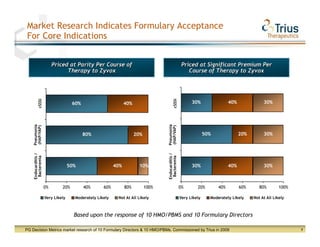

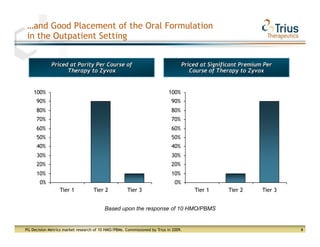

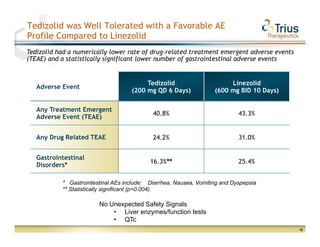

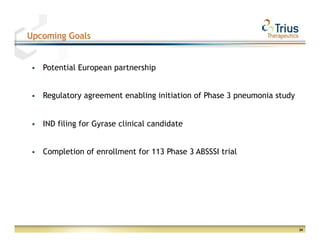

Trius Therapeutics presented on their best-in-class anti-infectives portfolio. They highlighted the success of their 112 trial which achieved all efficacy and safety objectives for their lead drug candidate Tedizolid phosphate. Their 113 trial is currently enrolling patients with top-line data expected in early 2013. Market research also indicates formulary acceptance of Tedizolid for core indications if priced at parity or with a premium compared to Zyvox.