Tu Bui – Proactive Advisor Magazine – Volume 4, Issue 2

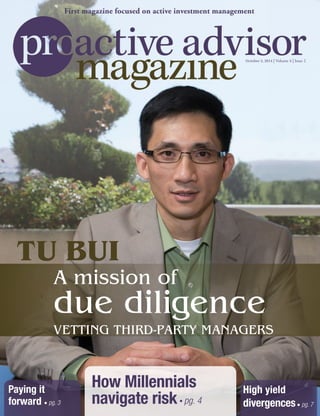

- 1. High yield divergences• pg. 7 Paying it forward • pg. 3 How Millennials navigate risk• pg. 4 October 2, 2014 | Volume 4 | Issue 2 First magazine focused on active investment management TU BUI A mission of due diligence VETTING THIRD-PARTY MANAGERS

- 2. TAX ALPHA THE POWER OF How can advisors level the playing field in a rising tax environment? For Financial Professional Use Only. Services are offered through Security Distributors, Inc., a subsidiary of Security Benefit Corporation (“Security Benefit”). 99-00471-50 2014/09/09 Download our white paper today to learn more: The Power of Tax Alpha: Adding Value by Subtracting Tax PowerOfTaxAlpha.com

- 3. I take a great deal of satisfaction out of all of these efforts. I have also been very active in my local chapter of the FPA, acting as its President and Chairman. I think it is very important for everyone in our profession to give back to the community in some way. It is not only gratifying to help others with your skill set, it is a terrific way to work side-by-side with so many caring and involved people.” have always been involved with trying to help others and have found my financial planning skills can have a real impact in the community. I was part of the initial planning ef- forts to kick off Financial Planning Week in 2008, providing free financial planning advice to the underserved in the greater Bay Area to promote financial literacy.This is now an annual event and the East Bay Financial Planning Association chapter has even been recognized nationally. With my husband being a Vietnam veteran, I care deeply about our U.S. armed forces veterans. I frequently work with them on veterans’ benefits planning. I am a member of the Ladies Auxiliary of the VFW and volunteer at the local veterans’ center. Whenever I can help a vet I will. As part of this effort, I have developed a network of relationships with CPAs, attorneys, and assisted care facilities. Frequently, veterans— especially those getting up there in age—will not be aware of the benefits that are available to them. I will often work with an accredited attorney to help them investigate the assistance that is out there for them. Passionate about paying it forward Nancy Hairsine CFP® , RFC® Pittsburg, CA Founder, Lifetime Planning Foresters Equity Services, Inc. I“ Nancy Hairsine is an Investment Advisor Representative offering securities and advisory services through Foresters Equity Services, Inc., a Registered Investment Advisor and Member FINRA/SIPC. Lifetime Planning and Foresters Equity Services are separate and unaffiliated entities. Read text only Advertising proactiveadvisormagazine.com/advertising Reprints proactiveadvisormagazine.com/reprints Contact proactiveadvisormagazine.com/contact Proactive Advisor Magazine Copyright 2014 © Dynamic Performance Publishing, Inc. All rights reserved. Reproduction of printed form, whole or in part, without permission is prohibited. Editor David Wismer Associate Editor Elizabeth Whitley Contributing Writers Katie Kuehner-Hebert David Wismer Graphic Designer Travis Bramble Contributing Photographer Jack Hutch October 2, 2014 Volume 4 | Issue 02 Proactive Advisor Magazine is dedicated to promoting and educating on active investment management. Distribution reaches a wide audience of financial professionals who advise clients on investments and portfolio management. Each issue features an experienced investment advisor who offers insights on active money management, client service, and investment approaches. Additionally, Proactive Advisor Magazine offers an up-close look at a topic with current relevance to the field of active management. The opinions and forecasts expressed herein are those of the author and may not actually come to pass. Any opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. The analysis and information in this edition and on our website is for informational purposes only. No part of the material presented in this edition or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any portfolio constitutes a solicitation to purchase or sell securities or any investment program. October 2, 2014 | proactiveadvisormagazine.com 3 TIPS & TOOLS

- 4. Millennials, born between 1980 and 2000, have faced significant financial and employ- ment challenges due to coming of age after a financial crisis and resulting recession—heavy college debt, fewer job prospects, stagnant wages, and a growing distrust of conventional institutions. Such hardships have created a new generation of prudent savers and cautious risk-takers, particularly in the eyes of their Baby Boomer parents, who believe the younger generation will have a tougher economic road to navigate than they did. But Millennials have also been shaped by paradigm-shifting concepts about their potential power on the world stage and how institutions can be molded to fit their visions, particularly through the use of social media and other forms of technology. Such dichotomies will sort themselves out as Millennials progress in their careers—and inherit wealth from their parents. Their improving financial situation and attitudes about asset protection should make them prime prospects for risk-mitigating investment strategies. Active management also fits in with Millennials’ penchant to utilize technology, as they are already early adopters of sites that use algorithms and systematic decision-making to determine investment allocations. Many are Read text only MILLENNIALS AND RISK MANAGEMENT Millennials, those roughly between the ages of 18 and 34, might be especially receptive to actively managed strategies. This younger generation—reared during the Great Recession and now considered to be almost as conservative as the generation that lived through the Great Depression—will want to be as proactive as possible to protect their growing assets. By Katie Kuehner-Hebert Navigating the “Perfect Storm” proactiveadvisormagazine.com | October 2, 20144

- 5. now expressing a desire for combining techno- logical tools with more hands-on interactions with advisors, and the generation raised to take charge of their own lives will likely prefer advisors who are more willing to collaborate with them. Whoever wins the business of Millennials in the future will reap great dividends, as their net worth is projected to increase greatly over the next several decades, partly due to increased numbers within that generation receiving col- lege degrees and partly due to inheriting wealth from their parents. Indeed, according to the World Economic Forum, Millennials and their older counterparts, Gen Xers, could potentially inherit roughly $41 trillion from their parents over the next 40 years. But even now, more Millennials have started saving for retirement in their early 20s than did Baby Boomers, who on average didn’t start saving until they were 35, according to a recent Transamerica Institute study. For those Millennials who were offered 401(k) or similar plans by their employer, 71% participated, contributing 8% of their salaries, on average. The younger generation is also particularly receptive to so-called “Robo-Advisor” startups suchasWealthfront,Betterment,FutureAdvisor and SigFig, automated money management sites that use algorithms to daily monitor and, if necessary, rebalance allocations in indexed funds based on modern portfolio theory and individual investors’ ages and objectives. Then there is Motif Investing, a new online brokerage that looks “for trends, ideas and world events that could create an investment opportu- nity,” and then builds portfolios of related in- vestments weighted to those opportunities. The concept is an extension of the growing trend of college students participating in “impact invest- ment clubs,” as well as the increased popularity of socially responsible investing overall. However, even with the rise of many differ- ent flavors of online investment management, many Millennials are also signaling that they will likely use more traditional financial advisors once they accumulate more assets. According to a July 2014 Investment News survey, 84% of Millennials currently without an advisor said they would use one when they got older, while 68% who already have an advisor said they continue on pg. 11 Hands-on advice still matters would prefer “more direct, personalized advice” in the future. Moreover, the survey found that 78% would prefer advisors who offer online services, as part of their preference for “holistic advisory services.” Millennials are expressing a desire for more frequent contact from their advisor both in person and digitally via text messaging, email, video conferencing, and social media. Millennials might be especially attracted to an advisor from their own generation—or close to it. A number of advisors in their 20s and 30s say they feel more like “financial coaches” who guide their younger clients through the planning process to reach specific objectives, or even “financial therapists,” who help clients work through their fears over investing. Such advisors help their young clients understand how much risk would be appro- priate for them to take within their portfolios, particularly by helping them to overcome anxi- eties created by the 2008-09 financial crisis and resulting recession. Many Millennials have not reaped the benefits of the current bull market in equities, but advisors who practice active management may help them see the wisdom of participating via risk-managed strategies. October 2, 2014 | proactiveadvisormagazine.com 5

- 7. 95 94 93 92 91 90 89 PRICE(HYG) MONTH JAN FEB MAR APR MAY JUN JUL AUG SEP 2014 High High yield ETF S&P 500 High yield sector shows divergences igh yield fixed income is one area that is closely monitored for any signs of confirmation or divergence with the equity market, according to Bespoke Investment Group. Because high yield is at the riskier end of the fixed income spectrum, movements are often closely correlated with equities. There has been some growing concern in recent weeks due to the deteriorating chart pattern of the ETF (HYG) that tracks high yield fixed income. Bespoke notes that for much of 2014, high yield fixed income was one of the strongest performers, with nearly an uninterrupted rally. After hitting multi-year highs early in the summer, though, HYG corrected by just under 3%. Beginning in August, HYG had a sharp rebound and nearly erased all of its July decline, but that rally fell just short of new highs. Since then HYG has given up more than half of the ground it gained from the H Source: Bespoke Investment Group lows. One of the most concerning aspects of the recent pullback was last week’s decline, one of the steepest of the year. While HYG failed to take out its prior high from the summer, the S&P 500 easily surpassed its summer highs before its own pullback. Market analysts will continue to closely watch the performance of the high yield sector, as continued weakness could foreshadow broader equity market issues. Bearish analysts have noted the additional divergences in other market areas, especially for small-cap equities (Russell 2000), down approximately 4% for 2014. Read text only 100 Years: Charles Dow to quants to predictive analytics for everyone The success of quantitative investing methods has brought the necessary statistical validation to the broader investment community over the past 20 years. The case for tactical asset allocation The investment objective of tactical asset allocation is to add value both with respect to return enhancement and risk mitigation through active asset allocation shifts. Advisors listening in How to solicit honest client feedback to grow your strengths—and fix your weaknesses. L NKS WEEK HIGH YIELD ETF VS. S&P 500: 2014 7October 2, 2014 | proactiveadvisormagazine.com TOPPING THE CHARTS

- 8. Read text only Tu Bui By David Wismer Photography by Jack Hutch due diligence A mission of Post-graduate studies honed his analytical skills. His parents’ missionary work in Vietnam cultivated his compassion for the needy. Now Tu Bui’s advisory practice relies on third-party risk management strategies to protect client assets for similar goals, and a rigorous vetting process is mandatory. Vetting third-party managers 8 proactiveadvisormagazine.com | October 2, 2014

- 9. Proactive Advisor Magazine: You have had a remarkable journey to success as a financial advisor. How did you get where you are today? Tu Bui: My family left South Vietnam in April of 1975, ahead of the fall of Saigon. We went from Vietnam to Guam and eventually California, where I grew up and attended high school. My father is an Adventist missionary and still very involved in helping support mis- sionary work in Vietnam. I went to college in California and earned a Masters degree in Nutrition at UC Davis and a Masters degree in Biological Sciences at CSU Sacramento. I worked for a few years on several important projects involving nu- trition education for the State of California while I was pursuing my PhD at UC Davis. But during this period, I was introduced by my sister to the world of financial services. I started part-time and quickly realized that I wanted a full-time career as a financial advisor. What attracted you to the advisory field? I had always been very interested in the financial markets, even as a student. I also think my scientific background and data analysis knowledge of solving problems, along with my family heritage of helping people, made this a very good career choice for me. Several of my clients are involved in missionary work and I get a lot of satisfaction in helping them to improve their financial situation. How has your investment philosophy evolved? Back in the 1990s, when I first got started, markets really only seemed to go up. Like most advisors, I was using pretty traditional mutual funds and asset allocation and everyone was very happy with their portfolio’s performance. I do not think our industry had a real answer for the tech crash of the early 2000s—it was just a matter of reassuring clients that if they held on, everything would work out. I was very uncom- fortable with that and, frankly, it was terrible to see client portfolios go down so much during that time. The market did eventually recover some- what and that brought us to 2007. My firm had started to introduce the concept of risk management and third-party active managers to its advisors. I was very interested in pursu- ing the idea of asset protection for my clients. How did you evaluate active managers? Well, I applied my belief in analysis to evaluating third-party managers. I met with many of them and tried to dig deep into their performance and philosophy. I have to admit this was not a perfect scientific exercise, as this was a field that was pretty new to many of us. I am a quick study, though, and recognized that it is not about chasing performance or what is hot or what is not. The defining moment for me is, “what can the money manager do for my clients when the markets are really moving down quickly?” I learned the value of my own due diligence and had the understanding that I am not looking for aggressive managers who can make the most money in a bull market—I am looking for true risk management. If the overall stock market is down 50%, and an active manager is down “only” 25%, that is not going to cut it for me. Down 25% is still a very big hit for many clients’ portfolios. So I look at the active manager’s abil- ity to really minimize losses in bear markets or even to profit via short strategies in down mar- kets. I value that bigger picture approach for my clients and the capability to effectively manage through all kinds of market environments. How has this influenced your advisory practice? The effect has been dramatic. I have a fair amount of high-net-worth clients—physicians, business owners, etc.—and this has given me a meaningful story to share with prospects that is very differentiating. Who wouldn’t want to talk about concepts that will allow for the protection and growth of wealth? It has pro- vided the opportunity to give second opinions to people about their investment portfolios with real strategies that they may not have heard about before. This helps to set me apart from advisors still pursuing passive strategies. How do you explain active management to those new prospects? I really like to let the facts do the talking as much as possible, so I will conduct an anal- ysis of a client’s or prospect’s past investment portfolio history. Not always, but most of the time, I will see periods of very high drawdowns and losses over the last fifteen years. Generally, I can pinpoint where they have lost years, or even a decade, of growth in their portfolio due to those big market crashes. continue on pg. 10 October 2, 2014 | proactiveadvisormagazine.com 9

- 10. Show your clients a friendlier bear market 800-347-3539 | flexibleplan.com Past performance does not guarantee future results. The opportunity for profits carries with it the possibility of losses. 800-347-3539 | flexibleplan.com A complete list of all of our recommendations over the last 12 months and Brochure Form ADV Part 2A are available upon request. L E A R N M O R E life. For many, this might mean the difference in successfully funding missions in the future. This can range from people with modest means to physicians who want to fund major medical missions down the road. I would like to reach as many people as I can to help with their future goals, and I am also personally committed to helping make these missions happen in any way that I can. This is really where the conversation starts in earnest. I explain that it is similar to the purchase of an automobile. I ask clients what they drive and many will say a high-end auto- mobile. I ask why they bought that kind of car and the reasons are always performance and safety. Then I ask, “Would you like to partner with an investment advisor who works to provide both performance and preservation of your capital through risk management?” This decision about their financial future is far more important than the decision to buy a car. It tends to hit home with people. The concept, similar to a car, is that the safety features in portfolio management are not used all that frequently. But when they are needed, they are very, very important. What about the performance side of the equation? It all depends on the client’s specific appetite for risk and what is appropriate for their long- term goals. We have some more aggressive active strategies that have done extremely well on the equity side, but they are somewhat more volatile and can have larger drawdowns. But for the more “middle of the road” client, I can demon- strate pretty thoroughly that a combination of strategies can provide very competitive returns over market cycles, with a strong focus on risk management and less volatility. The smoother ride is something that is also important, especial- ly for clients who are nearing or in retirement. You spoke about high-net-worth clients. What about other clients? It is important to me to bring risk manage- ment to all of my clients. My father is a prime example of someone who could have benefited from sound financial planning and the concept of asset protection. As a missionary, he didn’t have a high income, but he also was never really properly educated on financial matters. I am trying to bring to other church mem- bers the right education about saving what they can and then growing it to help them later in continued from pg. 9 Tu Bui is a Registered Representative and an Investment Advisor Representative with Transamerica Financial Advisors, Inc. Securities and Investment Advisory Services offered through Transamerica Financial Advisors, Inc. (TFA), Transamerica Financial Group Division—Member FINRA, SIPC, and Registered Investment Advisor. Non-securities products and services are not offered through TFA. TFG004742-09/14. 10 proactiveadvisormagazine.com | October 2, 2014

- 11. There can be no assurance that any investment product will achieve its investment objective(s). There are risks associated with investing, including the entire loss of principal invested. Investing involves market risk. The investment return and principal value of any investment product will fluctuate with changes in market conditions. Guggenheim Investments represents the investment management businesses of Gug- genheim Partners, LLC. Securities offered through Guggenheim Funds Distributors, LLC. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim Partners, LLC. x0515 #12526 Uncover the True Cost of Trading Mutual Funds and ETFs The reflexive perception that ETFs cost less, simply based on their low expense ratios, and are more cost-effective than mutual funds, is not entirely true. In addition to an expense ratio, there are additional considerations that should be considered when making an informed choice between ETFs and funds— including spreads and commissions. This informative white paper from Rydex Funds provides an in-depth look at the cost of ownership of no-transaction-fee (NTF) mutual funds and ETFs—with a focus on active investing strategies. Request your free copy. Call 630.505.3749 or visit guggenheiminvestments.com/rydex Chicago | New York City | Santa Monica Rydex Funds A Comparison of ETFs and Mutual Funds—The True Cost of Investing But advisors should also be prepared for Millennials to not just take them at their word, as the younger set will likely also conduct inde- pendent research on any investment strategy, as well as consult with other experts—even other advisors—before they sign off on any particular strategy. Advisors who utilize active investment man- agement will likely fit well within the mindset of Millennials, as this generation is more prone to favor technology, models, logarithms, and systematic decision-making to continually monitor and adjust portfolios as needed. Such advisors can also work closely with their clients in assessing appropriate risk profiles within a long-term investment plan, to determine the best course of action to help meet specific life goals. Advisors offering investment solutions based on proven risk management principles continued from pg. 5 Active management may present a competitive edge should be well-suited to serving as coaches for Millennials, especially in helping to overcome those anxieties regarding financial markets. They have the tools to demonstrate that there is a way to achieve favorable risk-adjusted returns in any market environment, as sophis- ticated algorithms and models are employed to capture a fair share of gains and protect against deep losses in a wide variety of sectors and asset classes. This should sit well with a generation that challenges conventional thinking by nature and has had to overcome the long-lasting effects of the Great Recession—and likely present such advisors with a powerful competitive edge. SAVINGS BREAKDOWN: MILLENNIALS VS. EVERYONE ELSE AGES 21 TO 36 ALL OTHER AGES 52% in cash 23% in cash Source: UBS Wealth Management, 2014 11October 2, 2014 | proactiveadvisormagazine.com