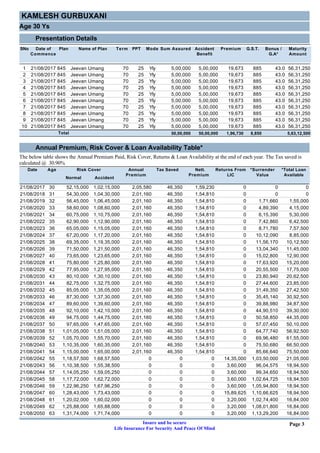

The document outlines details of a life insurance plan for Kamlesh Gurbuxani including:

- 10 policies each with a sum assured of Rs. 5,00,000 and annual premium of Rs. 19,673 taken at age 30.

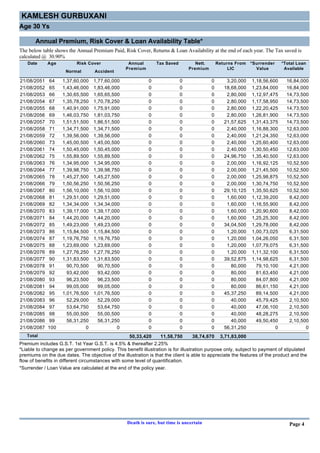

- A table showing how the risk cover, annual premiums, returns from LIC and loan availability change annually over the 70 year term of the policies.

- Key benefits include a maximum loan amount of Rs. 75.5 lakhs and maturity benefit of Rs. 1.51 crores at the end of the term.