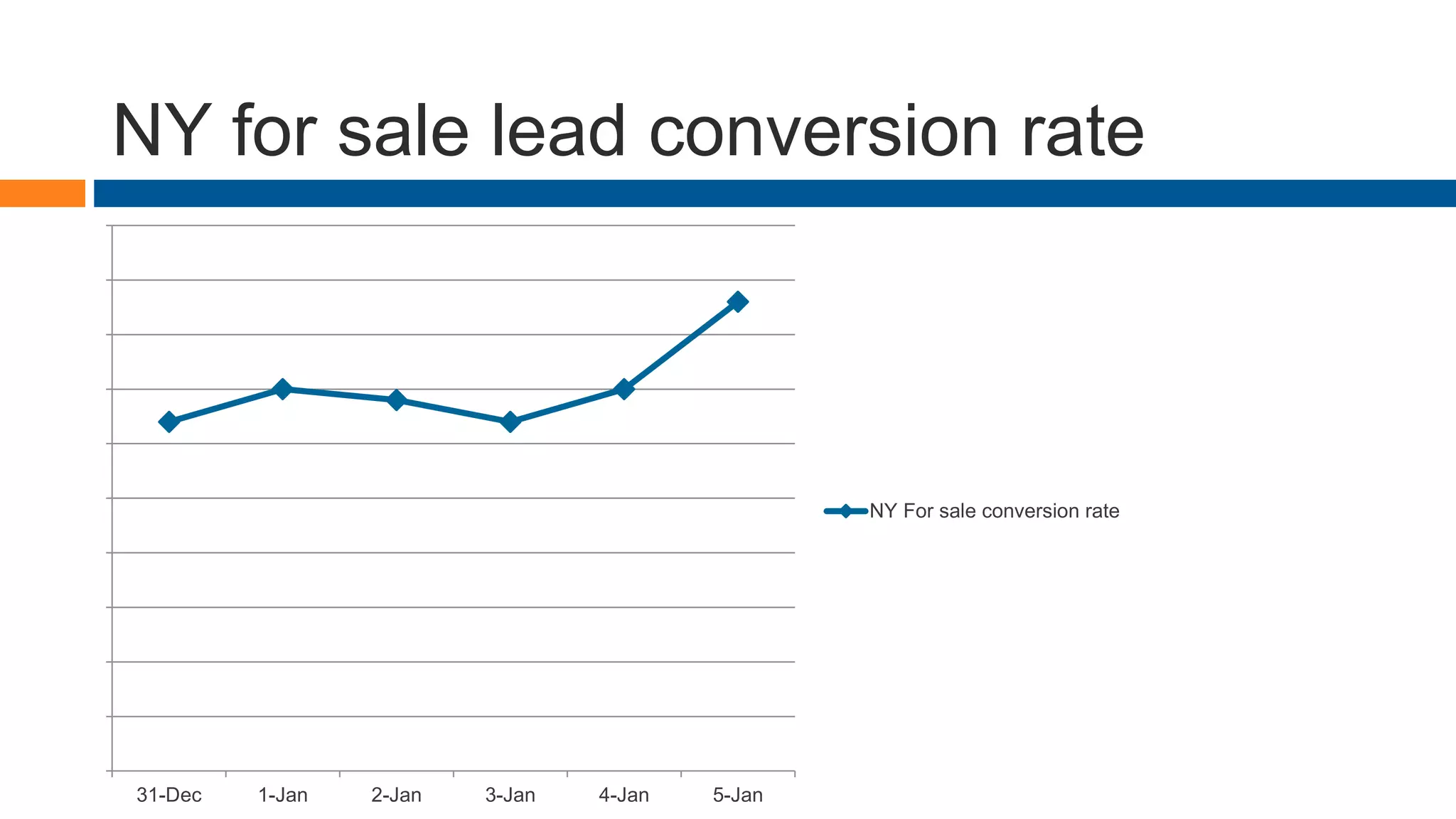

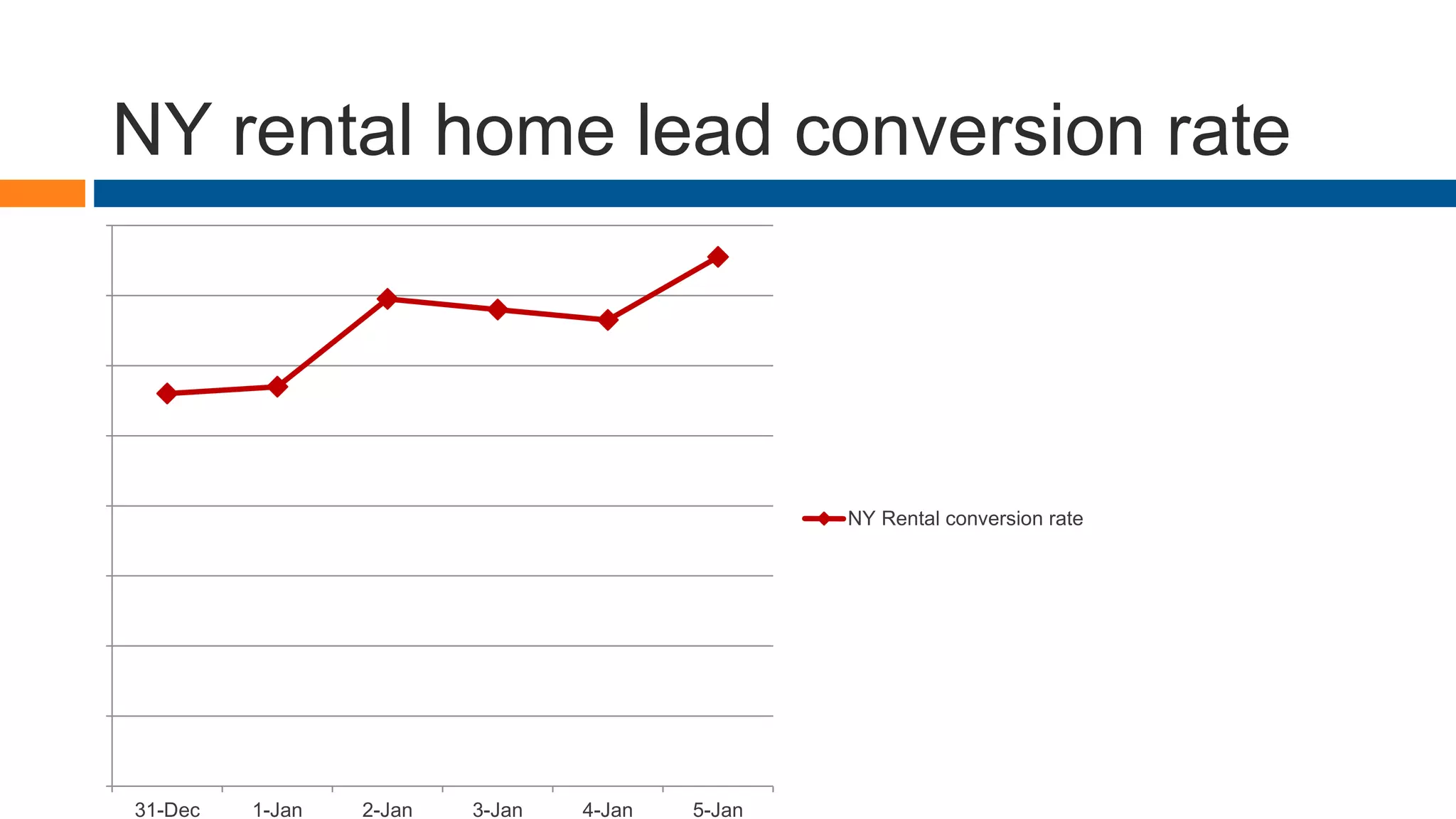

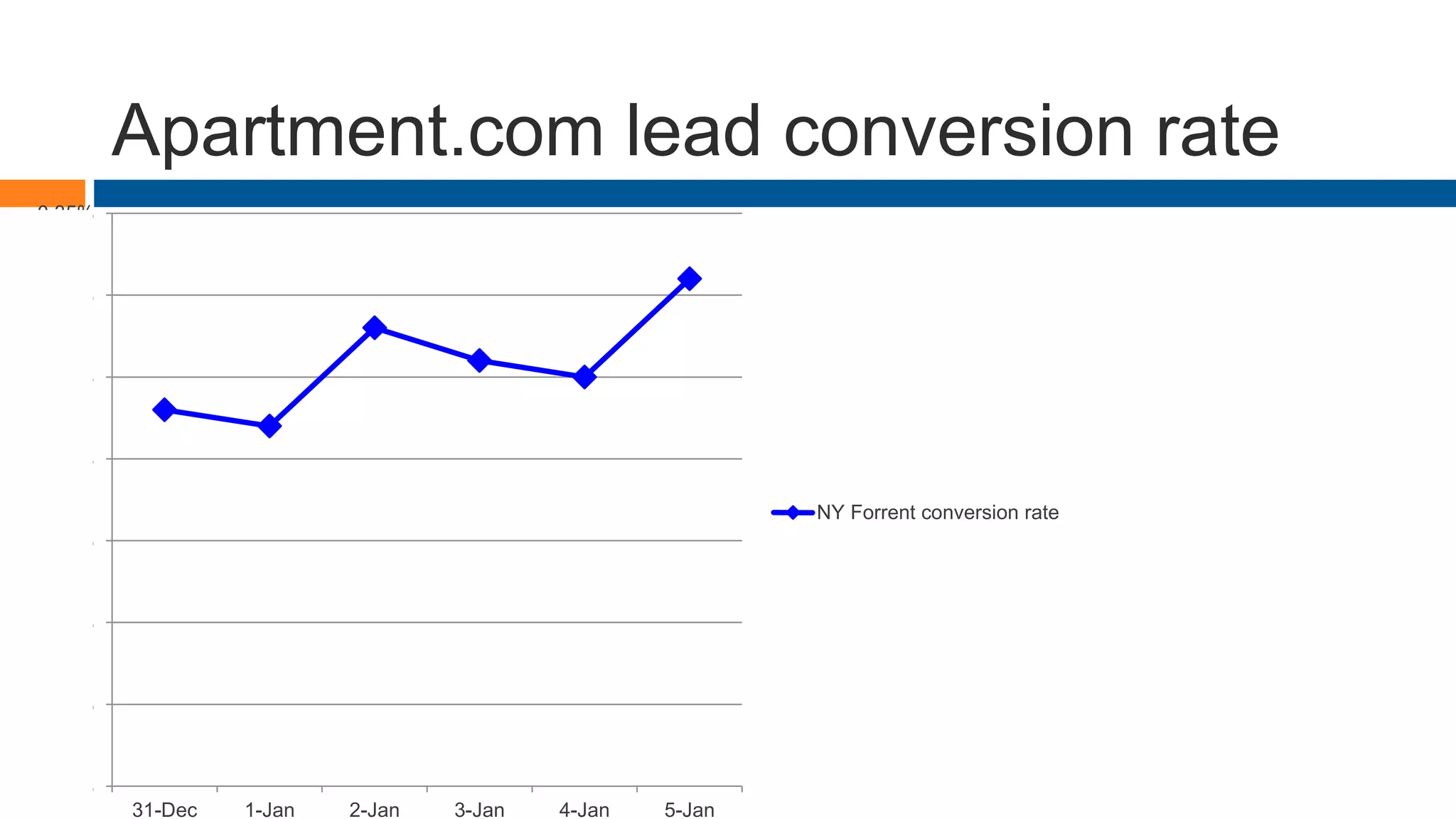

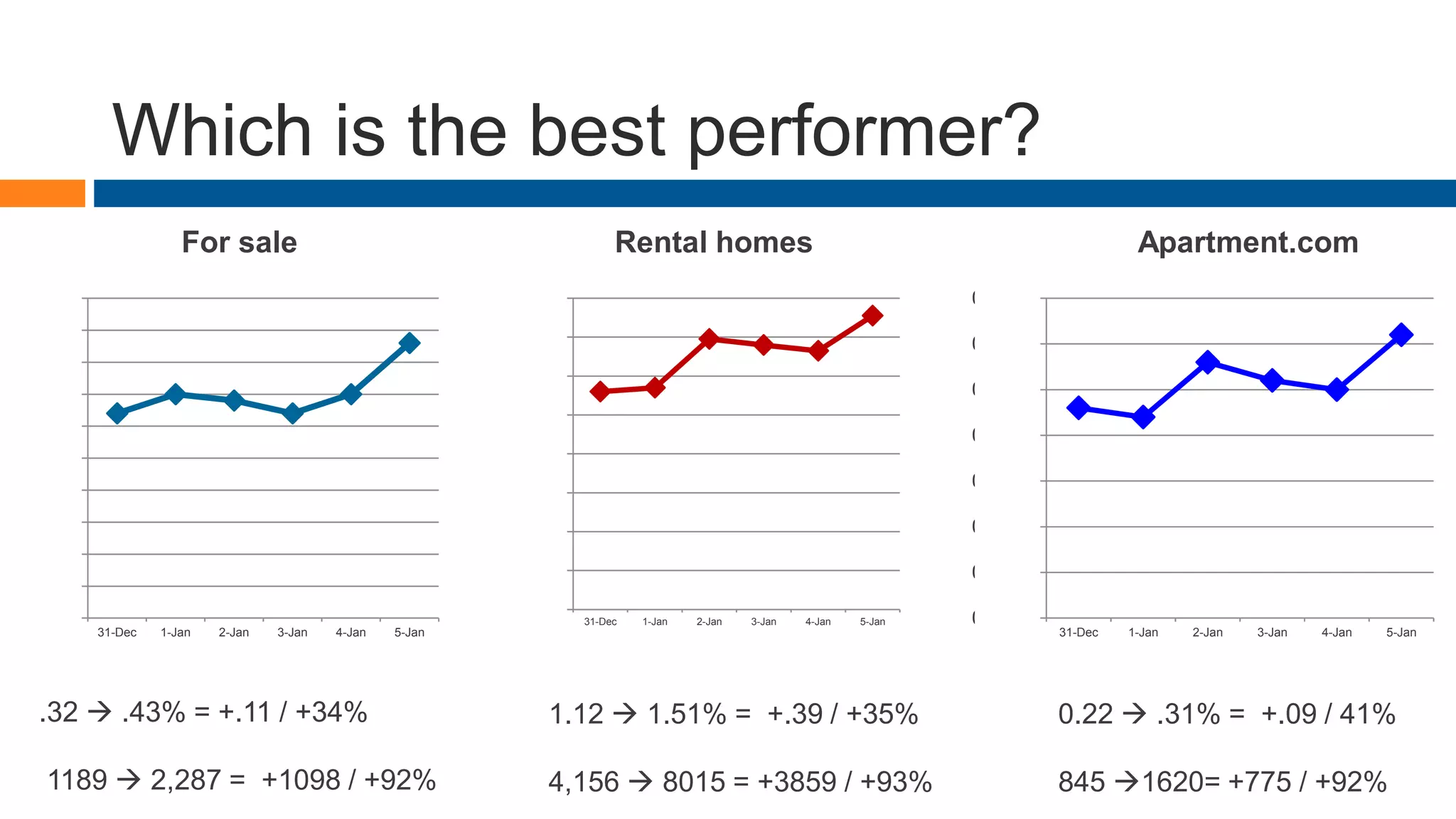

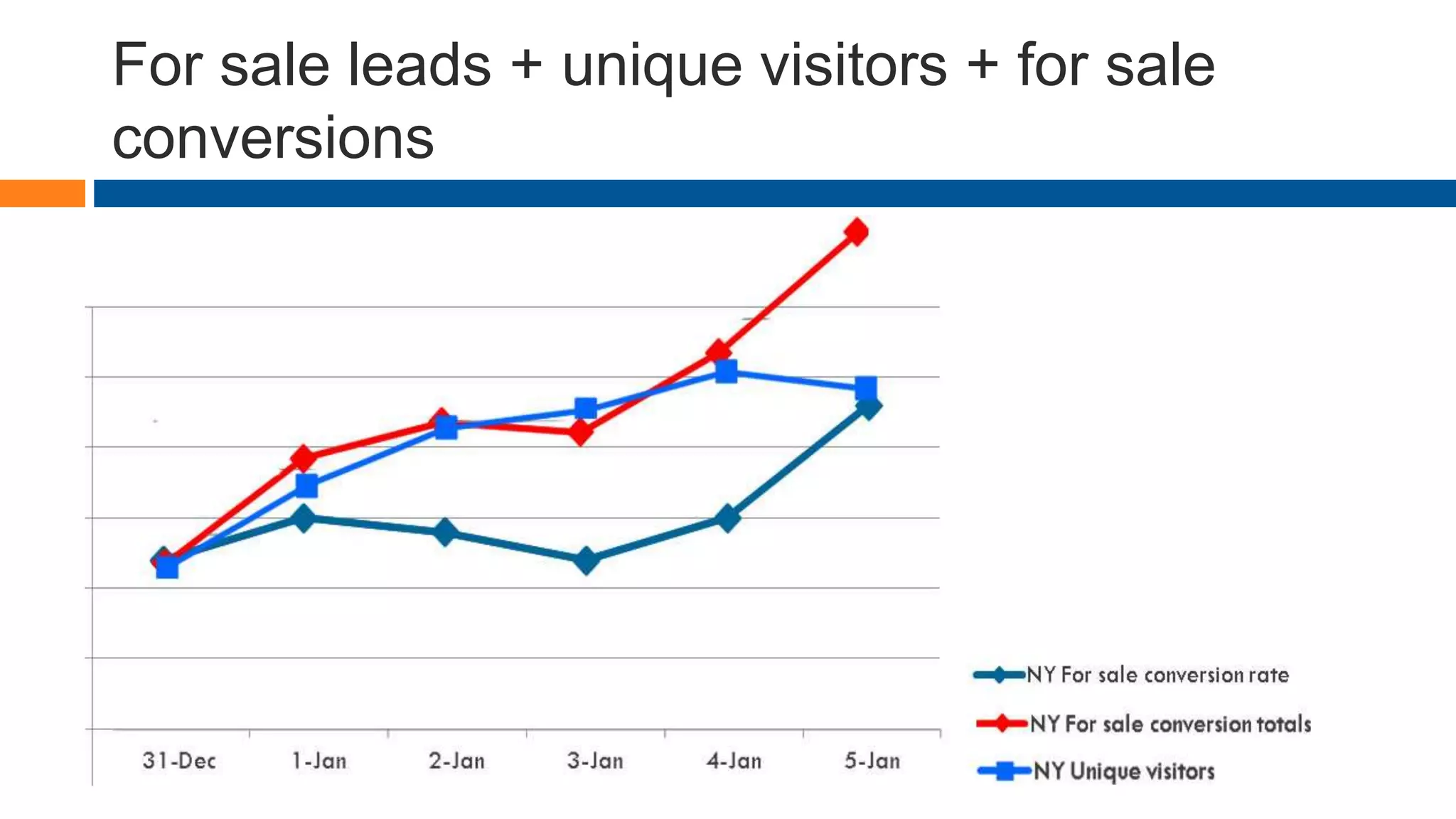

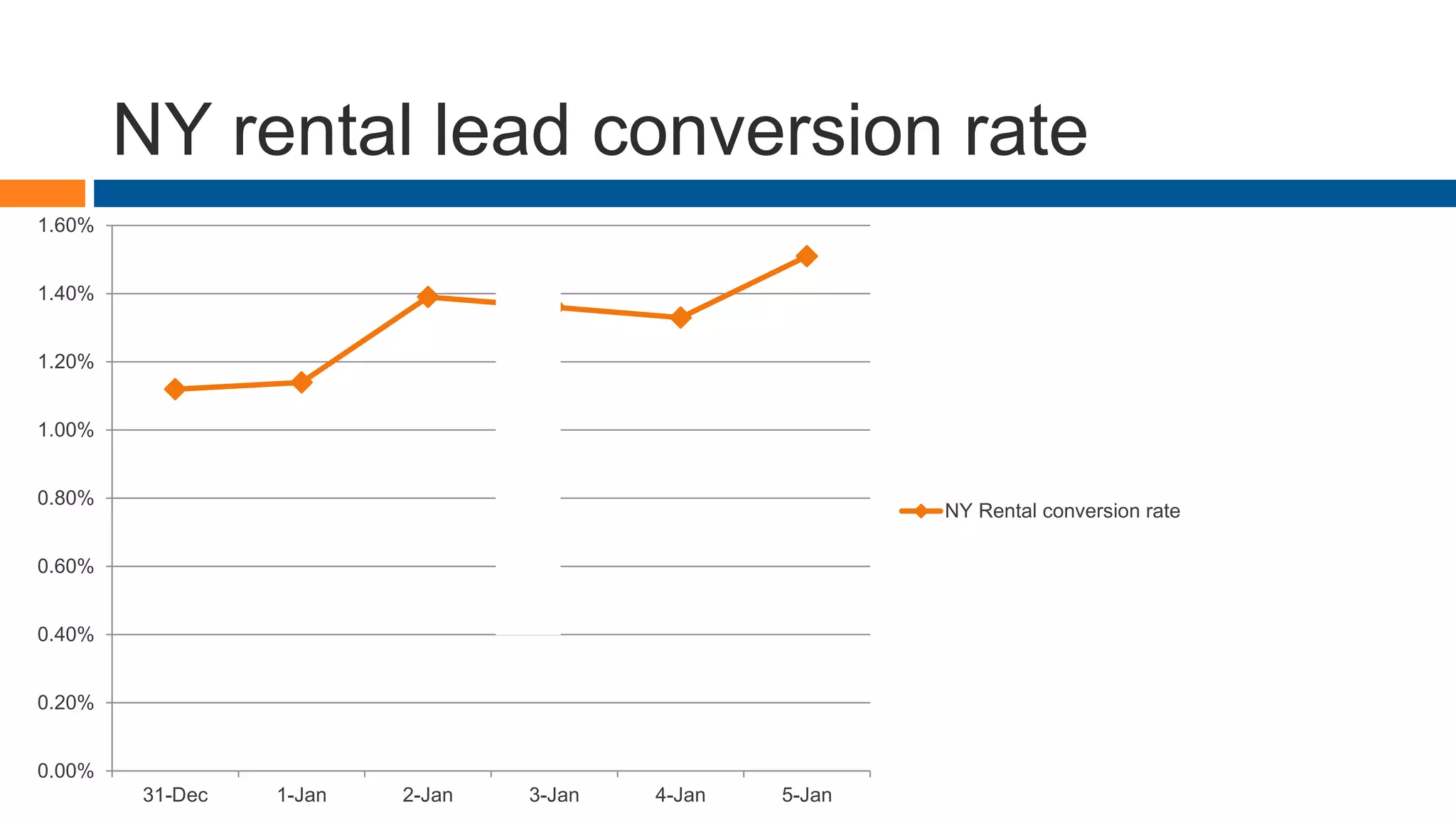

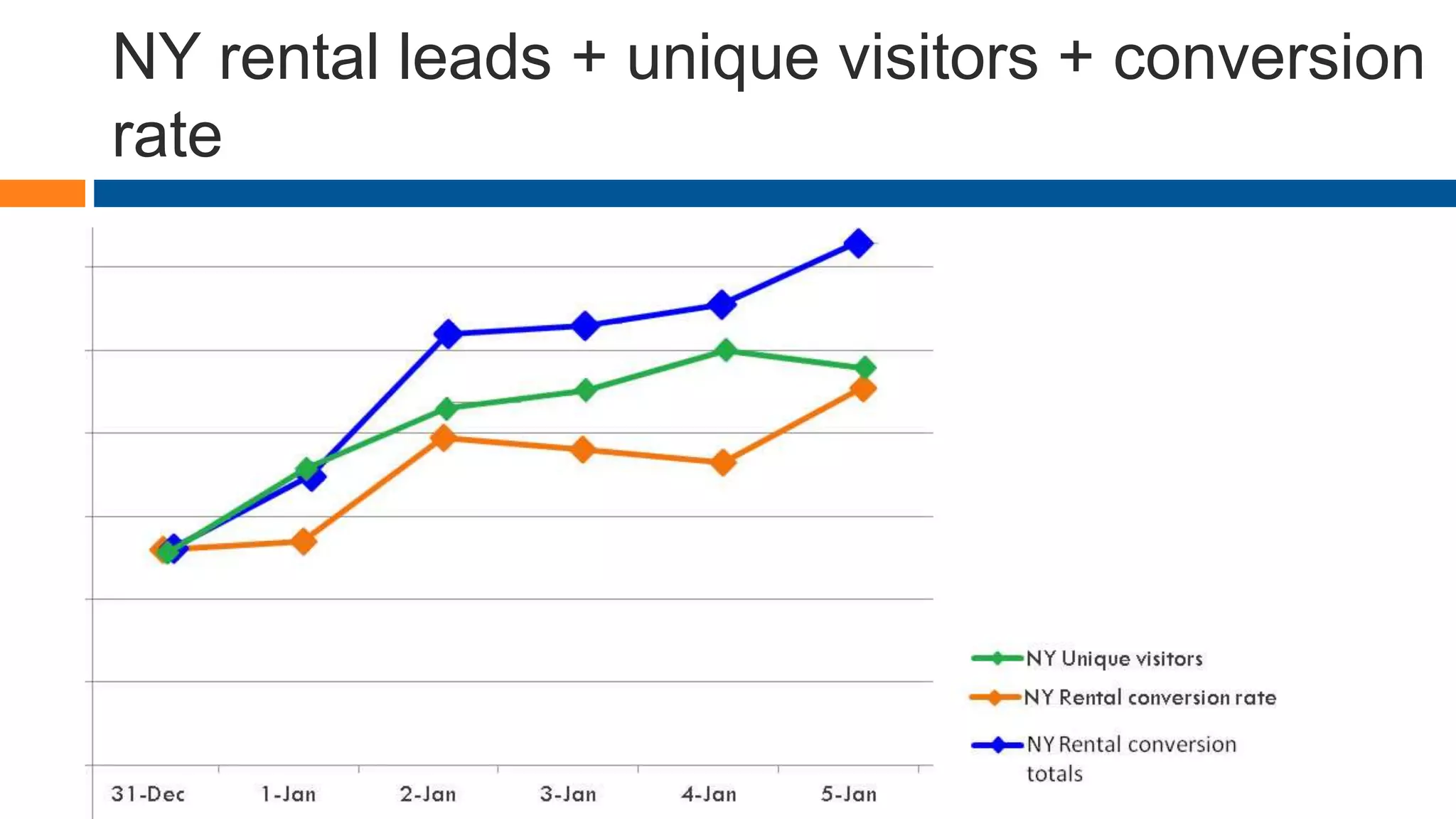

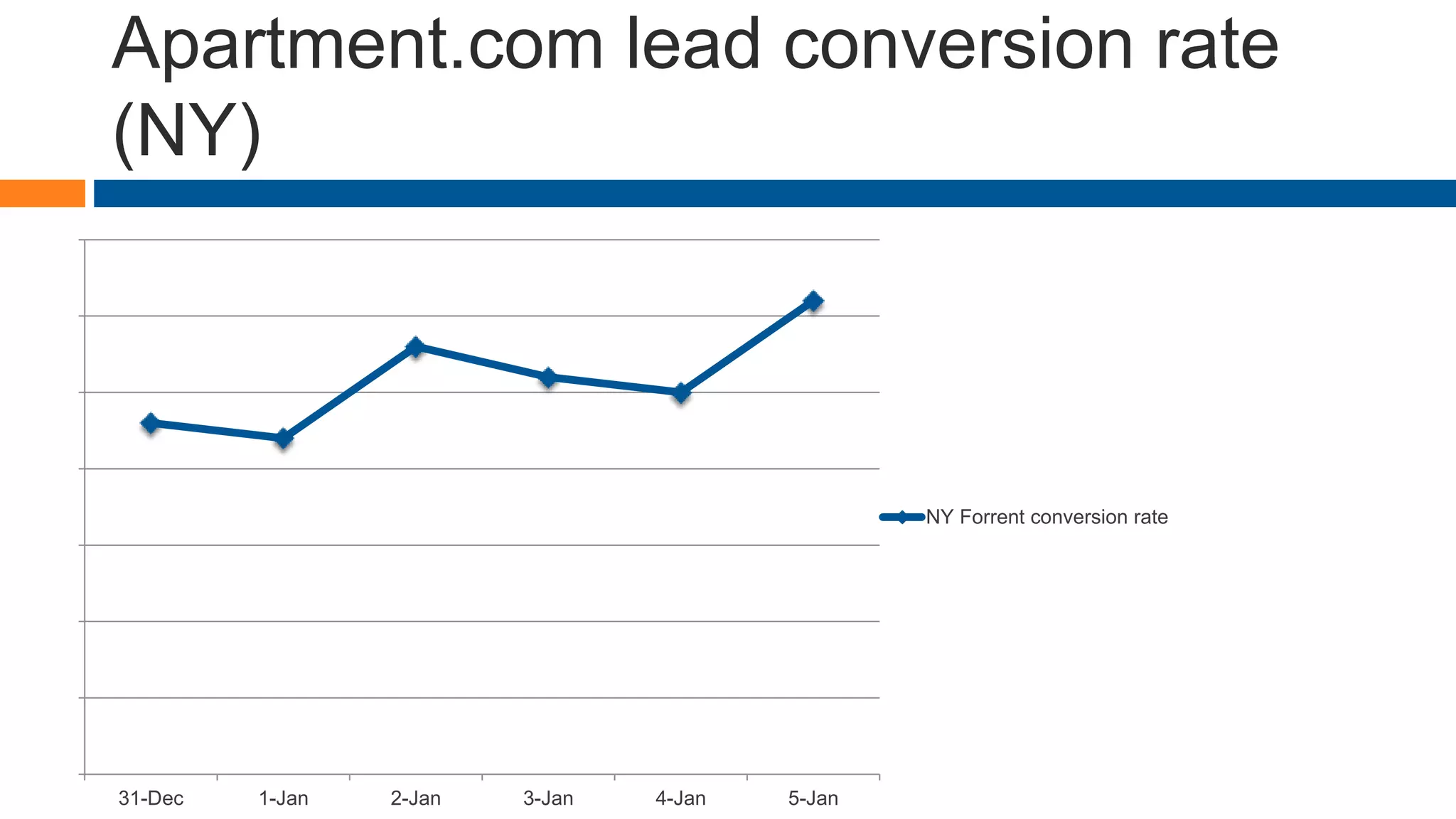

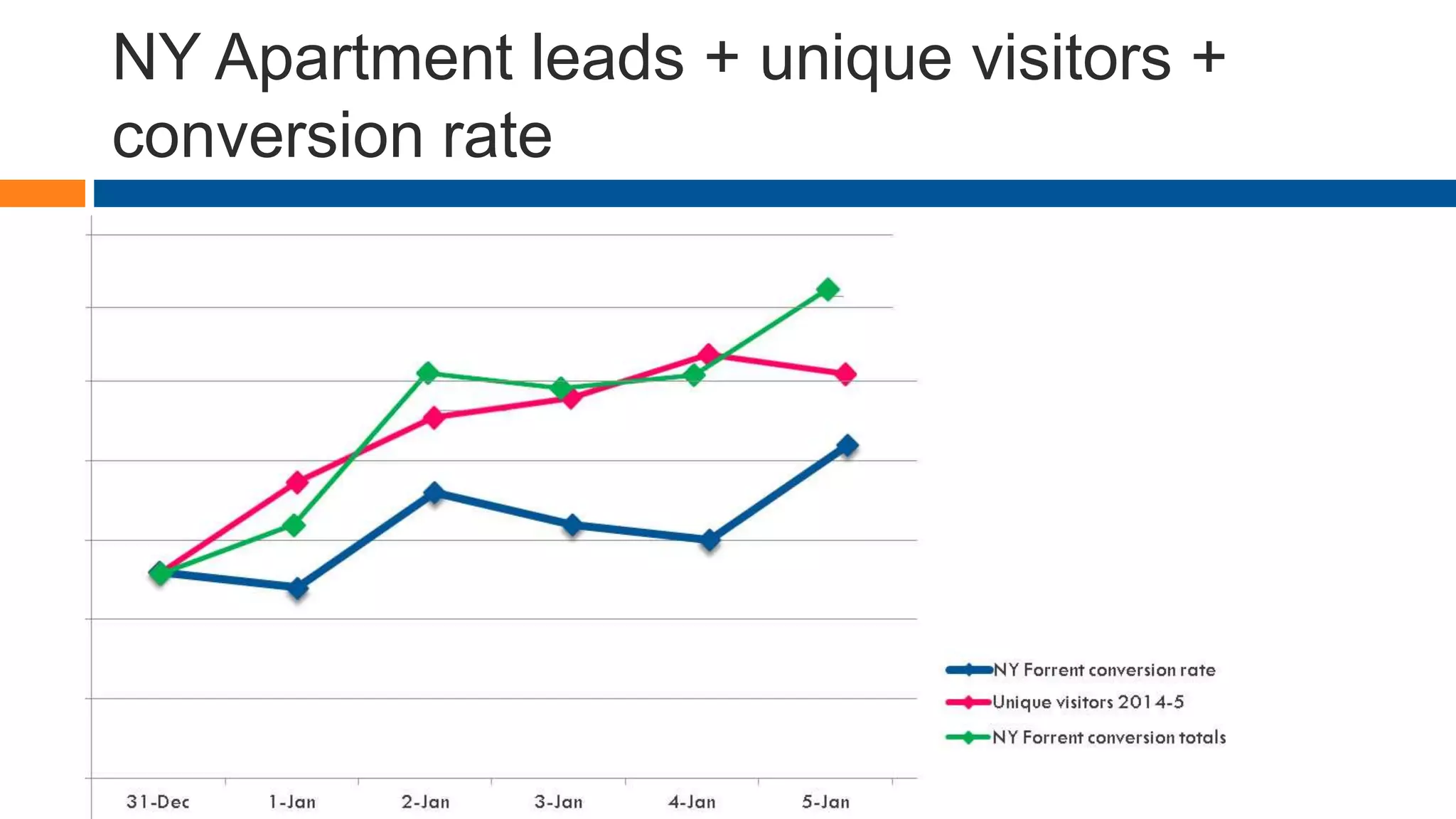

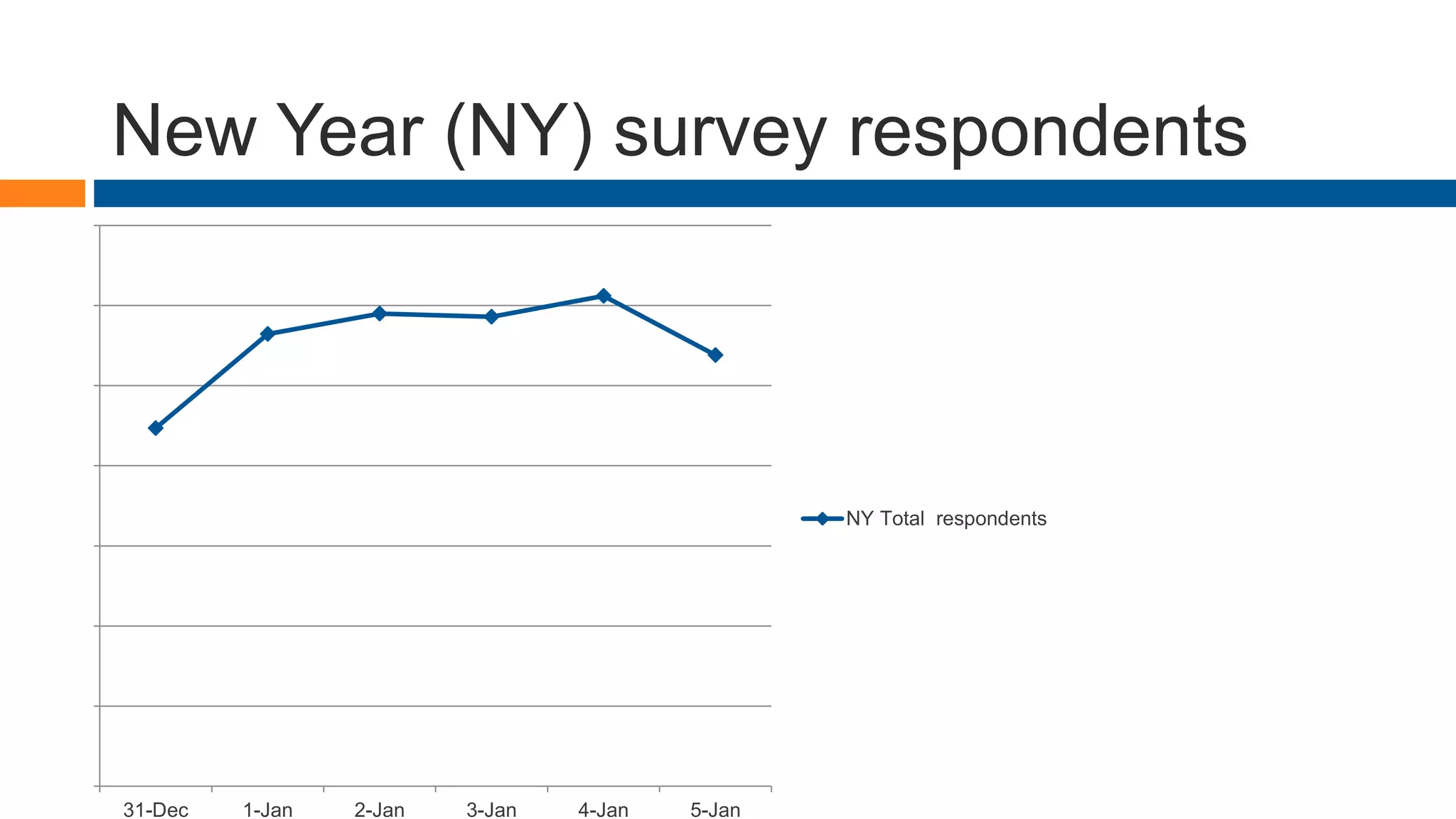

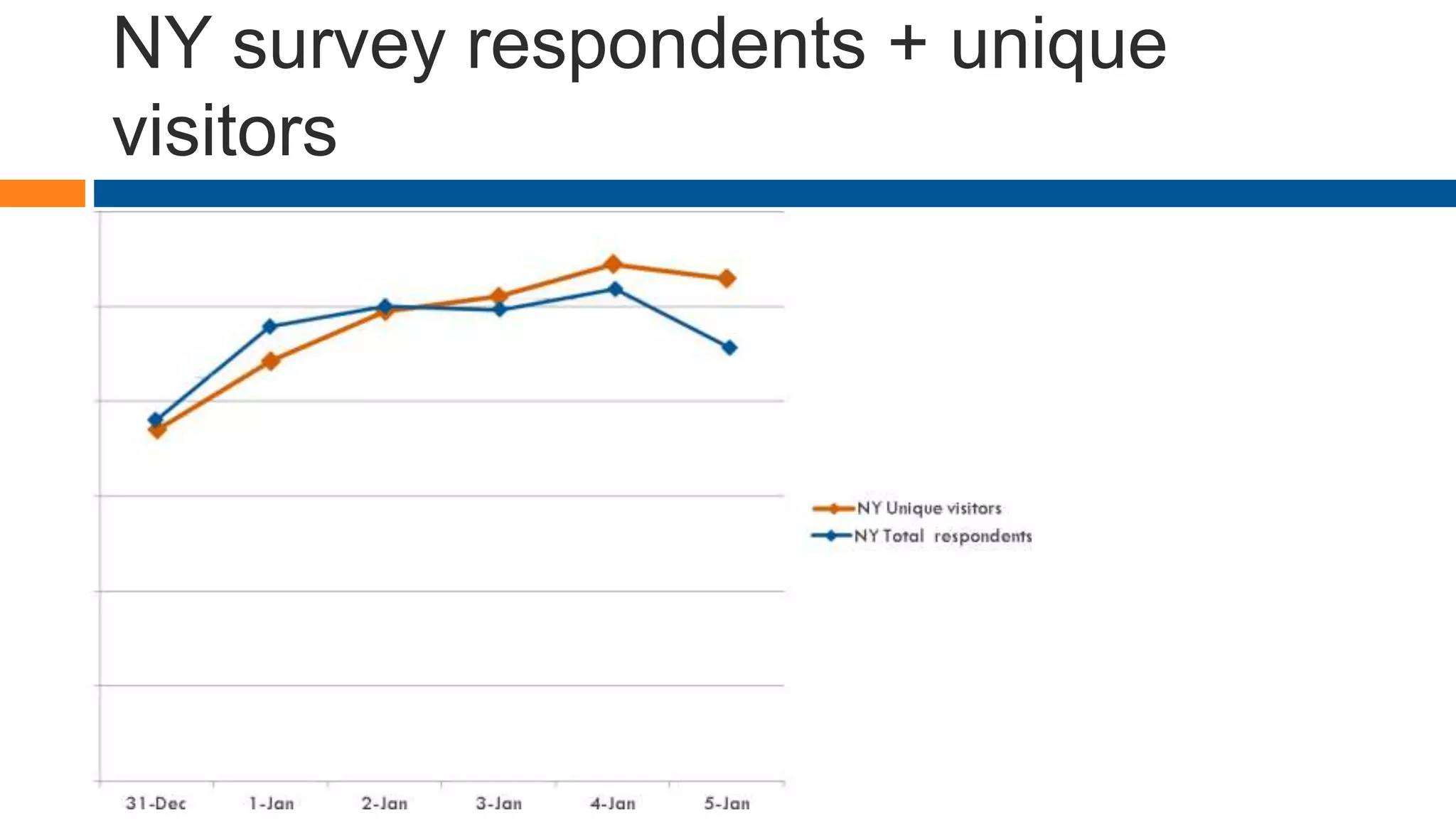

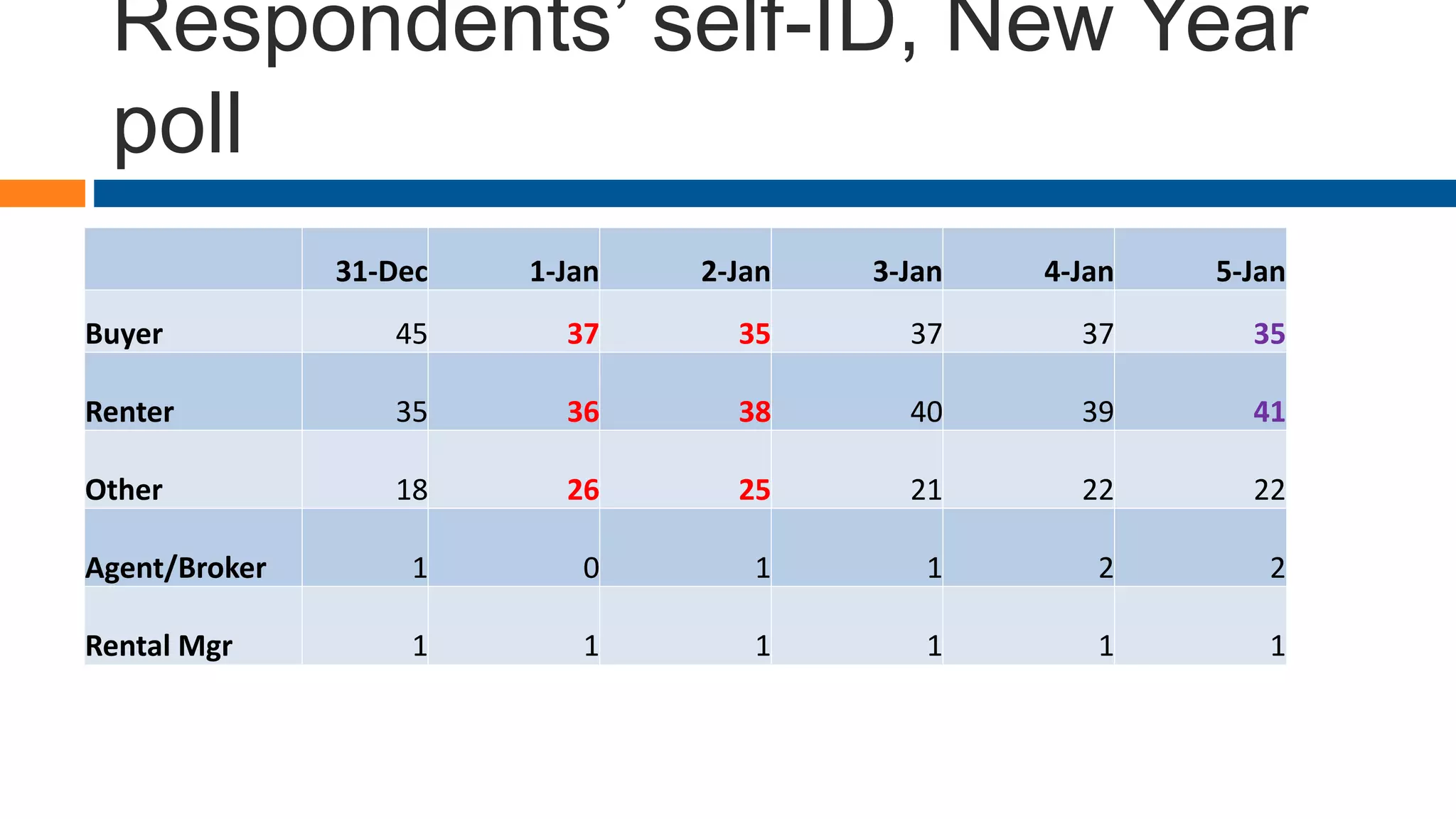

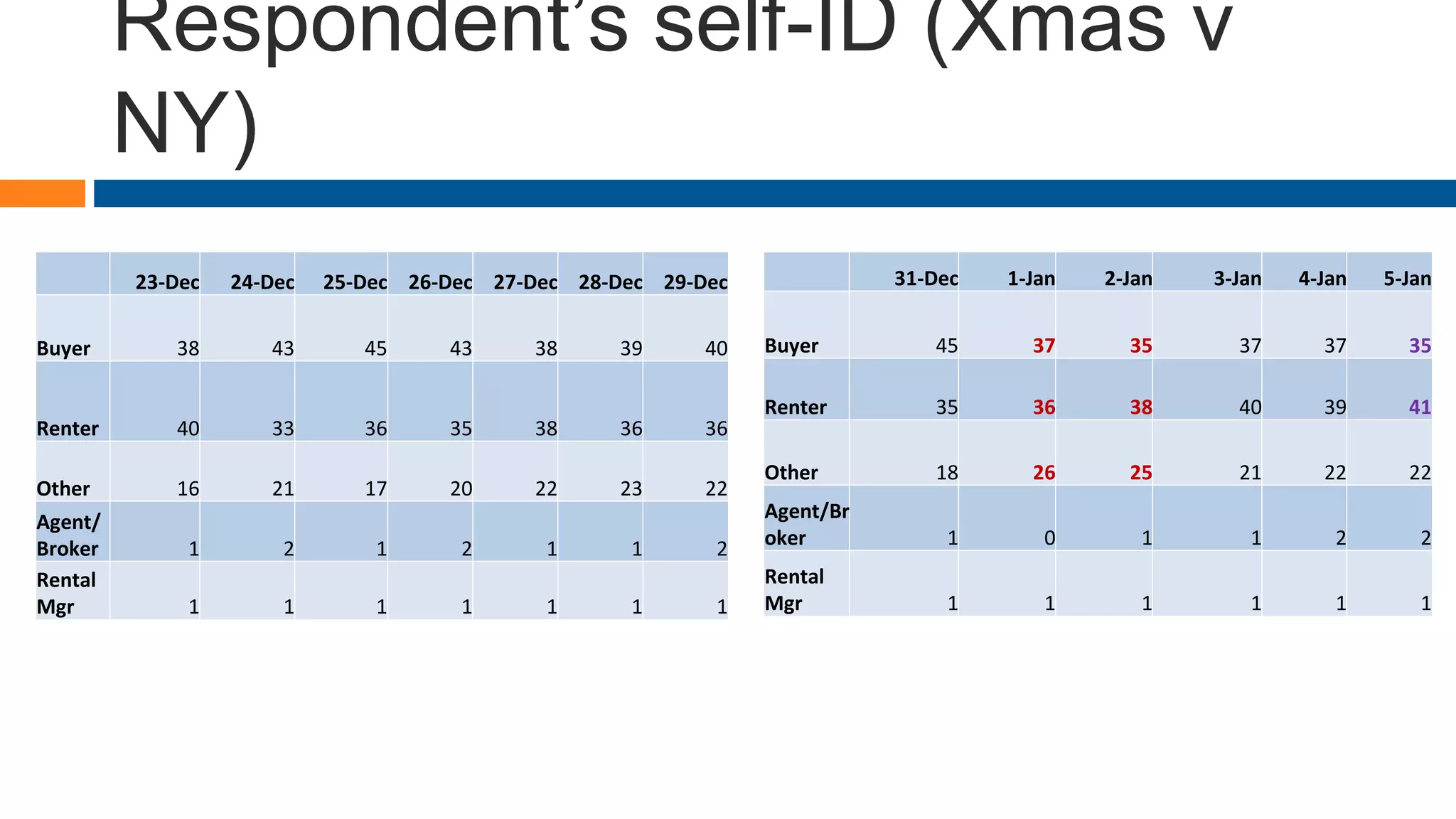

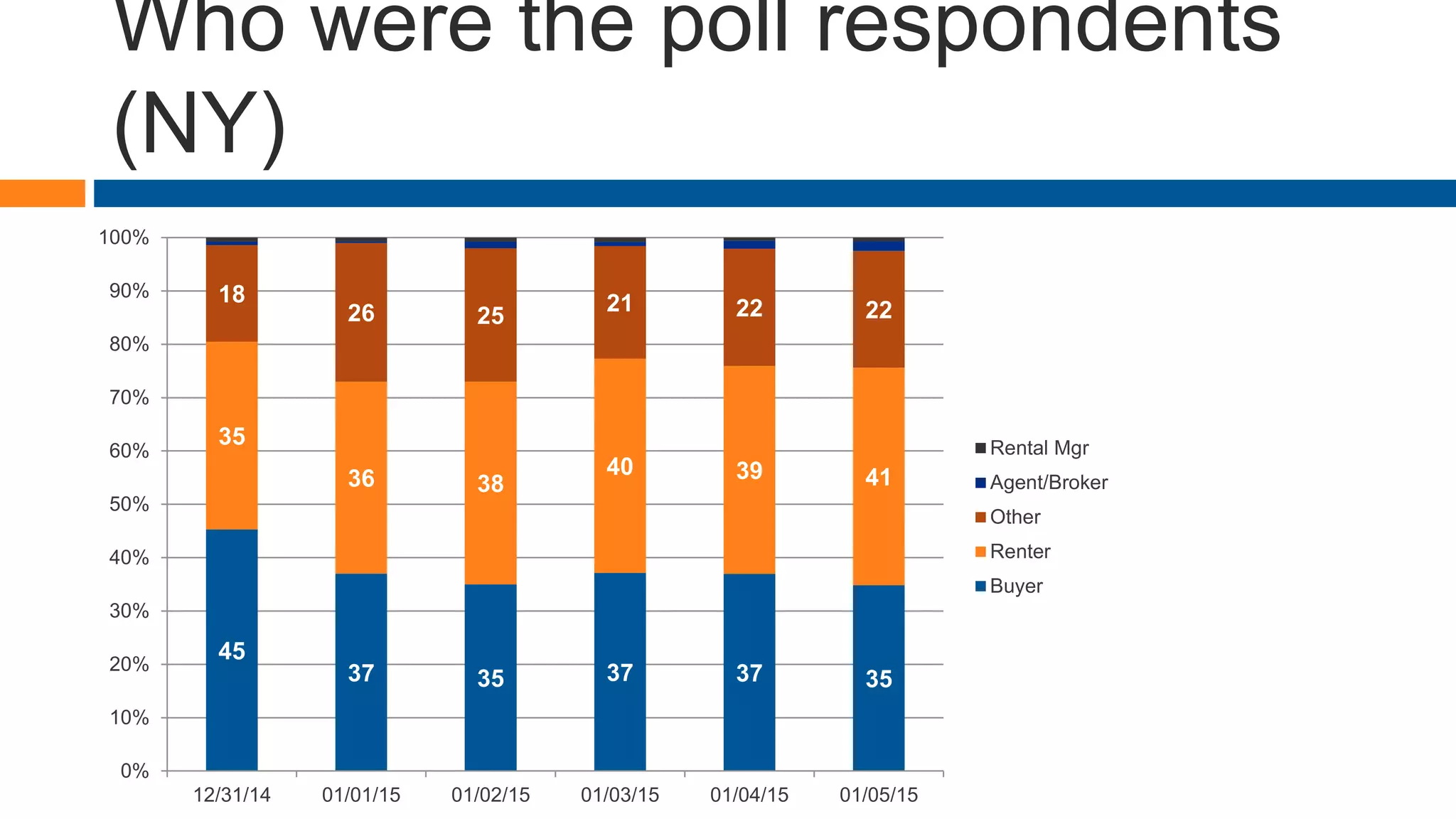

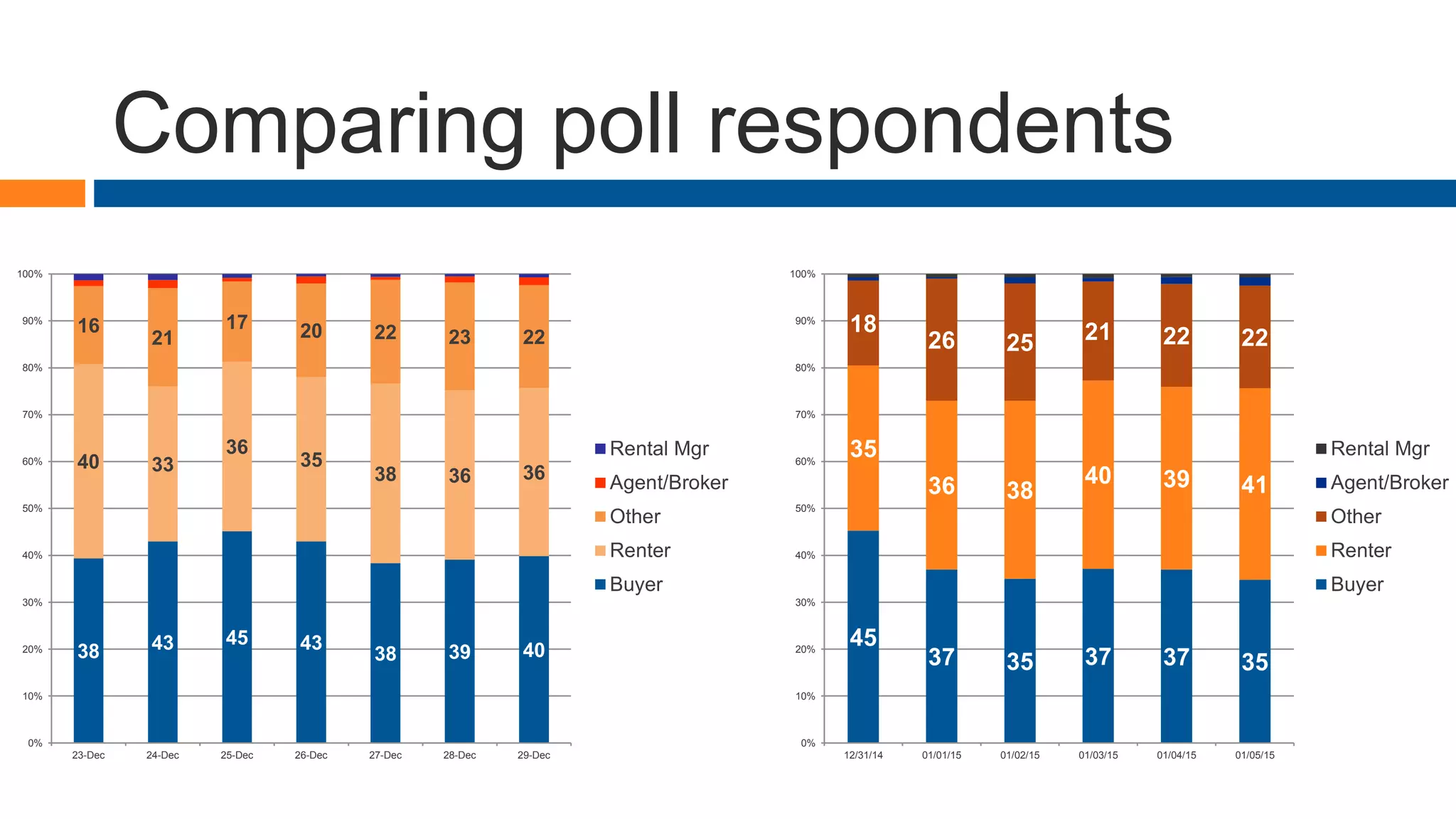

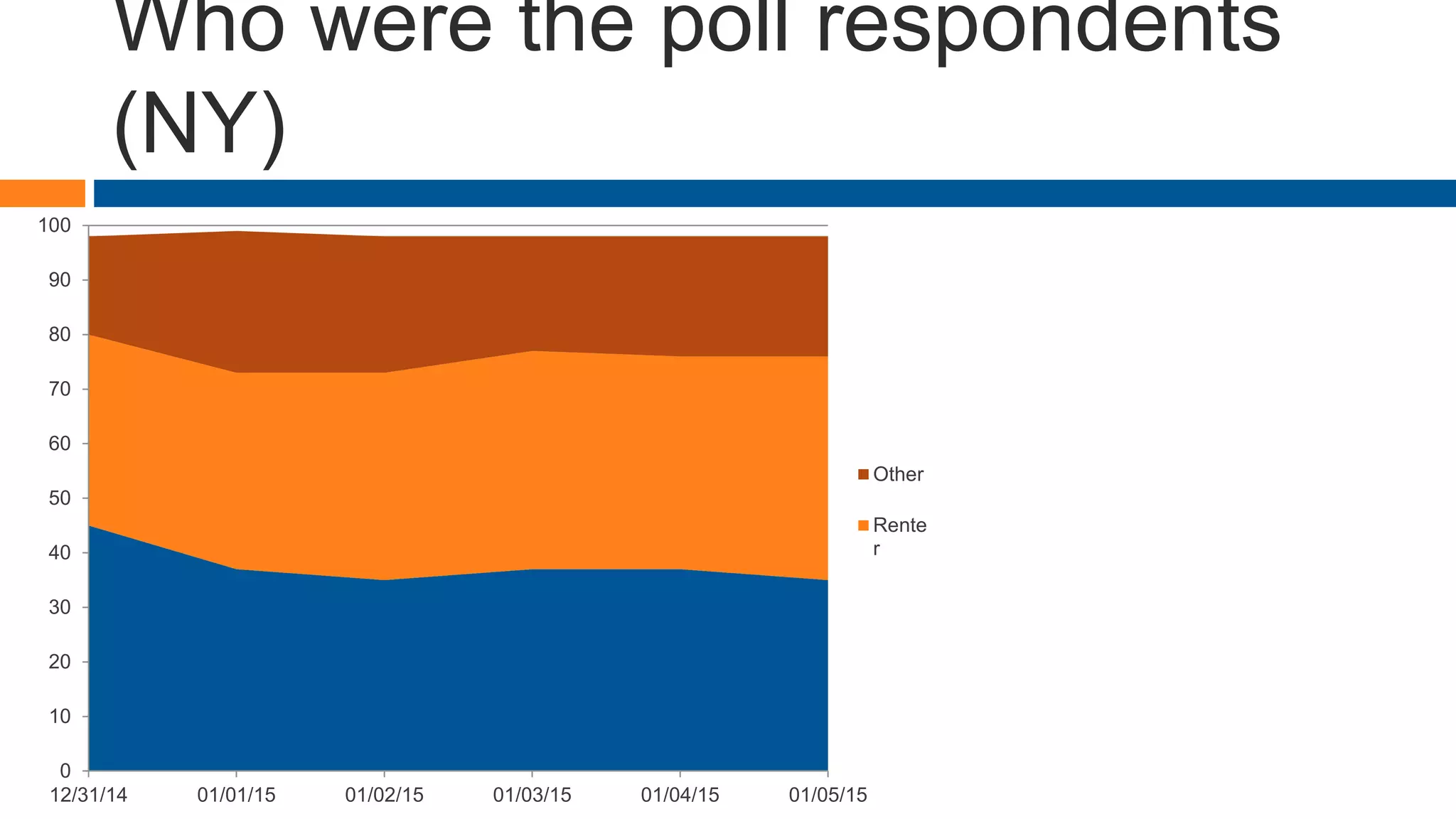

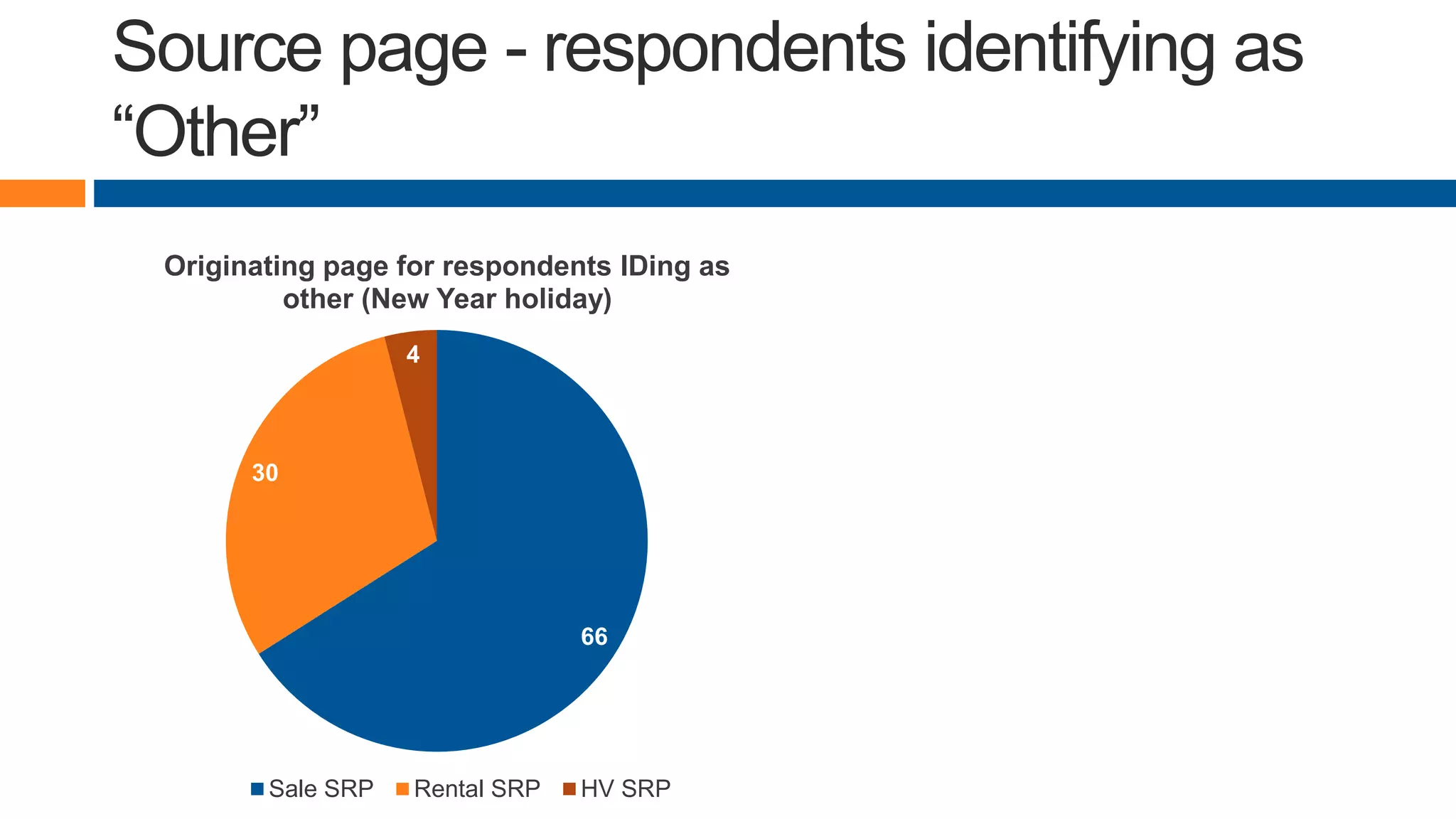

The document analyzes traffic spikes on acme.com during the Christmas and New Year periods, focusing on user behavior and conversion rates from 2012 to 2014. It highlights that traditional data reporting is insufficient and emphasizes the need for contextual analysis to understand traffic patterns and multiple metrics. Insights reveal consistent patterns in unique visitors, conversions, and user types, informing strategies for future traffic spikes.