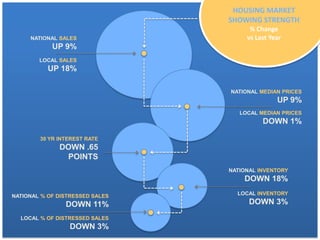

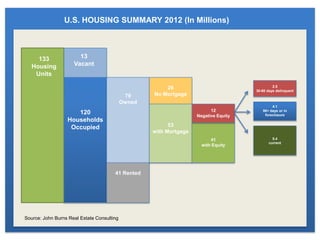

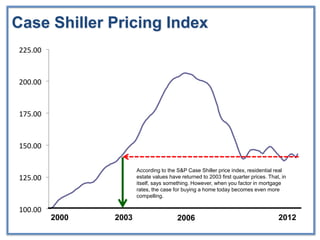

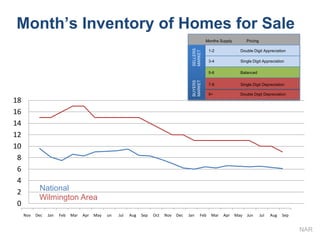

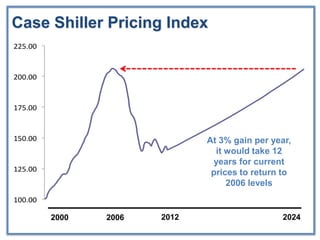

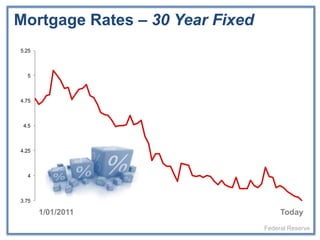

The document summarizes the state of the residential real estate market in 2012. It finds that nationally home sales were up 9% and median prices up 9% while locally sales were up 18% but median prices down 1%. Inventory was down nationally 18% and locally 3%. Distressed sales also declined nationally 11% and locally 3%. The housing market was showing signs of strength with low interest rates and declining inventory making home buying more attractive. However, prices had a ways to go before recovering to 2006 levels and pressure from distressed sales remained a factor.