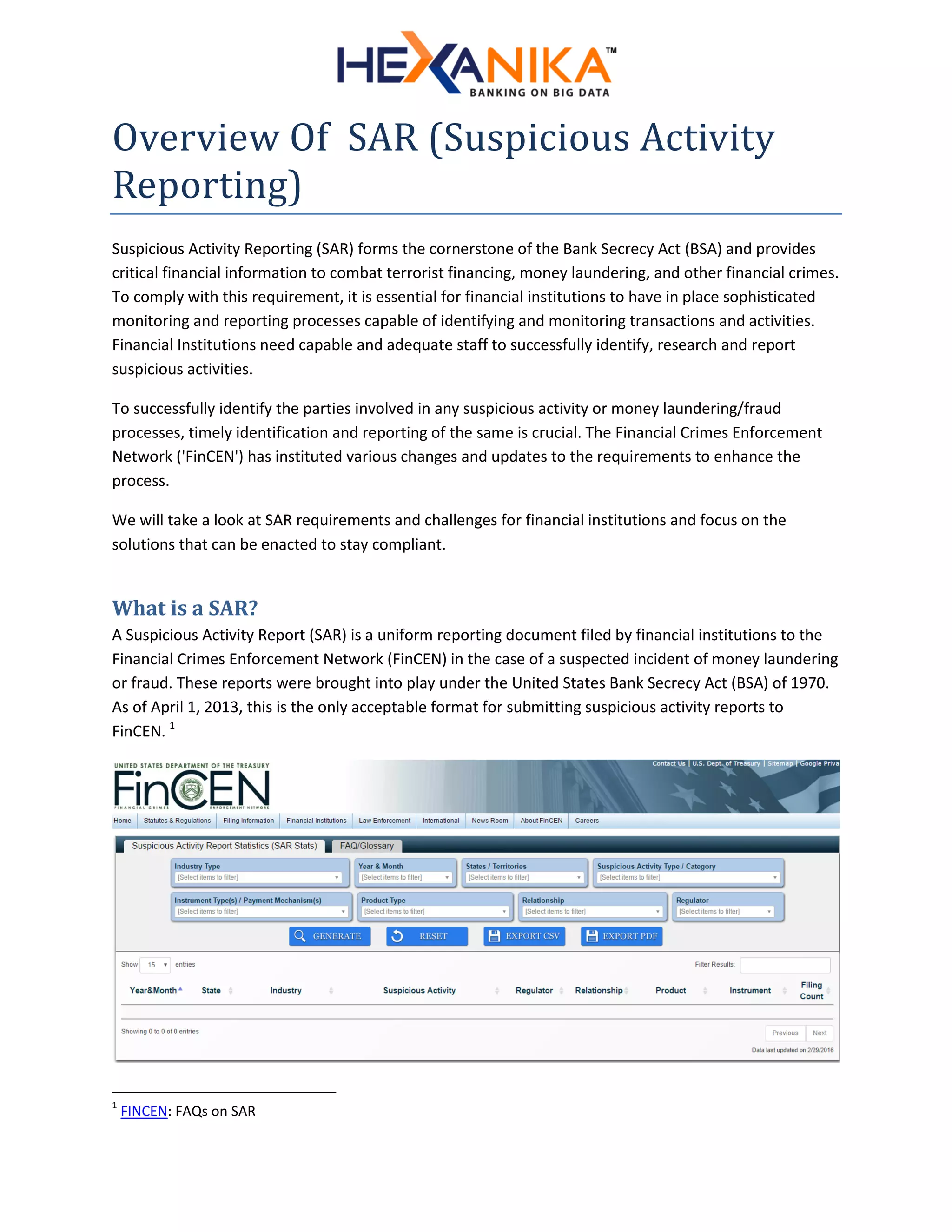

The document outlines the importance of Suspicious Activity Reporting (SAR) as a key component of the Bank Secrecy Act, emphasizing its role in combating financial crimes such as money laundering and terrorist financing. It details the requirements for filing SARs, challenges faced by financial institutions in monitoring and reporting suspicious activities, and the essential components of an effective reporting system. The document also introduces Hexanika, a fintech company that offers solutions to address data sourcing and reporting challenges for regulatory compliance.