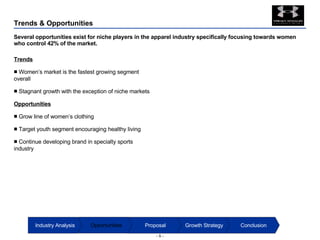

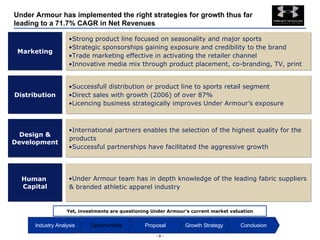

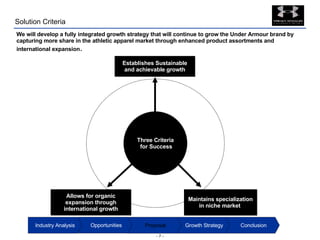

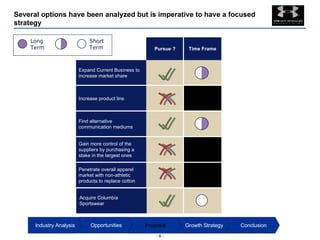

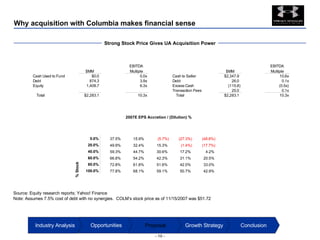

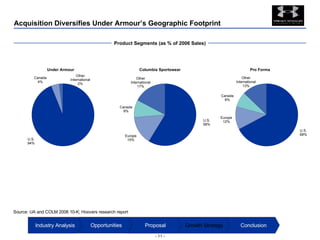

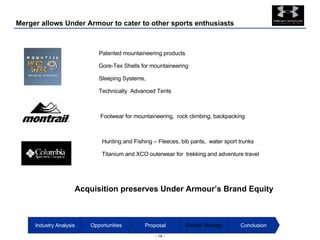

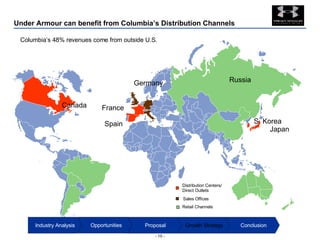

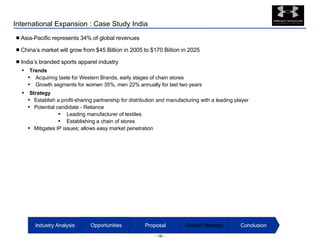

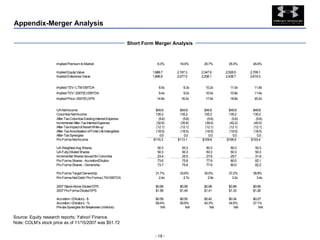

The document proposes that Under Armour acquire Columbia Sportswear to quickly expand its product offerings and strategically position itself in growing international markets. It analyzes the athletic apparel industry, identifying opportunities for growth. The document recommends that Under Armour acquire Columbia to preserve its brand equity while allowing for expansion into new product segments and geographic markets. It asserts that the acquisition would meet Under Armour's goals of organic growth and international expansion.